AGRI Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

|

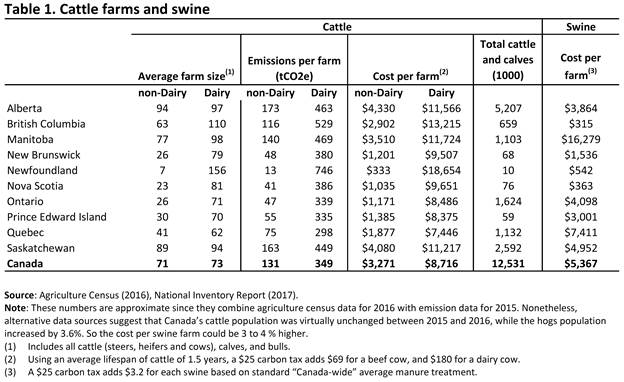

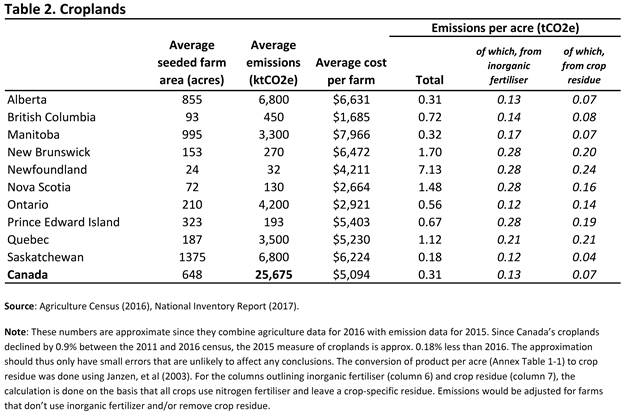

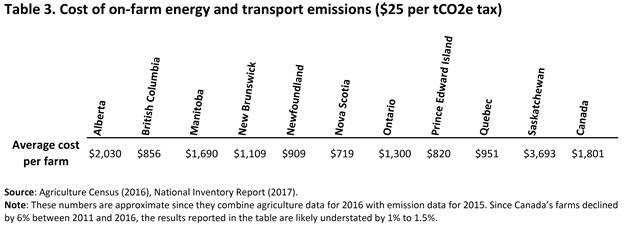

Dissenting Opinion The Conservative Party of Canada Climate Change and Soil and Water Conservation Introduction We would like to thank the witnesses who appeared before the Standing Committee on Agriculture and Agri-Food for its study on climate change adaptation and water and soil conservation. We agree with the majority of the Committee’s report and its recommendations. However, certain aspects of the report should be emphasized and more information must be made available to Canadians in terms of the Liberal government’s policies in addressing climate change. Recognition A constant theme we heard throughout the Committee’s study regarding the current government’s approach to climate change policy was a lack of recognition for past efforts made by farmers and ranchers on reducing their environmental footprint. Whether that’s through carbon sequestration or capture,[1] frameworks such as the 4R nutrient stewardship,[2] or as a result of research, innovation and increased efficiencies in animal health and reproduction,[3] the results are significant. Therefore, the government’s pursuit to penalize greenhouse gas (GHG) emitters through the imposition of a carbon tax without properly recognizing those who have been mitigating and removing GHG’s for years or decades, are both short-sighted and inequitable. The Cost of the Liberal Carbon Tax Throughout the study it became clear Liberal Members of the committee purposely avoided discussion or inclusion of politically inconvenient facts related to the economic aspects of the government’s key component of their Pan-Canadian Framework, the carbon tax. As indicated in the Committee’s report, under this framework, the Liberal government will impose a carbon tax on any province or territory whose climate change plan does not meet their approval. As such, we feel it is important for the government to tell Canadians how much of a reduction in greenhouse gas emissions will be achieved with the federal carbon tax and what the cost will be to Canadian farm families. We feel it is irresponsible for the government to not fully assess the environmental, economic, employment and fiscal effects of the federal carbon tax and share that information with Canadian farmers and agri-businesses. At present, Alberta, British Columbia, Ontario and Québec have implemented carbon pricing systems. Recently the Parliamentary Budget Officer (PBO) calculated the total amount of GST collected on carbon pricing in the four provinces to be between $236 million and $267 million in 2017-18 and between $256 million and $313 million in 2018-19.[4] The PBO’s report clearly shows, contrary to the federal government’s claim, the carbon tax is not revenue-neutral and will yield federal financial benefits. Agriculture and Agri-Food officials were able to confirm to the Committee a preliminary analysis of a $50-per-tonne carbon tax would cost farmers in Western Canada, on average, $3,705 a year and farmers in Eastern Canada $2,423.[5] In an internal memo to the Agriculture Minister which contained the analysis, it indicated a $50-per-tonne carbon tax was too low to achieve the target of a 2 per cent reduction of agricultural GHG emissions and a $100-per-tonne carbon tax was needed instead.[6] Furthermore, in the April 2018 Economic and Fiscal Outlook, the PBO reported the carbon tax will reduce Canada’s GDP by $10 billion per year by 2022.[7] With a focus on agriculture, the PBO also completed an analysis of what the cost of a $25-per-tonne carbon tax would be for Canadian farms (Table 1, Table 2 and Table 3).[8] As we can see these are not insignificant costs and they will compromise the competitiveness of our farmers, ranchers and processors who have, for years, demonstrated an ability to deliver meaningful reductions in emissions through the adoption of new technologies, education and innovative management practice. For example, Dennis Prouse of CropLife Canada highlighted through the use of plant science technologies, farmers have reduced greenhouse gas emissions by 29 million tonnes per year and lowered diesel fuel use by up to 194 million litres per year.[9]

Competitiveness Against the backdrop of rising global trade protectionism, government measures which erode Canada’s competitiveness and comparative advantages in agriculture will ensure the failure in achieving its goal of growing agri-food exports to $75 billion annually by 2025.[10] That is why many witnesses view the federal carbon tax as a disadvantage[11] [12] [13] [14] [15] which increases the cost of operations in Canada, while competitors in other countries face no such penalty. Conclusion We believe our agriculture sector has, and will continue to, contribute to Canada’s climate change objectives. We must recognize the sector’s past efforts and ongoing commitments to climate change, soil and water conservation. However, we must aim to improve the competitiveness of Canadian agriculture. As a result of damaging policies such as the carbon tax and inaction on issues like the grain backlog, the Liberal government has lost the confidence of the agriculture and agri-food stakeholders. They must reverse damaging policies to regain the lost confidence and trust. Recommendation That the Government of Canada abandon the federal carbon tax which disproportionately harms the agriculture sector and rural communities. [1] AGRI, Evidence, 1st Session, 42nd Parliament, 5 February 2018, 1550 (Doyle Wiebe, Director, Grain Growers of Canada. [2] AGRI, Evidence, 1st Session, 42nd Parliament, 5 February 2018, 1530 (Clyde Graham, Senior Vice-President, Fertilizer Canada). [3] AGRI, Evidence, 1st Session, 42nd Parliament, 31 January 2018, 1635, 1710 (Andrea Brocklebank, Executive Director, Beef Cattle Research Council, Canadian Cattlemen’s Association). [4] Cost of Carbon tax deduction from GST, 12 December 2017, Office of the Parliamentary Budget Officer. [5] AGRI, Evidence, 1st Session, 42nd Parliament, 9 November 2017, 1625 (Tom Rosser, Assistant Deputy Minister, Strategic Policy Branch, AAFC) and letter to the clerk of the Standing Committee on Agriculture and Agri-Food from AAFC on 22 December 2017. [6] Letter to the clerk of the Standing Committee on Agriculture and Agri-Food from AAFC on 22 December 2017 and access to information request A-2017-00037 (AAFC), June 2017. [7] Economic and Fiscal Outlook – April 2018, 23 April 2018, Office of the Parliamentary Budget Officer. [9] AGRI, Evidence, 1st Session, 42nd Parliament, 7 November 2017, 1535 (Dennis Prouse, Vice-President, Government Affairs, CropLife Canada). [10] Budget 2017, Growing the Economy Through Agri-Food Innovation, p. 107. [11] AGRI, Evidence, 1st Session, 42nd Parliament, 7 November 2017, 1635, 1700 (Jan VanderHout, Member of the Environment Committee, Canadian Horticultural Council). [12] AGRI, Evidence, 1st Session, 42nd Parliament, 7 December 2017, 1555, 1620 (Dr. Pierre Desrochers, Associate Professor, Geography Department, University of Toronto). [13] AGRI, Evidence, 1st Session, 42nd Parliament, 31 January 2018, 1700 (Tony Staathof, Board Member, National Farmers Union). |