FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

CHAPTER 3 – GENERAL GLOBAL AND CANADA ECONOMIC IMPACTS OF FALLING OIL PRICESA. BackgroundAccording to U.S. Energy Information Administration data on spot prices, in June 2014, international crude oil prices began to decline sharply. As shown in Figure 3, WTI crude oil – the North American benchmark for light sweet crude oil – was trading at US$50 per barrel in February 2015, down from US$105 per barrel in June 2014. Over the same period, and as presented in Figure 3, Bank of Canada data show that the Canada‑U.S. exchange rate has declined. In June 2014, on average, C$1.00 was equivalent to US$0.924; in February 2015, the average US$0.80, which represents a 13.4% decline over the period. Figure 3 – Crude Oil Prices and the Exchange Rate Between the Canadian Dollar and the U.S. Dollar, March 2014–February 2015 (monthly)

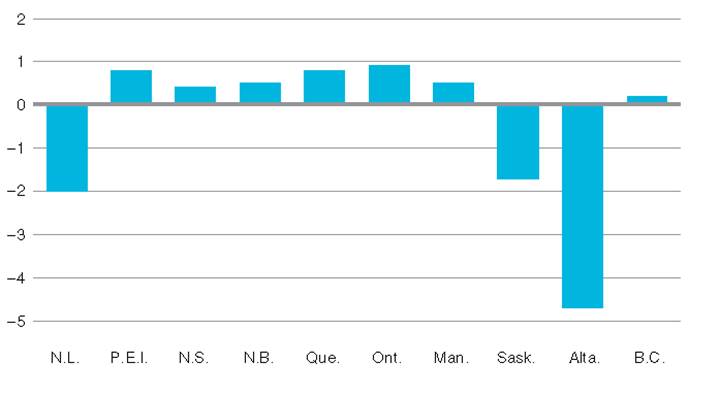

Note: Crude oil prices are West Texas Intermediate (WTI) spot prices free on board (FOB) at Cushing, Oklahoma. Sources: Figure prepared using information obtained from: U.S. Energy Information Administration, Petroleum & Other Liquids, “Spot Prices,” Data; and Bank of Canada, Monthly Average Exchange Rates: 10-Year Lookup, at closing. As Canada is a major producer and net exporter of oil, the negative effects of the decline in oil prices are being felt to a greater extent in the country’s provinces that produce oil, including Alberta, Saskatchewan, and Newfoundland and Labrador; in particular, drilling, investment and hiring intentions have declined. Businesses that provide goods and services to the oil sector are also being negatively affected by the fall in oil prices, and some of these businesses are located in provinces that do not produce oil. In January 2015, a Bank of Canada report indicated that – over the next year – economic activity may shift towards export-oriented firms and manufacturers, as a majority of firms in non-oil sectors were expecting to increase their hiring and were planning further investments in manufacturing production. A January 2015 report by the Conference Board of Canada estimated that lower oil prices will reduce Canada’s real gross domestic product (GDP) by 0.4% in 2015. Figure 4 provides a provincial breakdown of the expected reductions or increases. Figure 4 – Percentage-Point Impact on Real Gross Domestic Product of a 40% Reduction in Crude Oil Prices in 2015, by Province

Source: Conference Board of Canada, Regional Shake Up: The Impact of Lower Oil Prices on Canada’s Economy, January 2015. B. Witnesses’ ViewsWitnesses spoke to the Committee about the effect of lower oil prices on the Canadian economy. RBC Financial Group and the C.D. Howe Institute stated that the overall immediate effect of lower oil prices on the Canadian economy will be negative, and that positive effects are likely in the medium and long terms. RBC Financial Group also stated that, in the short term, nominal GDP will decrease and corporate profits will be lower; in the medium and long terms, exports from – and capital investment in – sectors other than oil and gas, such as manufacturing, will increase. Like Unifor and Canadian Manufacturers & Exporters, the Bank of Canada stated that – while the Canadian economy is worse off in general, lower oil prices will increase Canadian households’ disposable income, everything else remaining the same; in making this assessment, the Bank considered the reduction in aggregate real business incomes and supply chain effects across sectors that are linked to oil and gas extraction. In the Bank of Canada’s view, lower retail gasoline prices will lead to increased savings for consumers and non-oil-related businesses that export; moreover, lower operating costs for firms that use oil as an input will lead to higher production, investment and profits. According to the Automotive Parts Manufacturers’ Association, everything else remaining the same, a lower Canadian exchange rate as a result of lower oil prices increases the cost of imported goods, such as machinery and equipment; Canadian producers often purchase U.S.-made machinery and equipment. The Bank of Canada, the Canadian Labour Congress and Canadian Manufacturers & Exporters indicated that, in general, the rapid fall in oil prices between June 2014 and February 2015 will have negative effects on the Canadian economy for the first six months of 2015. The Bank of Canada noted that, even though real GDP grew by 2.4% in the fourth quarter of 2014, the real incomes of Canadian businesses fell due to the loss of purchasing power as lower global oil prices reduced the value of Canadian oil exports. As well, the Bank estimated that business investment in the oil and gas sector is about one third of total Canadian business investment, and is anticipated to fall by about 30% in 2015. Philip Cross, who appeared as an individual, expressed a similar view in his submission to the Committee. Moreover, the Bank of Canada, Canadian Manufacturers & Exporters and the Canadian Steel Producers Association suggested that, as nearly one third of the goods and services purchased by Alberta’s oil sands sector are sourced from other provinces, economic activity in certain sectors – mainly manufacturing and construction – will be negatively affected across Canada because of supply chains. Encana Corporation said that 2,300 suppliers throughout Canada support the oil and gas sector, and that oil price shocks are felt immediately throughout the supply chain. Canadian Manufacturers & Exporters estimated that, if lower oil prices continue, manufacturing production will decline by about $12 billion each year starting in 2015. Based on a recent survey of its membership, the Canadian Automobile Association noted that perceptions about the impacts of lower oil prices on the Canadian economy differ based on a person’s location. For example, it said that, among survey respondents, two thirds of Albertans felt that declining oil prices will have a significant negative effect on the Canadian economy over the longer term; this view was shared by no more than 40% of the population elsewhere in Canada. Further, its survey found that, while a number of forecasting groups expected lower oil prices to exist through to 2016, most of the Canadians it surveyed expected that oil prices will begin to increase by the fall of 2015; Wade Locke expressed a similar view in his submission to the Committee. The Canadian Automobile Association suggested that the gap in perception between forecasting groups and the general population regarding the effects of oil prices on Canadian economic performance may narrow over time if lower oil prices exist throughout 2015. The Bank of Canada and Unifor commented that lower oil prices are mainly the result of abundant global supply, which is stimulating economic activity in the United States. In particular, the Bank said that the decline in oil prices since 2014 will raise U.S. GDP by about one percentage point by the end of 2016. It stated that, in the longer term, the low relative value of the Canadian dollar will improve the competitiveness of production in Canada, especially in the manufacturing sector. Moreover, it mentioned that, because of increased U.S. economic activity, Canada’s manufacturing sector should expect further increases in its exports to the United States. Regarding the impact of lower oil prices on government revenue, Philip Cross mentioned that the fall in oil prices should not require the federal government to re-evaluate its fiscal policy, as the revenue impacts will be minimal. Wade Locke noted that reductions in provincial revenue will affect future equalization payments; in particular, payments to provinces with relatively weaker economies will be reduced. The Regional Municipality of Wood Buffalo said that the decline in oil prices has not yet affected the daily activities of residents within the region, although residents intended to limit future spending; the region includes Fort McMurray. It also mentioned that, in January 2015, the use of the region’s food banks was 75% higher than a year earlier; use was expected to be higher still in February 2015. |