SUPPLEMENTARY OPINION OF THE

LIBERAL PARTY OF CANADA

Thank

you to the hundreds of individuals and groups who shared their insights with

the Committee. We heard from many witnesses, and received a large number of written briefs, calling for bold

changes in Budget 2015 to address the big challenges facing Canada. Despite

these valiant efforts, the Committee has instead endorsed the status quo and

called on the government to “continue” or “maintain” existing policies. For

this reason the majority report represents a missed opportunity for the

Committee to provide the government with meaningful guidance on the upcoming federal

budget.

STRENGTHENING THE ECONOMY

The

Committee heard from numerous witnesses who identified slow economic growth as

a significant threat to Canada’s prosperity. Former Parliamentary

Budget Officer Kevin Page called the Canadian economy “relatively weak” and

recommended that “economic growth should be a priority going forward.” The Conference Board of

Canada said that “growth should become the core theme of budget making on a going

forward basis.” Former Deputy

Minister of Finance Scott Clark emphasized that “we can’t depend on a global

economy to grow the Canadian economy. We need a domestically created policy to

generate growth in Canada right now.”

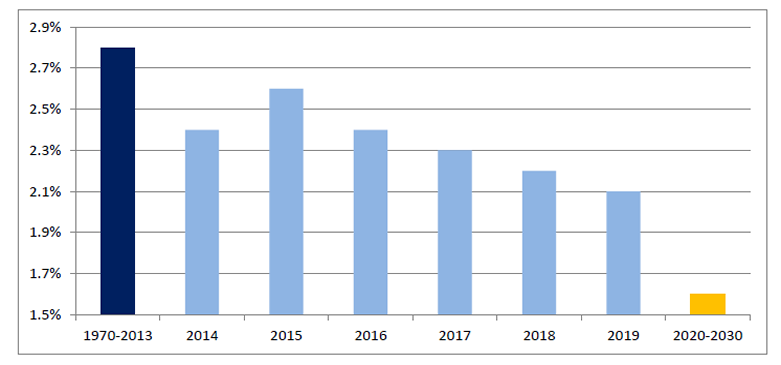

Real GDP Growth Projections for Canada

Source: Finance Canada, Update of Economic

and Fiscal Projections, 12 November 2014, Table 2.1 and Table A.1.

Infrastructure

In

order to generate growth, many witnesses – including Kevin Page, Federation of

Canadian Municipalities, Large Urban Mayors’

Caucus of Ontario, KPMG, Union of Quebec

Municipalities, Canadian Life and

Health Insurance Association Inc., Mowat Centre, Canadian Chamber of

Commerce,

and Canadian Labour

Congress – called for increases in economic infrastructure investments. Some witnesses called

on the government to prioritize transportation infrastructure in order to end

gridlock and get the economy moving. The Committee also heard calls for social

infrastructure that reduces financial pressures on Canadians and improves

skills training, innovation and productivity. More generally, Scott Clark recommended that

Canada’s domestic growth strategy be “built on infrastructure spending.” The Conference

Board of Canada said that “infrastructure

spending deserves higher priority” and that “Canada has

systematically underinvested in infrastructure for probably 25 or 30 years now,

so it's time to catch up.” In the words of the Canadian Council

for Public-Private Partnerships, “sound modern infrastructure is key to

Canada's productivity and economic growth and ultimately central to a more

prosperous and globally competitive Canada.”

Instead

of increasing its investments, the federal government cut planned new federal spending

on the Building Canada Fund, a key federal infrastructure program for provinces

and municipalities. The government cut planned new spending in this area by

almost 90 percent between 2013-14 and 2014-15, and decided to back-end load new

funding rather than support stronger growth in the near term.

Planned New Federal Spending on the Building

Canada Fund, 2011-12 to 2018-19

Sources: Finance Canada, Budget 2007 (Table 5.3) and Budget 2013 (Table 3.3.1)

Recommendation:

- That the federal

government provide significant new investments in economic and social

infrastructure in order to increase economic growth and create well-paying jobs.

Taxes

The

Committee heard from a number of witnesses who recommended against proceeding

with recently announced tax measures that are expensive and do nothing to increase

economic growth.

Witnesses

such as the YWCA Canada, the Mowat Centre, Mike Moffatt, and Professor Jennifer

Robson opposed the government’s income splitting scheme as it excludes single parents

and mainly benefits wealthier families. In the words of Dr. Frances Woolley, “if the federal

government does wish to deliver tax relief, it should look to increasing

efficiency, or equity, or both. Income splitting does neither.”

The

Committee also heard that the government’s Small Business Job Credit includes a

design flaw that perversely encourages employers to reduce hours and even fire

workers. The Office of the Parliamentary

Budget Officer told the Committee that this tax credit would cost the government $550 million and

create only 800 jobs over two years. Meanwhile, Finance Minister Joe

Oliver admitted to the Committee that the government did not do any analysis before introducing

this measure. Mike Moffatt identified some

advantages of an EI holiday for employers who create new jobs over the Small

Business Job Credit.

The

Retail Council of Canada reminded the Committee about $333 million in tariff

increases in Budget 2013 that come into effect in January 2015 and “will almost certainly

result in higher prices for Canadian consumers”. Mr. Moffatt called for the

elimination of tariffs with low effect tax rates as they impose a significant

regulatory burden for Canadian businesses while generating “almost no revenue”

for the government.

Recommendations:

- That

the federal government replace its income-splitting scheme with measures that

support jobs and growth and benefit a greater number of Canadians.

- That

the federal government replace the Small Business Job Credit with an EI holiday

for employers who create new jobs.

- That the federal

government cancel its planned tariff increases and work toward eliminating

tariffs on goods that are not manufactured in Canada.

- That the federal

government recognize the importance of evidence-based decision-making and

perform an economic impact analysis before introducing new tax expenditures.

INVESTING IN CANADIANS

Veterans

The

Committee heard from Canadians who called on the government to increase its

support for Canadian veterans, particularly injured veterans. The 2014 Fall Report of

the Auditor General of Canada showed that the government is denying

injured veterans timely access to the mental health services they need. Meanwhile,

the federal government is continuing to cut the number of employees at Veterans

Affairs who serve our veterans by 32 percent – from 4,039 FTEs in 2008-09 to 2,755

FTEs in 2015-16 – while it argues in court that it does not have a sacred

obligation to care for injured veterans.

Full-Time Equivalents (FTEs) at Veterans

Affairs Canada, 2008-09 to 2015-16

Source: Veterans Affairs Canada, Departmental

Performance Reports (2009-10 to 2013-14)

and the Report on Plans and

Priorities (2014-15)

We believe that

Canadian Armed Forces and veterans should have nothing less than the best of

care and support from a grateful nation.

Recommendation:

- That the federal

government reverse its cuts to Veterans Affairs and recognize its sacred

obligation to both those who serve in the Canadian Armed Forces and their

families.

Indigenous Communities

Once again, the

Committee heard about the serious need to stop underfunding education for

indigenous Canadians. The federal government has both a moral obligation and an

economic imperative to significantly increase investments in this area.

Recommendation:

- That the federal

government recognize the economic potential of young Indigenous Canadians and

work in partnership with Indigenous communities on a plan to ensure that every Indigenous

student has access to a high-quality education. As part of this plan, the

federal government should eliminate the funding gap for First Nations-led K-12

education, increase financial support for Indigenous language and culture

education, and remove the 2 percent funding cap on the Post-Secondary Student

Support Program.

Other

recommendations:

- That

the federal government amend the Canada Labour Code to provide both

clarity around unpaid internships and greater protection for vulnerable

Canadians who are being pressured into taking unpaid work, and direct

Statistics Canada to collect data on unpaid internships.

- That

the federal government reverse its funding cuts to the Youth Employment

Strategy as well as its cuts to the number of young Canadians employed

through the Canada Summer Jobs Program, Federal Student Work Experience

Program, and Co-operative Education and Internship Program.

- That the federal

government support Canadian seniors by reversing its decision to raise the age

of eligibility for Old Age Security (OAS) and Guaranteed Income Supplement

(GIS) benefits.

- That

the federal government examine the feasibility of amending the Air

Travellers Security Charge Act to exempt Canadian registered charities from

the air travellers security charge when the charity is providing a free flight

to a low‐income Canadian who is

travelling to a required medical appointment.

- That

the federal government cease its undemocratic use of omnibus budget

legislation.