SRSR Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

Support for the Commercialization of Intellectual Property

Introduction

On 22 September 2022, the House of Commons Standing Committee on Science and Research (the Committee) decided to “undertake a study on how the Government of Canada can better support the commercialization of intellectual property.”[1]

During its study, the Committee held nine meetings between 7 March 2023 and 27 April 2023. It heard from 34 witnesses and received 12 briefs. The Committee would like to thank all the individuals and organizations that took the time to participate in this study by appearing or submitting a brief.

The evidence compiled by the Committee led to recommendations for the Government of Canada to support the commercialization of intellectual property.

Overview

Intellectual Property

Intellectual property (IP) can generally be defined as any creation of the mind, such as inventions, literary and artistic works, and symbols, names, images and designs. Intellectual property rights are the systems that allow individuals and organizations to protect their IP from economic competitors.[2]

Mike McLean, Chief Executive Officer of the Innovation Asset Collective, described IP as follows: “IP and data are exclusionary assets used to limit competitors or to capture the financial benefits of innovation that come in the form of IP or data rents. You cannot commercialize what you don’t own.”[3] Giuseppina D’Agostino, an Associate Professor of Law at the Osgoode Hall Law School of York University, testifying as an individual, further mentioned the importance of IP in order to secure investment to “build businesses and to make local talent blossom.”[4]

Giuseppina D’Agostino brought up insulin as an example, as the initial inventors assigned the patent to the University of Toronto for a dollar, allowing researchers and businesses to use that patent at low cost.[5] After the initial patent expired, organizations in the United States (U.S.), which had a larger manufacturing market and risk tolerance, built on the initial patent, filing IP based on any advances subsequently made to the formula and processes, in order to further commercialize insulin.[6] Giuseppina D’Agostino ended her story of insulin by telling the Committee that, “[t]o learn from history, Banting and Best discovered insulin in Ontario, but this life-saving compound was not commercialized here. Today, it's a multi-billion dollar industry. This was a missed opportunity not be repeated.”[7]

Witnesses spoke on the different types of intellectual property that exist. Patents were a frequent topic of discussion, but witnesses also noted the use of trade secrets, contracts and licences to protect unregistered IP and to avoid releasing information that would be required for a patent or save on the costs associated with the patent process.[8] As Andrew Greer, Managing Director of Purppl, testified, “if you register a patent, it means you have to release what you’re patenting. That could be dangerous. It could also be very expensive for a global innovation.”[9] He gave the example of technical coding, where the code needs to be released to obtain a patent. Once the code is released, he told the Committee that it is “difficult to litigate to protect that and prove that someone is actually copying your code.”[10] Meanwhile, other types of innovation and intellectual property, such as social innovations that create new solutions to improve the welfare and wellbeing of individuals and communities, and process innovations that change the way tasks are performed, may not be patentable at all due to the nature of their innovation.[11]

Copyright, meanwhile, is a form of IP that protects original works of authorship, including both fiction and non-fiction, books, newspapers and textbooks. Gilles Herman, Vice-Chair of Copibec, suggested that, “[a]ll forms of intellectual creation that is in text form will be subject to copyright.”[12] Copyrighted works also play a substantial role in Canada’s commercial economy, with Canadian publishers generating a GDP of approximately $750 million and employing almost 10,000 people, with an export market of “almost $100 million, $7 million of which came solely from sales of rights.”[13]

A document submitted to the Committee by Innovation, Science and Economic Development Canada (ISED) also identified the territorial nature of many forms of IP, including trademarks and patents, and the need for applications to be filed and granted “in each country where protection is sought.”[14] However, international treaties related to patents, trademarks and industrial designs governed by the World Intellectual Property Organization (WIPO) allow IP to be filed in multiple countries through one single application in a member country.[15]

It was also noted that the type of IP that an individual or organization pursued was often specific to the type of business or the sector they operated in, with different businesses and sectors prioritizing patents, trade secrets, copyright, trademark and industrial design.[16] As written in a supplementary document submitted to the Committee related to artificial intelligence (AI) by Scale AI, “the appropriate IP leverage for each firm depends on its business objectives and product technology context: there are no one-size-fits-all IP solutions for AI.”[17] Therefore, Andrew Greer testified that with any strategy to address intellectual property in Canada, “we need to be focused on making sure that the rest of the protection is included.”[18]

The Innovation Continuum

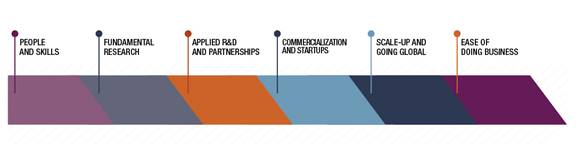

Innovation can be understood as a process that allows the ideas of individuals to move, ultimately, towards solutions that are integrated into everyday processes. Figure 1 below shows the innovation continuum developed by ISED.[19]

Figure 1—The Innovation Continuum

Source: ISED, Building a Nation of Innovators.

In the early stages of the continuum, including fundamental research, ideas may not have clear practical applications or commercial viability. Instead, they may allow for the emergence of new discoveries that will be advanced in various directions that may not be easily identified during their initial stages. As Kathryn Hayashi, Chief Executive Officer of TRIUMF Innovations testified, research ideas that may seem far removed from practical applications, such as work in fundamental physics, can lead, for example, to commercial developments in water monitoring, ventilators and fusion energy technology.[20]

Jim Balsillie, Chair of the Council of Canadian Innovators, also noted the connection between intellectual property and successful research and development. He testified that:

[W]e have a flaw in our orthodoxy of economic planning, in that we think that if you invest in [research and development (R&D)], you will get economic outcomes. What happens is that if you don't have the freedom to operate, then the person who invests in the R&D finds that the benefit accrues to whoever owns the freedom to operate.

[…]

Freedom to operate is all based on the legal principles of what's called restriction. I have the right to stop you from doing something. That's called a “negative right”. The ownership of this jacket is a positive right. Only one can wear it. It's rivalrous. The design for this jacket is non-rivalrous. It's a negative right. I can stop you from using that design. That's called intellectual property. You simply want the ability to say, “Only I can do this. I can stop you from doing it. If I'm going to allow you to do this, then I get a reciprocal bargained structure”, generally called a rent. I can also say, “You may not do it, but I will embed it in my product.” When you start to do that, you get leverage, which drives what's called productivity or [gross domestic product (GDP)] per capita. That's how these other economies get more wealth per worker and how to put more money in the average Canadian's pocket.[21]

When fundamental research and applied research and development lead to innovation and new IP, particularly when the research originates in a university setting, the next step is often for the originating researcher to coordinate with their institute’s technology transfer office to determine an appropriate plan for further development, which can include filing a patent.[22] This can be cost- and time-intensive before the university and researcher see any results, such as licensing revenue.[23] As Anne-Marie Larose, Former President and Chief Executive Officer of Aligo Innovation, appearing as an individual, testified, “[s]even to ten years, or even more, may pass between an invention disclosure and the first royalties from a transfer.”[24] She gave the example of Stanford University:

With 500 invention disclosures a year, it had to wait almost 20 years before seeing its royalty revenue increase substantially. Stanford now finances itself with that revenue, in particular thanks to a few successes, like Google, although fewer than 1% of its licensing agreements bring in significant amounts in royalties.[25]

Meanwhile, as described by Daniel Schwanen, Vice-President of Research at the C.D. Howe Institute, commercialization is the stage of innovation where “research and innovation visibly benefit Canadians more broadly.”[26] For Chad Gaffield, Chief Executive Officer of the U15 Group of Canadian Research Universities, social licensing also occurs during the commercialization phase, and people increasingly expect businesses and other entities to achieve goals of environmental sustainability and public health alongside business interests.[27]

However, not all innovation that reaches the stage of commercialization will necessarily succeed. Louis-Félix Binette, Executive Director of Mouvement des accélérateurs d’innovation du Québec, explained that when companies “test the ability of real inventions—that’s what intellectual property really is—to succeed in the marketplace” there is a high chance of failure, but failure is built upon by further innovation and development that may lead to future successes.[28]

Witnesses also highlighted a phase in the innovation continuum referred to as the valley of death, which is the period of time where a technology is being developed, potentially at high cost, before a market has been established. This period stretches along the early stages of the continuum through to early commercialization and start-up development.[29] As explained by Louis-Félix Binette:

The valley of death extends to the early commercialization period, because when you have a highly technological, highly innovative solution, there is a fair chance that your first clients will get a prototype-level solution and it will probably cost you three or four times, 10 times or 100 times more to produce that first prototype than you can actually get from the sale. The more you sell, the more your balance sheet goes into the red.[30]

In a brief submitted to the Committee, BioCanRx wrote that the challenges that arise in traversing the valley of death involve not only testing the scientific and commercial validity of the innovation, but also structural issues, such as limited funding, expertise gaps and organizational management.[31] This is particularly true for start-up organizations, new companies that “focus entirely on innovation in developing a product, service or business model, to quickly break into a market with huge potential.”[32]

At the stage of scaling-up, Jim Balsillie and Jim Hinton, an intellectual property lawyer, both highlighted the increasing role intangible assets, such as IP and data, play in building large companies.[33] The Innovation Asset Collective provided additional documentation following their appearance before the Committee to illustrate that intangible assets accounted for 91% of the market value of the Standard and Poor’s 500 in 2019, as opposed to only 17% in 1975.[34]

Both Kim Furlong, Chief Executive Officer of the Canadian Venture Capital and Private Equity Association and Alain Francq, Director of Innovation and Technology at the Conference Board of Canada, further explained the importance of IP for growing companies, testifying that IP-backed companies are 1.6 times more likely to experience high growth, two times more likely to innovate, three times more likely to expand domestically and 4.3 times more likely to expand internationally.[35] For companies, IP can act as a signal that they have ownership of something potentially valuable, and are worthy of further investment and development.[36]

Intellectual Property Use in Canada

Existing Supports for Intellectual Property and Commercialization

Federal Supports

The laws that apply to IP are the Patent Act, the Copyright Act and the Trademarks Act.[37] The Canadian Intellectual Property Office (CIPO) delivers IP services in Canada, including issuing trademarks, patents, copyrights and industrial designs. As Konstantin Georgaras, Commissioner of Patents, Registrar of Trademarks and Chief Executive Officer of CIPO explained, the patent process involves several steps:

- 1) An application, with a four-year period in which the applicant can decide whether they wish to move forward;

- 2) A request for examination, in which CIPO takes action within 14 months; and

- 3) The final IP filing, which takes place on average 30 months after the request for examination.[38]

Applications can be expedited in cases of green technology, applications that have already been reviewed in other jurisdictions, or through the payment of a fee.[39]

Numerous witnesses highlighted the federal government’s IP strategy, announced in 2019, and the strategic IP program review, announced in 2021, as recognition of the need for change in Canada’s IP landscape.[40] The announcement of the federal IP strategy included an investment of $30 million in a pilot project that would become the Innovation Asset Collective.[41] Witnesses further mentioned a number of federal initiatives supporting IP development and commercialization, as presented below.

The Industrial Research Assistance Program (IRAP) administered by the National Research Council (NRC) of Canada, was identified by Mark Schaan, Senior Assistant Deputy Minister of the Strategy and Innovation Policy Sector of the Department of Industry, as “a fundamental jewel in the overall innovation ecosystem.”[42] IRAP’s mission is to “accelerate the growth of small and medium-sized businesses by providing them with a comprehensive suite of innovation services and funding.”[43] Embedded within IRAP, IP Assist helps small- and medium-sized enterprises (SMEs) develop their IP awareness and strategies, as well as provides funding to execute those strategies.[44]

ExploreIP was also highlighted by Mark Schaan as a program that “provides one stop, web-based access to IP owned by Canadian governments and universities that can be bought or licensed.”[45] Meanwhile, ElevateIP, launched in 2021, provides support to business accelerators and incubators to help them assist start-ups in Canada, including through IP education and targeted supports to secure and maintain IP.[46] Karim Sallaudin Karim, Associate Vice-President of Commercialization and Entrepreneurship at the University of Waterloo, acknowledged that while the program helped start-ups understand and leverage IP, he felt the real issue at hand was enabling start-ups to pay for IP.[47] He went on to explain that the cost of filing a patent can quickly become a significant portion of a start-up’s initial costs and that while start-ups often already understand how important IP is, they may face challenges in how to pay for it.[48]

The Venture Capital Action Plan (VCAP), as described by Kim Furlong, leveraged a $340 million federal government investment to raise $1.3 billion, and with 33 venture capital investors, supported 360 companies that raised, in the aggregate, $2.8 billion. This allowed the Government of Canada to recoup their investment, making 44 cents on every dollar.[49] Similarly, the Venture Capital Catalyst Initiative involved the federal government as “an investor equal to all the other limited partners in the fund. It generates all the money back.”[50]

Nadine Beauger, appearing as an individual, was the former President and Chief Executive Officer of the Institute for Research in Immunology and Cancer–Commercialization of Research (IRICoR), a Centre of Excellence in Commercialization and Research specialized in drug discovery. She discussed IRICoR as a “benchmark model that the federal government must continue to support, and that should be adopted in other sectors to position Canada among the top countries in terms of the commercialization of intellectual property.”[51] IRICoR’s commercialization activities, as described by Nadine Beauger, focus on enhancing the value of basic research through the “establishment of co-development partnerships with biopharmaceutical industry and the creation of spinoff companies.”[52]

While the National Quantum Strategy, Pan-Canadian Artificial Intelligence Strategy and Canadian Critical Minerals Strategy are not IP specific initiatives, they are expected to support IP and commercialization goals through funding for basic and applied research, and commercialization of specific fields and technologies.[53] Similarly, the Committee heard that the Canadian Institutes of Health Research (CIHR) funds commercialization activities through programs such as the Project Grant Competition and the Clinical Trials Fund.[54]

Meanwhile, Global Innovation Clusters, such as Montreal-based Scale AI, support the adoption of made-in-Canada technologies, and Innovative Solutions Canada, an ISED initiative for research, development and commercialization, matches Government of Canada clients with SMEs in Canada undertaking R&D.[55] As an example, Todd Bailey, an intellectual property lawyer appearing as an individual, spoke about Scale AI’s ability to connect researchers, start-ups and established companies working in specific areas—in this case, artificial intelligence—fostering demand and providing a customer focus that directs innovation activities.[56]

Provincial Programs

Several witnesses also spoke to the importance of provincial programs in supporting IP and commercialization, with examples emerging specifically in the context of Quebec:

- the Quebec Research and Innovation Investment Strategy (SQRI2);

- the Deduction for Innovative Manufacturing Corporations (DIMC), a provincial patent box[57] taxation regime;

- the Mouvement des accélérateurs d’innovation du Québec (MAIN), a non-profit organization that strengthens “the capacity of the start-up support ecosystem,” funded as part of the Government of Canada’s ElevateIP program;

- Axelys, a non-profit Quebec technology transfer centre; and

- Synchronex, a network of college centres for technology transfer and innovative social practices.[58]

David Durand, President of the International Intellectual Property Forum–Québec, testified to the Committee that:

[Y]ou don’t necessarily have to take the U.S. market as a benchmark. Let’s look instead at Quebec, which has already taken some excellent steps through the Quebec Research and Innovation Investment Strategy, SQRI2, as well as with the Quebec Innovation Council, headed by Luc Sirois. Quebec is therefore positioning itself as a leader in the innovation space, and the entire Canadian ecosystem can learn from it.[59]

Louis-Félix Binette and Jesse Vincent-Herscovici, Chief Executive Officer of Axelys, further spoke of the positive role Quebec’s targeted investment and consolidation of innovation programs have played in that province’s IP landscape.[60]

Other provincial programs identified by witnesses as supportive of IP development and innovation include Saskatchewan’s investment in the agri-food industry, Intellectual Property Ontario, Alberta Innovates, British Columbia’s investment in the biotech sector and the Ontario Indigenous Institutes Act, which enhances post-secondary educational opportunities for Indigenous students and promotes Indigenous knowledge systems.[61]

Post-Secondary Institutions

Canada’s post-secondary institutions were also identified as a strength in terms of fundamental research and R&D, with Canada ranking “third among OECD countries in the percentage of all private R&D done in partnership with post-secondary institutions.”[62]

Several university-led accelerators—McGill University’s X-1 Accelerator, Velocity at the University of Waterloo, the Creative Destruction Lab at the University of Toronto, the Advanced Manufacturing Consortium of the universities of McMaster, Western and Waterloo, and École de technologie supérieure’s Centech—were highlighted as prominent Canadian examples of innovation leadership.[63] As Louis-Félix Binette testified, “[o]bviously, a start-up that receives incubator support from Centech or X-1 Accelerator enjoys not just tremendous visibility, but also tremendous opportunity in terms of developing an international client base, accessing investment and so on. It’s a huge advantage.”[64]

TRIUMF, and its commercialization arm, TRIUMF Innovations, were also discussed. TRIUMF is owned and operated by a consortium of Canadian universities and funded by the Government of Canada.[65] In addition to connecting Canadian researchers to businesses and international organizations, TRIUMF licenses IP that it owns, including 22 granted patents and 32 pending applications, to Canadian companies.[66]

Beyond accelerators, university-led programs such as IP informational and legal clinics run by law schools and business schools were also identified as important sources of informational support for researchers and SMEs, including, for example, the University of Calgary’s Hunter Hub for Entrepreneurial Thinking.[67]

The work done by universities and colleges in specific program areas was also highlighted as an integral contribution to Canada’s innovation work in those sectors, including work in agricultural food production at Université Laval, the University of Guelph, the University of Manitoba, the Ontario Agricultural College and the University of Saskatchewan.[68]

Jeffrey Taylor, Chair of the National Research Advisory Committee of Colleges and Institutes Canada (CICan), testified to the important role colleges also play in the development and commercialization of IP through partnerships with SMEs on short-term research projects and the subsequent industry ownership of any IP developed.[69] He particularly emphasized the important role colleges play in furthering applied research and development activities that lead directly to commercialization.[70] CICan provided further documentation to the Committee stating that, in 2019–2020, colleges completed over 6,400 applied research projects with 8,000 partners, the majority of which were SMEs.[71] Core funding for applied research in colleges is partly provided by NSERC’s College & Community Innovation Program.[72] CICan also provided an illustrative example of how colleges collaborate with SMEs to develop innovative research:

[W]hen Autobus Lion (as it was then known), a school bus manufacturer in Saint-Jérôme, QC, saw an opportunity to fill the market’s desire for electric vehicle transportation solutions, they partnered with the Institut Vehicule Innovant (IVI) at Cégep de Saint-Jérôme, an applied research centre with expertise in vehicle innovation. Through their partnership, IVI helped Autobus Lion develop the first-ever North American electric school bus prototype. After road testing, including in extreme winter weather conditions, the project was a success. This started an incredible scale-up journey, supported by the start of manufacturing based on the company’s applied research project. Several years after their collaboration, Autobus Lion re-branded to Lion Électrique—an all-electric transport vehicle manufacturer. Now, Lion Électrique is a North American leader in EV transport solutions, boasts multiple Tier 1 clients (Amazon, IKEA, the New York Times), is expanding its presence south of the border, and is listed on both the Toronto Stock Exchange and the New York Stock Exchange.[73]

Jeffrey Taylor further testified before the Committee that “[a]ccording to internal analysis, Canada’s colleges received only 2.39% of tri-council funding in 2020 … our funding limits our opportunities to help businesses generate new IP, iterate on existing products and explore ways to improve labour productivity.”[74] He later expanded on this point in saying that, “[i]t's 140 colleges fighting over 2% of the budget. I think there are 110 universities in Canada and they have 98% of the budget.”[75]

The Canada Innovation Corporation

The blueprint of the Canada Innovation Corporation was also released over the course of this study, and Mark Schaan with the Department of Industry spoke of the “clear and focused mandate to help Canadian businesses across all sectors and regions become more innovative and productive.”[76] The Canada Innovation Corporation is meant to move “at the speed of business” and with “private sector expertise” to provide targeted investment in business R&D.[77]

The NRC IRAP program will be transferred to the new Canada Innovation Corporation, as the “front-leaning mechanism to get at lots of those innovative start-ups,” but embedded within a broader process to “harness a lot of that kind of activity throughout the overall life cycle of scaling businesses.”[78]

Witnesses and the Advisory Panel on the Federal Research Support System suggested that one area the Canada Innovation Corporation should explore is providing a matching or linking service that brings together researchers and industry partners.[79] For example, Todd Bailey suggested adopting a model similar to that of Scale AI, which establishes matchmaking “expertise on which researchers are working in which area and which start-ups are doing which kind of work.”[80] He further suggested an education role for the Canada Innovation Corporation, in “setting a curriculum” for IP education, similar to the IP education role that ElevateIP already plays, and providing train-the-trainer services to interested organizations.[81]

International Models

Witnesses highlighted international examples of IP commercialization strategies that Canada may be able to learn from.

Mike McLean mentioned China’s recent national plan for building IP within the country.[82] China’s plan provided 115 steps of an “outline for building a powerful intellectual property country,” and China further provides funding for researchers to file patents.[83]

In describing Germany’s strong IP regime, Jim Balsillie pointed to the Fraunhofer Institute:

They have 74 research institutions, 30,000 employees and one TTO, tech transfer office. Ontario is a small fraction of the size of Fraunhofer, but it has 35 TTOs. That's between about two and three orders of magnitude of fragmentation. When Mr. Gaffield talks about these TTOs at the universities, they can't be at the scale you need in this. It's a structure problem. They are put in an impossible situation. How can you compete against an institutional apparatus that has orders of magnitude more scale than you do and national alignment from the funding agencies?[84]

Jim Balsillie also testified to international models where IP that results from government funded projects is assigned to the state, such as in the U.S. and Germany, but that in such cases, it is important to have an agency to steward such IP assets.[85]

Mike McLean further highlighted several jurisdictions that have established “sovereign patent funds” to advance IP in their countries, including South Korea, France and Japan.[86] Baljit Singh, Vice-President of Research at the University of Saskatchewan, also mentioned high investment in innovation in the U.S., Germany, Norway, France, India and Brazil.[87] Chad Gaffield described the United States’ CHIPS and Science Act, as well as other investments from countries such as Germany and the United Kingdom, as “game-changing.”[88] The CHIPS and Science Act provides US$280 billion to increase semiconductor capacity and support R&D in key sectors such as quantum computing, AI, clean energy and nanotechnology.[89] U.S. funding through programs such as the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs were also identified as important sources of development for early-stage research and innovation that involves “technological risk” that may make it challenging to secure other sources of funding.[90] Meanwhile, William Ghali, Vice-President of Research at the University of Calgary, spoke of how Singapore and Switzerland both invest substantially in major universities to fuel R&D innovation.[91]

Patent box regimes in jurisdictions such as Ireland, the United Kingdom, Spain and France were also identified as potential incentives for multi-national corporations to place their IP in jurisdictions with more advantageous tax rates.[92]

Witnesses also spoke of several jurisdictions where the national strategy regarding IP focuses on key technological sectors, including the Netherlands and agriculture, the United States and aerospace and defence, and Israel and technology.[93] Robert Asselin, Senior Vice-President of Policy at the Business Council of Canada, highlighted the U.S.’s Defense Advanced Research Projects Agency (DARPA), describing the model’s success as driven by its links to industrial strategy and the role it plays in de-risking private investment in expensive, breakthrough technology.[94] The model is being replicated in other key sectors in the U.S., such as the Advanced Research Projects Agency–Energy (ARPA-E) and the Advanced Research Projects Agency for Health (ARPA-H), with a focus not only on targeted sectors but on breakthrough innovation rather than incremental advancement.[95]

Mark Schaan, meanwhile, spoke of taking inspiration from Business Finland and the Israel Innovation Authority in the development of the blueprint for the Canada Innovation Corporation.[96]

Strong international protection for trade secrets and confidential information was also identified as a growing field. In his brief, Matt Malone identified several recent trade agreements that included measures to enhance protection for trade secrets, including the European Union–Japan Partnership Agreement of 2017, the United States–China Economic Agreement of 2020, the Canada-United States–Mexico Agreement of 2018 and the European Union Directive on Trade Secrets from 2016.[97]

Challenges Facing the Effective Commercialization of Intellectual Property

During his testimony, Jim Hinton said, “[y]ou can’t commercialize what you don’t own, and as a country, Canada does not own very much IP.”[98] Witnesses stated that “Canada faces an ongoing IP challenge,”[99] including:

- a shrinking proportion of intangible assets in relation to Canada’s economy since 2000;[100]

- a decline in patent applications per capita since 2005;[101]

- the proportion of GDP spent on R&D, at 20th in the Organisation for Economic Co-operation and Development (OECD);[102] and

- the lowest level of corporate R&D funding in OECD and G7 countries.[103]

Jim Balsillie, in his testimony before the Committee, said that:

Today the knowledge-based economy is in its fourth decade, the data-driven economy is in its second decade, and the age of machine learning capital is emerging, yet Canada's deficit on IP payments and receipts is widening at an alarming pace, a position we now share with developing nations. This is why the OECD recently projected that Canada's economy will be “the worst performing advanced economy over 2020–2030” and the three decades thereafter.[104]

Some of these challenges draw from broader factors being driven by international jurisdictions, such as:

- the purchase of Canadian IP and companies, and the acquisition of Canadian talent by foreign companies;[105]

- advantageous tax regimes in other jurisdictions;[106] and

- Canada’s relative scale in the global market.[107]

Challenges facing the effective commercialization of IP in Canada are explored more fully in the sections below, as well as ways in which the Government of Canada can potentially address them.

Funding for Intellectual Property Development and Commercialization Activities

A general barrier identified by witnesses was the high cost of developing, commercializing and protecting IP.[108] As Todd Bailey testified, “innovation is an expensive business, because no one is anywhere near a 100% effectivity rate.”[109] This can be particularly challenging for SMEs, start-ups,[110] and women entrepreneurs,[111] who may instead focus their limited capital on building and selling products. Krista Jones, Chief Delivery Officer of the Ventures and Ecosystems Group at the MaRS Discovery District, further mentioned that this may drive entrepreneurs and businesses out of Canada as they search for more funding and business opportunities elsewhere.[112]

Further challenges emerge in Canada because of a relatively low level of available venture capital, particularly early-stage investment that may carry a higher risk of failure.[113]

Funding that is available may also not cover the necessary time needed to develop and commercialize IP.[114] Mike McLean testified that:

Efforts are underway at the federal, provincial and regional level to help improve Canada’s IP capacity. However, the investment in these programs is extremely limited compared with the billions of dollars spent annually on innovation. These programs require funding at an increased scale and the will to sustain them over the long term in order to deliver a systemic impact on Canadian prosperity.[115]

Other programs, such as CICan’s partnership program between colleges and businesses, report that they do not have the capacity to meet market demands with their current funding.[116] They turned down 1,400 requested partnerships between 2020 and 2022 due to a lack of available funding.[117]

Witnesses expressed that the issue was compounded by the need to increase “the speed with which we can create the blended funding[118] to invest in our technology.”[119]

Louis-Félix Binette testified to the Committee that the approach to funding entrepreneurial development in Canada must change, given the risk involved:

The approach is what needs changing, whether we are talking about the Business Development Bank of Canada or another organization. We need to accept the fact that we don't support a set of companies in a distinct way. Instead, we support a pool of companies in a geographic- and sector-specific way, in the hope that some of those companies will succeed.

The approach to risk is different. We don't measure the individual risk of each company. We take a pool of companies and hope that some of them will be successful. For an investment fund, sometimes it's enough for one company to succeed in order to replenish the entire fund. That one transaction out of the 20, 30, 40 or 60 can be enough. According to the information, a company has a one in 250 chance of making it. We need to take a pool-based approach and accept that some companies won't make it.

The benefit of IP is that, when a company doesn't make it, that property remains. It can be reused and transferred to another company in that sector. It can be resold and enhanced in different ways. Let's not forget that entrepreneurs who didn't succeed are still entrepreneurs. They'll go on to start other companies.[120]

Likewise, Kim Furlong and Robert Asselin promoted the idea of allowing larger funds, such as pension funds and mutual funds, to invest in entrepreneurial ventures as alternative investments.[121]

Another alternative approach to funding proposed by witnesses was to adapt federal government procurement processes to encourage entrepreneurial solutions developed in Canada, providing businesses with markets in which their products can generate initial sales, test their products, and refine their products and services.[122]

Therefore, the Committee recommends:

Recommendation 1

That the Government of Canada explore policies and incentives to encourage entrepreneurial investment from large investment funds, including public pension plans.

Recommendation 2

That the Government of Canada review and revise federal procurement practices to increase, wherever possible, investment in Canadian start-ups and small- and medium-sized enterprises commercializing new products and services.

Establishing Freedom to Operate

One challenge identified by Jim Hinton was limited freedom to operate in industries with a large degree of patents owned by large companies, which makes it hard for new companies to enter those markets.[123] In such cases, often referred to as patent thickets, securing the right to manufacture products that encompass many different patents, potentially held by different companies, can make it prohibitively expensive for new companies to break into established markets.

One potential solution to patent thickets presented by witnesses was IP collectives. An IP collective is a tool that allows SMEs, start-ups and other entrepreneurs to pool intellectual property in order to provide freedom-to-operate in a particular sector. Mike McLean testified, for example, to the role the Innovation Asset Collective is playing in building a patent collective within the clean-tech industry to support Canadian companies “as they grow and access new markets.”[124] The Innovation Asset Collective also allows members to access resources such as IP insurance in order to “cover costs to defend or enforce IP rights.”[125] Several other witnesses also recommended further investments in IP collectives and an expansion of the Innovation Asset Collective’s mandate to other industries.[126]

Therefore, the Committee recommends:

Recommendation 3

That the Government of Canada consider expanding the Innovation Asset Collective model to other industries, either within the existing organization or through the establishment of parallel organizations in other industries.

Limited Coordination Between Initiatives

Witnesses also identified challenges regarding limited coordination between programs, both within the federal government and between orders of government, businesses and post-secondary institutions. Baljit Singh testified, for example, that “[t]here might be a suite of programs at the provincial level or at the federal level. Those are not deeply connected with each other.”[127] Meanwhile, Serge Buy, Chief Executive Officer of the Agri-Food Innovation Council, spoke to the fact that, in regards to agricultural R&D, it can be difficult to obtain information on total funding amounts and the streams through which those funds are distributed.[128] He testified that “[i]t speaks to the fact that there is no coordination. You have a multiplicity of programs, and people are creating new programs and more programs, and that seems to be the value or the measure of success.”[129]

Jim Hinton further spoke to the way differing initiatives may inadvertently create asymmetries in how different types and sizes of businesses are treated:

You can’t give $40 million to Nokia and then, in the same breath, give $10,000 through NRC IRAP’s IP Assist to a Canadian company. You’re increasing the asymmetry rather than trying to catch up. You’re putting wind in the sails of the foreign companies and then you’re putting anchors on the Canadian companies.[130]

This asymmetry can inadvertently lead to small companies being driven out of the market by larger competitors provided with greater funding opportunities and fewer constraints.[131] For example, the Strategic Innovation Fund sets IP retention terms to encourage Canadian companies to keep IP in the country, but funding for large multinationals like Nokia allows them to assign IP elsewhere; in that case, Finland.[132]

For Gail Murphy, Vice-President of Research and Innovation at the University of British Columbia, an additional challenge is ensuring programs cover the full spectrum of innovation, from fundamental research, through start-ups, into growth.[133] As she testified:

Where companies often face a challenge is making that jump from being within the university environment to being on their own and starting to grow into large companies. In general, in Canada, we see great success with our start-up companies. They get to a certain size, but then trying to grow into a much larger company is a challenge. Part of that is some of our industrial policy, in which there are cut-offs for the sizes of companies that are able to participate in certain programs. The more we can smooth that, the more we will be able to grow our companies more successfully.[134]

This point was further supported by Robert Asselin, who spoke of how “the federal government provides funds for research and assumes this knowledge will naturally make its way to industry. It neglects all the necessary steps to commercialization.”[135]

Serge Buy recommended that the federal government “undertake a review of Canada’s funding program ecosystem and find strong efficiencies, potentially merging some of the programs and bringing them under some coordination.”[136] Giuseppina D’Agostino further mentioned the potential of developing a map to identify where programs are concentrated to better visualize potential gaps in programming.[137] Meanwhile, Neil Desai, Senior Fellow at the Centre for International Governance Innovation, appearing as an individual, recommended a review of the Scientific Research and Experimental Development tax credits program to better incentive successful commercialization of the technologies developed.[138]

Therefore the Committee recommends:

Recommendation 4

That the Government of Canada, in collaboration with the provinces, territories and other stakeholders, undertake a review of Canada’s support system for intellectual property, research and development, and commercialization, with an aim towards identifying and addressing redundancies, gaps and inconsistencies.

Post-Secondary Driven Innovation Ecosystem

In Canada, a large proportion of R&D is performed in the post-secondary education sector, in universities and colleges, as mentioned above.[139] Robert Asselin testified to the fact that the focus on post-secondary research puts “too many eggs in that one basket” and limits economic returns on research and innovation.[140] As he said:

Currently, Canada does not have sufficient and adequate mechanisms to translate R&D and ideas into the real economy. No matter what financial instrument is deployed, public investments won’t produce better outcomes if we don’t change the way we think about, incentivize and produce innovation.[141]

Some witnesses also noted that, in Canada, there is a “patchwork system” of IP policies within post-secondary institutions, with some post-secondary institutions assigning IP ownership to individual researchers and others to the institution.[142] Witnesses testified that putting technology transfer within the responsibilities of individual post-secondary institutions puts an “unfair” burden on organizations whose “mandate is really about research” rather than commercialization.[143] Serge Buy testified that “the way businesses work with universities on IP is not coordinated,” and Chad Gaffield spoke of the need to coordinate university and college technology transfer activities, given that most offices are developed and organized at an institutional basis rather than at a larger, systems-wide level.[144] As Anne-Marie Larose explained in her testimony, this can lead to a disadvantage for small universities with few resources.[145]

The technology transfer system can also lead to challenges in moving IP developed in publicly-funded post-secondary institutions towards commercialization. Louis-Félix Binette testified that:

[T]here are still a lot of obstacles that researchers have to go over to launch a company. If you look at AI and software, it’s often easier for a Ph.D. to just get out of the university system and rewrite an algorithm than to try to take the algorithm they’ve developed in their Ph.D. out of the university.[146]

Likewise, Neil Desai shared that he worries “that our system doesn’t incentivize researchers to actually create companies.”[147]

Nipun Vats, Assistant Deputy Minister of the Science and Research Sector of the Department of Industry, mentioned the Department’s efforts to increase the amount of money given to College Centres for the Transfer of Technology (CCTT), which can help move innovation from post-secondary institutions into the market.[148] Giuseppina D’Agostino also spoke to the important role technology transfer offices in universities can play in furthering the development and commercialization of IP if funded and staffed appropriately.[149]

William Ghali, meanwhile, spoke of the competing missions of universities, who are balancing educational goals, the need to retain professorial staff and research infrastructure, and supporting innovation.[150] In the face of limited budgets, he testified that:

[I]nnovation expenditures are sometimes seen to be a luxury, nice to have but not necessarily must-haves. Clearly, there needs to be a change of mindset. Knowledge economies, in their fullest form, are fuelled by research universities if and only if the research in those universities is mobilized toward innovation.[151]

Baljit Singh recommended that this challenge may be solved by a fund within universities that they can provide directly to inventors at the early stage of innovation to expand ideas.[152] Alain Francq, meanwhile, recommended a review of ownership models for IP rights and technology transfer models within universities, colleges and research labs, with a view towards establishing federal coordination and consistent provincial implementation of best practices.[153] This was further supported by Jim Balsillie, who promoted national stewardship of technology transfer.[154]

Several witnesses, meanwhile, explained that while funding is often available to move IP to the prototype stage in universities, it can then be challenging to secure funding to move to the private sector or into a start-up.[155]

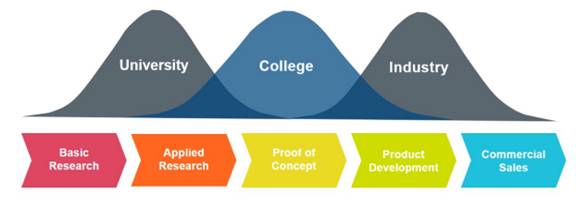

This challenge was illustrated in a brief submitted to the Committee by CICan illustrating the place of universities, colleges and industry along the innovation continuum:

Figure 2—Relationship Between Post-Secondary Institutions and the Innovation Continuum

Source: Colleges & Institutes Canada, Canadian Colleges: Creating IP and Powering Commercialization, Brief submitted to the House of Commons Standing Committee on Science and Research, April 2023.

Jeffrey Taylor supported the role of colleges in bridging the innovation gap between universities and industry (identified in the figure above). He told the committee that colleges receive only 2.39% of funding from Canada’s granting councils—the Natural Sciences and Engineering Research Council of Canada (NSERC), the Social Sciences and Humanities Research Council of Canada (SSHRC) and CIHR.[156] This limits the ability of colleges in Canada to engage in R&D and liaise with local businesses and communities, particularly in more rural, remote or northern communities.[157]

Therefore, the Committee recommends:

Recommendation 5

That the Government of Canada, in partnership with the provinces, territories and post-secondary institutions, identify promising practices for post-secondary technology transfer and fund the implementation of those practices.

Limited Intellectual Property Expertise

Witnesses also spoke of the need to develop further IP expertise in Canada, particularly as it relates to IP development and commercialization strategies.[158] As Mike McLean testified, “[f]or me, the largest roadblock is the lack of understanding about IP strategy and approaches to capture and commercialize IP. Canadian companies do not have access to role models or peers who understand these issues.”[159] Following their appearance before the Committee, a brief submitted by the International Intellectual Property Forum–Québec outlined a proposed tax benefit for entrepreneurial mentors to assist start-ups, early-stage companies and SMEs in lieu of payment for services, which would allow them to learn from experienced mentors with little to no cost.[160]

Witnesses further spoke to similar IP knowledge challenges in universities, with Giuseppina D’Agostino testifying that, “most academics are not trained entrepreneurs. They need to be educated about IP and require expert support from day zero.”[161] While some universities do have technology transfer offices that provide IP assistance and education, staff at those offices may have limited experience and resources to both recognize valuable IP and progress that IP towards commercialization.[162]

It was also recommended that Canada develop a resource that allows universities and private sector investors to share information about IP and research in a searchable database to facilitate greater connections between them.[163] A potential model for this may be a database developed by the University of British Columbia, which allows “people to be able to search across the federal agency databases and through patent databases for both researchers and companies to understand who’s doing what within the country.”[164] Chad Gaffield presented a similar example of Cognit.ca, a tool developed by the U15 Group of Canadian Research Universities that provides information on “experts, facilities and intellectual properties related to university research across Canada.”[165] Internationally, David Durand highlighted the Sweden model of “a stock market for intellectual property.”[166]

While witnesses acknowledge that the ElevateIP and IP Assist programs that emerged out of the 2018 intellectual property strategy may provide positive development in this area, “it’s still too early to assess their impact.”[167]

Witnesses also recommended developing additional education programs to build the capacity of Canadian innovators, including further support for ElevateIP, IP Assist and the Innovation Asset Collective.[168] Components of IP education that witnesses recommended included:

- A map of available programs at all levels of government to direct entrepreneurs to appropriate resources;[169]

- Funding for universities and colleges to create long-term partnerships with businesses and offer wrap-around IP supports, such as through technology transfer offices;[170]

- Support for entrepreneur-in-residence programs that place experienced entrepreneurs in mentorship positions in post-secondary institutions, start-ups and other businesses;[171]

- IP education materials and tools for students and researchers in a range of post-secondary fields, including the sciences, arts, business and law;[172] and

- Funding to attract and recruit more graduate students as the entrepreneurs of tomorrow.[173]

Therefore, the Committee recommends:

Recommendation 6

That the Government of Canada establish comprehensive IP education and awareness materials, available through the Canada Innovation Corporation and other existing IP programs, directed towards different industries, demographic groups and stages of innovation.

Foreign Ownership of Research Developed in Canada

An illustrative example of the impact of Canada’s lack of internal commercial development capabilities was presented by Baljit Singh, who discussed a collaboration between universities on a vaccine against a virus that affects pigs:

Researchers at the University of Saskatchewan discovered a virus, which led to the development of a vaccine in collaboration with Queen's University Belfast in Ireland and Ohio State University in the U.S. That vaccine technology was purchased by a company in France. Although we got more than $100 million in royalties to the university and the inventors, the job creation took place in France. We need to think about an ecosystem in this country that goes from end to end, in which we can take our intellectual property and develop the jobs in Canada.[174]

This leads to Canada being, as described by Daniel Schwanen, “a net exporter of ideas” and a “net payer for the services of intellectual property that such research or other creative or innovative activities in Canada or elsewhere help generate.”[175] Jesse Vincent-Herscovici further explained that “[a] large portion of the IP that was developed in Canada ended up being owned by international companies, notably in fields like AI, which are of crucial importance to our survival. […] We fund the effort, but our economy and society often don’t reap the greatest benefits.”[176]

Jim Hinton noted that foreign ownership of IP developed in Canada was a problem in Canadian universities, as “[m]ore than half of all industry-assigned IP that comes out of Canadian universities is assigned to foreign companies.”[177] Of note, this results in IP that “was often developed with public funding or incentives and is now generating income for foreign companies.”[178]

As Neil Desai described:

An innovation ecosystem that focuses so heavily on the upstream investments in R&D without back-end commercialization focus from Canada, and that has an economy open to foreign direct investment, is ripe to having those investments leak out to the benefit of foreign firms and jurisdictions.[179]

Witnesses spoke to the potential use of tax incentives and competitive tax rates in order to encourage private sector spending on R&D and the retention of IP in Canada. Specifically, a patent box was recommended to promote R&D and IP development through lowering the taxation rate on income earned from IP.[180]

Louis-Pierre Gravelle also discussed the use of taxation as a way to discourage the sale of Canadian IP to foreign entities. He referred to an Israeli measure that taxed the sale of Waze, an Israeli start-up, to Google, as a recovery method for research funded through public programs.[181] Louis-Félix Binette, however, disagreed with that approach, preferring a model that incentivized those who sold IP to reinvest in Canadian projects.[182]

Therefore, the Committee recommends:

Recommendation 7

That the Government of Canada establish taxation measures, potentially including the creation of a patent box, to encourage the commercial development of intellectual property and the retention of intellectual property within Canada.

Intellectual Property and Security

During this study, the Committee also heard testimony about the potential implications on national and global security associated with IP development and ownership. Jim Hinton, for example, discussed ongoing Canadian Security Intelligence Service (CSIS) monitoring of Canadian research institutions and foreign government actors, and ongoing research partnerships between Canadian universities and Huawei.[183]

Meanwhile, Baljit Singh mentioned the importance of coordination between universities and the federal government to ensure security directions are being adopted and enforced.[184] Marie Gagné, Chief Executive Officer of Synchronex testified that “[u]niversities are increasingly sensitive to and aware of the importance of having mechanisms to analyse the potential national security risks of partnering with foreign companies.”[185] However, she mentioned that it can be challenging to determine whether corporate partners are associated with larger parent companies or have ties to foreign governments that may pose a risk to Canadian research security, and that a centralized resource to help identify risks associated with potential partners would provide value to researchers.[186]

Representatives appearing on behalf of the Department of Industry spoke on Huawei partnerships specifically. The research security guidelines in place at the time of the study were not specific to any given company but provide general guidelines for assessing risk when considering partnerships.[187] Further, research that does not have a federal funding component was considered beyond the purview of the department.[188]

The National Security Guidelines for Research Partnerships address ways in which researchers, research organizations and federal government funders should assess risk in relation to research security.[189] During the course of this study, Innovation, Science and Economic Development (ISED) Canada announced that the federal research granting councils (SSHRC, CIHR, NSERC) and the Canada Foundation for Innovation should no longer fund research in sensitive areas if any of the researchers are “affiliated with a university, research institute or laboratory connected to military, national defence or state security entities of foreign state actors that pose a risk to our national security.”[190]

Several universities who appeared were also asked by the Committee to report the number of patents that had been transferred from their ownership to foreign companies based in China. For example, the University of Calgary reported that they had transferred one patent to companies in China over the past five years, had three ongoing projects with Huawei and that they would be declining new projects in partnership with Huawei moving forward.[191] The University of British Columbia (UBC) reported assigning 8 patent families to Huawei between May 2014 and October 2018, before moving to a joint ownership model between October 2018 and December 2022. The joint ownership model resulted in one patent family, and a partnership model where UBC owned the IP developed in collaboration with Huawei. As of December 2022, all partnerships between UBC and Huawei will undergo a security audit before proceeding.[192]

Therefore, the Committee recommends:

Recommendation 8

That the Government of Canada update the National Security Guidelines for Research Partnerships to provide research institutions and organizations with clarification in regards to jurisdictions and organizations that present potential risks to Canada’s national security.

Lack of Commercial Development in Key Sectors

One potential driver of Canada’s IP-related challenges, according to Karim Sallaudin Karim, is that Canada has few large pharmaceutical or high-tech firms. These organizations are frequently developing and launching new products and subsequent IP.[193] As he testified, “[w]e have smaller and medium-sized enterprises, where most of the day-to-day activity focuses on product development, sales and commercialization of existing technology, and maybe on incremental innovation. You don’t see a lot of people taking a lot of risks.”[194] He recommended focusing on start-ups in the pharmaceutical and tech industries as “the best chance to create these large behemoths that can compete on the international stage with other countries.”[195]

Robert Asselin also spoke of Canada’s need to focus on key industries in order to be competitive:

I find that in Canada we are spread too thin across the spectrum and so, when one speaks about the innovation ecosystem, I think we need to be really focused on these key advanced industries, scale our companies, create IP, retain it, leverage it and make sure we have more [initial public offerings (IPOs)] in Canada.[196]

Other sectors identified as potential areas in which Canada has a competitive advantage include bioinnovation and biomanufacturing, food science, clean technology, AI, quantum computing, medical technology, computer technology, civil and environmental technology, pharmaceuticals and transportation.[197]

Therefore, the Committee recommends:

Recommendation 9

That the Government of Canada, in collaboration with the provinces, territories and other stakeholders, identify key sectors in which to foster innovation, such as through ongoing support of the Pan-Canadian Artificial Intelligence Strategy and the National Quantum Strategy.

Copyright Legislation

Canada’s legislative landscape as it relates to copyright was also identified as a challenge. Gilles Herman testified that:

In 2012, when the Copyright Act was modernized, Parliament added a number of exceptions under which intellectual property could be circumvented, in particular by introducing the concept of fair dealing for educational purposes, but without specifying limits on its application. Since then, educational institutions have withdrawn in large numbers from the copyright regime. The financial losses directly attributable to this gaping hole in our legislation, on the order of $200 million in ten years, threaten an entire sector and interfere with its sound economic development.[198]

While Gilles Herman explained that the 2022 federal budget and recent mandate letters for the Minister of Canadian Heritage and the Minister of Innovation, Science and Industry mentioned further changes to the Copyright Act to ensure fair compensation for copyright holders, there has been no movement.[199] If this continues, he testified that:

The risk is that the education sector of tomorrow will no longer be teaching Canadian content, because Canadian publishers will have quite simply disappeared. The field is thus being left open to American, English or French publishers, who will be able to occupy our classrooms, and this is absolutely scandalous.[200]

He further clarified that this situation does not apply in Quebec, where the copyright system continues to provide adequate royalties to creators.[201]

While the Committee spent less time exploring the subject of copyright during these hearings, a previous study conducted by the House of Commons Standing Committee on Industry, Science and Technology in 2019 explored the issues more thoroughly.[202] Its report, Statutory Review of the Copyright Act, discussed the 2012 Copyright Modernization Act, which added the term “education” to the permissible purposes for fair dealing.[203] The report also described conflicting views regarding the impact of the Copyright Modernization Act’s fair dealing provisions.[204]

Views expressed in that report included several witnesses that claimed the changes to fair dealing inflicted a significant loss of revenue to publishers, creators and others, as educational institutions opted out of collective licensing.[205] Many witnesses in that report proposed clarifying the educational fair dealing component.[206]

In contrast, other witnesses argued during that study that the financial challenges currently facing Canadian authors and publishers predate the changes and are international in scope, driven by a shift to digital content, the increasing availability and use of open educational resources, and practices such as textbook rentals and peer-to-peer selling.[207] Several witnesses testified during that study that a limit to educational fair dealing would restrict the dissemination of learning materials.[208] That report cited many witnesses who denied claims of rampant copyright infringement at educational institutions and highlighted the amount spent on lawful acquisition of learning materials through a variety of means.[209]

Therefore, the Committee recommends:

Recommendation 10

That the Government of Canada undertake a review of the Copyright Act in order to study appropriate remuneration for Canadian content creators, particularly as it relates to educational material.

Regulatory Processes

Serge Buy testified to the need to balance a strong IP protection regime with a regulatory process that is not too burdensome or cumbersome. He expressed concern that Canada’s regulatory processes can drive companies to look elsewhere in regard to innovation:

There's a cumbersome and burdensome regulatory process. To be clear, if the process is too cumbersome and too much of a burden, companies will look at innovation elsewhere, and they already have. You may have a great intellectual property protection regime, but if the regulations or the regulatory guidance is delayed, nothing takes place and we lose traction.[210]

Similarly related to facilitating regulatory processes for IP development, Krista Jones testified to the value of having an internationally competitive regulatory process.[211] She testified that, “it's about being able to have a regulatory environment that is sought after globally, like the [U.S. Food and Drug Administration] is, such that when companies are approved here, they can be viewed as approved globally.”[212]

Serge Buy and a brief submitted by Matt Malone also expressed concern that Canada has lax enforcement of IP protection that can equally drive companies to take their IP to other jurisdictions with more robust protection regimes.[213]

Therefore, the Committee recommends:

Recommendation 11

That the Government of Canada undertake a review of Canada’s intellectual property regulation regime in comparison with other jurisdictions to ensure international competitiveness in regard to timelines, protection and interoperability.

Lack of Data to Inform Decision-Making

Witnesses mentioned the need for better data to measure innovation, such as where in their development process start-ups request funding from the federal government, tracking IP across ownership changes, job creation and social impact.[214] In a brief submitted to the Committee, Axelys further suggested moving away from measures such as licensing revenue to encompass a set of evaluation criteria that includes broader economic prosperity measures and societal benefits.[215]

Currently, most data analysis in this field measures patents and sales, but this can be considered more indirect and latent for early-stage innovation activities, which may not be at the sale stage yet.[216] Better data can help increase understanding of what supports are most helpful during the move from the lab to the market.[217]

David Durand mentioned in his testimony the desire to conduct an expanded version of the 2019 Statistics Canada survey on IP awareness and use that would include such additional measures.[218] Alain Francq, meanwhile, suggested the Government of Canada work on anonymizing and disaggregating data collected through programs such as the Scientific Research and Experimental Development tax credits to provide insights into Canada’s IP and innovation sectors.[219]

Therefore, the Committee recommends:

Recommendation 12

That the Government of Canada undertake additional data collection and analysis on Canada’s intellectual property landscape, including an expanded version of the 2019 Survey on Intellectual Property Awareness.

Representation Within Innovation Ecosystems

Several witnesses explained that there are groups that are under-represented within the IP and innovation ecosystems, particularly women and Indigenous peoples.[220] A brief submitted by Myra Tawfik and Heather Pratt on the under-representation of women in the IP ecosystem identified specific barriers related to a lack of networks and mentors, financing challenges, corporate culture and systemic biases.[221]

While the representation of women and Indigenous peoples in patent ownership is low, Giuseppina D’Agostino highlighted some Government of Canada programs that assist under-represented groups:

The federal government identified women and Indigenous communities as two communities that need assistance, and they've done this through their programming. I was the beneficiary of that through one of the proposals I put through and my IP innovation chatbot, which is a way to automate the commercialization process to be more responsive of women and Indigenous peoples who often don't have the resources—even more than just mainstream ecosystems—to ask the questions and to get the answers.[222]

Recommendations to improve the participation of underrepresented groups in IP included:

- outlining specific challenges faced by under-represented groups in IP awareness and education programs;

- visibly representing under-represented groups in educational and promotional materials; and

- launching communities of practice and mentorship programs for under-represented groups.[223]

Jarret Leaman, Founder and Chief Strategy Officer of the Centre for Indigenous Innovation and Technology, further spoke of the use of Indigenous data sovereignty and collective interests to ensure that Indigenous peoples and communities retain control over the collection, ownership and application of their data.[224]

Therefore, the Committee recommends:

Recommendation 13

That the Government of Canada launch communities of practice and mentorship programs to support the participation of under-represented groups in intellectual property development and commercialization.

Recommendation 14

That the Government of Canada, in collaboration with Indigenous governments, organizations and communities, explore the impacts of Indigenous data sovereignty and collective rights on intellectual property policies.

[1] House of Commons, Standing Committee on Science and Research (SRSR), Minutes of Proceedings, 22 September 2022.

[2] United Nations Economic Commission for Europe, Intellectual Property Commercialization: Policy Options and Practical Instruments, 2011.

[3] SRSR, Evidence, 7 March 2023, 1100 (Mike McLean, Chief Executive Officer, Innovation Asset Collective).

[4] SRSR, Evidence, 9 March 2023, 1200 (Giuseppina D’Agostino, Associate Professor of Law, Osgoode Hall Law School, York University, As an individual).

[5] Ibid., 1240.

[6] Ibid.

[7] Ibid., 1200.

[8] SRSR, Evidence, 25 April 2023, 1120 (Andrew Greer, Managing Director, Purppl); SRSR, Evidence, 27 April 2023, 1155 (Neil Desai, Senior Fellow, Centre for International Governance Innovation, As an individual); and SRSR, Evidence, 27 April 2023, 1255 (Todd Bailey, Intellectual Property Lawyer, As an individual).

[10] Ibid., 1155.

[11] Ibid., 1120.

[13] Ibid., 1115.

[14] Innovation, Science and Economic Development Canada, “ISED follow-up to Mark Schaan, Senior Assistant Deputy Minister, Strategy and Innovation Policy Sector, and Nipun Vats, Assistant Deputy Minister, Science and Research Sector, Appearance before the Standing Committee on Science and Research (SRSR) on March 23, 2023,” Written submission to the House of Commons Standing Committee on Science and Research, April 2023.

[15] SRSR, Evidence, 23 March 2023, 1235 (Konstantinos Georgaras, Commissioner of Patents, Registrar of Trademarks and Chief Executive Officer, Canadian Intellectual Property Office).

[16] SRSR, Evidence, 23 March 2023, 1235 (Mark Schaan, Senior Assistant Deputy Minister, Strategy and Innovation Policy Sector, Department of Industry); and SCALE AI, How Canada Can Build an AI-Powered Economy: AI at Scale, 2023.

[17] SCALE AI, How Canada Can Build an AI-Powered Economy: AI at Scale, 2023.

[19] Government of Canada, Building a Nation of Innovators.

[20] SRSR, Evidence, 21 March 2023, 1245 (Kathryn Hayashi, Chief Executive Officer, TRIUMF Innovations).

[23] Ibid.

[24] SRSR, Evidence, 27 April 2023, 1105 (Anne-Marie Larose, Former President and Chief Executive Officer, Aligo Innovation, As an individual).

[25] Ibid.

[26] SRSR, Evidence, 28 March 2023, 1105 (Daniel Schwanen, Vice-President, Research, C.D. Howe Institute).

[27] SRSR, Evidence, 30 March 2023, 1220 (Chad Gaffield, Chief Executive Officer, U15 Group of Canadian Research Universities).

[28] SRSR, Evidence, 7 March 2023, 1150 (Louis-Félix Binette, Executive Director, Mouvement des accélérateurs d’innovation du Québec).

[29] SRSR, Evidence, 7 March 2023, 1140 (Louis-Félix Binette); and BioCanRx, Submission to the Standing Committee on Science and Research Study on “Support for the Commercialization of Intellectual Property,” Brief submitted to the House of Commons Standing Committee on Science and Research, 12 April 2023.

[31] BioCanRx, Submission to the Standing Committee on Science and Research Study on “Support for the Commercialization of Intellectual Property,” Brief submitted to the House of Commons Standing Committee on Science and Research, 12 April 2023.

[33] SRSR, Evidence, 30 March 2023, 1240 (Jim Balsillie); and SRSR, Evidence, 18 April 2023, 1105 (Jim Hinton, Intellectual Property Lawyer, As an individual).

[34] SRSR, Evidence, 30 March 2023, 1240 (Jim Balsillie); and Innovation Asset Collective, “Appendix B,” Written submission to the House of Commons Standing Committee on Science and Research, 2023.

[35] SRSR, Evidence, 23 March 2023, 1105 (Kim Furlong, Chief Executive Officer, Canadian Venture Capital and Private Equity Association); and SRSR, Evidence, 25 April 2023, 1110 (Alain Francq, Director, Innovation and Technology, The Conference Board of Canada).

[37] Ibid., 1210.

[39] Ibid.

[40] SRSR, Evidence, 7 March 2023, 1100 (Mike McLean); SRSR, Evidence, 9 March 2023, 1205 (Louis-Pierre Gravelle, Partner, Bereskin & Parr, LLP, Intellectual Property Institute of Canada); SRSR, Evidence, 23 March 2023, 1205 (Mark Schaan); and SRSR, Evidence, 23 March 2023, 1210 (Mark Schaan).

[41] SRSR, Evidence, 7 March 2023, 1100 (Mike McLean); and SRSR, Evidence, 9 March 2023, 1205 (Louis-Pierre Gravelle).

[43] Government of Canada, About the NRC Industrial Research Assistance Program.

[44] SRSR, Evidence, 25 April 2023, 1110 (Alain Francq); SRSR, Evidence, 9 March 2023, 1230 (Louis-Pierre Gravelle); SRSR, Evidence, 7 March 2023, 1100 (Mike McLean); SRSR, Evidence, 18 April 2023, 1105 (Jim Hinton); and Government of Canada, NRC IRAP support for intellectual property.

[47] SRSR, Evidence, 9 March 2023, 1145 (Karim Sallaudin Karim, Associate Vice-President, Commercialization and Entrepreneurship, University of Waterloo).

[48] Ibid.

[50] Ibid., 1125.

[51] SRSR, Evidence, 9 March 2023, 1100 (Nadine Beauger, Former President and Chief Executive Officer, IRICoR, As an individual).

[52] Ibid.

[53] Innovation, Science and Economic Development Canada, “ISED follow-up to Mark Schaan, Senior Assistant Deputy Minister, Strategy and Innovation Policy Sector, and Nipun Vats, Assistant Deputy Minister, Science and Research Sector, Appearance before the Standing Committee on Science and Research (SRSR) on March 23, 2023,” Written submission to the House of Commons Standing Committee on Science and Research, April 2023.

[54] Canadian Institutes of Health Research, Study on the Support for the Commercialization of Intellectual Property, Brief submitted to the House of Commons Standing Committee on Science and Research, 2023.

[55] Innovation, Science and Economic Development Canada, “ISED follow-up to Mark Schaan, Senior Assistant Deputy Minister, Strategy and Innovation Policy Sector, and Nipun Vats, Assistant Deputy Minister, Science and Research Sector, Appearance before the Standing Committee on Science and Research (SRSR) on March 23, 2023,” Written submission to the House of Commons Standing Committee on Science and Research, April 2023.

[57] A patent box taxes income earned from IP at a rate lower than corporate income tax, in order to encourage R&D and IP development.

[58] SRSR, Evidence, 7 March 2023, 1105 (Louis-Félix Binette); SRSR, Evidence, 9 March 2023, 1210 (Louis-Pierre Gravelle); SRSR, Evidence, 28 March 2023, 1155 (David Durand, President, International Intellectual Property Forum–Québec); SRSR, Evidence, 30 March 2023, 1205 (Jesse Vincent-Herscovici, Chief Executive Officer, Axelys); SRSR, Evidence, 18 April 2023, 1110 (Marie Gagné, Chief Executive Officer, Synchronex); and Ontario Bioscience Innovation Organization (OBIO), Submission to the Standing Committee on Science and Research Study on The Commercialization of Intellectual Property, Brief submitted to the House of Commons Standing Committee on Science and Research, 2023.

[60] SRSR, Evidence, 7 March 2023, 1110 (Louis-Félix Binette); and SRSR, Evidence, 30 March 2023, 1205 (Jesse Vincent-Herscovici).

[61] SRSR, Evidence, 21 March 2023, 1200 (Baljit Singh, Vice-President, Research, University of Saskatchewan); SRSR, Evidence, 25 April 2023, 1130 (Alain Francq); SRSR, Evidence, 18 April 2023, 1105 (Jim Hinton); SRSR, Evidence, 7 March 2023, 1100 (Mike McLean); SRSR, Evidence, 30 March 2023, 1155 (Jim Balsillie); SRSR, Evidence, 21 March 2023, 1140 (William Ghali, Vice-President, Research, University of Calgary); SRSR, Evidence, 21 March 2023, 1100 (Gail Murphy, Vice-President, Research and Innovation, University of British Columbia); and SRSR, Evidence, 25 April 2023, 1205 (Jarret Leaman, Founder and Chief Strategy Officer, Centre for Indigenous Innovation and Technology).

[62] SRSR, Evidence, 30 March 2023, 1200 (Chad Gaffield); SRSR, Evidence, 21 March 2023, 1105 and 1120 (William Ghali).

[63] SRSR, Evidence, 7 March 2023, 1130 (Louis-Félix Binette); SRSR, Evidence, 9 March 2023, 1105 (Karim Sallaudin Karim); and SRSR, Evidence, 21 March 2023, 1255 (Kathryn Hayashi).

[65] TRIUMF and TRIUMF Innovations, Briefing Note for the Study on Support for the Commercialization of Intellectual Property, Brief submitted to the House of Commons Standing Committee on Science and Research, 23 March 2023.

[66] Ibid.

[67] SRSR, Evidence, 23 March 2023, 1215 (Mark Schaan); and SRSR, Evidence, 21 March 2023, 1105 (William Ghali).

[69] SRSR, Evidence, 7 March 2023, 1200 (Jeffrey Taylor, Chair, National Research Advisory Committee, Colleges and Institutes Canada).

[70] Ibid., 1210.

[71] Colleges and Institutes Canada, “Upcoming Study on the Commercialization of IP,” Written submission to the House of Commons Standing Committee on Science and Research, 17 October 2022.

[72] Ibid.

[73] Colleges & Institutes Canada, Canadian Colleges: Creating IP and Powering Commercialization, Brief submitted to the House of Commons Standing Committee on Science and Research, April 2023.

[75] Ibid., 1210.

[76] SRSR, Evidence, 23 March 2023, 1210 (Mark Schaan); Government of Canada, A Blueprint for the Canada Innovation Corporation.

[78] Ibid.

[79] SRSR, Evidence, 9 March 2023, 1105 (Karim Sallaudin Karim); SRSR, Evidence, 21 March 2023, 1140 (Gail Murphy); and Innovation, Science and Economic Development Canada, Report of the Advisory Panel on the Federal Research Support System, 2023.

[81] Ibid., 1225.

[85] Ibid., 1210; and 1235.