RNNR Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

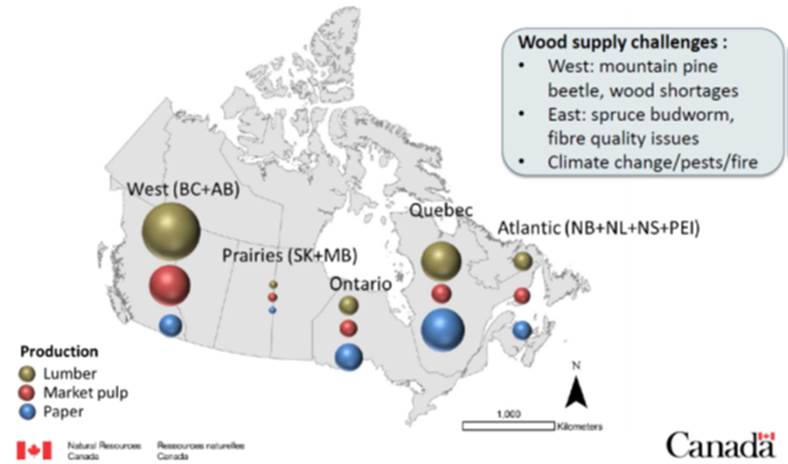

THE TRANSFORMATION OF CANADA’S FOREST SECTORI. INTRODUCTIONIn June 2008, the House of Commons Standing Committee on Natural Resources (the Committee) released a report entitled Canada’s Forest Industry: Recognizing the Challenges and Opportunities. The report was a response to a crisis that was facing Canada’s forest products industry, due to falling export demand and plant closures. Today the forest industry finds itself in a different place. As Mr. David L. Lindsay, President and CEO of the Forest Products Association of Canada (FPAC) stated: “[…] since the report of 2008 there has been considerable progress on the part of the industry, our partners in the innovation space, and the government to create an alignment and move forward on a journey of transformation for the Canadian forest sector […] the perfect storm of economic circumstances we faced over the last decade spurred the Forest Products Association of Canada, working closely with our partners, our member companies, and the academic community, to develop a strategic planning exercise.”[1] In light of this, the Committee undertook a study on the renewal of Canada’s forest industry. The Committee’s objective was to examine the current state of the forest products industry in Canada, and to determine how government investment and policies have contributed to the sector’s renewal since the Committee’s 2008 study on forestry. Furthermore, the Committee sought opinion on how industry, different levels of government and others can continue to support Canada’s forest sector in the future. The Committee dedicated eleven meetings to the study of Canada’s forest industry. During the first and second meetings, the Members discussed the findings of the Committee’s 2008 report on forestry, and heard from representatives from the Department of Natural Resources Canada (NRCan). Subsequently, the Committee held nine meetings on the study entitled the Renewal of Canada’s Forest Industry, hearing from a wide range of representatives from government, industry, First Nations communities, academia, and other forestry stakeholders across Canada. The Committee identified three themes to be examined: regional economic development, sector and market diversification, and strategic innovation. The following report presents the Committee’s findings and recommendations to the government, based on testimony from the study witnesses. II. REGIONAL ECONOMIC DEVELOPMENTHome to 10% of the world’s forest cover, Canada is considered a forest nation.[2] Approximately 92% of the country’s forests are publically-owned, while the remaining 8% (about 25 million hectares) is the property of thousands of small woodlot owners (about 20 million hectares) and a small number of major forest companies (about 5 million hectares).[3] With the exception of federal lands, including reserve lands, most forest resources in Canada fall under the jurisdiction of the provincial and territorial governments, while some are subject to forestry agreements with First Nations. Overall, witnesses agreed that the forest industry has recovered since the Committee’s 2008 study, and remains an important contributor to the Canadian economy. According to Mr. Lindsay: “[...] since the report of 2008 there has been considerable progress on the part of the industry, our partners in the innovation space, and the government to create an alignment and move forward on a journey of transformation for the Canadian forest sector.”[4] Mr. Glenn Mason, Assistant Deputy Minister of the Canadian Forest Service at Natural Resources Canada (NRCan), informed the Committee that the forest industry has accounted for 1.2% of Canada’s gross domestic product (GDP) for the past five years, and about 10% of the national manufacturing GDP last year, including $28.5 billion in exports.[5] Furthermore, Mr. Lindsay affirmed that the industry is the primary employer in hundreds of Canadian communities, providing between 200,000 and 230,000 direct jobs across the country.[6] As a result of cooperation between the industry, the federal government and other levels of government, the number of jobs in the forestry sector is expected to grow; “the Forest Products Association of Canada forecasts that another 60,000 Canadians could be recruited to work in the forest sector by the end of the decade,” according to Mr. Dennis Brown, Mayor of the Town of Atikokan.[7] This projected job creation will help compensate for a job loss of 125,000 which resulted from the “perfect storm” of economic circumstances in the industry – at its peak in 2008 – and, in the opinion of the Committee, demonstrates a strong recovery in the industry.[8] Often, when an industry adopts new innovation and new technology – as the forest industry has – fewer jobs are required to produce the same amount of product. The recent job creation in the forest industry breaks from this trend and is positive indeed. Based on testimony from the witnesses, the following sections present the Committee’s main findings with regards to the forest industry’s contribution to economic development in different Canadian regions. A. EMERGING ECONOMIC OUTLOOKThe forest industry is not homogenous across Canada. As Mr. Mason suggested, different regions have different production capacities and wood supply challenges.[9] Figure 1 provides an overview of the diverse regional economic challenges and opportunities in Canada’s forest industry. Figure 1: Diverse Regional Economic Challenges and Opportunities

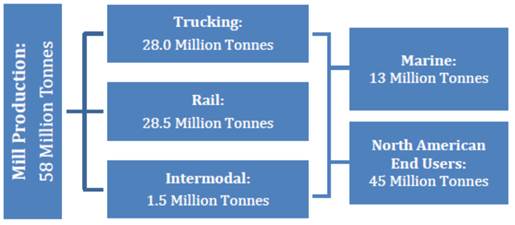

Source: NRCan In western Canada, the forest industry is an important contributor to the regional economy, particularly that of British Columbia. According to Mr. James Gorman, President and CEO of the Council of Forest Industries, B.C. is Canada’s “largest producer of softwood lumber, accounting for about 52% of [the country’s] overall production” (an approximated $12 billion annual contribution to the province’s GDP).[10] Furthermore, B.C. plays a major role in Canada’s lumber exports, most notably to North American and Asian markets. According to Mr. Ken Baker, CEO of Forestry Innovation Investment Ltd.: “Our biggest collective success so far—and I emphasize “collective” because this is a unique tripartite arrangement among the private sector here in B.C., the provincial government, and the federal government through NRCan—has been in China, where initially, in 2003, we were selling 69 million dollars’ worth of lumber, and we're now selling 1.4 billion dollars’ worth of lumber a year. That's 30% of British Columbia's lumber production now. This has not only made a home for that volume, but also, through added consumption around the world, has increased the price of lumber worldwide very dramatically, including in North America […] The big success in China has been our lumber, and I think we've peaked out on the volume from the B.C. industry, or at least from western Canada, because a certain amount goes into China from Alberta as well.”[11] One of the biggest threats to B.C.’s forest industry is the ongoing Mountain pine beetle infestation.[12] Mr. Gorman informed the Committee that 60% of pine trees in the province have been wiped out as a result, triggering a timber supply shortage. He added that the province’s annual lumber production is expected to drop from 11.6 billion board feet in 2015 to 9.7 billion board feet by 2020.[13] Some witnesses pointed to the fact that damage by the effects of the Mountain Pine Beetle infestation has created some new opportunities. Dr. Patrice Mangin, Professor at the Lignocellulosic Materials Research Centre at the University of Quebec at Trois-Rivières, stated that FPInnovations has worked on adding value to salvageable wood. Dr. Mangin also said that pine beetle-affected wood can be used as fuel.[14] Furthermore, according to Mr. Bob Matters, Chair of the Steelworkers’ Wood Council, the millions of hectares of trees infected by the pine beetle, particularly in the interior region around Quesnel, Williams Lake, up to Prince George, are prime growing country for future forests.[15] In the eastern and Atlantic regions, the spruce budworm has been a concern, according to some witnesses. However, Mr. James Irving, Co-CEO of J.D. Irving Limited, told the Committee that: “The federal government has [...] been proactive in partnering with the eastern region, the maritime provinces, on early intervention in the spruce budworm program. That's a 2014 program using the best technology and changing the way we attack a forest pest, which has been a big debilitating bug for eastern Canada for a long time.”[16] Ms. Guylaine Sirois, President of the Réseau Forêts-Bois-Matériaux de Témiscouata, cautioned that the spruce budworm infestation, which is still a problem in North Shore and eastern Quebec, may spread to other regions. She stated that the “medium- and long-term damage to the economies of the affected [Quebec] communities and the forest industry cannot be underestimated.”[17] In Ontario and Quebec, “the base of the world’s paper production historically,” the paper sector has been particularly affected by the declining demand for paper products (mainly owing to the rise of electronic media and e-readers).[18] Nonetheless, Ms. Sirois informed the Committee of new wood products in the region: “Our industry began producing new wood products such as cross laminated timber and three-dimensional poplar panelling. New reproduction methods such as somatic embryogenesis now enable us to produce trees that grow faster and have the desired physical properties. Optimizing harvesting processes has helped reduce the cost of wood. Growing poplars is revolutionizing the supply side of an entire sector of our industry. Our region is beginning to use biochemistry, as shown by the conversion of a pulp and paper mill into a biorefinery. Research programs on forest extractives are also underway, with the goal of opening up a new sector in the forest industry. All this has been accomplished in part thanks to the support of the Canadian government and research centres such as FPInnovations, the Centre de recherche industriel du Québec and technology transfer centres such as SEREX in Quebec’s Matapedia Valley.” (based on notes submitted to the Committee) In Northern Canada, the forest industry is still in the early stages of development—although it has potential for greater growth, according to representatives from Yukon and the Northwest Territories (NWT).[19] For example, Mr. Lyle Dinn, Forest Management Branch Director at the Government of Yukon, informed the Committee that 80% of Yukon’s modest annual forest harvest is used as fuelwood, and that wood products are sold almost exclusively in local markets. He explained that the industry’s potential growth could be realized by improving existing mills, identifying new value-added wood products and markets, maximizing the economic benefits of non-timber products (e.g., morel mushrooms, chaga tea and birch syrup), and exploring biomass opportunities (particularly for local energy generation, given the high cost of importing energy resources to Northern Canada).[20] Similarly, Mr. Evan Walz, Assistant Deputy Minister of Environment and Natural Resources at the Government of the NWT, highlighted the need for continued investment in the NWT, especially in business development, training and capacity building, and to ensure that accurate information is available to track forest renewal.[21] Mr. Dinn suggested that climate change is a growing challenge in Northern Canada, “anticipated to result in more frequent pest and disease outbreaks and fires.” He added that more frequent fires can impact “a generation of boreal forest.”[22] Mr. Mason stated that the Government of Canada is backing strategic science at the Canadian Forest Service (CFS) with regard to mitigating the effects of pests on forests: “[CFS] scientists have invented something called triazine, which can be used to inject the ash trees. […] More broadly, we work very closely with all the provinces, increasingly with the cities and also increasingly with the United States Forest Service to monitor pests on a continent-wide basis.”[23] B. EMPLOYMENT AND SKILLS DEVELOPMENTThe forest industry is an important Canadian employer, especially in rural regions, where over 200 communities depend on forest-related activities, including many First Nations communities.[24] According to Mr. Mason, the industry provides 209,000 direct jobs across the country (over 600,000 jobs, if estimates of indirect and induced jobs are included).[25] Forestry is particularly important in British Columbia, providing approximately 58,000 direct jobs and 100,000 indirect jobs.[26] Furthermore, the wood products sector is a major employer in Atlantic Canada, where it provided roughly 27,000 direct and indirect jobs in the region in 2012 (including approximately 11,900 direct jobs and 4,165 indirect jobs in New Brunswick, 5,400 direct jobs and 1,890 indirect jobs in Nova Scotia, 1,900 direct jobs and 665 indirect jobs in Newfoundland and Labrador, and 600 direct jobs and 210 indirect jobs in Prince Edward Island).[27] According to Mr. Gorman, “40% of B.C.’s regional economies are dependent on forestry.”[28] Similarly, Ms. Diana Blenkhorn, President and CEO of the Maritime Lumber Bureau, informed the Committee that, in 2012, over 70% of forest jobs in Atlantic Canada were in rural communities.[29] Despite the aforementioned employment statistics, some witnesses noted that forest-related employment has not fully recovered since the industry’s most recent economic crisis. Importantly, a turnaround is underway as was noted by Ms. Blenkhorn, who said that “the region’s production has recovered by 47% from 2009 to 2014,” although the industry provided 3,800 fewer jobs in 2014 compared to 2006, a situation that triggered a “shortage of skilled labour and woods workers.”[30] Mr. Brown informed the Committee of recent improvements in forest employment in Ontario, stating that “forest products jobs [in that province] grew by almost 4% between 2011 and 2012.[31] According to Dr. Luc Bouthillier, Professor in the Department of Wood and Forestry Science at Laval University, the industry has lost 115,000 jobs over the past decade, affecting mostly regional Canada, including places like Skeena, BC, Kapuskasing, ON, Shawinigan, QC, and Corner Brook, NL.[32] Similarly, Mr. Matters stated that “the last decade has been a difficult one for Canadian forest workers,” as employment in the industry “dropped by some 41%.”[33] In Northern Canada, the forest industry is still in the early stages of development, as previously mentioned (for example, it provides an estimated 150 jobs in Yukon, according to Mr. Dinn).[34] However, the Yukon Government believes the industry has a “much greater potential to provide employment,” most notably through energy generation from biomass and by producing value-added products.[35] Mr. Walz told the Committee that the northern workforce, namely in the NWT, is “largely unprepared for full participation in technical forestry jobs.” He highlighted the need for further training investment in the territory.[36] Overall, labour demand in Canada’s forest industry is expected to grow. According to Mr. Lindsay, the forest products industry will need 60,000 additional employees by 2020, including skilled, semi-skilled, and unskilled employees, “from truck drivers to warehouse operators to pipe-fitters and pressure vessel operators.”[37] In this regard, Mr. Keith Atkinson, CEO of BC First Nations Forestry Council, stated the following: “This is an extremely good opportunity. The research we've seen for the labour market shows […] about 14,000 new workers in the next five years, just about 3,000 workers a year in B.C. alone, and that is only the replacement need for the sector. If we can turn our sector into a growing, job-creating environment, we'll add to the need for more workers.” Mr. Atkinson noted that “aboriginal youth can be the replacement workforce that is clearly needed in the next 5 to 10 years,” adding that B.C.’s First Nations Forestry Workforce Initiative is helping the industry achieve that goal.[38] Furthermore, Mr. Ben Voss, President and CEO of MLTC Resource Development LP, provided the following commentary with regards to the federal Aboriginal Forestry Initiative: “The Aboriginal Forestry Initiative has been an ongoing partner in many ways. For example, when we need to apply a brand new technology in the harvesting of timber, we need to train those individuals on how that technology works—it's pretty high-tech these days, not chainsaws and skidders as it used to be—so we do benefit directly that way.”[39] Mr. Lindsay informed the Committee that attracting talent to the industry has been a challenge due to high competition for skilled workers. He explained that the forest products industry is working on branding itself as an attractive and inclusive place to work—for example, by calling itself “the greenest workforce” and emphasizing its environmental credentials, and by seeking to increase the representation of aboriginals, women and new Canadians among its employees. Mr. Lindsay also addressed the need for further training and educational initiatives to build the right workforce for the industry’s future.[40] Similarly, Mr. Dinn highlighted the need for technical support and advice in Northern Canada to help build the contribution of First Nations and local industry to the wood products sector. He stated that “providing the right advice, training, and expertise to First Nations and other industry players can help them realize more potential in the wood products market,” adding that “investment or incentives to industry for road building and forest management expertise would also enable the industry's greater opportunity for autonomy and growth.”[41] In this regard, Mr. Voss made reference to the Northern Career Quest program: “We've been working closely with the regional colleges and the professional and technical colleges to implement as many skilled trades training programs as we can. There were some federal programs we partnered with, one in particular called Northern Career Quest. I mentioned in my notes that it has been very successful. We would love to see it return and be rejuvenated because it's had the best outcomes of any program we've seen, largely because it's extremely flexible. It's able to address the immediate needs that are usually not compatible with typical funding programs, so that's been fantastic.”[42] C. INVESTMENT AND INFRASTRUCTURESome witnesses discussed the general need for infrastructural investment and capital modernization in Canada’s forest industry. For example, Mr. Bruno Marcoccia, Director of Research and Development in the Pulp and Paper Division of Domtar Inc., stated the following, referring to the pulp and paper sector: “Another thing that I would ask the committee to consider is that there hasn't been any significant capital modernization in the Canadian [pulp and paper] industry in over 20 years. The last green fuel mill in Canada was 20 years ago. One of the things that happens as a consequence of that is not only do we have higher transportation costs in and out and costs to market within Canada, you also don't enjoy the economy of scale. That's because we haven't been building in Canada and because you simply can't feed the mill enough wood to enjoy the kind of economies of scale that you'd get in a facility where the trees grow faster.”[43] Other witnesses referred to an ongoing transition within the pulp and paper sector. Mr. Lindsay made note of federal government investment in the transformation of the industry, notably: “The federal government brought forward something called PPGTP, pulp and paper green transformation program, and our companies were able to upgrade and invest in equipment to reduce the environmental particulate matter, to reduce smells, and increase the use of energy. It was a good investment in some of our base equipment.”[44] Witnesses also informed the committee of the opportunities as a result of the construction of new mills and the conversion infrastructure. Mr. Brown referred to a new pellet plant and sawmill which will create jobs in Atikokan, a community that has traditionally been influenced by the forest industry: “The resurgence of the forest sector has been very good for Atikokan. The old particleboard mill is in the final stages of being retrofitted as a pellet plant, employing about 40. A brand new, high-speed, state-of-the-art sawmill is being constructed on the site of the old sawmill, and it will employ about 100 workers. It is scheduled to open in May or June of this year—Canada's newest sawmill. In addition to the mill workers, there will be between 200 and 300 employed in harvesting and transportation, and many more in indirect and induced jobs.”[45] In addition, Ms. Blenkhorn said that, in fact, production has increased despite a net-decrease in the number of sawmills in operation following the downturn. Although the Maritime Lumber Bureau’s sawmill membership base was reduced from 140 mills in 2003 to 52 sawmills after 2006, the number of sawmills has increased and has levelled out in 62 facilities, while production in the region has grown by 47% between 2009 and 2014.[46] Mr. Walz provided the following commentary, specific to the NWT: “Now, a lot of investment is required to prepare for scaling up the forest industry. Several small community projects had been done with the federal government's support in the past. Building on this, a much larger and more comprehensive regional proposal was presented to the Canadian Northern Economic Development Agency, or CanNor, as well as to Natural Resources Canada, back in 2011. Approximately $6 million has been provided by the federal government over the last three years towards this industry, and that investment has been strategically targeted to build the foundation for an industry start-up in the NWT.”[47] Mr. Matters informed the Committee that there has been “little private sector capital investment in new manufacturing in Canada, while some of our Canadian forest companies are [...] expanding their footprint in the United States.”[48] Furthermore, Mr. Michael Giroux, President of the Canadian Wood Council, stated that the “long-term viability of [ageing] operations [e.g., older mills] narrows every day as the cost of retrofits grows,” highlighting the need to “encourage and facilitate” investment in the industry.[49] According to Mr. Marcoccia and Mr. Yvon Pelletier, President of Fortress Specialty Cellulose Ltd. at Fortress Paper, part of the problem is related to the cost disadvantages of investing in Canada, relative to other countries. Mr. Marcoccia stated the following: “Relative to what can be done to stop the flow of capacity into the United States—and elsewhere, actually, because I think there are more ferocious competitors beyond the United States, South America and Asia—I would come back to the notion that if you have structural cost disadvantages, which Canada does…. A simple fact of the matter is that in northern climates trees grow slower, the landmass is vast and transportation and access is very costly. That’s a key factor here.”[50] Moreover, Mr. Pierre Lapointe, President and CEO of FPInnovations, pointed out that the lack of equipment manufacturers in Canada has affected Canadian logging operations negatively, including sawmills and other operations.[51] According to Mr. Lindsay, attracting investors requires the right “hosting conditions,” including the right tax incentives, transportation infrastructure and investment climate.[52] From the corporate perspective, Mr. Brian MacDonald, Chair of the Dakwakada Development Corporation (DDC), provided the following commentary with regards to a public-private partnership involving First Nations in Yukon: “In 2010, Dakwakada Development Corporation, in partnership with the Village of Haines Junction and the Champagne and Aishihik First Nations, undertook the feasibility assessment of developing a power generation and district heating system for their community. A critical part of the feasibility study was the financial support we received from CanNor. The feasibility study determined that a scalable approach could work. However, from Dakwakada's perspective, the socio-economic opportunity outweighed the financial investment opportunity, and as a result was too far outside our investment mandate for DDC to participate in. A critical part of that discussion was reconciling the investment values in a public-private partnership.”[53] He further stated that the lack of certainty around the utilization of resources in Northern Canada is a “significant inhibitor to investment” for his company.[54] Mr. Dinn explained that Yukon has a unique aboriginal relations landscape that is “reflected in forest resource management plans in traditional territories.” According to treaty negotiations, 11 of Yukon’s 14 First Nations are self-governing. Furthermore, the territorial government has signed forestry agreements with First Nations communities in areas with completed forest resource management plans. These agreements, according to Mr. Dinn, are “key to establishing certainty in the forest land base.” On the other hand, he added that non-settled First Nations (i.e., ones that do not have a treaty or self-governance agreement) affect the potential expansion of the forest industry, and that “the instability caused by this situation impacts natural resource opportunities.”[55] As previously mentioned, most of Canada’s forest resources are public assets that fall under provincial or territorial jurisdiction.[56] According to Mr. Lindsay, “it is the classic Canadian challenge that the tenure system is the responsibility of the provinces and they need to make their decisions on what's in the best interests of the people on the landscape, the people who are creating the jobs, and the communities that they want to serve.” He added that changes to tenure laws or forest management agreements should take into account that companies make decisions based on 20-year investments: “to suddenly change a system after they've made a 20-year investment would not be good business and it wouldn't be good public policy either.” In Mr. Lindsay’s view, Canada’s tenure systems need to evolve, but still “respect that business decisions rely on certainty and stability.”[57] Finally, the need for better transportation infrastructure was addressed by some witnesses. For example, Ms. Catherine Cobden, Executive VP of the Forest Products Association of Canada, informed the Committee that the forest products industry operates in 200 remote communities, “nowhere near the main [railway] lines in most cases,” while shipping to 180 countries around the world—a situation that poses “a tremendous logistical challenge.”[58] Similarly, Mr. Lindsay suggested that improving Canada’s transportation infrastructure would help expand export opportunities, namely in the Pacific Rim.[59] Figure 2 presents estimates of the industry’s use of different modes of transport in Canada. Figure 2: Forest Products’ Use of the Transportation System

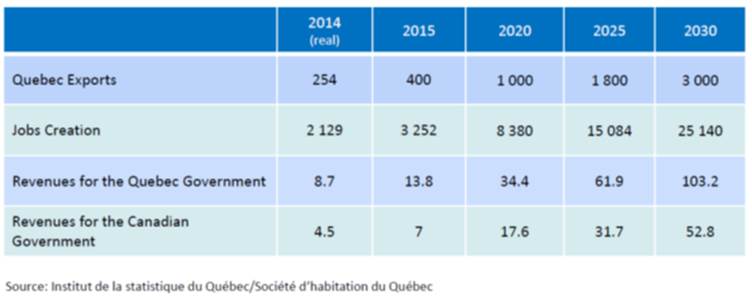

Source: FPAC (estimates using Canada Trade Online, Rail, and FPAC production data, 2011) Mr. Voss affirmed that the “massive” deficit in Saskatchewan’s transportation rail infrastructure has led the industry to rely on trucks and invest “tens of millions of dollars a year to pace highways to move product to market.”[60] Similarly, in Yukon, Mr. Dinn informed the Committee that high transportation costs are “the main barrier” to market access in the wood products industry: “Fuel costs are high, and the nearest access to rail is Fort Nelson, B.C., which is 950 kilometres away [...] The nearest port is Skagway, Alaska, which is about 150 kilometres south of Whitehorse. There's also a port in Haines, Alaska. Neither of these ports have the infrastructure to deal with the export of wood products from Yukon, and the Haines port is 400 kilometres from Whitehorse.”[61] According to Mr. Voss, the challenge of moving products to markets is a “fundamental national issue that should be addressed.”[62] D. ENVIRONMENTAL PERFORMANCE AND SUSTAINABLE DEVELOPMENTOverall, most witnesses agreed that Canada’s forest industry has a favourable environmental record. For example, Mr. Lindsay told the Committee that Canada has “more third party certified forests than any other country in the world, by an order of magnitude.”[63] According to Mr. Robert Beauregard, Dean of the Faculty of Forestry, Geography and Geomatics at Université Laval, “certification systems play an important role in reassuring markets and the public that we are managing the forestry resource responsibly and sustainably.”[64] In addition, Mr. Lindsay stated the following: “According to the 2014 Leger study of global customers, Canada's forest sector has one of the best environmental records in the world. We have huge potential and we have huge opportunity. Canadian forest fibre can be part of the solution to many of the resource stresses our planet is facing. For example, the carbon footprint of forest products is much smaller than the carbon footprint of many other building materials.”[65] Furthermore, he provided the following commentary: “For greenhouse gas emissions in particular, we're proud to say that we've reduced those by more than 70% since 1990. We've exceeded the Kyoto recommendations. The government's PPGTP [Pulp and Paper Green Transformation Program] was also a very helpful program in terms of helping our companies make further reductions in GHG emissions. We're continuing to hold ourselves accountable on a dozen different environmental metrics, including reduction of energy use, reduction of water use, reduction of waste sent to landfill, and a number of other metrics outlined in the report. […] we're well on our way to achieving the Vision 2020 goal of a further 35% reduction in our environmental footprint by the year 2020.”[66] With regards to forest disturbance, Mr. Lindsay outlined two categories that should be taken into account: natural disturbance (e.g., fire or insect damage), which is part of the eco-cycle and can be beneficial to the forest ecosystem, and anthropogenic disturbance (e.g., from oil and gas activities or the installation of a hydroelectric dam).[67] He mentioned that some observers fail to distinguish between these two categories, often contributing to misinformation about the industry’s practices. Furthermore, he affirmed that forest products companies in Canada are legally required to replace the forest cover they harvest, stating that “[a]ny harvesting that takes place by forestry companies is replaced so that there is a net zero reduction in forest cover by the forestry companies, except for the roads to get in and out.”[68] Similarly, Ms. Marianne Berube, Executive Director at Ontario Wood WORKS!, provided the following commentary: “Canada is a world leader in forest sustainability. We still have 91% of our original forest cover. We're doing a great job, and this is the message. Now we have a huge role to play in climate change.”[69] Various witnesses highlighted the need to support the industry in defending and promoting its environmental record. With regards to habitat conservation, Mr. Christopher Lee, Managing Director at the Canadian Association of Forest Owners (CAFO), explained that landowners face the challenge of having to manage habitat across their land base (as opposed to the entire habitat for any given species), while the Species at Risk Act (SARA) requires the implementation of a full recovery strategy for at-risk species, often calling for “several actions for several species all on the same land base.” According to Mr. Lee, the SARA approach “quickly becomes complicated, very expensive, and very difficult to measure in terms of success or failure.” He informed the Committee that CAFO is currently in discussions with Environment Canada to develop conservation agreements under SARA.[70] Finally, some witnesses discussed the importance of continued sustainable development in Canada’s forest industry. For example, Dr. Bouthillier highlighted the opportunities of developing a “green economy” within the industry, which he defined as “an economy that aims to create the most wealth possible with the explicit intention of being concerned about the distribution of this wealth and the secondary intention of minimizing the environmental impact, the risks, and avoiding the breakdown of ecosystems.”[71] Similarly, Ms. Cecelia Brooks, Research Director of Indigenous Knowledge at the Assembly of First Nations’ Chiefs in New Brunswick Inc., stated that sustainable development includes four pillars that must be kept in balance: social, economic, environmental, and cultural sustainability. She explained that forests are part of the traditional lands of First Nations communities, representing a natural resource that “must be managed carefully so as to provide benefits today while guaranteeing the rights and needs of generations to come.”[72] Dr. John Innes, Professor and Dean of the Faculty of Forestry at the University of British Columbia, noted that Canada’s forestry stakeholders need to work hard to maintain the industry’s environmental performance record, pointing out the “need to monitor what we're doing and be able to maintain the claims that we are the world leader in sustainability”—a task that requires “good information.”[73] He highlighted the importance of investigating the cumulative impacts of different, independently regulated industries: “What I think the federal government could do is undertake research or sponsor research that would enable us to really analyze cumulative impacts more effectively in different jurisdictions. [...] I know many First Nations would be very interested in that. I know many government agencies would be very interested. [...] I think, then, if we find good methods to do this, they need to be built into environmental assessment exercises so it's built into the review system that's done at both the provincial and the federal levels so that we can actually determine what the future impacts are likely to be. When we talk about maybe opening up a new area for a mine or for forestry activities, what's likely to happen and what other values on that land are going to be affected in the future by opening up that development? It's a big area of research. It's very complicated. We don't actually have good answers yet, so I think the federal government could really help us understand those types of things better.”[74] Dr. Innes also stressed the importance of ensuring that the industry’s supply remains healthy and sustainable: “Coming from one of Canada's eight accredited forestry schools, I have been dismayed at the lack of attention being paid to the supply side of the forest equation. We need healthy and sustainable forests if those forests are to support a vibrant forest industry. In particular, we need to assure customers buying Canadian forest products that they come from sustainably managed sources.”[75] Furthermore, Mr. Walz addressed the need for support with regards to the accuracy of forest inventories and sustainability targets: “[...] around the issue of sustainability, the third area is support to help us ensure that [the] forest inventories that we have are accurate, that decision-makers are provided with accurate information to ensure sustainability targets are met. […] we would like to see additional involvement with the federal government and support from the federal government.”[76] Finally, Mr. Aran O’Carroll, Executive Director and Secretariat of the Canadian Boreal Forest Agreement (CBFA), discussed considerations specific to Canada’s boreal forest: “The boreal forest is Canada's largest terrestrial ecosystem. It's the largest wilderness area on the planet, and more than half a million Canadians depend upon a competitive boreal forest industry for their livelihoods. The road to progress involves preserving both of these national treasures and finding ways for them to thrive together and endure for the sake of conservation and economic prosperity.”[77] Mr. O’Carroll stressed the importance of collaboration among governments, industry and the environmental community in shaping the future of the CBFA, stating that the Agreement is not just about conservation, but also about “the health, sustainability, and prosperity of Canada's forest industry.” Furthermore, he pointed out that building on environmental commitments, including those under the CBFA, “will position the industry for its long-term financial stability [and] create a niche market in the global marketplace for green products.”[78] III. SECTOR AND MARKET DIVERSIFICATIONThe Committee heard from many witnesses regarding the transformation and renewal of Canada’s forest industry, notably by means of sector and market diversification. Based on testimony from the witnesses, the following sections present the Committee’s main findings pertaining to select forest sectors and markets. A. OPPORTUNITIES AND CHALLENGES IN SELECT SECTORS1. Wood ConstructionA number of witnesses discussed the opportunities associated with taller wood construction. According to Mr. Mason, there is a large market for six-to-ten-storey buildings in the Canadian and U.S. markets. He stated that “[if] we could get more and more of those commercial buildings built out of mass timber and engineered wood products, [...] the opportunities for the industry would be enormous.”[79] Similarly, Mr. Lapointe explained that authorizing the construction of taller wood buildings opens markets in Canada, and that four-to-six-storey buildings represent “billions of dollars” of new and potential markets in the United States.[80] The tallest existing wood building, according to Mr. Robert Jones, Director of the Industry and Trade Division at NRCan, is 10 storeys high in the United Kingdom, while other taller buildings are under construction in Norway (14 storeys) and Australia (12 storeys).[81] More than 95% of single-family homes in Canada and North America are already made of wood.[82] Furthermore, a number of provinces have changed their building codes, authorizing the construction of four-to-six-storey wood buildings. At the federal level, NRCan has been working with the National Research Council (NRC) to update the National Building Code to allow wood buildings of up to 15 storeys, and is working with industry, architects and other building experts to increase the use of wood in industrial buildings, which are mostly built with steel and glass.[83] According to Dr. Ying Hei Chui, Professor and Director of the Wood Science and Tech Centre at the University of New Brunswick, the Government of Canada should be commended for funding research that support changes to the building code: “Through research conducted by organizations such as FPInnovations, the National Research Council, and universities, the wood product industry has managed to convince the building code authorities in Canada to increase the height limit for wood buildings from four to six storeys. The Government of Canada should be commended for providing the research funding to allow this research to be conducted in order to make this building code change possible […] We have come a long way since 2008, and a lot of it […] is because we had the federal government and provincial governments, to some extent, investing a lot of money in research and development to support this change in the building code.”[84] Similarly, Mr. Giroux told the Committee that, in mid-rise markets of five and six storeys, the “code change was championed or supported by NRCan through the National Research Council. That was absolutely critical to making that market work.”[85] Mr. Giroux also commented on the need for more technical expertise in the wood construction sector. He informed the Committee that the success of taller wood buildings requires design expertise and a foundation of knowledge about wood as a building material—one that “should be laid early in professional training, preferably at the post-secondary level or earlier.” Furthermore, he stated that the wood products sector should play a role in developing lower-energy performance buildings, pointing out that, in Canada, “not very much has been done […] in the area of building science.” He also said: “Thanks to the great building science brought on by organizations like the National Research Council and FPInnovations, the wood building systems of today perform much better than a generation ago. This improvement in performance capability has been driven by a desire for higher performance, a reduction in material use, and enabled by the ongoing, mostly focused, innovation.”[86] Similarly, Mr. Lapointe suggested that Canada’s performance is “lower than that of European countries, especially Austria,” due to our general lack of expertise in wood construction: “In the area of wood processing, especially high-rise construction, one of the challenges we are facing is related to partnerships with engineers who are used to working with cement or steel.” He added that training should be provided in that area.[87] With regards to fire safety, Mr. Jones informed the Committee that NRCan has funded research through the NRC to designate fire safety ratings for new engineered wood products. He added that all additives to panel products (e.g., resins and glues) must be approved for safety and non-toxicity by Health Canada or other regulatory bodies. Furthermore, he informed the Committee that, after construction, fire ratings are verified by building code officials who perform tests to ensure that all products meet fire rating standards and that building occupants could evacuate the building in case of fire.[88] Mr. Jones told the Committee that there are still no fire safety provisions to protect wooden material during construction; although he expects that some will be included in the new version of the National Building Code.[89] In reference to the involvement of firefighters in the modification of the National Building Code, Mr. Lindsay said the following: “I will certainly defer to my friends in FPInnovations on the technical aspects of what’s in cross laminated timber, but the firefighters are quite intimately involved in the building code process. They’re able to make submissions and presentations throughout the process. It’s a very public and open process. We have made a number of changes to the building code process. I don’t sit on that committee; other colleagues from the Canadian Wood Council do. They have made changes at the request of the firefighters. The use of sprinklers in everything from the balconies to the external cladding of buildings was made at the request of the firefighters. The use of cement for elevator shafts was made at the request of the firefighters, so I think they have been involved. I can’t speak to the specific chemicals in cross laminated timber, but I do know the firefighters have been involved, and we want to continue to work with them. The Canadian Wood Council, which I know is going to be here shortly, has been working with the firefighters to find additional ways we can ensure safety, and not only during the construction period, which is probably when there’s a greater degree of risk. Before you get the sprinklers up, before you get the Gyproc up, that’s when you have the vulnerable point. Once it’s constructed, it has the same standards and same calibre as any other construction material.”[90] Finally, Mr. Sylvain Labbé, CEO of the Quebec Wood Export Bureau, discussed the potential of further growth in Canada’s wood construction sector by promoting the production and export of more prefabricated building systems. He told the Committee that four prefabricated home builders recently went bankrupt in Quebec, while Alberta, Canada’s main importer of houses, is importing products from more competitive manufacturers in the United Stated. In Mr. Labbé’s view, Canada should adopt a new industry structure with fewer, larger businesses that produce more volume, and therefore, could sell at internationally competitive prices. He discussed Quebec’s Vision 2030 (Table 1) as an example, highlighting the province’s planned export forecasts of prefabricated construction systems and their benefits on jobs and tax revenues both provincially and nationally.[91] Table 1: Vision 2030: Benefits for Quebec and Canada (in $M and in person-years)

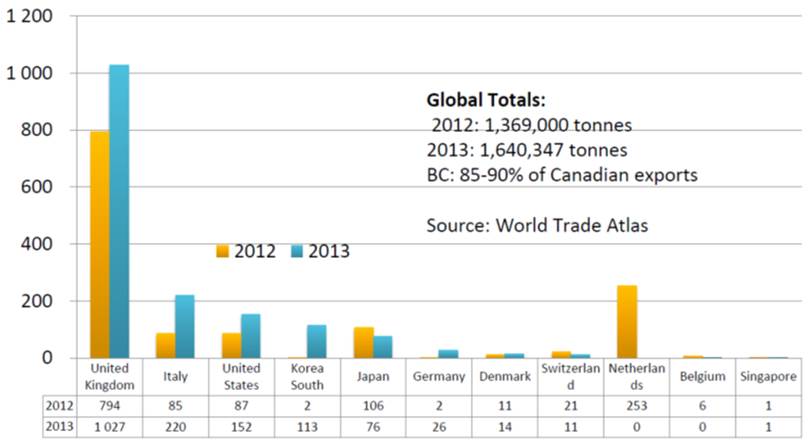

Reproduced by the Quebec Wood Export Bureau, 2015 2. Pulp and PaperA number of witnesses discussed the opportunities and challenges facing Canada’s pulp and paper manufacturers. With regards to the pulp sector, Mr. Irving told the Committee that market pulp is a growing segment that is increasing in value, with new investment opportunities (e.g., growing demand for tissues and different flexible packaging such as hospital gowns, grocery bags and packaging for online shipments). He pointed out that a box of tissues can add about 35 times to the value of a tree, compared to raw timber—a value-added that is also a generator of employment.[92] Furthermore, Mr. Beauregard told the Committee that there is need for innovation to ensure that the fibre that was previously directed to pulp production (which he deemed to be 30% of the wood fibre extracted in Canada) could be used to create new value-added products.[93] Mr. Mason told the Committee that the Government of Canada has invested $1 billion, through the Pulp and Paper Green Transformation Program (PPGTP), which was “substantially an investment in pulp mills that were producing black liquor,” in response to the U.S. black liquor subsidy. He added that each of the mills that received funding came out of the program “stronger, more capable, and able to compete with their American cousins and internationally.”[94] Furthermore, Mr. Pelletier stated the following: “[…] one of the first [programs] that came in the depressed period of 2008-10 was the [PPGTP]. It was an excellent program, flexible and easy to access, and it generated significant investment and increased the competitiveness of the sector. Many of the mills today that are still here producing and creating jobs have used that program.”[95] Similarly, Mr. Marcoccia provided the following commentary: “Allow me to say that in my career the PPGTP program is probably the single most successful program and implementation of policy I've ever been associated with, in terms of being impactful and quick to have that.”[96] Mr. Mason informed the Committee that international firms have been investing in Canada’s pulp sector to secure a long-term supply of fibre for their globally integrated corporations. These investments have created fairly secure jobs in communities where firms have been reopened.[97] Mr. Brown addressed the need for a predictable and affordable industrial fibre supply: “This is not to say that governments have not been supportive of the sector's recovery. Federal programs aimed at assisting in green energy projects, aiding in expansion into emerging new markets, and supporting science and innovation have been instrumental, and should be continued. Provincial governments have made similar investments. But these efforts will not bear fruit without a predictable and affordable industrial fibre supply and without a market strategy that ensures fact-based information about the sector.”[98] With regards to paper production, Mr. Mason informed the Committee, as previously mentioned, of a long-term decline of paper demand, owing to the rise of electronic media and e-readers—a market shift that has been particularly problematic in Ontario and Quebec.[99] Mr. Daniel Archambault, Executive VP and COO of the Industrial Products Division at Kruger Inc., explained that the reduced demand for paper has made it difficult for the sector to self-fund innovation or equipment upgrades,[100] which, according to Mr. Lindsay, is necessary to produce more contemporary print products, beyond the traditional (and increasingly unpopular) newsprint.[101] According to Mr. Archambault, “[o]ne of the biggest challenges [facing the sector], particularly in today’s newsprint industry, is developing R&D projects in a declining market with very limited means.”[102] One of the many promising R & D projects has involved the use of cellulose. Mr. Archambault pointed to the partnership with FPInnovations as an example of how such R&D can be promoted: “One example of the benefits of such investments has been the creation of the world's only cellulose filament demonstration plant, located in Trois-Rivières and developed by Kruger in partnership with FPInnovations. [...] This project includes a $25-million research and development program to support the industrial scale-up, jointly with industries and/or companies that could benefit from including cellulose filament in their products. This groundbreaking research and innovation project represents a total investment of $43 million. It's a three-year program. This includes funding from the Government of Canada through the IFIT program. I take the opportunity to thank NRCan, who believed in us from day one, for their support, as well as the financial support from the Government of Quebec, the Government of British Columbia, Kruger, and FPInnovation.”[103] 3. Wood PelletsA number of witnesses discussed the potential of the emerging wood pellet sector to diversify the forest industry and generate economic benefits across Canada. According to Mr. John Arsenault, Director of Market Access at the Wood Pellet Association of Canada, the pellet sector is “complimentary” to the forest industry, given its use of forest residue as a primary resource. Wood pellets are made of residue from sawmills or logging operations for two main purposes:

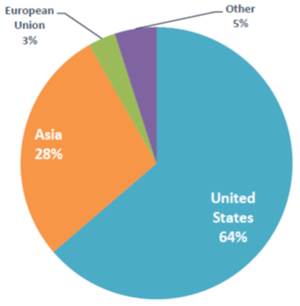

Mr. Arsenault explained that wood pellets yield more efficiency when used in cogeneration systems to produce both heat and power (e.g., in the paper industry, where they are sometimes used to produce both electricity and steam).[104] According to Mr. Arsenault, the global demand for wood pellets has been growing by 2 million tonnes a year for the last decade. The European market, particularly the U.K., is the biggest (Figure 3), although other markets, such as Korea, are also growing. Furthermore, Mr. Arsenault told the Committee that the wood pellet sector would “create a whole line of [economic] activity” and employment opportunities, stating the following: “NRCan has been helping us with our export markets, mostly, in developing the overseas markets and helping us to show overseas markets the sustainability of our products, but there is a huge potential in Canada that has to be developed, and we'd like to see some incentives being put up there to use more biomass locally to replace fossil fuels [...] There’s also the possibility of the government setting an example by converting its offices to biomass and replacing oil in remote communities. There are all the northern communities that are being served with oil currently that could be served with biomass by organizing conversions and haulage routes or whatever.”[105] Similarly, Dr. Bouthillier stated that the wood pellet sector will generate employment, especially in rural Canada where jobs are needed, and will “allow us to benefit from an export market that we have, here and now.”[106] Dr. Sudip Kumar Rakshit, Professor at Lakehead University and Canada Research Chair in Bioenergy and Biorefining Processes, pointed out that, currently, Canada produces and exports only “normal” pellets, while importing advanced pellets from manufacturers overseas. He suggested that the Canadian technology requires only a modest upgrade to enable the production of advanced pellets.[107] Figure 3: Canadian Export Destinations for Wood Pellets (thousands of tonnes)

Source: Wood Pellet Association of Canada The opportunities and challenges facing the wood pellet industry vary across Canada. In eastern Canada, a number of witnesses discussed the high cost and low‑competitiveness of wood pellet production. For example, Dr. Bouthillier explained that, in Quebec, the abundance of hydroelectricity and strong competition from Hydro-Québec makes it difficult for wood pellets to succeed in domestic electricity markets. As a result, the sector needs to focus on exporting its product to Europe.[108] Similarly, Mr. Lapointe stated that, in both Ontario and Quebec, “very little work has been done because the business plan is unworkable.” He added that “as long as European countries are subsidizing wood pellet production, it will only be profitable for those with lower wood‑related costs.”[109] Finally, Ms. Sirois and Mr. Arsenault pointed out that the conversion from fossil-fuel to wood pellets for heating purposes is often costly, and the return on investment long (about eight years when burning pellets for heat, according to Ms. Sirois).[110] In Northern Canada, there is growing interest in wood pellets, given the high cost of imported fuel in that region. According to Mr. William Mawdsley, Associate Director of the NWT Government’s Forest Management Division, pellet heating technology in the NWT has “advanced considerably in the last 20 years since wood pellets first came on the market,” demonstrating success within institutional systems and among individual consumers.[111] Furthermore, Mr. Walz informed the Committee that the NWT government is growing the pellet market by converting public buildings to pellet fuel—a trend that the territory’s private businesses seem to be following as well. He stated that locally produced pellets are expected to channel “millions of dollars into the NWT economy, which would otherwise be exported outside.” Mr. Walz also pointed out that the new industry will create business and employment opportunities in communities that typically have high rates of unemployment, including certain First Nations communities.[112] In Yukon, the territorial government is also working towards promoting the use of forest resources for heating, including incentive programs to encourage institutional and residential biomass heating systems.[113] According to Mr. Dinn, the demand for wood pellets in Yukon has “tremendous opportunity for growth,” considering that the territory imports about $50 million in heating products every year that could be re-channelled to generate wealth for Yukoners. Furthermore, he stated that moving towards biomass heating systems is proving to have other “broad benefits” in the north, including energy savings and local employment opportunities.[114] Finally, Mr. Brian MacDonald informed the Committee that the geographical isolation of Yukon’s local markets provides protection against competition from larger population centres, thereby improving the feasibility of wood pellet production in the territory.[115] In western Canada, Mr. Lapointe mentioned that wood pellet production has been profitable in B.C. (relative to the eastern provinces).[116] Furthermore, MLTC Resource Development is building the first wood pellet manufacturing facility in Saskatchewan, with a design output of “10,000 tonnes per year of premium wood pellets for use in residential heating and environmental spill cleanup.”[117] According to Mr. Voss, the upcoming Saskatchewan plant can be expanded as the company develops more markets in North America.[118] Finally, in Alberta, Mr. Arsenault stated that the province’s few pellet producers are having difficulty finding markets. He suggested that the oil industry could be a potential consumer in the province, given the need for steam in oil sand extraction operations.[119] 4. Value-added, Niche Markets and Non-timber ProductsA number of witnesses discussed diversification opportunities in other sectors, including value-added products, non-timber harvest and extracts, and other niche products. According to Ms. Brooks’ testimony, a 2013 literature review produced by the Assembly of First Nations’ Chiefs in New Brunswick Inc. concluded that there is a need to expand the view of the forest industry towards non-timber products such as mushrooms, nutraceuticals and essential oils. She added that the extraction of such products are more in sync with First Nations cultural values, pointing out that their markets can be developed without even cutting trees.[120] Mr. Dinn also expressed interest in the long-term management of non-timber forest resources, such as morel mushrooms, chaga tea and birch syrup, stating that Yukon’s annual 6-week morel mushroom boom can generate anywhere between $3 million and $5 million of economic activity.[121] Similarly, Mr. William Martin, Chair of the Medway Community Forest Co-op, discussed the value of a more diversified products industry, especially in high-value niche markets. He gave the example of the market for guitar tops, where a high-quality red spruce (a piece of wood that “fits in an envelope”) can be worth $150. According to Mr. Martin, niche products cannot always be anticipated; however, “we can create a viable timber supply that is diversified and [...] market structures that are flexible and dynamic so that those best opportunities can be achieved.” He told the Committee that encouraging product development for different market scales, including smaller, local markets, is a “potential source of resiliency” for forestry-dependent communities, particularly in jurisdictions where a high percentage of the forest land is privately owned (e.g., in Nova Scotia).[122] In the secondary wood products sector, Mr. Iain Macdonald, Chair of the Wood Manufacturing Council and Managing Director of the Centre for Advanced Wood Processing at University of British Columbia, informed the Committee that most products are produced by small and medium enterprises (SMEs), which face a number of particular challenges: “Ninety-seven percent of the industry is made up of small- and medium-sized enterprises with less than 100 employees. SMEs bring specific challenges, such as a lack of formal management skills, difficulty in accessing capital for investment in technology, poor economies of scale in production, and difficulty in releasing key employees from the production floor for training. The sector tends to be less technology-intensive than some of our competitors, resulting in productivity and efficiency gaps. The sector has challenges in finding and retaining employees, particularly at the entry level, due to competition from the oil, gas and automotive sectors, and perceptions of the industry as offering unattractive career prospects to young people. Some elements of the sector, particularly wooden furniture, have suffered harsh competition from offshore imports, predominantly from China, but now shifting to Cambodia and Vietnam. Finally, secondary manufacturers have difficulty obtaining lumber inputs from Canadian mills due to their focus on volume rather than value-based production and distribution.”[123] According to Mr. Iain Macdonald, Canada’s secondary wood products sector employed approximately 90,000 people directly in 2014, 41% of which worked in wood furniture and 23% in the cabinet sub-sector. He highlighted the need for further support for “industrial innovation in product development, manufacturing, and business processes, as well as […] human resources and skills development” in order to help companies take full advantage of future opportunities in the sector.[124] In this regard, Mr. Brian MacDonald pointed to the Canada Job Grant as a beneficial program to Dakwakada Development Corporation: “[…] it was focused on all of our senior managers having better project management skill sets, better financial management comprehension, better leadership training, better corporate governance. Basically it kept it at the higher levels within our companies to build those types of skills. I think that going forward the value I would see in that is just better project manage of new initiatives for our companies.”[125] Furthermore, Dr. Mohini Mohan Sain, Dean and Professor of the Faculty of Forestry at the University of Toronto, expressed the need to support the development, commercialization and procurement of new products from small companies.[126] With regards to the pulp sector, Mr. Pelletier and Dr. Rakshit explained that much of Canada’s exported dissolving pulp gets resold to Canada as value-added products made in Asia (e.g., non-woven napkins, wipes and environmentally-friendly textile products).[127] Dr. Rakshit highlighted the need to support the kind of industrial transformation that would enable more made-in-Canada value added products within the pulp sector.[128] Finally, with regards to First Nations’ businesses, Mr. Atkinson and Mr. Joe Hanlon, project Manager with the Wawasum Group LP, told the Committee that their communities lack access to capital for investment purposes. Furthermore, Mr. Voss stated the following: “The programs I did mention that work for most of the forest companies, like accelerated capital cost allowance or SR and ED programs, don't work with first nations-owned companies. Our corporate structure doesn't qualify, so there are some gaps there. We would love to see those gaps addressed because we're being penalized, essentially, compared to our peers.”[129] Similarly, Mr. Hanlon noted that aboriginal project developers would benefit from more assurance of the stability of the funding they receive.[130] B. INTERNATIONAL TRADE CONSIDERATIONS1. Canada–U.S. Trade and the Softwood Lumber AgreementDespite numerous market challenges south of the border since the 2006 housing crisis, the United States remains Canada’s primary export market for wood products (Figure 4). Canada's share of the U.S. market dropped from 34% in 2006 to about 29% today. Meanwhile, the U.S.’s share in its own domestic market grew from about 61% to 71% during the same period.[131] Figure 4: 2013 Export Market Shares

Source: Forest Products Association of Canada Dr. Bouthillier informed the Committee that the U.S. market has improved for all wood products, residential and non-residential alike, offering the possibility of recovering Canada’s “primary market.”[132] On the other hand, the Council of Forest Industries anticipates that Canada’s share of the U.S. market will remain flat or decline slightly in future years: 1) due to the sustained commitment to market expansion and diversification, especially in Asian markets; and 2) owing to a shortage in B.C.’s timber supply (the Council anticipates a 17% decline in the province’s production between now and 2020, mostly due to the mountain pine beetle epidemic).[133] Mr. Mason expressed similar concerns, affirming the threat of a timber shortage as a result of B.C.’s “massive beetle kill,” and pointing out that, in the past, the lack of wood has caused some mill closures in the province’s interior.[134] Despite the continued importance of the U.S. market for Canada, some witnesses were critical of the trade dynamic with our southern neighbour, most notably in discussions of the Softwood Lumber Agreement (SLA). For example, Mr. Jocelyn Lessard, DG of the Québec Federation of Forestry Coorperative, stated that the SLA “betrays the spirit of the free-trade agreement” between Canada and the U.S., pointing out that the barriers imposed on the Canadian industry tend to protect U.S. interests to the detriment of Canadian stakeholders and timber consumers south of the border.[135] Furthermore, Mr. Irving told the Committee that his company does not support the SLA in its current form, explaining that their “Canadian competitors are not paying any duties, and the Maritimes […] is paying the highest stumpage rates in Canada, 40% higher than most other jurisdictions.”[136] Ms. Brooks also criticized the agreement for having been developed without sufficient input from First Nations.[137] Mr. Mason told the Committee that the Canada-U.S. “trade wars” have made it “essential” for the Canadian industry to diversify markets away from the U.S. On the other hand, he also stated that some Canadian companies have been investing south of the border to secure their market access against trade barriers and/or fibre supply shortages (e.g., due to B.C.’s beetle kill).[138] As shown in Figure 5, Canadian firms now own 14% of U.S. lumber production. Figure 5: North American Lumber Capacity Ownership (January 2015)

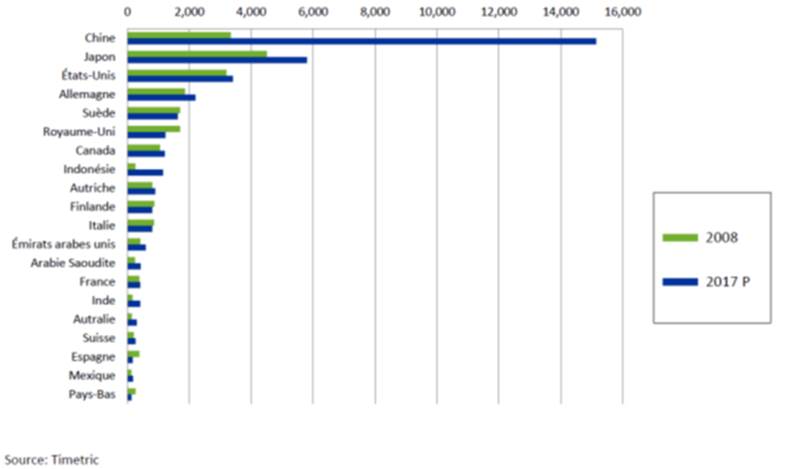

Source: Natural Resources Canada Despite criticisms of the SLA, most witnesses were supportive of extending the agreement. For example, Mr. Lindsay and Mr. Gorman told the Committee that the trade agreement has brought stability and certainty to the sector, as well as to markets and producers on both sides of the border. Similarly, Mr. Lessard stated that, despite the SLA’s shortcomings, the “forest cooperatives are well aware that the lack of an agreement would be even worse.”[139] However, Ms. Blenkhorn insisted that the Atlantic Provinces should remain excluded from any managed trade provisions under the SLA (e.g., quotas, taxes or duties), as has been the case since 1987. She explained that, unlike in the rest of Canada where timber is owned primarily by provincial governments, 67% of softwood lumber production in the eastern provinces is generated from private land, leading to the highest wood costs in the country. Any managed trade provisions would, according to Ms. Blenkhorn, further hinder the region’s competitiveness.[140] Mr. Voss was in favour of attributing more quotas to Saskatchewan under a future SLA. He told the Committee that, while several provinces have excess quotas, Saskatchewan does not have enough, stating that the province has three saw mills operating and enough quotas for only one, and that choosing to not increase the province’s quota could cost “a thousand jobs.”[141] Finally, Mr. Lessard suggested that the relevance of Quebec’s exemption from the SLA be revisited, given that the province’s forestry regime is now “much more based on a free market”[142] The future of the SLA remains unclear, considering the standstill provision undertaken by the U.S., which defers any trade action until October 2016. According to Mr. Gorman, the Trans-Pacific Partnership (TPP) has taken priority over the SLA south of the border; an official position from the U.S. is unlikely to emerge until the TPP is concluded.[143] In Mr. Lindsay’s view, the 2006 negotiations involved compromises from both countries, and if Canada and the U.S. were to enter into another round of negotiations, “we would end up very close to the same spot.”[144] On the other hand, he pointed out that the market dynamics have changed considerably since 2006; Canadian ownership of U.S. facilities has increased, as well as Canada’s market opportunities overseas.[145] Finally, Dr. Sain stated that regardless of the future outcome of SLA negotiations, “we should find ways in terms of regulations, policy and other trades to facilitate this conventional, very profitable industry going beyond the United States, particularly to reach people in China, India, Brazil, Colombia—which has now become very important—and Chile.”[146] 2. Canada’s Growing Trade with ChinaA number of witnesses discussed the value of existing and emerging opportunities in markets overseas, particularly China, where significant progress has been made in terms of wood products trade with Canada. Traditionally, China has used primarily concrete and cement for construction. However, Mr. Lindsay and Mr. Rick Jeffery, President and CEO of the Coast Forest Products Association and President of the Canada Wood Group, explained that over the past decade, the Canadian forest industry, in collaboration with government and trade officials, has worked extensively to develop the Chinese market for wood products—for example, by training architects in how to use more wood in construction, or by providing R&D support to adopt a wood building code that is acceptable to governments in China.[147] Today, China’s market has changed considerably, with the use of wood now representing 10% of the country’s construction, according to Mr. Labbé.[148] As shown in Figure 6, the projected growth of the Chinese market for wood prefabricated buildings is significant compared to other international markets. Figure 6: Main Global Markets for Wood Prefabricated Buildings (in million $US)

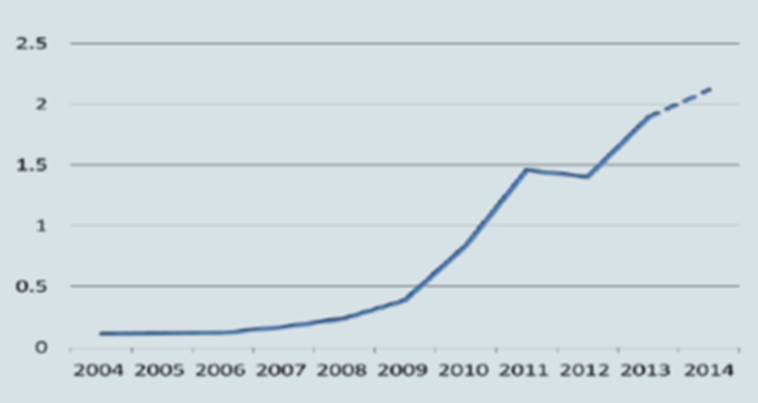

Reproduced by the Quebec Wood Export Bureau, 2015 Since 2007, Canadian wood exports to China grew by 1,400%, according to Mr. Mason (Figure 7).[149] Mr. Jeffery praised the role of Canada Wood, supported by federal and provincial governments, in advancing Canadian wood exports to the Chinese market: “Today, after 15 years of effort spearheaded by Canada Wood and supported by the federal and provincial governments, China has now become our second leading market and represents about $1.5 billion per year in sales […] The federal government has been very critical in maintaining market access […]”[150] Figure 7: Canadian Wood Exports to China ($billions)

Source: Natural Resources Canada Similarly, Mr. Lindsay informed the Committee that forest products, whose exports grew by 10% after a number of difficult years, are now Canada’s largest export to China: “We are quite proud of that factoid. We climbed from about two billion dollars’ worth of exports to China in 2009 to currently about $4.7 billion. We're exporting to 180 countries around the world […] we're quite proud of the success we've had in opening up the China market [...] Thanks to the governments, provincial and federal, and thanks to our companies, we have gone from virtually zero to [...] over $4.7 billion.”[151] On the other hand, Mr. Pelletier stated that “China's implementation of an import duty on Canadian dissolving pulp brought major investment opportunities in Canada to a halt,” warning that similar repercussions could be felt in other wood sectors should China choose to implement similar import duties on other Canadian wood products.[152] Both Mr. Mason and Mr. Lindsay agreed that the Chinese market is expected to continue to provide opportunities in the long term, affirming that “the next China is China.”[153] Mr. Mason told the Committee that the industry has made a long-term commitment to the Chinese lumber market in particular, including investments in new high-value products. Similarly, Mr. Baker stated that western Canada’s lumber trade with China has already peaked in terms of volume. The focus has now shifted to “[increasing] the value proposition in China to get a higher unit price for different applications.”[154] 3. Other Trade OpportunitiesSome witnesses discussed opportunities in other Asian markets, including Korea, Japan and India. For example, Mr. Lindsay stressed the importance of expanding Canada’s trade opportunities in the Pacific Rim, particularly through the TPP. He highlighted Canada’s sustained trade relations with Japan over the past century, as well as the importance of the Free Trade Agreement with Korea for Canada’s international competitiveness: “The Free Trade Agreement in Korea is also very helpful to us. Australia had already entered into a free trade agreement, so making sure we were competitive in our tariffs was very important. [I]f you mention those three countries—China, Korea, and Japan—they are among the three largest international customers we already have.”[155] According to Mr. Jeffery, India is also a potential future market for Canadian forestry products. He told the Committee that there is demand for Canadian wood, technology and know-how in India, referring to the country as Canada’s “next major market diversification opportunity” offshore.[156] Furthermore, Dr. Bouthillier discussed potential trade opportunities from eastern Canada to the European Union in areas such as green construction and bioenergy with pellets and briquettes.[157] A number of witnesses advocated that Canada continue working on its product brand in order to improve the competitiveness of Canadian wood products, both domestically and internationally.[158] Finally, Mr. Jeffery discussed the importance of tackling non-tariff barriers, most notably phytosanitary issues that hinder the market access of Canadian products abroad. IV. STRATEGIC INNOVATIONThroughout the Committee’s study, the witnesses presented a host of innovative products and ideas of strategic value to Canada’s forest industry—ones that have come as a result of a technological revolution in the industry. Products mentioned throughout the study include: tall wood buildings, prefabricated building systems, fabric, wood pellets, nanocystalline cellulose, cellulose filaments, lignin and cross laminated timber. As discussed in previous sections, there is broad potential for innovation in various areas, including (but not limited to):

Many witnesses acknowledged the role of the federal government in promoting strategic innovation in the forest industry through initiatives like FPInnovations and the Forest Industry Transformation (IFIT) program. For example, Mr. Lapointe informed the Committee that IFIT fills an important gap in the financing of new technologies, since banks and other ordinary financial institutions generally do not finance the kind of technologies the program is designed to target: “[…] Being able to go toward pre-commercial financing is a first in Canada, and that has helped tremendously [...] it's the IFIT program, run by NRCan, that provides a less risky financial commercialization process. In the case of the lignin extraction, again the federal government with the IFIT program, has been really instrumental in getting that new process in.”[159] Similarly, Mr. Irving stated that: “People don’t thank the federal government very often, and we'd like to thank them for their IFIT program. It's an investment in forest innovation and technology. It's helped us and other companies innovate, and that's a well-run program that we think Canada is getting good value from. It helped address some of our challenges and improve our competitiveness.”[160] Dr. Chui also praised government investment in the forestry industry: “[...] the funding provided by the federal government actually helped bring the Canadian universities, FPInnovations, and the National Research Council together to form a large Canadian innovation network that is now the envy of the world.”[161] According to Mr. Lindsay, tree usage in Canada’s forest industry has improved significantly, allowing for the production of a wide range of products, from bio-fuels to new bio-chemicals to other innovative bio-products. He stated that the history of innovation in the industry has been to “move from 60%, 70%, 80% to now over 90% […and] 95% usage of the tree.”[162] Similarly, Mr. Lapointe affirmed that the philosophy and culture of FPInnovations has been to “get the best value from the trees at each step of the harvesting.”[163] On the other hand, many witnesses explored the prospects of developing Canadian bio-products further, within a broader bio-economy. For example, and in line with previous discussions of the wood pellet sector, Mr. Mason pointed out that there is “remarkable opportunity” for bio-energy products in off-grid communities, especially in Northern Canada, adding that anything made from petroleum could also be made from a tree.[164] Mr. Walz confirmed that his government foresees the eventual use of bio-fuel throughout the NWT.[165] Furthermore, Dr. Bouthillier told the Committee that the development of forestry bio-energy could “galvanize disadvantaged communities and diversify employment” in eastern Canada: “[The industry] is in its very early stages, but we are seeing that when we give up petroleum products for forestry energy, where we used to employ one person a year, we could employ up to seven people a year by diversifying the forest production chain toward community heat generating units.”[166] Other witnesses discussed a broader range of emerging wood-based bio-products, most notably: