INDU Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

Blockchain Technology: Cryptocurrencies and Beyond

Introduction

On 26 September 2022, the House of Commons Standing Committee on Industry and Technology (the Committee) passed a motion to:

recognize that blockchain technology—a virtual ledger able to register transparently great volumes of transactions—is an emerging technology with vast potential to bring about innovation and efficiency gains in different industries such as financial services, health care, travel, entertainment, agriculture and many more sectors of our economy; that blockchain startups have seen an impressive growth in the last years; that regulatory certainty could bring about more investments in that specific field and drive innovation across the Canadian economy; that as such, pursuant to standing order 108(2), the Committee undertake a comprehensive study on the current state of blockchain technology in Canada, and potential applications, to determine the innovative opportunities it presents as well as the risks, alongside the legal and regulatory framework required to govern this emerging technology; that the Committee devote a minimum of four meetings to this study and report its findings to the House.[1]

Over the course of the study, the Committee held 5 meetings during which it heard from 31 witnesses. The Committee also received 6 briefs.

During its study, witnesses told the Committee about the ways that blockchain technology is already changing the digital landscape and providing significant economic benefits, while also expressing optimism that greater opportunities using the technology lie ahead. Much of this discussion focused on cryptocurrencies, like Bitcoin, whose framework is based on blockchain technology, but witnesses emphasized that this technology has use cases across industries and sectors.

Despite this promise, the blockchain industry is also facing many challenges. While allegations of massive fraud and the collapse large cryptocurrency firms have been the subject of media attention in recent years, witnesses also spoke about the threat of smaller-scale crimes perpetrated against consumers seeking to enter cryptocurrency markets. At the same time, concerns have increased regarding the energy resources consumed by the blockchain industry, and its potential negative impact on strained energy grids and the transition to a green economy.

Witnesses recognized that the recent history of blockchain has demonstrated the need for better regulation, including protection for consumers from fraud and other malfeasance. While many emphasized Canada’s strong regulatory safeguards, such as provincial securities regulation and federal anti-money laundering and anti-terrorism financing obligations, witnesses stated that governments need to partner with industry to better understand this rapidly evolving sector and enact regulations that protect consumers without unnecessarily hindering innovation.

Blockchain Technology and Cryptocurrencies Explained

In public discourse, blockchain and cryptocurrency, which both originated from a 2008 paper attributed to Satoshi Nakamoto, are often confused or used interchangeably.[2] Blockchain, however, refers to a type of distributed ledger, or database, technology where every member, or node, of a network possess a copy of the ledger and can participate in maintaining it. Blockchain uses cryptography and what are known as consensus mechanisms to validate new information which is added to the ledger and ensure that the ledger is secure from tampering.

In a blockchain network, blocks of encrypted information are added to the database once they have been validated by the nodes in the network using an algorithmic consensus mechanism. The cryptography used for each block is linked to the preceding block in a chain, impeding the ability of a node to retroactively alter the information contained in the preceding blocks.[3]

Blockchain networks provide a means for ensuring the integrity of the information contained in a database without requiring a central authority to validate its authenticity. Instead, nodes in a blockchain network are collectively responsible for maintaining the integrity of the information, creating a decentralized authority that promotes the secure recording and storage of information.

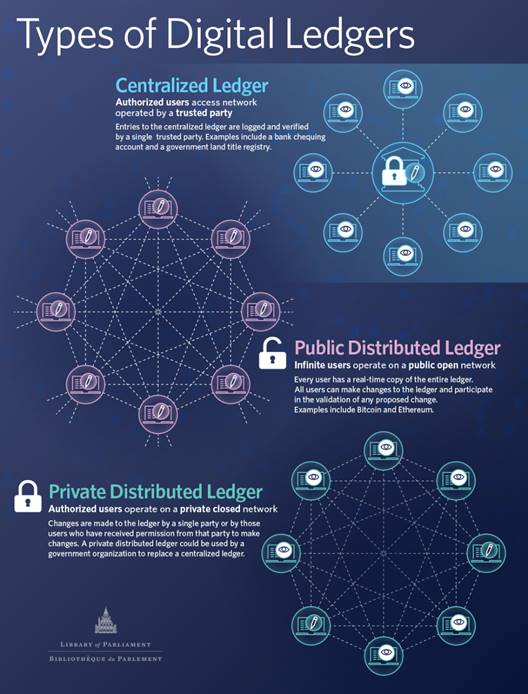

Blockchain networks, and other forms of distributed ledger technology, can be broadly categorized into networks that are open/permissionless and private/permissioned.[4] Open/permissionless networks allow any user to join as a node and then propose changes to the database and participate in validation. Open/permissionless include the most well-known blockchain networks, including the Bitcoin and Ethereum networks. Private/permissioned networks require that users be authorized before becoming a node and the ability to propose or validate changes to the database may be further restricted to certain nodes in the network.

Figure 1—Types of Digital Ledgers

Source: Adriane Yong, “Beyond Digital Currencies: Blockchain in the Public Sector,” HillNotes, 23 April, 2019.

The original, and still most commonly associated, usage of blockchain technology is as a ledger for crypto assets, including cryptocurrencies. Proposed legislation in Ontario defines a crypto asset as “a digital representation of value or contractual rights, which may be transferred and stored electronically, using distributed ledger or similar technology.”[5] While Merriam-Webster dictionary defines cryptocurrency as “any form of currency that only exists digitally, that usually has no central issuing or regulating authority but instead uses a decentralized system to record transactions and manage the issuance of new units, and that relies on cryptography to prevent counterfeiting and fraudulent transactions.”[6]

Though each cryptocurrency blockchain operates according to its own protocols, most are modelled, at least to some extent, on the Bitcoin blockchain network, the first and largest cryptocurrency by market capitalization.[7] With the proper software installed, any computer user can join the Bitcoin network, engage in bitcoin transactions, and participate in validation of the ledger.[8] The software provides users with a matching set of cryptographic keys, commonly referred to as a wallet: one public, which is used to identify the user on the ledger and track their bitcoin transactions, and one private, which allows users to sign transactions to ensure only they may transfer the bitcoin attributed to them. The Bitcoin ledger keeps a complete record of transactions, allowing users to track the chain of ownership of bitcoins.

Figure 2—Public Key Cryptography, Digital Signatures and Chain of Ownership

Source: Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 31 October 2008.

The Bitcoin network uses a consensus method known as proof of work. Under proof of work, nodes in the network compete to solve a computational problem, with the node finding the solution first winning the right to validate the next block (containing the record of recent bitcoin transactions) to be added to the chain. Nodes that validate a block are rewarded with newly minted bitcoin, in what is referred to as bitcoin, or cryptocurrency, mining. The Bitcoin network is calibrated to validate a new block approximately every ten minutes, with the difficulty of computational problems increasing as nodes devote greater computational power to solving proof of work problems.[9]

One alternative to proof of work as a consensus mechanism in cryptocurrency blockchain networks is proof of stake. Under proof of stake, nodes must commit, or stake, cryptocurrency instead of dedicating computational power, as in proof of work, in order to have the opportunity to validate a new block and add it to the chain. Nodes participating in validation are rewarded with cryptocurrency, like with proof of work, but may also be penalized for bad behaviour through penalties levied against the cryptocurrency they have staked.[10] Ethereum, the second largest cryptocurrency by market capitalization, completed its transition from proof of work to proof of stake in September 2022.[11]

Blockchain technology and related cryptocurrency networks are part of a broader evolution in digital technology called Web 3. Web 3 refers to the emerging third phase of the internet that incorporates blockchain as well as other technologies like artificial intelligence and the internet of things. This third phase of the internet is differentiated from the first phase, which ran through the early 2000s and was characterized largely by the consumption of information, and the second phase, which beginning in the 2000s was dominated by social media and characterized by both the consumption and creation of information. Instead, Web 3 is characterized by the ability to consume, create, and own information and supports “online privacy, self-sovereign identity, and property rights to digital assets.”[12]

The Characteristics of Blockchain Networks

In a 2019 white paper, the Digital Governance Institute identified four key characteristics of blockchain networks:

- Transparency: Blockchain networks are an “open book”, generally providing each node with a complete copy of the network’s database.

- Traceability: The chronological recording of transactions allows users to track the chain of ownership of assets recorded in the database.

- Immutability: The distributed nature of blockchain databases means that information is permanently registered and resistant to tampering.

- Disintermediation and user empowerment: blockchain networks allow for peer-to-peer transactions without the oversight of a central authority or intermediary. Responsibility for management of the database is collectivised.[13]

Table 1 sets out the strengths and weakness of blockchain networks compared to other forms of information storage, such as centralized databases and cloud storage, as identified by the Digital Governance Institute.

Table 1—Strengths and Weakness of Blockchain Networks

Strengths |

Weaknesses |

|

|

Source: Digital Governance Institute, “Registres Distribués, L’Évolution de la Chaîne de Blocs : Impacts, enjeux et potentiels pour le Québec,” White Paper, November 2019.

Blockchain Applications

Witnesses presented the Committee with a range of real and potential applications of blockchain technology, which can be broadly grouped into those related to cryptocurrencies, and those intended for other sectors. Several witnesses also cautioned against assuming that the blockchain applications identified today will ultimately prove the most valuable. According to Brian Mosoff, Chief Executive Officer, President of Canadian Web3 Council, Ether Capital, “It's really hard to imagine what the biggest businesses will be in this new world. There are probably things that are more digitally native or blockchain-native than something that we can mirror back to society today.”[14] Jean Amiouny, Co-founder and Chief Executive Officer, Shakepay Inc., made a similar comment, comparing the current state of blockchain to the early days of the internet:

[A]ny new technology is never well understood, and it takes time for society to experience its benefits. The Internet in the 1980s was an incredible innovation, but it took time for it to mature and develop into what it is today.[15]

Witnesses emphasized that there are a broad range of crypto assets created using blockchain technology. As Laure Fouin, Co-Chair Digital Assets and Blockchain, Osler, Hoskin & Harcourt LLP, explained, crypto assets can be organized into categories:

The first category is cryptocurrencies …The second category is cyber-indexed tokens, which include non-fungible tokens—in other words, digital assets that represent real objects such as art, music and videos—tokens that refer to currency or currencies, commodities or other digital assets, and the so-called tokens representing rights, such as investors' rights in a joint venture, which are then securities… The third category is utility tokens, which have a specific purpose. For example, they may be used in the future on a platform in exchange for a special service or to receive preferential treatment for certain services on that platform.[16]

Non-Cryptocurrency Applications

Morgan Hayduk, Co-Chief Executive Officer, Beatdapp Software Inc., testified that his company is one of “a growing class of companies that leverage blockchain technology for non-financial or non-speculative reasons.”[17] In general, witnesses emphasized how the secure, transparent and decentralized nature of blockchain networks could promote the efficient recording, transmitting and storing of information across industries. Namir Anani, President and Chief Executive Officer, Information and Communications Technology Council, said that blockchain offered “solutions to improve business value chains, enhance efficiencies and enable a system of trust based on consensus, while unlocking at the same time further economic activities without the need for a trusted third party intermediary.”[18] According to Jesse McWaters, Senior Vice President, Global Head of Regulatory Advocacy, Mastercard, blockchain has “the potential to transform how information is shared and how value gets moved.”[19]

Witnesses spoke about how blockchain could make supply chains more efficient, transparent and responsive. Charlaine Bouchard, Research Chair in Smart Contracts and Blockchain, Digital Governance Institute, testified that applying blockchain technology to supply chains will “protect data and streamline processes, in addition to decreasing resource waste and abuses.”[20] According to Patrick Mandic, Chief Executive Officer, Mavennet Systems Inc., supply chains are “still largely paper-based” or using “near-paper formats like PDFs or emails,” as organizations, each using their own digital systems, do not “speak the same digital language.” Therefore, once supply chains pass organizational boundaries “digitalization simply goes out of the window.”[21]

Through blockchain networks that are interoperable across organizations, Patrick Mandic believed that it would be possible to:

create supply chains that can adapt to supply chain shocks in real time. It means the ability to automate contract settlement and payments, the ability to enable automatic trade finance, the ability to identify the origin of products in their composition, being able to prove the environmental footprint of a product to enable buyers’ conscious decisions on what products they’re buying.[22]

According to witnesses, blockchain-enabled supply chains could improve outcomes across numerous industries. Koleya Karringten, Executive Director, Canadian Blockchain Consortium, pointed to pharmaceutical provenance and food security as issues that could be addressed by blockchain-enabled supply chains. Such supply chains could help reduce the “four billion incorrectly labelled or fake drugs [that] are administered each year” by allowing doctors and pharmacists to “verify the authenticity of the pharmaceuticals they administer and even get real-time alerts directly from manufacturers for when medications expire or become available.” In the food industry, blockchain could “cut food recall times down from days to seconds” enabling food retailers to “verify what product was contaminated and where it was delivered, and quickly remove the items from stores, saving companies millions in food recalls and improving Canadian food security.”[23]

Witnesses also highlighted the ability of blockchain-enabled supply chains to help track CO2 emissions and improve carbon credit systems. According to Tanya Woods, Chief Executive Officer, Futurity Partners, the “carbon credit market is complex and challenged by a lack of transparency and traceability, and authenticity issues regarding the credits sold and the projects related to the credits,” and blockchain could help provide “verified carbon credits.”[24]

Guillaume Déziel, Digital Culture Strategist, Digital Governance Institute, pointed to the distribution of revenues in cultural industries, such as music and video game production, stating that blockchain could allow companies to “automatically distribute [revenue] to the people who should be receiving them … without human intervention, seamlessly, transparently and in perpetuity.”[25] Referring to fraud detection in the distribution of royalties for music streaming, Morgan Hayduk said his company is now able to track “trillions of individual events annually, across hundreds of services, with thousands of rights holders each having an audit right over that service for their catalogue.”[26]

Blockchain is also enabling new digital-native industries, like businesses built around the sale and trade of non-fungible tokens (NFTs). A NFT is a record of ownership stored on a blockchain ledger of a unique, i.e., non-fungible, asset. NFTs are most closely associated with ownership of unique digital assets, like artwork, but may also record ownership of real-world property.[27] Citing the example of the National Basketball Association’s digital collectibles marketplace, Top Shot, Alison Kutler, Head of Government Affairs, Dapper Labs, said the NFTs her company produces:[28]

provide real utility. They strengthen relationships between fans and their favourite players and teams and entertainers, providing new creative channels for brand expression, engaged and exciting communities, and opportunities for consumers to be rewarded for their fandom, online and off‑line.[29]

Public Sector Applications

Witnesses also identified public sector applications where blockchain could improve the provision of public services and program delivery. Aidan Hyman, Chief Executive Officer, Chainsafe Systems Inc., gave the example of a World Food Programme project which has used blockchain to provide cash assistance to refugees and to date has transferred US$325 million to one million refugees in Jordan and Bangladesh.[30]

Patrick Mandic spoke about his firm’s work with both the Canadian and U.S. governments to use blockchain technology to improve traceability in the oil and gas, and steel industries, to improve supply chain transparency and potentially reduce fraud.[31] While Charlaine Bouchard told the Committee about a project to create a blockchain for notary public services in Quebec that will seek to automate notarial contracts.[32]

Tanya Woods pointed to government issued identification as another potential public sector application: “Passports are a great example. Driver's licences, health cards and anything that relates to needing to show identity is a digital identity use case.”[33]

Financial Blockchain Applications

Witnesses generally presented cryptocurrencies as a form of investment, as opposed to a means of facilitating financial transactions like traditional currencies. Witnesses also highlighted that cryptocurrencies were a new product unlike existing financial instruments, and the industry is likely to continue evolving rapidly. According to Pascal St‑Jean, President, 3iQ Corporation, cryptocurrencies allow “citizens to invest in the foundations of the technology, which was not possible before.”[34]

So-called “smart contracts,” which will allow for forms of “decentralized finance,” were one commonly cited application of cryptocurrency networks beyond simply holding cryptocurrencies as investments. As Pascal St‑Jean explained, using the example of the information used to determine the terms of a mortgage:

A smart contract is essentially a programmatical way of entering all this information into a contract that is basically observed and triggered based on data that gets provided. Let’s say we were to go online and generate a contract together: I’ll loan you x amount for x percentage, and you will give me x amount in collateral, and if you pay it back by a certain date, you’ll get your collateral back. This is all triggered by computer code, which is a smart contract. That enables a lot of innovation of peer-to-peer finance, which is decentralized finance.[35]

Aidan Hyman noted that the use of smart contracts can be taken further, “enabling individuals to create these autonomous organizations through a series of smart contracts that enable functionality way beyond trading crypto.”[36]

Dina Mainville, Founder and Principal, Collisionless, among others, pointed to “the fractionalized ownership of traditional assets that are becoming increasingly out of reach for Canadians, like real estate” as a financial service that could be unlocked through blockchain.[37] According to Pascal St‑Jean, “Fractionalization of ownership, whether it is of cryptocurrency, real estate, fine art or other assets, will enable Canadians across the country to have a small piece of assets to help them grow their net worth as they try to build a life for themselves.”[38]

In discussing the advantages of cryptocurrencies, many witnesses emphasized their potential to better serve those currently underserved, or excluded, by the banking sector. Koleya Karringten listed financial inclusion as the first example of how blockchain can improve the lives of Canadians or others around the world. Citing the 8 million Canadians whose credit level is considered “non-prime,” she said firms in the cryptocurrency sector “provide ways for the unbanked to save [and] access credit.”[39] Other witnesses emphasized the potential for cryptocurrencies to help people in the Global South experiencing hyperinflation or oppression from authoritarian regimes. According to Ethan Buchman, Chief Executive Officer, Informal Systems Inc., “Cryptocurrencies offer an opportunity. They offer a way to escape certain authoritarian regimes, ways for families in these countries to try to protect their wealth and potentially to escape with it.”[40]

Relatedly, witnesses also pointed to facilitating cross-border transactions as a financial service that can be improved by cryptocurrencies. Justyna Osowka, Founder, Women in Blockchain Canada, cited conversations with people from similar immigrant backgrounds “about sending money abroad” being “difficult and expensive” as inspiring her to begin her career in blockchain.[41] Matthew Burgoyne, Co-Chair Digital Assets and Blockchain, Osler, Hoskin & Harcourt LLP, claimed cross-border transactions using cryptocurrencies could be made “in a matter of seconds, versus waiting sometimes up to a week to settle cross-border transactions with bank wires.”[42]

Blockchain in Canada

Witnesses painted a complex picture of the current state of the blockchain industry in Canada. From one perspective, Canadians have a demonstrated track record of being leading developers of the technology and industry innovators. Witnesses highlighted the development of the Ethereum blockchain network and the launching cryptocurrency-based investment funds, such as exchange-traded funds for bitcoin and ether, as examples of Canadian innovation. Aidan Hyman testified that:

Toronto is one of the major homes of the Ethereum project, with almost half of the Ethereum co-founders being Canadian, mostly notably Vitalik Buterin, the leading founder of Ethereum. We've seen many great Canadian companies and projects being sprung out of the vision and idea that is web3.[43]

Namir Anani, President and Chief Executive Officer, Information and Communications Technology Council, citing the findings of a report by his organization, stated that “”Canada punches above its weight” in global blockchain innovations and entrepreneurial capacity.”[44] Others framed Canada’s advantage more in terms of future potential, like Koleya Karringten, who believed “Canada has an opportunity to be a leader in this space, not just on the financial services side but… in the enterprise-level blockchain space.”[45]

At the same time, witnesses warned that Canada risks falling behind. According to Jaime Leverton, Chief Executive Officer, Hut 8 Mining Corporation:

The lack of clarity and the lack of support from a funding perspective have ultimately driven a lot of our talent away. Canada was very early in this ecosystem. Tons of talents were born in Canada. They are subsequently taking their businesses, their innovation and their property, and establishing themselves elsewhere in the world.[46]

Dina Mainville testified that “the risk of losing Canadian entrepreneurship to other jurisdictions that maybe afford better clarity or have better incentives for bringing that entrepreneurship elsewhere is a real risk that we need to address as a community here in Canada.”[47]

Blockchain’s Economic Impact in Canada

Witnesses were not able to provide firm estimates of the current value of the blockchain industry in Canada. Both Pascal St‑Jean and Brian Mosoff estimated that “billions” are being invested in the sector, which has grown significantly in recent years.[48] Namir Anani cited an estimate of the global blockchain industry, stating that it was expected to grow to US$1.59 trillion by 2030.[49]

Numbers from Statistics Canada show that use of blockchain technologies among Canadian businesses remains low but is growing.

Table 2—Use of Blockchain Technologies by Small, Medium-sized and Large Enterprises in Canada

Small enterprises |

Small enterprises |

Medium-sized enterprises |

Medium-sized enterprises |

Large enterprises |

Large enterprises |

2019 |

2021 |

2019 |

2021 |

2019 |

2021 |

0.3 % |

0.2% |

0.4% |

0.8% |

1.6% |

2.5% |

Source: Statistics Canada, Table 22-10-0117-01 Information and communication technologies used by industry and size of enterprises.

In terms of employment, witnesses emphasized the broad range of expertise required by blockchain businesses. Speaking of cryptocurrency trading platforms’ employment needs, Evan Thomas, Head of Legal, Wealthsimple Crypto, Wealthsimple, said:

[W]e have engineers; we have designers; we have operational professionals; we have anti-money-laundering specialists and other regulatory specialists. We have to bring together all of their various talents in order to offer these services.[50]

Dina Mainville highlighted that the blockchain industry “offers uniquely low barriers to entry” for potential employees while paying competitive salaries.[51] Namir Anani estimated total employment in the industry at 16,000 in 2020, while Stephen Oliver cited statistics claiming 13,000 people worked for cryptocurrency firms registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in 2022.[52]

As it relates to the demand side of the industry, Evan Thomas pointed to recent studies by the Bank of Canada and the Ontario Securities Commission (OSC) as offering insights into the adoption of cryptocurrencies by Canadians.[53] The OSC report, which was based on a survey conducted in Spring 2022, included the following findings:

- 13% of Canadians owned at least one type of crypto asset (including through investment funds);

- Crypto asset owners were disproportionately male (67%), between the ages of 25 and 44 (59%), and university educated (49%);

- A majority (53%) of owners who purchased crypto assets directly reported the present value of their assets at below $5,000, while half of owners who own crypto assets through an investment fund reported present value below $10,000;

- Approximately half of owners who purchased crypto assets directly, did so through a cryptocurrency trading platform and hold their cryptocurrency through such a platform.[54]

The Blockchain Ecosystem

A variety of organizations have grown around blockchain networks, and, through organizations such as the Canadian Blockchain Consortium, are organizing at the industrial level. In describing their organizations, witnesses who testified during the Committee’s study demonstrated the breadth of activities being undertaken around blockchain networks.

Many blockchain businesses are focused solely, or primarily, on the exchange of cryptocurrencies. Crypto-asset trading platforms, like Wealthsimple, Shakepay, WonderFi Technologies and the National Digital Asset Exchange, provide services for the buying, selling, and trading of cryptocurrencies and are one of the primary means by which many users access cryptocurrency markets and hold cryptocurrencies. In contrast, firms like Ether Capital and 3iQ have focused on providing access to cryptocurrency markets through other means, such as exchange-traded funds.

Other firms, like Bitfarms, Hut 8 and DMG Blockchain Solutions, work in cryptocurrency mining, providing the computational services for the proof of work consensus mechanisms that underly cryptocurrencies like Bitcoin. Less well-known firms like Tetra Trust Company, act as cryptocurrency custodians, holding the assets of exchanges and their customers in trust, in what is often referred to as “cold storage.”

The Committee also heard from representatives of firms that are using blockchain technology in other sectors, such as Beatdapp Software which uses blockchain for auditing and fraud detection in digital media, and Dapper Labs, which creates NFTs. Other firms, such as Mavennet Systems, Informal Systems and Chainsafe Systems, focus on the development of software and digital products using blockchain technology.

The blockchain ecosystem also contains firms, like Collisionless and Futurity Partners, providing consulting and advisory services as well as non-profit and academic organizations, such as Women in Blockchain Canada, the Digital Governance Institute and the Information and Communications Technology Council, that study and promote the benefits of blockchain. Finally, firms from other sectors are also participating in the blockchain industry, including financial firms, such as Mastercard, and Canadian law firms.

The State of Blockchain Regulation in Canada

Canada’s regulation of blockchain firms is evolving along with the technology itself. Generally speaking, regulators have been focused on cryptocurrencies, in particular firms engaging in cryptocurrency markets and providing related financial services to Canadians, such as cryptocurrency trading platforms. Regulation of cryptocurrencies is occurring at both federal and provincial level, with provincial securities regulators playing an important role.

This increased interest by Canadian regulators is broadly is line with developments in other jurisdictions. Regulators around the world have been expanding the regulation of cryptocurrency to make their treatment more consistent with the treatment of similar financial instruments. As the Financial Stability Board stated in its proposed framework for the regulation of crypto assets, regulations should be based on the principle of “same activity, same risk, same regulation.”[55] Experts have noted, however, that while there is a general push for greater regulation, approaches very significantly across jurisdictions, leading to a fragmented international landscape for cryptocurrency regulation.[56]

The Canada Revenue Agency considers cryptocurrencies as commodities for the purposes of the Income Tax Act, meaning that when they are used to purchase goods and services, the transaction is considered a barter transaction (i.e., an exchange not involving legal currency).[57] The disposition of cryptocurrencies, for example by using them to make purchase or selling them for Canadian dollars, results in capital gains or losses for tax purposes (or business income or loss where the transaction is a business activity).[58]

Amendments made to the Excise Tax Act in 2021 defined most cryptocurrencies as a “virtual payment instrument,” thereby including cryptocurrencies within the existing GST/HST exempt for financial services.[59] This means that the purchase of cryptocurrencies is not generally subject to GST/HST (GST/HST must still be paid on goods and services purchased with cryptocurrencies).[60]

Cryptocurrency firms are also regulated at the federal level under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.[61] Businesses dealing in virtual currency, as defined by the Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, are required to register as a money services business with FINTRAC and fulfill the related requirements regarding “know your client,” transaction reporting and record keeping.[62]

Provincial and territorial securities regulators, often acting collectively through their national umbrella organization, the Canadian Securities Administrators (CSA), have taken the position that many crypto assets are securities or derivatives, and therefore subject to securities legislation. The CSA has further found that even where businesses are solely engaging in transactions involving cryptocurrency that are considered commodities, like bitcoin and ether, the underlying contract between the business and their customers may constitute a security or derivative, making them subject to regulation.[63]

To assist cryptocurrency firms in meeting their regulatory obligations, the CSA initiated a Regulatory Sandbox program, by which provincial regulators may provide temporary exemptive relief from certain legal requirements to cryptocurrency firms.[64] This relief allows firms to continue to operate while they become regulatorily compliant, including through registration with the Investment Industry Regulatory Organization of Canada. At the time of writing, the Ontario Securities Commission listed 11 firms that have received exemptive relief as either a dealer or a marketplace under provincial legislation.[65]

Cryptocurrency Trading Platforms

According to Evan Thomas, there are “about 11 Canadian-based crypto trading platforms,” which “serve Canadians primarily, if not exclusively,” as well as at least 15 “foreign platforms that serve many countries, including Canada.”[66] Tanim Rasul, Chief Operating Officer, National Digital Asset Exchange Inc., citing information from the OSC, stated that “three of the top four platforms used by Canadians are foreign‑based.”[67]

Witnesses generally believed that cryptocurrency trading platforms are sufficiently regulated to protect consumers from risks seen from foreign platforms. Several witnesses cited the 2019 collapse of QuadrigaCX, a Canadian cryptocurrency trading platform, as motivation for Canadian regulators taking a stronger approach to regulation than other jurisdictions. As Koleya Karringten explained, following QuadrigaCX’s collapse,

Canadian regulators came in and we have been working very closely with them, law enforcement, [the Investment Industry Regulatory Organization of Canada] and [the Office of the Superintendent of Financial Institutions] for years to not only make sure that Canada has the strongest regulations, but that we have safeguarded and made sure that consumers are protected.[68]

Evan Thomas explained the regulatory requirements that platforms must follow:

Platforms that hold crypto for clients must register with Canadian securities regulators and comply with specific requirements. For example, we must keep at least 80% of our clients’ crypto‑assets with regulated and insured crypto custodians. We do ongoing due diligence on every crypto asset that we list. We create and update risk disclosures for every asset. We hold our clients’ crypto assets in trust. We do not lend out or use our clients’ property, ever. We are also registered with FINTRAC, Canada's financial intelligence agency, and we have built a robust anti-money-laundering and sanctions compliance program.[69]

Adam Garetson, General Counsel and Chief Legal Officer, WonderFi Technologies Inc., also noted that firms like his are “public compan[ies], so we are subject to the same laws, rules and requirements of any other traditional publicly traded TSX-listed company, including displaying audited financial statements quarterly and annually, etc.”[70]

One aspect of Canada’s regulatory requirements for platforms highlighted by witnesses was the need for cold storage. As Adam Garetson explained:

under the modified crypto rules that layer onto the more traditional securities requirements, we are required to hold 80% of client assets in what's referred to as “cold storage”. … [T]he security regulators require platforms like ours to hold 80%-plus of our client assets in the vault, in cold storage, at all times, and only take them out if we’re going to be moving them around. In practice, what that means for trading platforms like ours is that 95%-plus of our assets typically remain in cold storage, with only a small portion of that—3% to 5%—coming out to do daily transactions.[71]

Stephen Oliver, Chief Compliance Officer and Head of Calgary, Tetra Trust Company, testified that his firm is “Canada's first and only regulated custodian for crypto assets” and “was established as a special-purpose trust company incorporated under the Loan and Trust Corporations Act of Alberta.” He went on to state that “[d]igital asset custodians are the foundational piece of all risk mitigation strategies related to digital assets” as they “act as a trusted independent third party to secure the assets of institutions and their underlying investors.”[72]

Cryptocurrency Mining Firms

Witnesses highlighted both Canada’s competitive advantage in cryptocurrency mining and the benefits the industry provides to Canada. According to Sheldon Bennett, Chief Executive Officer, DMG Blockchain Solutions Inc., Digital Asset Mining Coalition, there has been “a dynamic shift” of cryptocurrency mining “out of Europe and Asia and into North America…because of the rule of law, because of infrastructure and because of a well-educated workforce—all things that Canada has.”[73] Jaime Leverton noted that “Canada's natural cooling system, our cold winters,” help Canadian firms to “to minimize heat and mine much more efficiently than many of our global peers.”[74] While Daniel Brock, Law Partner, Fasken, Digital Asset Mining Coalition said “Canada has a decided advantage because we have an abundance of clean, renewable energy.”[75]

Geoffrey Morphy, President and Chief Executive Officer, Bitfarms Ltd., Digital Asset Mining Coalition, spoke about how his firm has provided “considerable value to the Canadian economy:”

We pay corporate and other taxes; we have spent almost half a billion dollars on our Canadians operations through investments in construction, materials and equipment; and we generate much-needed revenue for smaller locally owned hydro companies and their municipal owners.[76]

Other witnesses also emphasized the benefits that cryptocurrency mining operations provide to smaller population centers. Sheldon Bennett said his firm’s operations in Christina Lake, British Columbia is “one of Canada's leading digital asset mining facilities,” built in a “abandoned wood processing factory that had been shut down for close to a decade.”[77]

Despite these benefits, witnesses also spoke about the challenges related to the energy usage of cryptocurrency mining operations, which globally is comparable to the energy consumption of entire countries. According to the Cambridge Bitcoin Electricity Consumption Index, the Bitcoin blockchain network uses 121 terawatt hours of electricity per year, which, were it a country, would rank it 33rd in energy usage, behind Argentina and ahead of the Netherlands.[78]

Concerns have been raised by electricity utilities in Canada regarding the demands being placed on power grids by cryptocurrency mining firms, with utilities in several provinces placing curbs on new mining connections.[79] A report from BC Hydro found that the “unprecedented level of requests” for new connections from cryptocurrency mining firms, if not properly managed, “could mean less energy for greener pursuits such as electrification or hydrogen production, and higher electricity rates for British Columbians.”[80]

Witnesses acknowledged the high energy usage of cryptocurrency mining but pointed to innovations in the industry that have mitigated the strain that this usage puts on energy infrastructure and the environment. The use of renewable energy sources was a common example provided. According to Jaime Leverton, Bitcoin mining is “one of the most renewable-intensive industries on the planet,” and its energy usage can be used for the “greater good… to build stable, renewable [energy] grids.”[81] Koleya Karringten spoke about how mining firms work with utilities to take of advantage of energy that would otherwise go to waste and participate in “load balancing,” whereby mining operations shutdown during peak usage hours “to support the grid.”[82]

Other witnesses pointed to alternative consensus mechanisms as a means of reducing cryptocurrency energy consumption. As Brian Mosoff stated, “Ethereum… has transitioned away from proof of work to something called proof of stake and has reduced its energy footprint by over 99.9% because there is no more electricity in computing hardware” needed to achieve consensus.[83]

Current Challenges

While witnesses were unanimous in expressing their optimism for the future of blockchain, many also acknowledged that the cryptocurrency industry faces a number of challenges. In some cases, witnesses stated media reporting was overly negative or that issues were merely the product of a new industry maturing, but many witnesses also recognized that recent events in the industry require action by industry participants and governments.

Fraud Committed by Cryptocurrency Companies

Witnesses acknowledged that high-profile cases of cryptocurrency firms, in particular cryptocurrency trading platforms, allegedly defrauding their customers has had a negative effect on the industry. The most commonly cited case, that of Bahamas-based FTX Trading Ltd., became public during the Committee’s study. In December 2022, the United States Securities and Exchange Commission charged FTX chief executive officer and co-founder, Samuel Bankman‑Fried, with fraud relating to the misuse of US$1.8 billion in clients’ investments.[84]

Witnesses also referenced the Canadian case of QuadrigaCX, which ceased operations and filed for creditor protection in February 2019, ultimately resulting in investor losses of at least $169 million. An investigation by the OSC attributed most of those losses to the fraudulent behaviour of the firm’s deceased chief executive officer and co-founder, Gerald Cotton. The OSC report on the case compared the firm’s operations to a Ponzi scheme and described it as “old-fashioned fraud wrapped in modern technology.”[85]

In reference to the FTX case, Aidan Hyman said it is “critical to separate the technology from bad actors. Fraud is illegal no matter how it happens or what technology is used to commit it” and it would be “pretty harmful” to take “a negative stance about crypto and blockchain technology altogether.”[86] Evan Thomas made a similar comment: “These risk and failures… are organizational, not technological; that is, these businesses fail because of how they run their businesses, not because of blockchain or crypto.”[87]

Koleya Karringten testified that these cases do not “represent any of the exchanges we currently have in Canada,” while Jean Amiouny stated that “[t]he measures that platforms are subject to here in Canada mean that the risks [of fraud] are much lower.”[88] Charlaine Bouchard noted, however, that even if these cases are the exception, they nonetheless demonstrate the need for regulation: “Like any technology, blockchain is used in a world in which some individuals will misuse them, and that, unfortunately for the fierce advocates who have developed these technologies, [means it] will require protection for consumers.”[89]

Other Cryptocurrency-related Crime

In addition to some prominent cryptocurrency firms being accused of criminal behaviour, the cryptocurrency sector also faces accusations of being used in other types of criminal activity, either specific to cryptocurrencies, such as thefts through hacking and scams perpetrated against consumers, or where cryptocurrencies are used to facilitate other crimes, for example as a means of money laundering or terrorism financing. A February 2023 report by blockchain data platform Chainalysis found that cryptocurrency illicit transaction volumes were at an all-time high in 2022, with an estimated value of US$20.6 billion.[90] The report did note, however, that most of the growth in illicit transactions could be attributed to United States (U.S.) sanctions against Russian cryptocurrency firms following the invasion of Ukraine, and that the estimate represents just 0.24% of all cryptocurrency transactions.

In Canada, the Royal Canadian Mounted Police (RCMP) has stated they received reports of cryptocurrency fraud leading to the loss of $75 million in 2021, a sharp increase from previous years. An article published by the RCMP gave the example of criminals using cryptocurrency automated teller machines, often located in convenience stores and other small businesses, as a means getting victims to transfer them funds under false pretenses.[91]

Witnesses emphasized that the secure nature of blockchain technology does not necessarily apply to the firms and platforms that interact, or allow consumers to interact, with it. As Justyna Osowska testified, “[i]t's the technology between the blockchain and how it interacts with the real world” that raises security concerns.[92] Pascal St‑Jean agreed, stating “[t]he risks are not necessarily related to blockchains, but rather to third-party applications,” which if not properly secure will “definitely get hacked.”[93]

Speaking to the prevalence of cryptocurrency scams, Matthew Burgoyne said he receives a call “roughly once every two weeks … from a Canadian who has been the victim of fraud,” and that law enforcement is unsuccessful in retrieving the funds in “the majority of cases” as “[t]he crypto has been transferred to someone out of the country, and nobody knows where.”[94]

In contrast, other witnesses noted how the transparency of blockchains can assist law enforcement to apprehend criminals. Stephen Oliver said the “traceability in blockchain” has enabled firms to identify “bad actors,” and led to “law enforcement agencies being able to recover funds and sometimes arrest the culprits.”[95] Tanya Woods spoke of a case where a blockchain firm partnered with law enforcement in the U.S. to take down a child pornography network as an example of where the use of cryptocurrency by criminals led to their apprehension.[96]

Cryptocurrency Volatility

Witnesses also addressed the perception that cryptocurrencies are volatile, high-risk investments. This perception was supported by the performance of many cryptocurrencies in 2022. At the time of writing, Bitcoin, which is estimated to represent over 40% of the cryptocurrency industry, had been valued as high as US$48,086.84 and as low as US$15,599.05 over the previous 12 months.[97] Brian Mosoff acknowledged that “[t]he assets are volatile” and that the cryptocurrency industry is “in a very speculative part of the cycle,” but said that “a societal shift… to a more digital economy, to embrace these technologies” still presented an opportunity. Jaime Leverton described Bitcoin’s loss of value as “not entirely abnormal” and that “[m]any securities fluctuate in the same way.”[98]

Other witnesses differentiated between Bitcoin and other cryptocurrencies. Brad Mills, Angel Investor, Bitcoin Coalition of Canada, testified that “you really can't lump Bitcoin in with the rest of everything else that's going on” as many cryptocurrencies are “just unregistered securities, often unethically launched and fraudulently pumped on unregulated crypto exchanges, leaving retail buyers holding the bag when the bubble collapses.”[99] Jean Amiouny, Patrick Mandic, Morgan Hayduk, Koleya Karringten and Andrew Batey, Co-Chief Executive Officer, Beatdapp Software Inc. also made this distinction, describing cryptocurrency investments, other than Bitcoin, as high risk.[100]

Ways Governments Can Support Blockchain

Over the course of the Committee’s study, witnesses made a number of recommendations regarding how regulators and other public sector actors can better support the blockchain industry.

Regulatory Clarity

A common issue raised by witnesses was the need for, or the current lack of, regulatory clarity for blockchain firms in Canada. According Aidan Hyman, “Canada has fallen behind other jurisdictions like the U.S. and Europe when it comes to digital asset policies,” and there is “an opportunity of a generation” to create “regulatory clarity and clear standards so that businesses can flourish in Canada.”[101] Ethan Buchman said “it's not clear which regulators have jurisdiction over which blockchains and blockchain products,” that creates “a huge problem for entrepreneurs.”[102] Brian Mosoff described the current situation in Canada as “a fragmented securities regulatory environment.”[103]

Witnesses said that this lack of clarity has motivated some Canadians to establish or move their firms to other jurisdictions. Dina Mainville warned firms will “continue to leave Canada in favour of building companies in places with better regulatory clarity” and Jaime Leverton cited a lack of clarity as a reason Canada has “driven a lot of our talent away.”[104] Koleya Karringten pointed out that where firms move to “more lax…regulatory jurisdictions” offshore, it means that “consumers aren't protected.”[105]

One tangible example provided by witnesses of this lack of clarity is related to the regulation of crypto assets that differ from cryptocurrencies. According to Koleya Karringten, “Canada needs to clearly delineate which digital assets qualify as securities, derivatives, commodities, data and currencies” through “the development of a digital asset taxonomy.”[106] Dina Mainville made a similar comment, recommending that Canada “take a nuanced approach to regulation by differentiating between types of crypto assets, by creating appropriate provisions for those assets and by regulating only the parts of this industry that make sense.”[107] Speaking to her firm’s experience producing NFTs, Alison Kutler cautioned against a “one-size-fits-all approach,” stating “[t]his is not to say that NFTs should not be regulated, just that they shouldn't be governed by what would be overly burdensome rules taken from other sectors.”[108]

Several witnesses pointed to the European Union (EU) as an example of a jurisdiction that has introduced effective regulations. In June 2022, the Council of the EU and the European Parliament reached a provisional agreement for regulations on markets in crypto-assets (MiCA).[109] The proposed MiCA regulations, which must still be formally adopted by both institutions, seeks to protect consumers through measures such as mandatory registration for all crypto-asset service providers. Dina Mainville stated that “the new MiCA regulation in the EU is much more comprehensive than many of the regulatory moves we've seen previously.”[110] Laure Fouin, Co-Chair Digital Assets and Blockchain, Osler, Hoskin & Harcourt LLP, noted that the MiCA regulations “pay particular attention to stable cryptocurrency backed by the euro,” and exclude NFTs, deciding to “regulate them differently.”[111] According to her, the proposed regulations provide “some legal clarity, but it brings with it a lot of issues worth considering.”[112]

Engagement on a National Strategy

As a means of addressing the perceived lack of regulatory clarity, witnesses recommended that governments at all levels engage more with industry participants and that the federal government needs to develop a national strategy. Tanya Woods said that “engagement is really important,” as the “rapid rate of change” that the blockchain industry is experiencing “can really only be best understood by industry.”[113] Speaking to his experience engaging with the federal government on blockchain-related taxation issues, Daniel Brock stated that “there hasn't been any meaningful interaction between those officials who are drafting the laws and government decision-makers who are having these laws passed to really understand what's happening in the industry.”[114]

According to Dina Mainville, “for Canada's blockchain economy to prosper, collaboration between government stakeholders and industry practitioners is required to develop a national regulatory framework.”[115] Koleya Karringten made a similar comment:

The value of having the government collaborate with this industry specifically would be to help engage with regulators and industry to develop frameworks that are going to not just protect consumers but allow for products to get tested on the market in a safe way, to allow for this industry and the innovation within this industry to expand exponentially.[116]

Witnesses also referenced Bill C‑249, An Act respecting the encouragement of the growth of the cryptoasset sector, which was defeated in the House of Commons at second reading, as part of the discussion of government engaging with the blockchain industry.[117] Jaime Leverton was “disappointed in the defeat” of the bill and Koleya Karringten said it would have probably been “a good step.”[118]

Stablecoins

Stablecoins were one type of crypto asset highlighted by witnesses as in need of greater regulatory attention. As Matthew Burgoyne explained, stablecoins are “a digital token that's anchored one for one with the Canadian dollar,” and provincial securities regulators have “taken a position that these Canadian dollar-anchored stablecoins … should be regulated as securities,” even though “the intent is to use these tokens like currency,” and “no one's really buying these Canadian dollar-anchored stablecoins with the expectation that they're going to increase in value.”[119]

Jesse McWaters also believed that “a particular focus should be given to stablecoins,” noting advancements in other jurisdictions, he testified:

Canada may wish to consider the merits of a comprehensive regulatory regime for stablecoins that imposes robust requirements for liquidity and capital management, as well as standards for redeemability, consumer protection, operational resilience and the resolution of stablecoin arrangements in the event of failure.[120]

Matthew Burgoyne stated that it would be “more appropriate” for stablecoins to “be regulated under a different regulator like the Bank of Canada or another regulator, because they're more akin to a currency than a security.”[121]

Other witnesses made reference to central bank digital currency (CBDC) as a related area of interest.[122] According to Tanim Rasul, “central banks around the world are understanding the benefits of how they can bring the dollar onto the blockchain,” including how “CBDC transactions can speed up and secure payments between people and institutions, banks and businesses.”[123]

Taxation Issues

Issues around the taxation of crypto assets were also raised by witnesses. Accord to Evan Thomas, “[t]here are various issues relating to taxation of transactions of crypto assets that could bear some clarification to assist Canadians,” including whether “the revenues and profits that [foreign] platforms are generating from Canadians' activities are being appropriately taxed and received by Canada.”[124] Ethan Buchman testified that “the tax code makes it difficult for companies in Canada to understand what tax liabilities they're going to face in certain kinds of blockchain transactions, because they don't exactly know how to account for them.”[125]

Daniel Brock and Tamara Rozansky, Partner, Indirect Tax, Deloitte Canada, Digital Asset Mining Coalition, spoke extensively regarding proposed changes to the GST/HST treatment of cryptocurrency mining published by the Department of Finance in February 2022.[126] A revised version of the proposed amendments was later included in Bill C-47, An Act to implement certain provisions of the budget tabled in Parliament on March 28, 2023.[127] At the time of writing, the bill was under consideration by Parliament. As Tamara Rozansky explained:

The principal feature of these proposed tax amendments was to declare that digital asset mining activities are not a commercial activity in Canada. That would mean that companies engaged in digital asset mining would no longer be eligible to receive input tax credits, ITCs. For larger digital asset mining companies, these ITCs can have a value in the tens of millions of dollars.[128]

According to Daniel Brock, the proposal “is effectively a hidden 5% to 15% tax” on cryptocurrency mining firms, which has already “had a chilling effect on investment decisions… in a highly competitive environment” that could have “a serious negative impact on the future growth and sustainability of these businesses in Canada.”[129]

Access to Banking and Insurance Services

Difficulty accessing banking and insurance services was also an obstacle for blockchain firms identified by witnesses. According to Matthew Burgoyne, blockchain firms “who otherwise comply with regulation and raise significant investment from Canadian investors are being denied basic business banking and chequing accounts quite regularly.”[130] Dina Mainville, among others, attributed banks’ attitude towards blockchain firms to a misunderstanding of the current state of the industry:

The banking industry in Canada has classified blockchain businesses as high risk because of a perceived lack of adherence to traditional rules and concerns related to money laundering. Cryptocurrency businesses in Canada are required by law to register with FINTRAC and to meet the regulatory requirements of other money services businesses.[131]

Sheldon Bennett noted that this problem included federal Crown corporations, like the Business Development Bank of Canada (BDC) and Export Development Canada: “BDC has told me directly that they have a mandate not to support crypto companies.”[132]

Witnesses highlighted that blockchain firms also face difficulty accessing insurance services. Matthew Burgoyne said his clients “are forced to obtain policies from offshore or foreign insurance providers, sometimes at astronomical premiums and rates.”[133] Evan Thomas explained that insurance companies “view [blockchain firms] as a new category of risk” and have “regulatory concerns” that make it difficulty for them to “underwrite the risk in terms of determining what the risks are and what the losses may be.”[134]

Diversity and Inclusion

Justyna Osowska told the Committee that “[W]omen are under-represented in blockchain technology.”[135] Koleya Karringten said her organization’s “goal was to make sure that we had gender parity within the space” and “that blockchain has an amazing opportunity to create better inclusion” for “under-represented groups.”[136] Both witnesses pointed to education as one means of promoting greater inclusion in the industry. According to Justyna Osowska, “women and girls… need role models… need to see women who are actually succeeding in the field and are being shown that these are potential careers for them.”[137]

Research and Education

Some witnesses also highlighted support for research, and its commercialization, as a means by which the government could support the blockchain industry. Namir Anani listed “supporting research… with a focus on commercialization through targeted investments” first among the ways in which government can support the industry, while Ethan Buchman gave the example of current support to artificial intelligence research as the type of “strong, supportive stance” that the government should take towards blockchain technology.[138]

Many witnesses also mentioned education as an area in need of greater attention to create a better general understanding of the blockchain industry as well as to better protect consumers from fraudulent behaviour. In terms of consumer protection, Jean-François Gauthier, Chief Executive Officer, Digital Governance Institute, said “very strong measures should be taken to increase people's digital literacy to help them do a better job of managing their digital identity.”[139] Tanya Woods made a similar comment, recommending the government “fund programs for digital literacy that include blockchain education, crypto education, NFT education, metaverse education and so on. It's fundamental.”[140] Namir Anani said that blockchain education should “begin in elementary schools.”[141]

Talent Development and Retention

Namir Anani also testified that “work is needed with post-secondary institutions because it's important to develop talent to meet industry needs.”[142] According to Sheldon Bennett, “universities are very interested in this technology, because their students are very interested in it.”[143] Jean-François Gauthier pointed to “the creation of the first research chair on smart contracts in Quebec, at Université Laval,” currently held by fellow witness Charlaine Bouchard, as an example of universities increasing their blockchain related programs.[144] Aidan Hyman gave the example of a “blockchain education network” of “maybe 50-plus universities” that he and his co-founders participated in prior to entering the industry as the type of initiative that “that help[s] foster the kind of great skills that are necessary to participate in these high skill opportunities.”[145]

The importance of such initiatives was juxtaposed against difficulties firms face in hiring and retaining the skilled workers they require. Evan Thomas said recruitment and retention “is a challenge” as blockchain is “truly a global industry” and its workers “are very mobile,” meaning that Canadian firms “are competing with businesses around the world.”[146] Pascal St-Jean warned of a possible “brain drain” of talent leaving Canada as investment in the blockchain industry continues to increase in other parts of the world.[147]

Observations and Recommendations

Over the course of its study, the Committee heard about the real contributions that blockchain technology is making to the Canadian economy and the potential for it to provide substantially greater value in the future. While most of the present value is in the variety of actors participating in the cryptocurrency industry, the Committee was impressed by testimony regarding the technology’s current and potential applications in other sectors. Blockchain, together with other technological advances like artificial intelligence, have the potential to digitalize the parts of our economy that have not been digitalized already, unlocking efficiencies and value similar to previous waves of digitalization.

Recommendation 1

That the Government of Canada recognize blockchain as an emerging industry in Canada, with significant long-term economic and job creation opportunities.

At the same time, the Committee is aware of the context in which it undertook its study. Cases of alleged fraud on a massive scale, such as the collapse of FTX, have had a devastating effect on the cryptocurrency industry globally, leading some prominent media reports to question the industry’s viability.[148] At the time of writing, the effects of these shocks are continuing to reverberate through the industry, and it remains to be seen what the final outcome will be. But one consequence is already apparent, regulators around the world are re-evaluating their approach to cryptocurrencies in an effort to prevent such events from occurring in the future.

From that perspective, the Committee came away generally satisfied with the current regulatory approach to cryptocurrencies in Canada. Witnesses raised several concerns related to the current state of regulation, which the Committee share to some extent, but witnesses also pointed to the regulatory environment as a primary reason why Canadian firms where less affected by recent events and why such events were significantly less likely to occur in Canada than elsewhere. This suggests that regulations are doing their job.

Nonetheless, regulatory improvements can, and should, be made to ensure that Canada continues to be a leader in cryptocurrencies, and the blockchain industry more broadly. To that end, the Committee believes that a national strategy, similar to those already in place for other key sectors, is required to clarify the government approach to regulation and demonstrate Canada’s commitment to the industry.

Recommendation 2

That the government of Canada should, in its efforts to improve consumer protection and regulatory clarity to the emerging and innovative field of digital assets, be guided by the principle that individuals’ right to self custody should be protected and that ease of access to safe and reliable on and off ramps should be defended and promoted.

Recommendation 3

That the Government of Canada, following consultation with the provinces and stakeholders, establish a national blockchain strategy that clarifies the government’s policy direction and regulatory approach, and demonstrates support for the industry.

Recommendation 4

That the Government of Canada, with a view to adopting a national blockchain and distributed ledger strategy:

- call on a group of experts, entrepreneurs, academics and investors, as well as people in the artificial intelligence industry cluster, to support its analysis and understanding and help it determine best steps;

- give the group a mandate to:

- set up a platform for information exchange and monitoring;

- carry out analyses to identify the most promising or high-risk areas for disruption;

- advise the government on promising initiatives; and

- support the government in implementing selected initiatives.

Recommendation 5

That the Government of Canada pursue opportunities for international cooperation in the development of blockchain regulations and policies, including with our major trading partners.

Recommendation 6

That the Government of Canada conduct innovative pilot projects using distributed ledgers to help strengthen the ecosystem and recognize up-and-coming businesses.

Recommendation 7

That the Government of Canada create a sandbox where entrepreneurs can test technologies unhindered by as yet unadopted regulations.

The regulation of stablecoins was put forward by witnesses as one area where the federal government could play a larger regulatory role and distinguish these products from other, more speculative, forms of cryptocurrencies. The Committee agrees that these products have different use cases than other cryptocurrencies and raise unique regulatory concerns.

Recommendation 8

That the Government of Canada adopt a distinct regulatory approach to stablecoins that reflects the difference between these products and other cryptocurrencies, and account for the unique regulatory challenges they present.

Witnesses also pointed to the important role played by cryptocurrency custodians that provide cold storage services to exchanges and other businesses. With only one currently operating in Canada, and established under provincial legislation, the Committee believes that there are growth opportunities that could be promoted through regulatory reform.

Recommendation 9

That the Government of Canada adopt regulatory changes to promote the establishment of federally regulated cryptocurrency custodians to meet the demand for cold storage services from Canadian cryptocurrency firms.

The Committee was concerned to hear from witnesses about the challenges blockchain entrepreneurs and small businesses face in accessing basic banking and insurance services. Such challenges present an unnecessary obstacle to innovation that the government should address.

Recommendation 10

That the Government of Canada adopt measures for access to banking and insurance services for blockchain firms, including through Crown corporations.

Witnesses highlighted that consumer education can be a valuable tool to preventing cryptocurrency related fraud and in explaining the advantages of accessing cryptocurrency markets through regulated Canadian platforms. The Committee believes that a public awareness campaign focusing on cryptocurrencies could inform consumers about ways to reduce the risk of fraud while also promoting legitimate Canadian businesses. This could potentially be achieved by augmenting current information provided by the Financial Consumer Agency of Canada.[149]

Recommendation 11

That the Government of Canada establish a public awareness campaign, in consultation with the provinces and the industry, to educate the public about risks related to cryptocurrencies and the benefits of accessing cryptocurrency markets through regulated Canadian entities.

Recommendation 12

That the Government of Canada draw on the previous report on SMEs and launch a strategic initiative to develop skills and talent and support research.

Outside of cryptocurrencies, the Committee heard compelling testimony regarding the application of blockchain to other sectors, particularly about the potential to create more efficient and transparent supply chains. As Canada continues to deal with the repercussions of supply chain disruptions during the COVID-19 pandemic and seeks innovative ways to decarbonize the economy, the Committee believes that blockchain can play an important role in addressing many of the shortcomings of current logistics and supply chain management.

Recommendation 13

That the Government of Canada investigate ways to promote the adoption of blockchain technology in supply chains.

Recommendation 14

That the Government of Canada, in collaboration with the Commissioner of Canada Elections, undertake a study on the new opportunities this technology presents for electronic voting, consultation, and the modernization of our democratic institutions.

The principle of equity between provinces in the Excise Tax Act aims to ensure fair treatment among the different provinces of Canada regarding the taxation of goods and services. The objective is to avoid unfair tax advantages or disadvantages between provinces. To achieve this equity, the Excise Tax Act establishes a mechanism for refunding taxes paid by individuals, businesses, and government organizations in one province where the GST/HST is collected but predominantly used in another province where the GST/HST is also collected. In summary, the principle of equity between provinces in the Excise Tax Act aims to ensure that taxpayers are not penalized or advantaged due to differences in provincial tax rates.

Recommendation 15

That the government of Canada should investigate equity between provinces in the application of the Excise Tax Act to mining activities to ensure fair taxation.

Recommendation 16

That the government of Canada, in order to foster a competitive digital asset mining environment and in order to continue to attract investments, should maintain that digital asset mining constitutes a commercial activity in Canada; and as such adopt a neutral and equitable position towards this new and growing industry.

[1] House of Commons, Standing Committee on Industry and Technology [INDU], Minutes, Meeting No. 34, 26 September 2022.

[2] Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 2008.

[3] The World Bank, Distributed Ledger Technology (DLT) and Blockchain, FinTech Note, No. 1, 2017.

[4] Adriane Yong, Beyond Digital Currencies: Blockchain in the Public Sector.

[5] Ontario Regulatory Register, Capital Markets Act - Consultation Draft, 12 October 2021.

[6] Merriam-Webster, cryptocurrency.

[7] CoinMarketCap, Today’s Cryptocurrency Prices by Market Cap; Rainer Böhme et al., “Bitcoin: Economics, Technology, and Governance,” Journal of Economic Perspectives, Vol. 29, No. 2, Spring 2015.

[8] Bitcoin.org, Bitcoin Core.

[9] Rainer Böhme et al., “Bitcoin: Economics, Technology, and Governance,” Journal of Economic Perspectives, Vol. 29, No. 2, Spring 2015.

[10] Ethereum, PROOF-OF-STAKE (POS); Vitalik Buterin, “A Proof of Stake Design Philosophy,” Medium, 30 December 2016.

[11] CoinMarketCap, Today’s Cryptocurrency Prices by Market Cap; Ethereum, The Merge.

[12] Douglas Heintzman and Irving Wladawsky-Berger, “What is Web 3?,” Research Brief, Blockchain Research Institute, 28 September 2022.

[13] Digital Governance Institute, “Registres Distribués, L’Évolution de la Chaîne de Blocs : Impacts, enjeux et potentiels pour le Québec,” White paper, November 2019 [available in French only].

[14] INDU, Evidence, 44th Parliament, 1st Session, 21 November 2022, 1135 (Brian Mosoff, Chief Executive Officer, President of Canadian Web3 Council, Ether Capital).

[15] INDU, Evidence, 44th Parliament, 1st Session, 24 November 2022, 1600 (Jean Amiouny, Co-founder and Chief Executive Officer, Shakepay Inc.).

[16] INDU, Evidence, 44th Parliament, 1st Session, 27 October 2022, 1605 (Laure Fouin, Co-Chair Digital Assets and Blockchain, Osler, Hoskin & Harcourt LLP, As an Individual).

[17] INDU, Evidence, 44th Parliament, 1st Session, 24 November 2022, 1535 (Morgan Hayduk, Co-Chief Executive Officer, Beatdapp Software Inc.).

[18] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1615 (Namir Anani, President and Chief Executive Officer, Information and Communications Technology Council).

[19] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1630 (Jesse McWaters, Senior Vice President, Global Head of Regulatory Advocacy, Mastercard).

[20] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1650 (Charlaine Bouchard, Research Chair in Smart Contracts and Blockchain, Digital Governance Institute).

[21] INDU, Evidence, 44th Parliament, 1st Session, 24 November 2022, 1545 (Patrick Mandic, Chief Executive Officer, Mavennet Systems Inc.).

[22] Ibid.

[23] INDU, Evidence, 44th Parliament, 1st Session, 24 November 2022, 1540 (Koleya Karringten, Executive Director, Canadian Blockchain Consortium).

[24] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1615 (Tanya Woods, Chief Executive Officer, Futurity Partners).

[25] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1655 (Guillaume Déziel, Digital Culture Strategist, Digital Governance Institute).

[26] INDU, Evidence, 44th Parliament, 1st Session, 24 November 2022, 1535 (Morgan Hayduk, Co-Chief Executive Officer, Beatdapp Software Inc.).

[27] Ethereum, Non-fungible tokens (NFT).

[29] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1600 (Alison Kutler, Head of Government Affairs, Dapper Labs).

[30] INDU, Evidence, 44th Parliament, 1st Session, 21 November 2022, 1105 (Aidan Hyman, Chief Executive Officer, Chainsafe Systems Inc.); World Food Programme, Building Blocks.

[31] INDU, Evidence, 44th Parliament, 1st Session, 24 November 2022, 1545 (Patrick Mandic, Chief Executive Officer, Mavennet Systems Inc.); U.S. Department of Homeland Security, “DHS Awards $86K for Cross-Border Gas Import Tracking Using Blockchain Technology,” News Release, 9 October 2020; Innovation, Science and Economic Development Canada, “Government of Canada invests in tracing the steel supply chain,” News Release, 24 Janaury 2020.

[32] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1650 (Charlaine Bouchard, Research Chair in Smart Contracts and Blockchain, Digital Governance Institute); Université de Laval, Chaîne de blocs notariale [available in French only].

[33] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1705 (Tanya Woods, Chief Executive Officer, Futurity Partners).

[34] INDU, Evidence, 44th Parliament, 1st Session, 27 October 2022, 1640 (Pascal St‑Jean, President, 3iQ Corporation).

[35] INDU, Evidence, 44th Parliament, 1st Session, 27 October 2022, 1710 (Pascal St‑Jean, President, 3iQ Corporation).

[36] INDU, Evidence, 44th Parliament, 1st Session, 21 November 2022, 1135 (Aidan Hyman, Chief Executive Officer, Chainsafe Systems Inc.).

[37] INDU, Evidence, 44th Parliament, 1st Session, 1 February 2023, 1640 (Dina Mainville, Founder and Principal, Collisionless).

[38] INDU, Evidence, 44th Parliament, 1st Session, 27 October 2022, 1615 (Pascal St‑Jean, President, 3iQ Corporation).

[39] INDU, Evidence, 44th Parliament, 1st Session, 24 November 2022, 1540 (Koleya Karringten, Executive Director, Canadian Blockchain Consortium).

[40] INDU, Evidence, 44th Parliament, 1st Session, 1 February 2023, 1800 (Ethan Buchman, Chief Executive Officer, Informal Systems Inc.).

[41] INDU, Evidence, 44th Parliament, 1st Session, 27 October 2022, 1620 (Justyna Osowska, Founder, Women in Blockchain Canada).

[42] INDU, Evidence, 44th Parliament, 1st Session, 27 October 2022, 1610 (Matthew Burgoyne, Co-Chair Digital Assets and Blockchain, Osler, Hoskin & Harcourt LLP, As an Individual).

[43] INDU, Evidence, 44th Parliament, 1st Session, 21 November 2022, 1105 (Aidan Hyman, Chief Executive Officer, Chainsafe Systems Inc.).

[44] The Information and Communications Technology Council, Chain Reaction: Investment in Canada’s Blockchain Ecosystem, August 2020; INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1615 (Namir Anani, President and Chief Executive Officer, Information and Communications Technology Council).

[45] INDU, Evidence, 44th Parliament, 1st Session, 24 November 2022, 1635 (Koleya Karringten, Executive Director, Canadian Blockchain Consortium).

[46] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1735 (Jaime Leverton, Chief Executive Officer, Hut 8 Mining Corporation).

[47] INDU, Evidence, 44th Parliament, 1st Session, 1 February 2023, 1740 (Dina Mainville, Founder and Principal, Collisionless).

[48] INDU, Evidence, 44th Parliament, 1st Session, 27 October 2022, 1650 (Pascal St‑Jean, President, 3iQ Corporation); INDU, Evidence, 44th Parliament, 1st Session, 21 November 2022, 1105 (Brian Mosoff, Chief Executive Officer, President of Canadian Web3 Council, Ether Capital).

[49] INDU, Evidence, 44th Parliament, 1st Session, 8 December 2022, 1615 (Namir Anani, President and Chief Executive Officer, Information and Communications Technology Council).

[50] INDU, Evidence, 44th Parliament, 1st Session, 21 November 2022, 1245 (Evan Thomas, Head of Legal, Wealthsimple Crypto, Wealthsimple).