FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

CHAPTER FOUR: COMMUNITIESThe third question posed by the Committee when it launched its consultations in advance of the 2017 federal budget was the following: What federal measures would ensure that urban, rural and remote communities throughout Canada enable residents to make their desired contribution to the country’s economic growth and businesses to expand, prosper and serve domestic and international customers in order to contribute to growth? The Committee’s witnesses responded to the question with comments about infrastructure and its financing, the environment and climate change, and safety and security. A. INFRASTRUCTURE AND ITS FINANCINGRegarding Canada’s infrastructure and options for financing it, the Committee’s witnesses highlighted the following: an infrastructure strategy; the transportation of goods, people and information; housing and recreation; rural and remote regions; and financing methods. Infrastructure Investments Announced in the 2016 Federal Budget, 2016–2021 (Total over 5 years, $millions)

Note: The 2016 federal budget announced new infrastructure spending totalling $11.9 billion over five years beginning in 2016. The figure illustrates the amount of proposed infrastructure investments that were announced in the budget. Source: Figure prepared using data obtained from: Department of Finance, Growing the Middle Class, 2016, p. 90. 1. An Infrastructure StrategyIn commenting on a national infrastructure strategy, the Business Council of Canada informed the Committee about a number of measures that it believes should be included in such a strategy, including independent bodies to evaluate infrastructure projects, and adequate resources for regulatory processes in relation to such projects. The City of Fredericton and Ignite Fredericton highlighted the need for transportation, digital and innovation infrastructure, while the Canadian Federation of Agriculture requested a review of current infrastructure needs. Desjardins Group encouraged the government to collaborate with the other levels of government in meeting Canadians’ specific infrastructure needs, and Financial Executives International Canada advocated transparency and predictability with respect to infrastructure investments. The Chartered Professional Accountants of Canada asked the government to make fiscally responsible investments in core public infrastructure focused on longer-term goals, while the Conference Board of Canada and the Newfoundland and Labrador Federation of Labour proposed the establishment of a public infrastructure stimulus program. The C.D. Howe Institute suggested that infrastructure projects that fall under federal jurisdiction, which could be completed rapidly, be given priority. Regarding the next phase of the government’s infrastructure plan, the Federation of Canadian Municipalities and the Association of Manitoba Municipalities said that funding models should allow local decision makers to direct funds to the projects that are needed the most. Forest NB asked for strategic investments to be a part of the next phase of the government’s infrastructure plan, PEI BioAlliance advocated the development of manufacturing infrastructure, and the Federation of Canadian Municipalities urged a focus on projects designed to build public transit systems. In mentioning access to federal financial support, the Alberta Urban Municipalities Association requested that funds be allocated directly to municipalities, without provincial involvement. It also proposed that funding through federal-provincial infrastructure agreements be matched to Alberta's construction season. The Province of Prince Edward Island supported the implementation of less restrictive project requirements as a means of enhancing access to funds. Witnesses commented on labour issues related to infrastructure projects, with the Canadian Union of Public Employees indicating that contractors and subcontractors who work on federally funded infrastructure projects should meet social and ethical standards, including in relation to wages, labour rights, pay equity, a representative workforce, opportunities for apprentices and corporate responsibility. Unifor asked the government to make provisions for made-in-Canada public transit equipment, as well as local content and hiring rules, including with a focus on under-represented groups. Supporting Employment & Economic Development Winnipeg Inc. encouraged the implementation of neighbourhood revitalization programs with multi-year funding, along with community benefit agreements, social value weighting and a national community economic development policy framework. Alberta-Pacific Forest Industries Inc. said that infrastructure projects should be selected with a focus on those that are the least carbon-intensive. 2. The Transportation of Goods, People and InformationThe Committee was told about the ways in which goods and people are transported. For example, the Manitoba Chambers of Commerce supported investments in railways. Western Economic Diversification – Saskatchewan called for railway construction in northern Saskatchewan, while the Canadian Labour Congress and the Quebec Employers Council highlighted the need for improvements to the Québec City–Windsor corridor; particular mention was made of a dedicated track on the Montréal–Ottawa–Toronto corridor, and both faster and more frequent service. The Quebec Employers Council requested the construction of a high-speed rail network between Toronto and Québec City. In focusing on other aspects of railways, the Agricultural Producers Association of Saskatchewan said that grants and tax incentives should be used to encourage investment in short-line rail networks that are able to transport grain by rail, and the National Cattle Feeders’ Association indicated that changes in rail transport policies are needed in order to facilitate open access to all rail lines. The Canadian Wheat Board Alliance proposed nationalization of the railway facilities at the Port of Churchill, Manitoba, while the Saskatchewan Mining Association noted that mining companies need a competitive, reliable and responsive rail system in order to get products to the marketplace. Witnesses also commented on airports and related issues, with the Atlantic Canada Airports Association, the Canadian Airports Council and the Greater Charlottetown Area Chamber of Commerce advocating reform of the Airports Capital Assistance Program’s eligibility requirements to ensure that airports included in the National Airports System are eligible for funding. As well, the Atlantic Canada Airports Association and the Canadian Airports Council mentioned the need for additional infrastructure funding for small airports in the National Airports System, and for easier access to the Airports Capital Assistance Program. The Greater Toronto Airports Authority stated that airports wishing to achieve a higher level of service should have access to a program to assist them in this regard. In highlighting airports’ expenses, the Atlantic Canada Airports Association made a number of suggestions regarding airport rents: eliminate them; change the formulae for calculating them; or introduce a limit on them. Similarly, the Quebec Employers Council requested the elimination of airport rents, with this proposal supported by the Canadian Airports Council for airports with fewer than 3 million passengers annually and by the Board of Trade of Metropolitan Montreal for major Canadian airports. However, in suggesting that the current airport ownership model is appropriate, Unifor urged the government to maintain airport rents, and to extend leases for all airports. The C.D. Howe Institute proposed the auctioning of airport leases. Some witnesses noted particular airports, with the Fredericton Chamber of Commerce, as well as the City of Fredericton and Ignite Fredericton, advocating investments in the Fredericton International Airport. The Greater Toronto Airports Authority urged the allocation of funds to provincial and municipal governments in order to finance transit projects that would connect to Toronto Pearson International Airport. Witnesses also mentioned roads and highways, with the Agricultural Producers Association of Saskatchewan, Western Economic Diversification – Saskatchewan, the Federation of Canadian Municipalities, Forest NB and the Union des Producteurs Agricoles requesting additional investments in road infrastructure. The Canadian Northern Economic Development Agency indicated that support for all-weather roads would facilitate access to Canada’s most remote communities, while the National Cattle Feeders’ Association proposed that the government establish an infrastructure fund for rural road and bridge projects. The Saskatchewan Association of Rural Municipalities suggested that the government allow some flexibility under the New Building Canada Fund for projects that use innovative financing methods to build and maintain road infrastructure. With a focus on ports, the Manitoba Chambers of Commerce, the Public Service Alliance of Canada and the Union of Canadian Transportation Employees called for nationalization of the Port of Churchill, Manitoba; the Canadian Wheat Board Alliance said that the grain facilities at the Port of Churchill should be nationalized. The Public Service Alliance of Canada also stated that the Port of Churchill should become a port authority with a board structure that represents all stakeholders, including Indigenous peoples. The Quebec Employers Council asked for investments in Quebec’s ports. A number of witnesses highlighted pipelines. For example, the Canadian Energy Pipeline Association, the Canadian Association of Petroleum Producers, Financial Executives International Canada, Western Economic Diversification – Alberta, Western Economic Diversification – British Columbia and the Regina and District Chamber of Commerce urged the approval of outstanding pipeline projects. In commenting specifically about the TransCanada Energy East pipeline project, the Atlantic Institute for Market Studies and the Canadian Association of Petroleum Producers supported the project, with the Atlantic Canada Opportunities Agency – Nova Scotia, the Atlantic Canada Opportunities Agency – Prince Edward Island, Western Economic Diversification – Saskatchewan and the Federal Economic Development Agency for Southern Ontario suggesting that completion of the project would have economic benefits. As well, witnesses mentioned public transit, with the Board of Trade of Metropolitan Montreal, the Canadian Labour Congress, the Canadian Urban Transit Association, the Quebec Employers Council, the Federation of Canadian Municipalities and the Green Budget Coalition urging the government to allocate funds to public transit projects. The Canadian Urban Transit Association particularly mentioned infrastructure that supports public transit, car sharing and carpooling over single-occupancy vehicles. It proposed the creation of an expert advisory panel to help establish program parameters for infrastructure and public transit funds, and it stated that urban transit investments should be available to communities of all sizes. The Canadian Urban Transit Association also called for an evidence-based discussion about transportation user fees. Regarding other transportation issues in relation to moving goods and people, the Canadian Urban Transit Research and Innovation Consortium said that the government should provide it with funding that would enable it to conduct transportation-related research. According to it, the funding should be directed to an independent, not-for-profit innovation consortium that would allocate the funds to relevant stakeholders. The Canadian Urban Transit Association suggested that the government partner with it and the Canadian Urban Transit Research and Innovation Consortium to support research, development, demonstration and integration projects in the transit sector. Memorial University of Newfoundland requested funds for marine infrastructure. In mentioning the transportation of information, Keystone Agricultural Producers highlighted the need for digital infrastructure in order to support increased access to education and skills training, and the City of Fredericton and Ignite Fredericton asked for investments in digital infrastructure and innovation. Regarding telecommunications technology regulations, the Saskatchewan Association of Rural Municipalities encouraged the government to take several actions: revise the service areas defined for the purpose of competitive licencing processes; modify the rules that apply to broadband auctions; and allow Internet service providers to purchase spectrum licences that have been unused for more than two years. The Agence interrégionale de développement des technologies de l'information et des communications and the Alberta Urban Municipalities Association advocated incentives for Internet service providers and cellular carriers that provide service in rural or remote regions. Friends of Canadian Broadcasting asked the government to help fund Canadian broadcasters’ transmission equipment upgrades. As well, the Agence interrégionale de développement des technologies de l'information et des communications focused on affordable mobile Internet access, and said that the government should establish project selection criteria that would prioritize cellular technology for the Internet and telephones. The Information Technology Association of Canada commented on the opportunity to enable 5G in Canada by developing partnerships, funding vehicles and policy initiatives, and it urged the creation of a digital leadership advisory council. The Royal Conservatory of Music requested funding to build a digital educational platform to provide greater access to its content and publications. 3. Housing and RecreationThe Committee was presented with a range of proposals in relation to housing. For example, the C.D. Howe Institute advocated the creation of a mortgage insurance fund for residential housing, and the Canadian Home Builders' Association suggested that – for well-qualified borrowers who are purchasing a home that is priced under $500,000 – Canada Mortgage and Housing Corporation once again insure mortgages that have a 30-year amortization period. It also asked that Canada Mortgage and Housing Corporation continue to insure mortgages where the down payment is 5% of a home’s purchase price, and consider the use of equity financing programs; particular mention was made of shared appreciation mortgages, loan insurance for joint mortgages or rent-to-own mortgages. Some witnesses made general comments about the housing market. For example, HSBC Bank Canada said that the government should encourage home owners to reduce their level of indebtedness, while Desjardins Group promoted collaboration in deciding the next step for addressing housing-related vulnerabilities. The Canadian Home Builders' Association urged the government to support the development of indicators and analysis in relation to the housing sector. According to the Atlantic Provinces Economic Council, additional housing initiatives should not be implemented until the housing market has adjusted to the recently announced measures. Desjardins Group stated that housing measures that target first-time buyers and young households – rather than those involved in the rental market or those who purchase real estate for speculative reasons – should be adopted. The Quebec Employers Council said that the government should avoid imposing restrictive pan-Canadian home ownership measures. The Canadian Home Builders' Association called for changes to the Home Buyers’ Plan. The Co-operative Housing Federation of Canada encouraged the government to ensure that co-operatives have access to mortgages with low interest rates, and to make a commitment to provincial/territorial funding streams that are allocated to support low-income households. Supporting Employment & Economic Development Winnipeg Inc. urged the creation of a national co-operative housing plan. Some witnesses mentioned the Goods and Services Tax and housing, with – for example – the Canadian Home Builders' Association requesting changes to the Goods and Services Tax rules for secondary homes and to the amount on which the Goods and Services Tax is applied. The Quebec Employers Council encouraged the government to eliminate the Goods and Services Tax on new capital expenditures on rental housing. The Canadian Association of Social Workers, the Front d'action populaire en réaménagement urbain and Gabriel Housing Corporation supported the development of a national housing strategy that would, among other things, recognize the right of all Canadians and Canada’s Indigenous peoples to housing. The Canadian Association of Social Workers asked the government to implement accountability measures with the provinces/territories in the context of such a strategy, and the Federation of Canadian Municipalities and Habitat for Humanity Canada identified the need for a robust, long-term plan for housing infrastructure. In commenting on social housing, the Front d'action populaire en réaménagement urbain, Gabriel Housing Corporation and the Réseau d'aide aux personnes seules et itinérantes de Montréal advocated the creation of new social housing, while the Réseau d'aide aux personnes seules et itinérantes de Montréal asked the government to restore funding for the construction of new social housing units in Quebec. Habitat for Humanity Canada proposed an expansion of Canada Mortgage and Housing Corporation’s securitization program to include affordable housing. The Co-operative Housing Federation of Canada commented that Canada Mortgage and Housing Corporation should set aside a portion of its Affordable Rental Housing Innovation Fund and its Affordable Rental Housing Financing Initiative to test and scale innovative development, and to finance co-operative housing models. Habitat for Humanity Canada suggested that federal lands be used for affordable housing, and the Canadian Home Builders' Association said that the government should both provide federal land for family-suitable housing to support mixed-income, mixed-use communities and work with the provinces/territories to address housing supply issues. The Canadian Home Builders' Association indicated that public education should occur to help the provinces address "not-in-my-backyard" opposition to mixed-income housing, while Reena supported federal and provincial grants to develop a number of affordable housing projects for mixed use across Ontario. In mentioning housing policies designed for specific groups, the Front d'action populaire en réaménagement urbain advocated major investments in the renovation and construction of housing units in northern and Inuit communities. Gabriel Housing Corporation urged the renewal of agreements and subsidies regarding operating costs and repairs that will soon expire, and requested funds to train Indigenous peoples to build and upgrade housing units. The National Pensioners Federation suggested that the government support seniors who are unable to pay their rent, while Reena said that the government should allocate a portion of all funds allocated to the proposed national housing strategy to support housing for people with developmental disabilities. Generation Squeeze supported a reduction in child care and parental leave costs to counteract high housing costs for young households. Choices for Youth commented on youth homelessness and said that this issue should be prioritized, while Gabriel Housing Corporation indicated that Indigenous peoples should have greater control over housing and homelessness funds in implementing related programs in Saskatchewan. According to the Réseau d'aide aux personnes seules et itinérantes de Montréal, measures to combat homelessness should focus on prevention and housing development. It asked the government to renew and increase funding for the Homelessness Partnering Strategy, and it also suggested that funding be targeted at those cities that have the most acute homelessness, with greater flexibility regarding local funding decisions. The Front d'action populaire en réaménagement urbain said that the government should support individuals and families who do not have access to adequate housing or who are homeless. With a focus on reducing the cost of housing, Gabriel Housing Corporation asked the government to provide capital grants for the purpose of building or purchasing and maintaining new social housing units. The Réseau d'aide aux personnes seules et itinérantes de Montréal stated that the government should work with Quebec’s government when developing housing programs, and that funding for housing projects should be allocated to community organizations and to provincial governments. Habitat for Humanity Canada encouraged the use of low-cost capital to finance affordable housing. The Canadian Home Builders’ Association proposed funding to Canada Mortgage and Housing Corporation, the National Research Council of Canada and Natural Resources Canada to support research on ways in which housing construction costs could be reduced. The Canadian Home Builders' Association stated that National Research Council of Canada should receive additional funds to support harmonized standards and to develop the National Building Code further. The Canadian Home Builders' Association requested an increase in residential housing density along transit corridors. Regarding recreational infrastructure, the Canadian Parks and Recreation Association and Sport Matters Group urged the creation of both a “repair” fund and a “new build” fund, with capital dedicated to small communities and ethnic populations, and a comprehensive inventory of sport and recreational facilities. With a focus on Canada’s tourism sector, the Recreation Vehicle Dealers Association of Canada supported investments in camping and recreation vehicle infrastructure in Canada’s national parks. The Recreation Vehicle Dealers Association of Canada, as well as the City of Fredericton and Ignite Fredericton, suggested that tourism-related marketing funds be delivered through Destination Canada. 4. Rural and Remote RegionsThe Committee was told about the need for reliable broadband in Canada’s rural, remote and northern regions. For example, the Agricultural Producers Association of Saskatchewan, the Alberta Urban Municipalities Association, Financial Executives International Canada, Keystone Agricultural Producers, the National Cattle Feeders’ Association, the National Farmers Union and the Saskatchewan Association of Rural Municipalities supported investments in new and existing telecommunications technology in rural regions. According to the Agricultural Producers Association of Saskatchewan, Internet speeds in rural regions should reach a certain standard by a given date. Given the high cost of fibre optic infrastructure, the Agence interrégionale de développement des technologies de l'information et des communications and the Information Technology Association of Canada asked the government to focus on developing satellite connections for rural regions. The Fédération des communautés francophones et acadienne du Canada and the Information Technology Association of Canada advocated a coordinated strategy among all levels of government, the private sector and community stakeholders regarding the development of broadband in rural and remote regions. The Saskatchewan Association of Rural Municipalities made several proposals regarding rural municipalities: increase the amount allocated to the Small Communities Fund; reduce the population threshold for a municipality to be a “small community”; and consider the various ways in which “rural municipality” is defined across Canada. The Federation of Canadian Municipalities noted that the next phase of the government’s infrastructure plan should build on the Small Communities Fund and prioritize rural infrastructure projects. The Manitoba Chambers of Commerce suggested that the government collaborate and consult with Manitoba’s northern communities in the development of a long-term economic development plan. To ensure that payments are made to rural municipalities that provide local emergency services, the Saskatchewan Association of Rural Municipalities advocated the adoption of mandatory road maintenance agreements and mutual aid agreements. The Macdonald-Laurier Institute highlighted a “dig once” policy that would involve the concurrent laying of fibre optic and other cables, as well as wires, in rural and other under-serviced areas, and asked the government to accelerate the approval process for telecommunications construction. The National Cattle Feeders’ Association mentioned the need for social infrastructure in rural regions. As well, the National Cattle Feeders’ Association said that the Gas Tax Fund should be shared on the basis of fuel consumption, rather than population. The Northern Lights School Division No.113 requested a reduction in provincial-federal barriers to providing assistance, and asked the government to expand the family resource centre model. 5. Financing MethodsThe Committee was informed about a variety of ways in which infrastructure could be financed. For example, the Business Council of Canada suggested the implementation of a user-pay model, while the Canadian Labour Congress encouraged innovative financing methods. The Canadian Chamber of Commerce suggested that the government create the conditions for Indigenous businesses and communities to be financial partners in infrastructure projects. With a focus on the proposed infrastructure bank, the Canadian Construction Association supported this initiative as a means by which to enhance investments in trade-related infrastructure, and the Chartered Professional Accountants of Canada asked the government to release details about the proposed bank. The Canadian Community Economic Development Network and Supporting Employment & Economic Development Winnipeg Inc. thought that such a bank could provide affordable financing, and the Canadian Community Economic Development Network suggested that the bank could provide loan guarantees. The Federation of Canadian Municipalities urged the government to ensure that financing through an infrastructure bank does not replace – but is instead complementary to – current infrastructure funding. Considering the size of Canada’s infrastructure needs, the Advisory Council on Economic Growth said that an infrastructure bank is a way to attract private-sector investment, and it also mentioned the idea of a North American infrastructure bank. The Rick Hansen Foundation suggested the creation of an accessibility fund to finance innovation and accessibility in the design of the built environment, and supported accessibility-based eligibility criterion for projects seeking infrastructure funding. The Business Council of Canada and Financial Executives International Canada supported the public-private partnership model to finance infrastructure, while the Canadian Union of Public Employees and the Public Service Alliance of Canada asked that PPP Canada be eliminated. According to the Canadian Union of Public Employees, public infrastructure should be publicly financed and operated. It supported comprehensive accountability and transparency legislation in relation to public-private partnerships. The Public Service Alliance of Canada encouraged the government to redirect capital from the P3 Canada Fund to public infrastructure projects. The Association of Manitoba Municipalities requested funding from all levels of government to help meet the capital costs of infrastructure projects. Unifor suggested that – prior to the sale of public infrastructure – the government examine the impact of asset recycling on productivity, safety and economic development, particularly with respect to public airports. 6. The Committee’s RecommendationsRecognizing that people, businesses and communities need infrastructure that is adequate to meet their evolving needs, and that is maintained over time, the Committee recommends: RECOMMENDATION 61 That the Government of Canada prioritize measures in relation to strategic green, social and core infrastructure that have a direct and measurable impact on the Canadian economy, and that attract or facilitate foreign investment and trade. These measures include:

RECOMMENDATION 62 That the Government of Canada undertake a review of the municipal infrastructure funding formula to ensure that – like the permanent and indexed Gas Tax Fund – funding is long-term, predictable, sustainable and dedicated. RECOMMENDATION 63 That the Government of Canada ensure that access to infrastructure funding occurs through streamlined and timely approval processes, and that coordination and consistency between federal and provincial/territorial infrastructure funding programs are enhanced. RECOMMENDATION 64 That the Government of Canada commit long-term funding to address the forthcoming expiration of federal operating agreements in relation to geared-to-income rental housing. RECOMMENDATION 65 That the Government of Canada re-examine the definition of housing affordability that is used by the government and Canada Mortgage and Housing Corporation. RECOMMENDATION 66 That the Government of Canada renegotiate the funding agreements in relation to housing to ensure the existence of firm targets for the number of new rental units to be built annually. RECOMMENDATION 67 That the Government of Canada extend the affordable housing programs for seniors and for victims of violence that were announced in the 2016 federal budget and that are set to end in two years. RECOMMENDATION 68 That the Government of Canada proceed with the infrastructure bank to increase private-sector investment in the Canadian economy. RECOMMENDATION 69 That in order to stimulate growth and ensure economic viability, the Government of Canada work with the community of Churchill, Manitoba to develop a long-term strategy for the Port of Churchill, as well as rail transport to and from the community. RECOMMENDATION 70 That the Government of Canada improve access to child care in order to help fulfill the government’s promises to invest in social infrastructure. B. THE ENVIRONMENT AND CLIMATE CHANGEIn focusing on the environment and climate change, the Committee’s witnesses mentioned the following topics: a climate change strategy; energy supply; energy use and efficiency; and species and habitat.

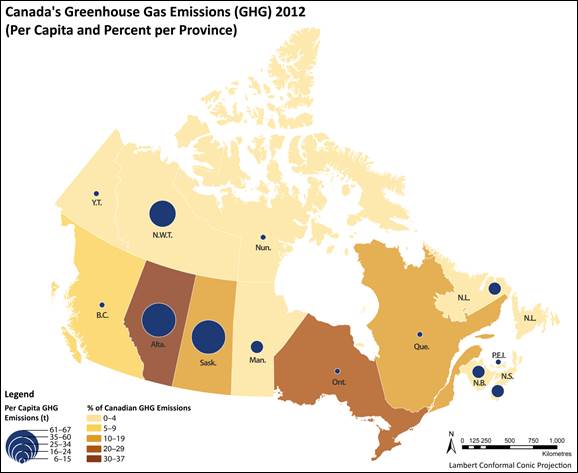

Source: Map prepared by the Library of Parliament, Ottawa, 2016. Scale: 1:25,000,000. Based on data from Canada’s National Inventory Submissions (1990-2013) to the United Nations Framework Convention on Climate Change; Statistics Canada Boundary Files, 2011 Census: Catalogue no. 92-160-X; Census Tables and Natural Earth, 1:50M Cultural Vectors v.2.0. The following software was used: Esri, ArcGIS, version 10.3.1. Some information is licensed under the Open Government Licence – Canada. 1. Climate Change StrategyThe Committee was told about the need for a climate change strategy that would include – among its elements – green financing mechanisms. Canadian Manufacturers & Exporters urged the government to create a national program similar to Ontario’s Green Investment Fund, and the Canadian Coalition for Green Finance stated that the Low Carbon Economy Trust should be allowed to allocate funds to create a green investment bank. The Canadian Labour Congress requested the re-establishment of postal banking through the Canada Post Corporation in order to finance green investments. The Low Carbon Partnership advocated the creation of a fund to assist the transition to a low-carbon economy, while the Province of Prince Edward Island said that the government should consider a building and transportation conversion that supports such an economy. The Canadian Geothermal Energy Association called on the government to incorporate geothermal energy investments into the Green Bond Framework, the Low Carbon Economy Trust and the proposed infrastructure bank. The Low Carbon Partnership asked for funding to scale up its low-carbon programs. The Canadian Labour Congress and the Canadian Solar Industries Association supported the use of green bonds to finance renewable energy infrastructure projects. The Canadian Solar Industries Association also requested the creation of tax credits for investments in solar energy, and of tax policies that would facilitate the development of low-carbon-emitting infrastructure. Witnesses also highlighted the need for measures to price carbon as an element of a climate change strategy. For example, Clean Energy Canada and the Canadian Urban Transit Research and Innovation Consortium supported carbon pricing in general. However, the Business Council of Canada and the Regina and District Chamber of Commerce said that the government should not establish a price for carbon. The Canadian Solar Industries Association and the Quebec Employers Council advocated a region-specific carbon pricing system that would reflect the economic reality of each province/territory. However, Alberta-Pacific Forest Industries Inc., the Canadian Labour Congress, the Chicken Farmers of Canada and the Green Budget Coalition supported a Canada-wide carbon pricing system. The Green Budget Coalition also proposed that the starting price for carbon consider carbon’s social cost, and suggested that this price increase in a predictable manner; the Canadian Union of Public Employees called for a carbon price that would increase as the amount of emissions rises. The Canadian Union of Public Employees and the Green Budget Coalition said that carbon pricing–related revenue should be directed to low-income or vulnerable households, entities affected by carbon pricing or to green investments. As well, the Green Budget Coalition indicated that this revenue should be used to finance “clean” economic growth, and to support climate change adaptation. The Saskatchewan Mining Association urged increased support for carbon capture and sequestration. According to witnesses, a climate change strategy should also provide for the development of clean technologies. For example, Alberta-Pacific Forest Industries Inc., the Canadian Association of Petroleum Producers and the Canada Mining Innovation Council highlighted the need for new clean technologies. In particular, the Canada Mining Innovation Council requested a multi-year investment in clean technologies, with government funds matched by the mining sector. The Canadian Gas Association asked the government to partner with the provinces and utilities to advance innovation in energy technologies for end-users. The Canadian Urban Transit Research and Innovation Consortium mentioned the need for smart infrastructure, and for more research, development, demonstration and integration to support the creation of zero-emissions, light-weight, connected transportation technologies. In the context of agriculture, the Canadian Federation of Agriculture, Keystone Agricultural Producers and the Prince Edward Island Federation of Agriculture advocated the creation of incentives to support the development of clean technologies. The Canadian Federation of Agriculture asked that these incentives be enhanced with investments in infrastructure that would assist with the adoption of clean technologies. In commenting on climate change-related labour and social issues, the Canadian Labour Congress and the Canadian Union of Public Employees urged the establishment of a framework to help workers and their communities adapt to climate change. Unifor asked the government to develop a process to review the labour market impacts of a shift to renewable energy, and to ensure that the costs associated with this shift are not unfairly borne by workers. It also said that the government should create federal-provincial working groups to make proposals on Canada's climate change action plan goals, policies and programs; the unions representing the employees most affected by climate policy should be connected to the working groups. Some witnesses highlighted climate-related mitigation and adaption. The Canadian Federation of Agriculture identified a need to promote climate change mitigation and adaptation, and to invest in the collection of information that could be used both to encourage environmental initiatives and to assist in the development of management tools. Similarly, the Green Budget Coalition stated that investments are needed to mitigate the impacts of climate change; funds should be allocated to upgrading road and water infrastructure, assisting provinces and municipalities with their adaptation efforts, and conserving healthy ecosystems as the climate changes. Regarding new infrastructure investments, the Canadian Community Economic Development Network asked for the inclusion of criteria that would prioritize funding for clean energy projects in communities that are vulnerable to climate change. As well, the Canadian Urban Transit Association indicated that public transit systems should be allowed to access green infrastructure funding with a focus on climate-related resiliency. A number of witnesses presented proposals designed to reduce greenhouse gas emissions. For example, the Canada Mining Innovation Council mentioned the need for a strategy to reduce greenhouse gas and carbon dioxide emissions, while the Federation of Canadian Municipalities asked that municipalities receive predictable funding for projects aimed at reducing greenhouse gas emissions. The Canada Green Building Council, the Green Budget Coalition and The Low Carbon Partnership stated that greenhouse gas emissions should be reduced, while Western Economic Diversification – Alberta called for a smaller carbon footprint in the oil and gas sector. The Canadian Vehicle Manufacturers' Association supported the adoption of a Canada–U.S. policy regarding the attainment of reductions in greenhouse gas emissions. Alberta-Pacific Forest Industries Inc. requested decarbonization of the economy through the development of practices that reduce greenhouse gas emissions. Desjardins Group stated that climate change should be an integral part of the overall approach to both medium- and long-term economic development. 2. Energy SupplyIn informing the Committee about various aspects of Canada’s energy supply, Clean Energy Canada mentioned the development of a national action plan for electrification that would include the following elements: a national goal of a near–zero-carbon electricity supply; assessments of growth in the clean power supply; sector-by-sector electrification goals; a cost-benefit analysis of modernization of the electrical grid; estimation of the financing needs associated with electrification; and targeted approaches for electrification in rural, remote and Indigenous communities. Clean Energy Canada also highlighted the need to do the following: attract businesses to manufacture their products in regions where clean electricity is produced; facilitate research and development support, pilot projects and innovation; increase clean power capacity; change rate structures for utilities; and support a forum for sharing best practices in producing clean electricity. As well, Clean Energy Canada said that the government should facilitate – and enable opportunities for – the movement of clean power within Canada, and create a panel of experts to recommend best practices for utility-related legislation and regulations in a low-carbon economy; the panel’s recommendations should be used when considering support for energy-related infrastructure. The Canadian Gas Association made several proposals for government action regarding natural gas, including the following: help to finance the incremental cost of natural gas engines for vehicles, ships and railcars; fund innovations in relation to renewable natural gas technologies; and support clean energy infrastructure. It also advocated the delivery of more affordable energy options, such as liquefied natural gas, to Indigenous communities and businesses in Canada’s North, as well as increased development of new renewable natural gas facilities. As well, it suggested that the government amend the Renewable Fuel Regulations to include renewable natural gas when – for the purpose of transportation fuel – it is used as a compressed natural gas or a liquefied natural gas. With a focus on renewable energy, the Canadian Labour Congress suggested that the government expand local renewable energy generation in Canadian homes and communities, implement job creation targets, support goals to reduce greenhouse gas emissions, and increase energy generation from solar, wind and geothermal sources. It also said that the government should work with Indigenous, rural and remote communities to increase access to renewable energy, as well as to facilitate the development of renewable energy projects at the local level. The Canadian Solar Industries Association stated that the government should remove regulatory requirements that prevent investments in renewable energy. The Canadian Geothermal Energy Association mentioned the need to implement the following proposals: recognize geothermal energy as a heat resource; permit geothermal energy suppliers to claim the Canadian renewable and conservation expense in relation to geothermal exploration; support geothermal exploration and development; fund the Geological Survey of Canada; develop a public geothermal data system, as well as a resource assessment and classification system; and create a geothermal power and heat production incentive or re-establish the ecoENERGY for Renewable Power program. The Saskatchewan Mining Association promoted investments in uranium-sourced nuclear power. 3. Energy Use and EfficiencyThe Committee was told about green infrastructure, with the Canadian Union of Public Employees suggesting that the government’s infrastructure funding decisions involve consideration of impacts on the environment and greenhouse gas emissions, and Financial Executives International Canada advocating support for renewable energy infrastructure to meet Canada’s long-term energy needs. The Cooper Institute requested that no new carbon-based infrastructure be constructed, and proposed investments in local renewable energy infrastructure, as well as in local food production and distribution. Clean Energy Canada made a variety of proposals designed to increase the use of electric vehicles, including the following: increase support for electric vehicle charging infrastructure; offer rebates when electric vehicles are purchased; support pilot programs designed to increase the number of electric vehicles in car-sharing fleets; provide financial assistance for electric vehicle education; and create a transportation innovation fund to support the electric vehicle supply chain. With a focus on reducing congestion and promoting sustainable transit initiatives, the Canadian Urban Transit Association said that the government should make employer-provided transit benefits tax-exempt, and create incentives that would lower the cost for transit systems to procure green buses, rail cars and trucks. The Canadian Union of Public Employees urged the government to support the Green Economy Network's plan to “green” public transportation and public renewable energy. The Canadian Urban Transit Research and Innovation Consortium highlighted the need for more vehicle charging systems, and the Canada Green Building Council supported the installation of emission-reducing fuel pumps. A number of witnesses commented on fossil fuels and biofuels. Alberta-Pacific Forest Industries Inc. suggested that the government promote biofuels and low–carbon-emitting fuels for the transportation sector. The Cooper Institute stated that the government should phase out fossil fuel subsidies, and said that no new investments in extraction projects related to fossil fuels should be made. The Canadian Gas Association requested support for the development of natural gas refueling infrastructure across Canada, and the Canola Council of Canada advocated an increase in the federal biodiesel mandate. NRStor Inc. proposed that the government redirect public funds currently allocated to diesel power generation to renewable energy projects in Indigenous communities, while the Green Budget Coalition urged support for the Assembly of First Nations' proposal to reduce diesel use in Indigenous communities and for its proposal regarding clean energy funds. The C.D. Howe Institute indicated that the government should increase the Goods and Services Tax rate applied on transportation fuels. Alberta-Pacific Forest Industries Inc. advocated nation-wide establishment of offsets, such as forest sinks, and carbon displacement projects, such as biofuels and bioenergy. A number of witnesses focused on ways to encourage retrofits. The Canadian Gas Association supported retrofits for residential and commercial buildings, while the Canadian Home Builders' Association urged comprehensive retrofits for residential, not-for-profit and co-operative housing units, as well as for municipal buildings. Gabriel Housing Corporation highlighted the need to retrofit social housing. Clean Energy Canada suggested that, in relation to existing buildings, greenhouse gas emissions be reduced, and energy performance levels be improved, through tax credits for retrofits; the value of the tax credits should be proportional to the extent to which energy efficiency is improved. The Canadian Union of Public Employees urged support for the Green Economy Network's plan to transform Canada's economy with investments in “greening” homes and buildings. The Canada Green Building Council proposed the retrofitting of most buildings that exceed 25,000 square feet, the recommissioning of a significant proportion of the remaining buildings, and the installation of solar panels and other renewable energy sources on a certain proportion of buildings. According to the Canadian Labour Congress, a strategy that would promote investments in home and building retrofits, as well as energy efficiency and conservation, should be developed; Employment Insurance funds should be used to finance retrofits. Some witnesses commented on environmental performance measurement. For example, the Canada Green Building Council said that the government should require energy benchmarking for federal buildings, and Clean Energy Canada advocated a requirement for energy audits and home energy labels when a home is sold and when major renovations occur. The Canadian Home Builders' Association stated that the government should create a permanent, refundable renovation tax credit, and requested that the EnerGuide Rating System be used nation-wide to rate and compare home energy performance. Witnesses also mentioned energy efficiency standards, with the Canada Green Building Council stating that the government should adopt the Leadership in Energy and Environmental Design Platinum standard for federal buildings. The Canadian Labour Congress proposed that the government work with the provinces/territories to reach an agreement on national energy efficiency standards. The Canada Mining Innovation Council highlighted the need for a strategy to improve energy efficiency, and the Forest Products Association of Canada said that building codes and standards should be updated to incorporate consideration of the carbon footprint of the built environment. The Canada Green Building Council suggested that net–zero-energy buildings be constructed. Clean Energy Canada urged the government to create a research institution focused on zero-carbon industrial processes; the institution should bring together universities, federal and provincial governments, businesses and federal science bodies, such as the National Research Council of Canada. The Quebec Employers Council suggested that actions be taken to ensure responsible development and transportation of natural resources. The Saskatchewan Mining Association asked the government to establish science-based environmental regulations. 4. Species and HabitatThe Committee was informed about species and habitat preservation, with the Forest Products Association of Canada supporting a pan-Canadian reforestation plan, and the West Coast Aquatic Stewardship Association requesting funds for habitat restoration and for collaborative management in fishing areas. The Saskatchewan Association of Rural Municipalities suggested that the government amend the Species at Risk Act in order to recognize incidental harm of species at risk as a result of farming activities. It also said that the government should compensate farmers who voluntarily preserve land for a species that is at risk. The Green Budget Coalition proposed a number of actions that the government should take regarding environmental conservation, including the following: expand and better safeguard the terrestrial protected areas system; direct green infrastructure funding to natural infrastructure, such as wetlands and coastal strengthening; allocate funding to the Pan-Canadian Framework on Clean Growth and Climate; support the Indigenous Leadership Initiative's "Guardians Program"; create additional measures to conserve unique and ecologically significant wildlife habitat; support environmental conservation measures, such as federal environmental rights legislation that would promote a healthy environment; and empower Canadians to conserve their natural environment by supporting stewardship, “citizen science” and environmental education. As well, the Green Budget Coalition mentioned the marine habitat, and identified the need to reach and exceed international marine protection targets, ensure ocean health and sustainable fisheries, renew freshwater programs that are scheduled to expire in March 2017, and improve and standardize freshwater monitoring data collection and reporting. Earth Rangers urged the government to continue funding the organization’s youth environmental education programs. 5. The Committee’s RecommendationsBecause Canada is part of a global community that is focused on protecting the environment and addressing climate change, the Committee recommends: RECOMMENDATION 71 That the Government of Canada engage, support and bring together Canadian businesses and organizations to find innovative solutions for reducing greenhouse gas emissions. RECOMMENDATION 72 That the Government of Canada take action to support and encourage Canada’s geothermal sector. RECOMMENDATION 73 That the Government of Canada encourage the use of electric vehicles by investing in the infrastructure that is needed to support these vehicles, such as charging stations. RECOMMENDATION 74 That the Government of Canada reduce the use of diesel power for electric power generation in Indigenous communities through clean energy projects. C. SAFETY AND SECURITYThe Committee’s witnesses highlighted a number of topics in relation to Canada’s safety and security. In particular, they focused on air and maritime security, emergency management, contraband tobacco, and defence and law enforcement issues. Selected Canadian Safety and Security Agencies

1. Air and Maritime SecurityIn relation to air security, the Committee was told about airport security screening and runway safety regulations. For example, the Canadian Airports Council called for reform of the current pre-boarding security screening policies, and the Greater Toronto Airports Authority advocated increased support for the Canadian Air Transport Security Authority in order to implement a service standard that would be consistent with that of world-class airports. The Greater Toronto Airports Authority also requested capital funding to implement the new “CATSA Plus” screening technology. In commenting on the Runway End Safety Area regulation, the Atlantic Canada Airports Association and the Canadian Airports Council proposed support to fund the construction costs required by this regulation. With a focus on marine security, Unifor Local 2182 urged the government to increase staffing at Coast Guard radio stations, while the Union of Canadian Transportation Employees suggested the creation of a Coast Guard base at the Port of Churchill, Manitoba. 2. Emergency ManagementThe Committee was informed about emergency responses and responders, with the Alberta Urban Municipalities Association asking the government to restore federal disaster program funding to levels that could be characterized as appropriate. As well, the Association of Manitoba Municipalities said that the government should reverse the decision to transfer disaster relief responsibilities to provincial governments. The Saskatchewan Association of Rural Municipalities urged consultations with local governments before further developing the National Disaster Mitigation Program, an initiative that it thought could be expanded to include both structural and non-structural mitigation projects. It requested assistance to establish consistent guidelines regarding access to mitigation funds and – following adequate time for consultations with local partners – the ability to collaborate with local governments on a review of the Disaster Financial Assistance Arrangements. As well, it proposed the establishment of an emergency response fund. The Canadian Red Cross advocated the development of a strategic partnership with the government; the partnership should focus on community-based emergency preparedness, response readiness and improved coordination with federal authorities. Regarding the first of these, it made a variety of proposals: increase the number of community responders; train First Nations responders; and use more technology in emergency response efforts. 3. Contraband TobaccoThe Committee was told about contraband tobacco activity in Canada, with the Canadian Convenience Stores Association identifying a need to facilitate the collection of fines imposed for selling contraband tobacco, and to maintain the current tax rate applied on tobacco products. It also urged the government to raise public awareness about the dangers of contraband tobacco. The Quebec Employers Council asked that the impact of plain packaging for tobacco products be evaluated, and that the tobacco tax rate remain predictable. 4. Defence and Law Enforcement IssuesWhen informing the Committee about defence and law enforcement issues, the Alberta Urban Municipalities Association focused on the Royal Canadian Mounted Police, and requested additional funding for two purposes: to increase enrollment in the cadet program; and to fill existing officer vacancies. It also highlighted the need to improve the screening process for the Royal Mounted Canadian Police training program in an effort to enhance completion rates. The Assembly of First Nations advocated increased support for First Nations police forces on reserves. 5. The Committee’s RecommendationBelieving that safety and security continue to be a high priority for Canadians, the Committee recommends: RECOMMENDATION 75 That the Government of Canada work with the Canadian Air Transport Security Authority and the Canada Border Services Agency to raise service level standards and reduce wait times without increasing fees charged to travellers. |