INDU Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

E-COMMERCE IN CANADA: PURSUING THE PROMISEINTRODUCTIONOn October 5, 2011, pursuant to Standing Order 108(2) and the motion adopted by the Committee on September 26, 2011, the House of Commons Standing Committee on Industry, Science and Technology (hereafter “the Committee”) began a study of e-commerce and mobile payments in Canada. The Committee heard from 33 witnesses over the course of the study, and the hearings concluded on November 21, 2011. According to the Organisation for Economic Co-operation and Development (OECD), e-commerce is defined as follows: An e-commerce transaction is the sale or purchase of goods or services, conducted over computer networks by methods specifically designed for the purpose of receiving or placing of orders. The goods or services are ordered by those methods, but the payment and the ultimate delivery of the goods or services do not have to be conducted online. An e-commerce transaction can be between enterprises, households, individuals, governments, and other public or private organisations.[1] From a macro-economic standpoint, the growth of e-commerce can be an important factor in increasing national productivity: e-commerce can be a key driver of increasing sales while using fewer production resources such as labour. From a micro-economic standpoint, e-commerce could be a key element in enhancing a company’s competitive advantage, and allow it to capture market share. A thriving e-commerce market is also a key pillar of the digital economy. The digital economy is increasingly becoming a priority policy area for the Government of Canada, which launched a national consultation on a digital economy strategy in May 2010.[2] This report aims to identify the key challenges and the existing core strengths of the e-commerce market in Canada, and to propose recommendations to the Government of Canada as to how to address some of these challenges. To that end, this report provides a summary of the testimony presented to the Committee for the study of e-commerce and mobile payments in Canada as well as a list of recommendations. Chapter 1 of this report presents the state of e-commerce in Canada, both from the perspective of the consumer and of industry. Chapter 2 identifies the obstacles to a more rapid and widespread adoption of e-commerce solutions by Canadian businesses. Since the cost of processing payments was a challenge identified by many witnesses, Chapter 3 focuses on this particular obstacle. Chapter 4 describes the opportunities that e-commerce provides for Canadian businesses, in particular small and medium-sized enterprises (SMEs). Finally, Chapter 5 provides the Committee’s recommendations to the Government of Canada. An overview of past and present federal government initiatives and programs related to e-commerce is provided in Appendix A. 1. THE E-COMMERCE SITUATION IN CANADAA) The Consumers’ PerspectiveIf problems exist with respect to the development of e-commerce in Canada, it is not as a result of consumers’ lack of enthusiasm for using the Internet. According to Michael Geist (Canada Research Chair, Internet and E-commerce Law, University of Ottawa), Canada is a global leader in Internet usage: The Canadian consumer success story is well known. We’re among the global leaders in internet use and online video consumption. For several years Canada was the world’s largest per capita users of Facebook, Netflix launched online only first in Canada and quickly grew to 1 million subscribers, and digital music sales have grown faster in Canada than in the United States for each of the past five consecutive years.[3] Several witnesses referred to statistics showing the high level of Internet usage and online purchases among Canadians. The objective of this section is to provide an overview of these statistics. i. Market Potential for e-Commerce

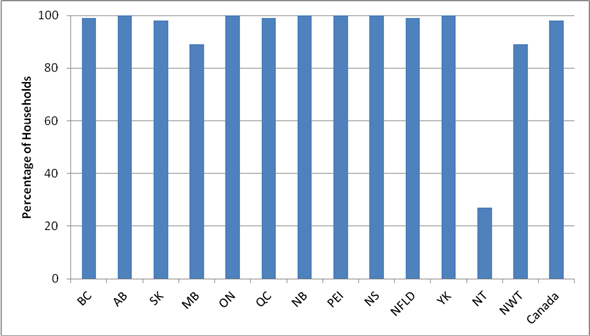

The Canadian Internet Use Survey (CIUS) includes some data on e-commerce. This survey was previously conducted on a biennial basis; data from this survey are available for 2005, 2007 and 2009. In 2010, the CIUS was redesigned and became a hybrid survey that measures both household Internet access and the individual online behaviours of a selected household member. A good approximation for the size of the potential market for e-commerce in Canada is the percentage of Canadian households with Internet access (see Table 1). More than half of connected households used more than one type of device to go online, which is also an important driver of e-commerce, given that potential customers have additional options for online accessibility. Table 2 shows that 74% of users employed the internet for window shopping or browsing for information on goods or services. Table 1 – Percentage of Households with Home Internet Access, 2010

Note: The Canadian Internet Use Survey did not include the three territories. Source: Table prepared by the Library of Parliament using data obtained from Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/110525/t110525b1-eng.htm. Table 2 – Online activities from any location, 2010 (% of Internet users)

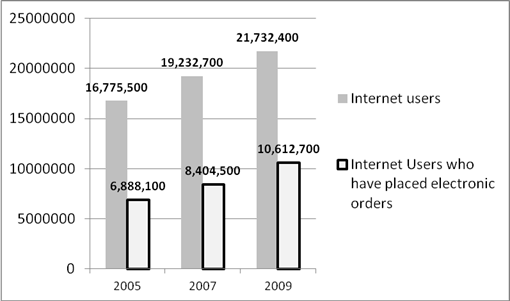

Source: http://www.statcan.gc.ca/daily-quotidien/111012/t111012a3-eng.htm. Another important metric for Canadian businesses involved in e-commerce is the number of Internet users who have placed electronic orders. Data from the 2005, 2007 and 2009 CIUS on these Internet users are presented in Figure 1. There was a large increase in the number of overall Internet users and the number of Internet users who placed electronic orders (30% and 54%, respectively) from 2005 to 2009. Figure 1 – Internet Users vs. Internet Users who Have Placed Electronic Orders

Source: Figure prepared by the Library of Parliament using data obtained from Statistics Canada, Table 358-0135. ii. Value of internet orders in Canada

Table 3 shows the quantity and value of internet orders in Canada in 2010. Retail e-commerce was a $15.3 billion market in Canada in 2010, almost double the 2005 level. The average value of internet orders per person was $1,362. Payment via credit card represented 89.4% of electronic orders.[4] According to the 2009 CIUS, the most common types of online orders are for travel services; entertainment products (such as concert tickets); books and magazines; and, clothing, jewellery, and accessories. Table 3 – Electronic commerce, number and value of orders (2010)

Source: http://www.statcan.gc.ca/daily-quotidien/111012/t111012a2-eng.htm. B) The Business Perspective

Some witnesses alluded to a lack of data, which prevents adequate monitoring and benchmarking with other countries, on Canadian businesses’ e-commerce adoption and deployment. Notwithstanding this concern, witnesses indicated that Canadian businesses have generally underinvested in information and communications technology (ICT) solutions, including e-commerce platforms, relative to their U.S. counterparts. Similarly to consumers, Canadian businesses have access to, and make regular use of, the Internet. This section provides a statistical overview of these aspects. i. Internet usage among Canadian businesses

According to research from the Canadian Federation of Independent Business (CFIB), 89% of small businesses have an internet connection.[5] Similarly, a study sponsored by the Business Development Bank of Canada (BDC) found that 93% of SMEs have an internet connection[6]. For businesses with between 5 and 19 employees, this proportion is 90%; for businesses with between 20 and 99 employees, this proportion is 98%; 100% of businesses with between 100 and 499 employees have an internet connection.[7] By 2011, 10% of companies in Canada did not use a high speed connection.[8] With respect to the reasons for the lack of a high-speed internet connection, 50.6% of SMEs cited unavailability in their region, and 33.8% of SMEs indicated that a high-speed connection was not required for their type of internet usage.[9] Although the percentage of SMEs using the internet stands at more than 90%, the percentage of SMEs using their own web site as a business platform is 70%.[10] This percentage varies greatly with the size of the business; larger businesses have a much higher probability of having their own web site. With the proliferation of mobile devices (e.g., BlackBerrys and iPhones) the proportion of SMEs having a mobile-friendly web site in the context of e-commerce is also an important consideration. In 2011, only 8.2% of all SMEs indicated that they had a mobile-friendly web site.[11]

Although 71% of connected Canadian SMEs reported making online purchases, only 18% reported making online sales.[12] Even among larger SMEs (between 100 and 499 employees), only 30% reported online sales. Among Canadian SMEs selling online, 72.5% indicated that the share of their online sales represented 25% or less of total sales.[13]

The Canadian Chamber of Commerce provided the Committee with a report entitled Powering up the Network, which surveyed small businesses’ use of e-commerce in Canada. Results from this survey show that 96% of companies have a web site they use for business purposes. However, only 27% of respondents were able to accept online payments, 31% provided the opportunity for online ordering and tracking, and 51% are sending and receiving electronic invoices.[14] ii. Growth of Business Investment in Software

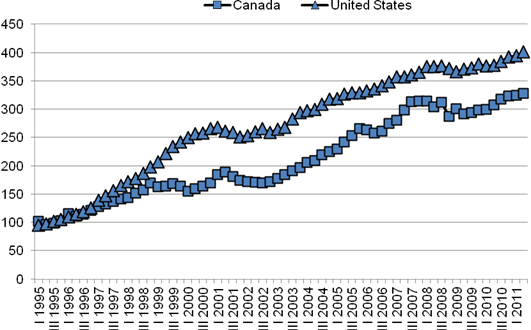

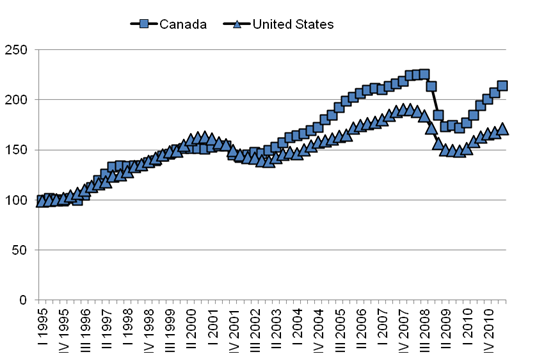

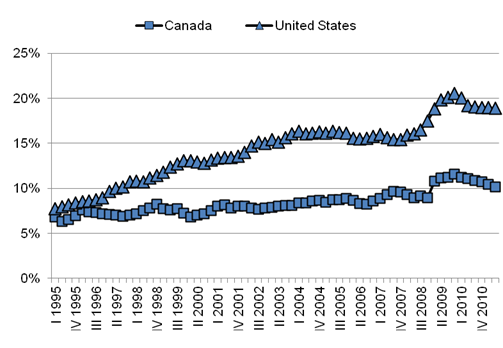

Data presented in the previous section and provided to the Committee by witnesses suggest that selling products online is not yet popular among Canadian SMEs. Witnesses also mentioned to the Committee that the underdevelopment of online sales by SMEs mirrors the fact that Canadian businesses generally tend to invest less in ICT solutions than do their U.S. counterparts. For businesses, the launch of an e-commerce platform often requires investment in software. Figure 2 illustrates the growth of software investment for both Canada and the United States. In the second quarter of 2011, business investment in software in the United States was 4.0 times higher than in 1995, whereas it was 3.3 times higher in Canada. Figure 2 – Inflation-Adjusted Business Investment in Software, Canada versus

United States

|

(...) Canada is, quite frankly, the leader in contactless globally -- now the time is ripe to take NFC and then use that acceptance footprint to move mobile payments into the future. Don Leboeuf (Vice-President and Head, Customer Delivery, MasterCard Canada), November 2, 2011 (1640) This committee has considered what e-commerce might look like in the future, but it’s important to recognize that here in Canada today, we have a successful example of Internet-based commerce that can serve as a model for the expansion of e-commerce in other areas of the economy. (...) Online banking is the most widely used form of Internet commerce in Canada, with over two-thirds of Canadians reporting that they used online banking in 2010. Terry Campbell (President and Chief Executive Officer, Canadian Bankers Association), November 16, 2011 (1545) Canadians spend over 40 hours online each month, by some measures, and while Canadian e-commerce stats are nothing to write home or to Parliament about, as the case may be, Canadians have embraced certain forms of e-commerce, like online banking, at world-leading levels. Jacob Glick, Canada Policy Counsel, Google Inc., October 31, 2011 (1550) |

Notwithstanding the preceding data, it is important not to generalize Canadian businesses’ lacklustre performance regarding ICT investment and adoption. For example, the Committee heard testimony that Canada is a leader when it comes to near-field communications technology deployment (e.g., “contactless” card payments); as such, Canada is also extremely well positioned to become a world leader in point-of-sale mobile payments.[16] Similarly, witnesses told the Committee that Canada has always been a global leader in online banking deployment and adoption.

2. OBSTACLES TO INVESTING IN E-COMMERCE PLATFORMS FOR CANADIAN BUSINESSES

A) Cost and Access to Financing

So why are small business owners embracing the Internet but being slow to sell their products online? Much of it has to do with cost. Corinne Pohlmann, Vice-President, National Affairs, Canadian Federation of Independent Business, October 26, 2011 (1550) |

Two surveys on ICT adoption by Canadian SMEs were published in 2011. One was sponsored by CFIB and the other by the Business Development Bank of Canada (BDC). Both organizations provided testimony and relayed information pertaining to these two surveys to the Committee.

i. CFIB and BDC Surveys

According to a 2011 survey of 8,209 (SMEs) sponsored by the CFIB, the cost of implementing an e-commerce platform was the most important obstacle to accepting electronic payments. Table 4 illustrates the results of the CFIB survey.

Table 4 – Obstacles to Accepting Electronic Payments (Percentage of Respondents Citing the Obstacles Listed)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: CFIB, Evidence presented to the Committee, original source: CFIB, Changing the Way We Pay: Getting the Transition Right for SMEs, October 2011, p. 7, http://www.cfib-fcei.ca/cfib-documents/rr3239.pdf.

Echoing other comments presented to the Committee, the CFIB report expands on the cost factor as an obstacle to accepting electronic payments:

Cost is a big setback. Over half of business owners state that this is why they do not accept electronic payments from customers. Currently, the cost of renting or leasing electronic payment equipment, including set-up and operating costs, remains high. Charges associated with processing electronic payments are high with the exception of debit card payments. If these costs continue hurting businesses’ bottom lines, even current benefits of electronic payments may not be sufficient to influence a full switch from manual payment.[17]

Online security was also mentioned by 26% of respondents in the CFIB survey as an important obstacle to accepting electronic payments. According to the CFIB representative who appeared before the Committee, SMEs feel there is a potential risk of losing customer or business data, or having sensitive personal or financial information stolen for which they themselves may become liable. This is a particular concern for smaller firms that cannot afford to protect their systems with sophisticated software.[18]

Questions on the main obstacles preventing Canadian SMEs from investing in ICT, and more specifically, from selling their products online, were also included in the BDC survey: 23.2% of respondents mentioned inadequate access to funding and 18.7% mentioned lack of competent or specialized personnel as being obstacles preventing them from adopting ICT solutions. Michel Bergeron from BDC expanded on the difficulty for small businesses to access financing. He pointed out that the reality of investing in ICT is that much of these are intangible assets, and therefore, there is no collateral associated with it. Businesses would typically use their working capital for this type of investment which reduces liquidity available for other endeavours.[19]

|

Actually, you already mentioned the obstacles. Usually, the problem has to do with money, especially a lack thereof. The budgets that small and medium-sized businesses have at their disposal are limited, especially in retail. We are talking about a margin of 3% or less. In grocery stores, it is around 1%. So there is very little money in the bank, so to speak, to invest in new technologies that have a very high level of risk attached. The second challenge is what is known as economies of scale. It costs businesses that are a lot smaller a lot more. The third obstacle has to do with labour. It is hard to find people who want to work for a small business, especially in the area of technology. Most university graduates want to work for big international companies. Those are the three biggest challenges that small merchants face today. Diane Brisebois, President and Chief Executive Officer, Retail Council of Canada, November 16, 2011 (1710) |

Regarding the main obstacles preventing SMEs from selling online, 59.5% of respondents indicated that their product is not appropriate for this type of sale in the BDC survey. The remaining respondents (i.e., respondents whose products are suitable for online sales) cited a lack of resources, the need to establish contacts with clients, and the cost factor as the most important obstacles.[20]

A report from the OECD notes that SMEs are concerned about the costs of establishing and maintaining e-commerce systems since these companies are generally under budget constraints and are less sure of the expected returns on the investment. The OECD report also points out the following:

Some SMEs cannot afford to adopt sophisticated ICT solutions (e.g. a web site with a secure environment for credit card transactions). Some small businesses, especially micro-enterprises with 1-9 employees or the self-employed, may adopt a simple web site without any e-commerce function if the cost of basic Internet use is well within their marketing budget.[21]

According to the OECD report, e-commerce maintenance and upgrades can also be very costly. This is particularly true in cases where firms wish to set up sophisticated and customized virtual shops. Web site maintenance may be the most costly element of ongoing expenses. Other on-going costs include telephony, Internet service provider (ISP) charges and web site hosting. In particular, Internet access prices are a key determinant of Internet and e-commerce use by individuals and businesses.[22]

For firms with low sales volumes that are willing to offer a more generic (i.e., not customized) online shopping experience to their customers, numerous low-cost software options now exist on the market. According to consulting firm Gartner,[23] by eliminating custom-development efforts for commodity functions (such as shopping cart management, searches, product merchandising and management) and replacing these with commercial, off-the-shelf, or open-source e-commerce applications, businesses can realize considerable savings on the costs of conducting e-commerce.

Similarly, the Business Development Bank of Canada notes on its web site that direct costs for large companies looking to deploy in-house e-business initiatives are high.[24] However, outsourcing such initiatives for smaller firms may be an interesting option from a cost standpoint. A common way for smaller companies to begin e-commerce operations is to buy an all-in-one package that includes hosting, site design and e‑commerce applications.[25] Outsourcing still allows for some degree of customization and control over a web site's operations.

ii. Access to Foreign Capital

Witnesses such as Professor Geist told the Committee about the importance of access to foreign capital for Canadian businesses, especially in the telecommunications sector:

Capital is difficult to obtain for some of the Canadian-owned new entrants. If we want to have the robust competition and the sorts of things that we've heard from the manufacturers arguing for open access (to capital), we need to open the doors to some of the international giants. They can provide a more robust and competitive environment.[26]

Additionally, Mr. Jason Kee (Entertainment Software Association of Canada (representing members of Canada’s video gaming industry)) spoke of how the video game industry is increasingly using e-commerce to sell its content on console-based network sites such as PlayStation Network and Xbox Live. Specifically, downloads, as a percentage of total sales were 5% in 2009, 20% in 2011, and are projected to be 50% by 2013.[27] As regards foreign investment, he provided the following testimony:

Essentially, our industry has been built on the investments made by companies like Electronic Arts from the United States or UbiSoft from France, which essentially poured millions of dollars into the studios here that employ thousands of people in these high-paying jobs and basically develop world-class content that is distributed around the world. These investments then, in turn, led to the formation of studios, where people would go off and form their own independent studios and be their own independent Canadian businesses, which has really built the ecosystem that we see today. It's one of the reasons among many that we actually see the clustering effect. It's also because you do have these investments that were made, and that you kind of have an acorn. It's like a tree that basically grows and spreads out from those initial investments.[28]

It should be noted that on March 14, 2012, the Minister of Industry announced that the Telecommunications Act will be amended to “lift foreign investment restrictions for telecom companies that hold less than a 10 percent share of the total Canadian telecommunications market.” [29] All provisions of the Investment Canada Act still remain in force, as do the foreign investment restrictions of the Broadcasting Act.[30]

B) Other Obstacles to E-Commerce

i. The Nature of the Canadian Market

(...) there are two issues here. There’s the cost of doing business in Canada. It’s very expensive both on the payment side and on the shipping side. The shipping side could be resolved. Canada post is making an effort. They have set up a subsidiary that actually does channel some sales back and forth between U.S. and Canada, but on the payment side, there’s not much happening. Samer Forzley, Managing Director, Market Drum, Ottawa Centre for Regional Innovation, October 17, 2011 (1600) |

Canada’s large geography and low population density provide many challenges for many industries, and in particular, e-commerce. In general, Canada’s population of 34.6 million people[31] is sometimes viewed as not being large enough to render some business lines profitable. According to Wendy Cukier, “the economies of scale, quite honestly, for many of the big consumer-oriented businesses, simply are lacking in Canada, and that is a big challenge.”[32] Gordon Reed of UPS compared the costs to ship in Canada and the United States and stated “if I look at our cost to serve in Canada versus the United States, it is significantly lower in the United States. The density is there.”[33] In this vein, many witnesses also discussed the high cost of logistic services (shipping, storage, etc.) as compared to the United States, as further causes of Canada’s poor e-commerce performance.[34] The witnesses also claimed these high costs are for both shipping within Canada, as well as to foreign destinations. Consequently, these costs are passed along to the consumer.

Samer Forzley (Managing Director, Market Drum, Ottawa Centre for Regional Innovation) suggested there is not yet a critical mass of online merchants to create a robust merchant market,[35] which results in a lack of supply chain development — if there aren’t enough merchants, there’s no reason for suppliers or ancillary service providers (payment processors, storage and shipping companies) to enter the mix; if a sector has a weak supply chain, new companies are less likely to enter the market.

Several witnesses were quick to accept that part of the problem of low e-commerce adoption stems from the fact that Canada has a disproportionately large number of SMEs; these firms, especially those with fewer than 20 employees are less likely to procure adequate ICT, let alone engage in online sales. Furthermore, during an appearance before the Committee on September 28, 2011, Richard Dicerni, (Deputy Minister of Industry Canada) explained that “one of the key aspects that explains the difference in productivity between Canada and the United States is the lack of ICT adoption by small and medium-sized businesses.”[36] Both the Information Technology Association of Canada and the Canadian Chamber of Commerce told the Committee that despite the many proven benefits of ICT adoption and e-commerce (lower operating costs, access to larger markets, better supply and customer-value chain management), too many Canadian SMEs have yet to embrace ICT.[37]

This situation suggests the Canadian online market may be in a “catch-22” situation: high costs and lack of merchant clusters have kept businesses offline; in turn, Canadians do not have the prices and product availability they desire, so they do their online shopping with foreign-based companies.[38] Further complicating the problem, according to Samer Forzley, is that eventually, successful Canadian companies look to move to other jurisdictions like the United States.[39]

ii. Consumer Protection

Although Canada does have consumer protection laws at the provincial and federal level, they are not uniform across the country, especially as they relate to new concepts like e-commerce, social media, etc. Jacques St. Amant (Université du Québec à Montréal) told the Committee that current consumer protection governance is no longer viable, and that Canada will need to make the rules clear for all stakeholders.[40] This, in turn, will encourage e-commerce, given consumers and suppliers will be more confident in a governance structure that is clear and uniform across Canada.

The importance of encouraging digital literacy as a means to increase consumer protection was also cited during the study. Terry Campbell summed up much of the issue as follows:

But on digital literacy, I think there is a role all players — the banking industry, this committee, the government — need to play to foster awareness in the Canadian population about the importance of security. It's very often through the customer's computer system that the bad guys get in. With greater awareness comes greater comfort and greater confidence in being able to use the systems, and that will go a long way.[41]

In almost every poll or study taken on the barriers to e-commerce — and I've looked at quite a few of these online over the past few days — the principal concerns raised have been privacy and security of personal information. Consumers want some assurance that their information is going to be protected. Businesses want that assurance as well, and they want to know whether they're meeting adequate standards to protect that information and to protect themselves against possible liability. Michael Deturbide, Professor and Associate Dean, Academic, Schulich School of Law, Dalhousie University, 19 October 2011 (1530) |

The issue of consumer safety (with respect to personal information and secure transactions) is a fundamental issue in e-commerce; without it, there cannot be a marketplace, and this theme was made clear by many witnesses.[42] Professor Deturbide (Dalhousie University) stated that “One estimate is that over 35% of Internet users will not give their credit card information online because of security concerns. That's a large chunk of people who are just not engaging in e-commerce and who could be.”[43]

To combat such sentiment, and to further the development of e-commerce, the Government of Canada has stated that it aims to ensure the Canadian e-commerce market is safe and secure, because it believes that in order to have a robust electronic marketplace, Canadians need to be confident that it is a safe place to shop, that consumer protections are in place, and that personal information is secure.[44] The federal government asserts that these goals will be met, in part, through recent amendments to the Personal Information Protection and Electronic Documents Act (PIPEDA), updated anti-spam legislation,[45] and changes to copyright legislation.

iii. Availability of Broadband Internet Services

Broadband internet is the infrastructure of e‑commerce. The term “broadband” refers to internet download speeds of at least 1.5 Mbps (megabits per second), a speed which “encourages e-commerce,” according to Helen MacDonald of Industry Canada.[46] Figure 5, below, shows Canada’s broadband availability by region.

Figure 5 - Broadband availability by province and territory, percentage of households, 2010

Source: Created by the Library of Parliament, with data from CRTC Broadband Report, November 2011 — Table 2.1.1 Broadband availability by technology and province/territory, 2010 http://www.crtc.gc.ca/eng/publications/reports/broadband/ bbreport1111.htm#t2.1.1

According to data from the Canadian Radio-television and Telecommunications Commission (CRTC), in 2010, national residential broadband availability was 98%; for rural households, it was 96%.[47] When looking specifically at higher speed Internet service, the availability in rural areas declines sharply relative to urban areas. For example, at speeds of 5 Mbps and above, availability is still close to 100% in urban areas, while it is in the neighbourhood of 50% in rural areas.[48] To help address this disparity, the Government of Canada launched Broadband Canada, a $100 million dollar program aimed at improving broadband availability for underserved regions of Canada; this program is discussed in Appendix A of this report.

Several Committee members and witnesses commented on the importance of broadband access. Professor Geist spoke of the importance of affordable broadband, and how Canada was not a leader in terms of the price and quality of service available. For example, on the issue of data usage limits, he stated: “It represents a significant impediment on both sides: businesses are unable to take advantage of the technology and consumers have to pay more.” [49] The Canadian Chamber of Commerce commented on how Canada’s e-commerce infrastructure was no longer “world class,” and how “ICT infrastructure is now a 21st century pillar. It must be given at least as high a priority as traditional infrastructure. We can't afford to be left behind.”[50] Jason Kee stated the following:

Government policies that encourage more affordable, accessible, and faster broadband will be not only vital for the future growth of our industry, but it [they] also has [have] the additional value of fostering job growth within our industry. At the same time, it will foster consumer interest in the online games industry and digital delivery platforms, helping in turn to drive demand for further broadband infrastructure.[51]

It doesn't make sense, if I want to serve the area around Ottawa or around Calgary, that I also have to spend on the 94% of the population I don't want to serve. I don't want to serve downtown Calgary. I don't want to serve downtown Toronto. I want to serve the rural regions, but I have to buy that spectrum, warehouse or inventory it, and incur that cost, to capture the spectrum for the 6% of the population that I want to serve. John Maduri, Chief Executive Officer, Xplornet, October 31, 2011 (1630) |

John Maduri of Xplornet suggested that rural broadband access could be important to Canada’s economic prosperity, given that much of Canada’s primary industries exist in rural regions. He went on to state the recent launch of Xplornet’s newest satellite with next-generation technology should provide improved and more affordable broadband access to Canada’s rural and remote regions.[52] However, Mr. Maduri suggested that spectrum auction rules have to be changed so that peripheral low-density areas adjacent to urban areas are not part of the same license as core urban areas — he suggested that bundling together high-density urban areas and low-density areas under the same license results in rural areas being chronically underserved by current license holders.[53]

It should be noted that on March 14, 2012, the Minister of Industry announced some of the key conditions of the upcoming 700 MHz spectrum auction; specifically, he noted that Canada’s radio spectrum would be divided into 14 zones, each comprised of several “blocks.” Additionally, licence holders could be obliged to deliver advanced wireless services to rural Canada.[54]

iv. Labour Supply: Education and Training

Many witnesses discussed the importance of education and training for improving the development, deployment, and adoption of e-commerce. Digital literacy must begin early, as was expressed by John Weigelt of Microsoft, who talked about how even children using computers must be taught the importance of concepts such as computer ethics and cyber bullying.[55] Karna Gupta (President and CEO, Information Technology Association of Canada) stated the following with regard to encouraging young Canadians to study the various disciplines needed for a career in ICT:

The big part of this is that it has to start at a very early stage, down to the high school level at grade 10, because there is not enough awareness and training that kids can go into ICT as a career. So when you look at the ICT community today, it is a fairly small community and there are a significant number of job gaps. Most of the kids are still not properly trained in this area.[56]

So they need to have hands-on working experience as they go through their schooling, which is absolutely critical in today's world, as well as multi-disciplinary teaching. Kids come out with a single-threaded education. It is no good to a business. They need to understand the business side of the education as well. How do you take a product to the market? What does developing a product mean? How do you launch a product? These are critical skills that need to be weaved even into technical training. Without that, the individual coming out is not quite complete and the businesses often tend to go where they can get that knowledge. So the training piece not only needs to be a compulsory part of the program but also needs to be expanded into the other dimension of multi-disciplinary training. It is critical for business today to survive. Karna Gupta, President and Chief Executive Officer, Information Technology Association of Canada, October 19, 2011 (1645) |

Wendy Cukier of Ryerson University also stated that the technical skills, while crucial, are still not enough; Canada must also ensure that management, entrepreneurship, and creative skills are encouraged and developed.[57] Further to this point, Karna Gupta stated that young Canadians need more “hands-on” training in these areas to not only acquire these skills, but to ensure they have a comprehensive education that will allow them to help commercialize the innovations they help develop.[58] To this end, Budget 2011 announced an additional $60 million over three years to help encourage enrollment in the key disciplines driving the digital economy: Science, Technology, Engineering, and Mathematics — collectively these subjects are referred to as “STEM.”[59] This initiative complements the $80 million-dollar, three-year Digital Technology Adoption Pilot Program (DTAPP), which will be administered through the Industrial Research Assistance Program (IRAP).[60]

CANARIE (Canada’s Advanced Research and Innovation Network), which was created by the Government of Canada in the 1990s to ensure researchers were able to collaborate and share large data sets over a secure fibre optic network, received high praise from several witnesses.[61] Additionally, this organization funds research projects in several areas related to innovation. The president of CANARIE, Jim Roche, told the Committee of the organization’s contributions to the development of Canada’s digital society, having “funded projects to help develop and accelerate adoption of advanced e-business applications and services;” also, it has leveraged over $240 million dollars of private investment for research and collaboration.[62] The Canadian Manufacturers and Exporters expressed support for CANARIE, and told the Committee that “CANARIE, Canada's Advanced Research and Innovation Network, which provides more than 19,000 kilometres of ultra high-speed fibre optic cables, is a crucial enabler of Canadian innovation.”[63] Michael Geist, who is a member of CANARIE’s board, stated the importance of ensuring that the organization’s mandate and funding is renewed, as otherwise: “we're just going to have to build it again — our education networks and others are so dependent upon it.”[64]

v. “Red Tape”

If I look at the survey results in terms of barriers to e-commerce adoption, regulatory barriers are not identified at all. Michel Bergeron, Vice-President, Corporate Relations, Business Development Bank of Canada, October 19, 2011 (1635) |

Regulatory burden was not identified as a major barrier to the adoption of e-commerce by Canadian business. Michel Bergeron notably discussed the results of a BDC survey which showed that regulatory barriers were not identified as discouraging e‑commerce adoption.[65]

Professor Deturbide (Dalhousie University) stated that “sometimes legislative intervention is required to ensure adequate data protection mechanisms are in place, otherwise there may be little incentive to remedy the problem.”[66] For his part, Ian McLean (President and CEO, Greater Kitchener Waterloo Chamber of Commerce) expressed that if regulations are necessary, they must be clear and easy to follow:

We share the view that the Internet and digital economy are key drivers of growth and productivity in Canada's economy. Some argue that the success in this area may largely be a result of fewer regulations in this area, as opposed to our creating more regulation. While regulation may be necessary, it should be clear, understandable, and fair, especially for small businesses.[67]

3. TRANSACTING ONLINE FOR CANADIAN BUSINESSES: COST AND METHODS OF PAYMENTS

(…) in many cases merchants pay significantly lower fees for accepting debit card transactions than for accepting credit cards. A credit card fee for a merchant may be up to 3% of the total purchase price, whereas for debit in this country, it’s usually fixed at about 12 cents, regardless of the size of the purchase. However, in many cases consumers aren’t aware of that, and consumers aren’t aware that merchants maybe paying higher fees. Because of the rules imposed by Visa and MasterCard, in our view, merchants really don’t have the ability to steer consumers to different types of payments. We suspect that if they had that ability, not only might it make merchant fees that are set by the credit card companies more competitive, it might also make these other methods of payment more of an option for consumers. Matthew Kellison, Acting Assistant Deputy Commissioner, Civil Matters Branch, Competition Bureau, October 5, 2011 (1655) |

Witnesses spoke of the relatively high cost of electronic payment processing services in Canada. For some retail market segments, such as consumer electronics, operating margins are so slim that the prospect of having to pay extra fees to allow for online payments has deterred many businesses from engaging in e-commerce.[68] The goal of this chapter is to discuss payment methods in the context of the development of e-commerce and mobile payment systems.

A) Cost of Transacting Online for Businesses

Payment processors provide merchants with processing services for their credit card and debit card transactions.[69] These services link merchants to payment card networks, such as those overseen by payment card network operators (e.g., Visa, MasterCard and Interac). Through payment card networks, payment processors connect with cardholders’ card-issuing financial institutions, which authorize and make payments on behalf of cardholders. These payments are transferred from card-issuing institutions to payment processors, which deposit them in merchants’ accounts.

From PayPal's perspective, we don't charge any contract fee, or any annual or monthly fee. In fact, if you set up a PayPal account and never do any transactions, you never pay any fee at all to us. We're very transparent in our transaction fees. There's a sliding scale from 1.9% to 2.9%, plus 30 cents a transaction, and we've made that as simple as possible for merchants to understand, because it is a net rate as well. So it doesn't matter if you're using a basic credit card, a premium credit card with loyalty points, a Visa, a MasterCard or an American Express card, whether you're processing a China UnionPay card, a Switch Solo card from the UK, or a bank transfer from Germany. Darrell MacMullin, Managing Director, PayPal Canada, November 21, 2011 (1555) |

To provide these services, acquirers charge merchants a fee, known as the merchant discount fee, which is set at a level designed to cover payment processors’ costs (labour, buildings, equipment, etc.) and various fees paid by payment processors to payment card network operators and card-issuing institutions. For credit card transactions, the largest of these fees is the interchange fee, which is set by payment-card network operators and paid to card-issuing institutions. Payment processors may also be required to pay other fees to network operators, such as foreign card fees and assessment fees.

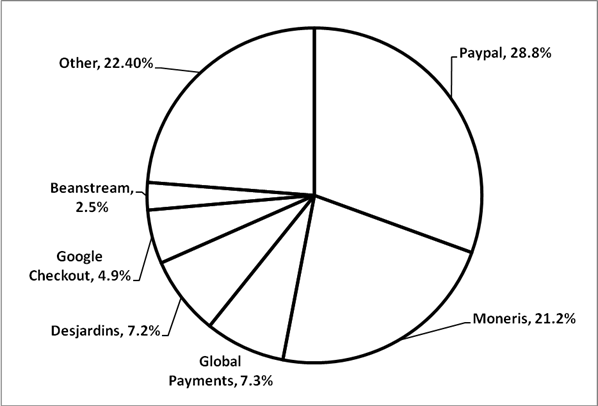

As shown in Figure 6, the most widely used internet payment processors by SMEs were PayPal (28.8%), Moneris (21.2%), Global Payments (7.3%) and Desjardins (7.2%).

Figure 6 - Most Widely Used Internet Payment Solutions by SMEs that Sell Online

Source: Use of ICT by Canadian SMEs. A Survey of Over 2,000 companies. CEFRIO, October 2011, p.84, http://www.cefrio.qc.ca/fileadmin/documents/Publication/NetPME_2011_ Use_of_ICT-angl_HW_01.pdf.

PayPal’s business model is to charge a “one-fee-covers-everything” amount to its clients. According to PayPal, its business model allows small businesses to minimize capital costs since no investment in software (e.g., shopping cart and invoice service software) is necessary on the part of the online seller.

Fees charged by PayPal to merchants are publicly available and are shown in Table 5. The standard rate charged by PayPal for receiving payments (either debit or credit) for goods and services is 2.9% plus 30 cents per transaction. Volume discounts apply such that for purchase payments exceeding $125,000 per month, the rate charged to merchants drops to 1.9%.

Table 5 – Transaction Fees Charged by PayPal to Merchants

|

|

|

|

|

|

|

|

|

|

Source: PayPal, https://www.paypal.com/ca/cgi-bin/webscr?cmd=_display-receiving-fees-outside&countries=.

B) Witness Testimony on the Use of Credit and Debit Cards for Online Payments

i. Debit Card versus Credit Card Payments

The biggest problem we’ve had with electronic payments has been the cost, particularly the costs imposed by the banks, and Visa and MasterCard. Dan Kelly, Senior Vice President, Legislative Affairs, Canadian Federation of Independent Business, November 21, 2011 (1550) Canadians on the personal side and business side give up a lot less in payments than their counterparts south of the border. Through all of this debate, the one thing that we do know is that Interac has been at the heart of that low-cost, efficient payment system for a very long time. Kirkland Morris, Vice President, Enterprise Strategy, Interac Association, November 16, 2011 (1610) |

Debit cards are generally preferred by merchants over credit cards as a mode of payment for point-of-sale transactions.

Much of the popularity of Interac for point-of-sale transactions has to do with the lower merchant discount rate associated with Interac payments. According to one witness, there is a competition paradox in the debit and credit card market:

(...) they always talk about more competition. Interac has the monopoly. Funny, monopoly is cheaper than competition. It’s odd how that’s working.[70]

Regulatory structures and voluntary codes have been put in place that effectively gives Interac a debit monopoly for transactions in Canada. Online debit in Canada is extremely limited, and there is no global interoperability for Intrac debit. (...) It doesn’t have to be this way. Don Leboeuf, Vice-President and Head, Customer Delivery, MasterCard Canada, November 2, 2011 (1545) [on co-badging] I think it’s terrible. (...) The problems here is that the customer who sees the advertising: if you use this product you’ll get five points instead of one, or you’ll get points, but if you use this other products you won’t. You create the demand at the consumer level because it’s not costing them more and you’re making the middle guy pay. Diane Brisebois, President and Chief Executive Officer, Retail Council of Canada, November 16, 2011 (1725) |

Diane Brisebois (President and Chief Executive Officer, Retail Council of Canada (RCC)) also noted that even with all the improvement in technologies, costs are going up. Dan Kelly from CFIB illustrated these higher merchant fees for credit card transaction by using as an example MasterCard’s recent launch of World Elite credit cards: fees on these types of cards are approaching the 3% mark for merchants.

Terry Campbell (President and Chief Executive Officer, Canadian Bankers Association) however urged the Committee to use caution when looking at merchant fees, and when comparing credit and debit card fees for merchants. Mr. Campbell argued that credit and debit are different products; banks are extending credit when credit cards are used and, as such, a risk of default has to be priced-in. Furthermore, Mr. Campbell also pointed out that the benefits of a payment system that works well are very important for consumers, retailers and businesses alike, so one has to be careful in considering only the cost side. According to Mr. Campbell, consumers value rewards programs, and the benefits arising from high security standards.

ii. Online Transactions

As it relates specifically to e-commerce, several witnesses noted that payment options are extremely limited for online purchases. Although Interac debit cards are starting to be accepted by a greater number of merchants for online transactions, credit cards still hold a near monopoly with close to 90% of online transactions being conducted using this method of payment in 2010 in Canada.

We need to be cautious about the application of the code to new technologies. For example, if two of the provisions of the code were to apply beyond cards, to mobile payments, a customer might require three cellphones to enable three different payments of their choice -- that is one for Visa credit, one for Interac, and one for Visa debit. Michael Bradley, Head of Products, Visa Canada, November 2, 2011 (1535) |

With respect to competition in the debit card industry, on the one hand, network operators such as MasterCard and Visa would like to get into the debit card market and be allowed to compete head-to-head with Interac on the same card (so-called “co-badging”). On the other hand, CFIB and the RCC are adamantly opposed to such a move as they are afraid that this would result in higher fees for debit transaction for merchants. In this regard, representatives of CFIB expressed support for the Voluntary Code of Conduct (VCC) for the debit and credit card industry in Canada. Although Visa and MasterCard were generally supportive of the VCC, they indicated that debit card co-badging should be allowed under the code. As per Visa and MasterCard’s assertions, this would promote competition and give consumers more choice. Visa and MasterCard suggested that VCC limitations on debit card co-badging prohibit them from competing head-to-head with Interac for point-of-sale and online transactions. In written correspondence to the Committee, MasterCard further stated: “when considering the state of e-commerce in Canada, the Committee cannot overlook the fact that Canada continues to lag behind the rest of the world in online debit because of specific merchant lobbying to protect Interac.”[71]

It should be noted that all witnesses, despite sometimes having specific reservations about particular clauses of the VCC in its current form, expressed high praise for the Government of Canada’s VCC initiative. Although the VCC, as its name indicates, is voluntary and largely stakeholder-led, it is nevertheless supplemented by legislation:

It is a voluntary code but it is back-stopped by the Payment Card Network Act, which the Minister of Finance can put in legislation. So we treat the voluntary code quite seriously and we want to adhere to it.[72]

Witnesses also noted the work on some of these complex issues by the Task Force for the Payments System Review, which was launched by the Minister of Finance in June 2010 (see Appendix A). The task force presented the Minister with their final report, entitled Moving Canada into the Digital Age, in December 2011.[73]

iii. Point-of-Sale Mobile Phone Payments

(...) Many small businesses are afraid of this, because they’ve seen the abuse that the Visa and MasterCard have imposed on small and medium-sized firms over the last number of years. We’re very open to and interested in how this is all going to roll out. (...) Our concern was about the attempt of Visa and MasterCard to piggyback on Interac’s debit card network across Canada, to use it essentially to expand its marketplace. Dan Kelly, Senior Vice-President, Legislative Affairs, Canadian Federation of Independent Business, November 21, 2011 (1600 and 1700) |

As mentioned during the Committee hearings, point of sale “tap-and-go” payment methods (also known as “contactless payment”), using near-field communication technology are being rolled out quickly in Canada. Currently, “tap-and-go” is mostly used with a chip-enabled credit card (such as MasterCard or Visa). One of the advantages of this technology is that it is versatile and could be used with a mobile phone acting as a substitute for traditional credit cards (“tap-and-go” mobile phone payment). Since several payment products could reside on the same phone, this raises the question of how to treat co-badging in the context of mobile payments.

An alternate to the “tap and go” near-field communication point of sale payment methods has also been introduced to the Canadian market. Paypal’s “Here” system uses a triangle-shaped card reader that plugs directly into mobile devices allowing consumers to make purchases directly at the point of sale. The card reader itself is free for merchants, while the fees associated with payment adhere to Paypal’s fixed cost structure.

Representatives of credit card companies who appeared before the Committee pointed out that it would make no sense to have one mobile phone for each type of payment; conversely, the CFIB indicated that infrastructure changes can be made to comply with the code of conduct that would still allow the adoption of mobile technologies.[74] CFIB further pointed out that they “are not suggesting for a second that anyone needs to carry with them multiple different cellphones to be able to make different types of payments.”[75]

4. OPPORTUNITIES: THE PROMISE OF E-COMMERCE

The most prominent and compelling model to emerge is cloud computing. In very simple terms, cloud computing is a new model for accessing and delivering information technology and business services. Its relevance to policy is its potential to reduce the opportunity cost of investing in technology. Cloud computing helps to reduce costs, complexity, and management resources—several of the conventional barriers to IT adoption and use by SMEs. Chris Paterson, Director, Government Programs, IBM Canada, October 24, 2011 (1545) |

Though Canadian businesses may face obstacles to succeeding in e‑commerce, it also offers them tremendous opportunities. An effective e-commerce platform can render anyone in the world with an internet connection and the ability to access postal services a potential customer. In fact, for some services (such as online entertainment and the provision of information), businesses do not produce anything that requires shipping. This ability to reach customers beyond Canada’s borders helps businesses alleviate the challenges associated with operating in a relatively small domestic marketplace.

Not only can e-commerce be used by Canadian businesses to expand their global footprint, but it can also be used to target niche markets. Indeed, for a traditional “bricks-and-mortar” store, the market for a niche product is often too small within a given geographical area to offer an attractive opportunity. E-commerce may make this opportunity enticing to the extent that niche markets could be scaled up across geographical areas.

By taking advantage of low-cost outsourcing options for web hosting and site design services as well as “off-the-shelf” applications, a firm could also increase its profit margin through e-commerce since existing overhead costs could be spread over a greater volume of sales.

It is important to note that E-commerce in not just about selling things online to internet customers; it is about using ICT and integrating “e-business” strategies with business practices to become more efficient. The BDC web site offers Canadian businesses information and access to services to help companies understand the vast potential of e-commerce, as well as how better to capitalize on it.[76] For example, BDC explains the potential benefits of employing Customer Relationship Management (CRM) systems to better understand the needs and patterns of a business’s clients.[77] Though CRM is not limited to e-businesses, the very nature of online/network enabled commerce requires the sharing of customer information with the business (contact information, preferred products, price sensitivity, spending patterns, etc.). Consequently, businesses can use this information to better understand their customer base, as well as to help gauge the market at large; in turn, firms can then tailor their business practices to better align with market demand, which can lead to increased sales.

(...) e-commerce has also dramatically changed the way products are brought into the market. Today companies are able to develop, design, test, market, and sell all manner of consumer products using e-commerce tools and tie various global supply chains together virtually. For example, cars and trucks—which a decade ago took five to seven years to bring to market—are now being brought to the showroom floor in two to three years. Corporate R and D, while still centrally controlled, is now conducted throughout various portals globally. The process, including tying suppliers and sub-assembly contractors, and R and D and design with product testing, can be completed almost entirely virtually and 24/7 with offices around the globe. Mathew Wilson, Vice-President, National Policy, Canadian Manufacturers and Exporters, October 17, 2011 (1540) |

The potential benefits of e-commerce are not limited to a business’s revenue-generating operations (sales, marketing, consumer access, etc.), but can also be realized in relation to its cost-generating internal processes. According to the OECD,

ICT and e-commerce offer benefits for a wide range of business processes. At firm level, ICT and its applications can make communication within the firm faster and make the management of the firm’s resources more efficient. Seamless transfer of information through shared electronic files and networked computers increases the efficiency of business processes such as documentation, data processing and other back-office functions.[78]

The opportunity to save both time and money is one of the many positives for Canadian businesses investing in e-commerce and ICT. Furthermore, such potential can be applied to the earlier stages of a firm’s supply-chain management, were firms willing to integrate e-commerce with suppliers and business partners. The OECD states the following on this subject,

At inter-firm level, the Internet and e-commerce have great potential for reducing transaction costs and increasing the speed and reliability of transactions. They can also reduce inefficiencies resulting from lack of co-ordination between firms in the value chain. Internet-based B2B interaction and real-time communication can reduce information asymmetries between buyers and suppliers and build closer relationships among trading partners. In fact, adopters of e-commerce tend to reduce transaction costs, increase transaction speed and reliability, and extract maximum value from transactions in their value chains.[79]

Overall, the effective use of technology and networks can help a business reduce costs, improve efficiency, ultimately leading to increased productivity. In fact, studies have shown that, in general, adopters of e-business strategies have experienced “the positive impacts of e-commerce on their turnover and profitability and to a lesser extent on employment, most notably when e-commerce is part of larger business strategies of firms.”[80]

Ultimately, a business chooses a particular strategy and corresponding business practices after having considered both their costs and benefits. A decision on whether to employ an e-commerce platform is no different. In fact, the OECD report on e-commerce states that “most SMEs will not adopt e-commerce if the benefits do not outweigh the costs of developing and maintaining the system. The issue is costs relative to benefits expected, not cost itself.”[81] It becomes clear, therefore, that the better a business can identify and calculate the potential benefits of e-commerce, the more encouraged it will be to use it.

5. THE COMMITTEE’S PERSPECTIVE: RECOMMENDATIONS TO THE GOVERNMENT OF CANADA

During the course of this study, the Committee learned of the potential benefits of e-commerce, as well as some of the key obstacles that hinder its advancement in Canada. On the basis of its study, the Committee makes the following recommendations to the Government of Canada.

RECOMMENDATION 1

The Committee recommends that the Government of Canada place an emphasis on e-commerce in its forthcoming digital economy strategy.

RECOMMENDATION 2

The Committee recommends that the Government of Canada work with industry to modernize payments systems to ensure an efficient, fair, safe, competitive and world-leading payments system in Canada.

RECOMMENDATION 3

The Committee recommends that the Government of Canada work with industry to increase the affordability, reliability and speed of broadband internet available to Canadians.

RECOMMENDATION 4

The Committee recommends that the Government of Canada examine ways to reduce “red tape” and costs of cross-border business and shipping for businesses and consumers.

RECOMMENDATION 5

The Committee recommends that the Government of Canada examine ways to increase disclosure and transparency related to all costs associated with e-commerce, including cross-border transactions, with a view to ensuring that businesses and consumers are aware of the total costs prior to purchase.

RECOMMENDATION 6

The Committee recommends that the Business Development Bank of Canada make information and communications technology adoption a strategic focus.

RECOMMENDATION 7

The Committee recommends that the Government of Canada take the necessary measures to bring the Fighting Internet and Wireless Spam Act into force, which will help to increase consumer confidence in the e-marketplace.

RECOMMENDATION 8

The Committee recommends that the Government of Canada work with the provinces and industry to develop strategies to meet the skilled workers shortage in information and communication technology industries.

RECOMMENDATION 9

The Committee recommends that the Government of Canada act on the recommendation from the R&D Review panel, led by Tom Jenkins, to provide an easily accessible directory or service containing all government programs related to innovation and R&D to help firms access the tools and support they need to increase innovation and adopt ICT.

RECOMMENDATION 10

The Committee recommends that, given the importance of internet connectivity for businesses, the Government of Canada work with Internet service providers to ensure and promote the availability of 24/7 technical support to their clients to ensure their services are functioning as required, and to ensure that clients have transparent and up-to-date access to their account information.

RECOMMENDATION 11

The Committee recommends that the Government of Canada examine ways to increase the quality of information available regarding ICT adoption and use by Canadian SMEs, and the business impact of such adoption and use.

RECOMMENDATION 12

The Committee recommends that the Government of Canada ensure that with regard to online, mobile, and other emerging transaction technologies, consumers and retailers are suitably protected by a code of conduct.

RECOMMENDATION 13

The Committee recommends that the Government of Canada become a “model user” of e-commerce and online solutions in its procurement practices and delivery of services to Canadians.

RECOMMENDATION 14

The Committee recommends that the Government of Canada ensure that its information technology systems, along with the personal and private information of Canadians held therein, are secure from potential security threats to avoid lengthy shutdowns of Government of Canada online services.

RECOMMENDATION 15

The Committee recommends that the Government of Canada work with industry and consumer groups to examine ways to address digital literacy by simplifying the terms and conditions for e-commerce transactions, including making the language of these service agreements more clear for consumers to understand.

RECOMMENDATION 16

The Committee recommends that the Government of Canada take the view that financial literacy and digital literacy are intertwined due to the widespread adoption of electronic and mobile payments systems.

During the course of this study, several Committee members and witnesses referenced various panel reports and federal government programs that have the potential to affect e-commerce in Canada. This Appendix provides a summary of some of these initiatives.

1. REPORT OF THE EXPERT REVIEW PANEL ON FEDERAL SUPPORT TO RESEARCH AND DEVELOPMENT

In the fall of 2010, the Government of Canada tasked Tom Jenkins to chair a panel of experts whose mandate was to “provide recommendations on maximizing the effect of federal programs that contribute to innovation and create economic opportunities for business.”[82] Moreover, the panel was not to devise recommendations that affected federal funding levels or currently regulated federal research requirements.

On October 17, 2011 the panel presented Innovation Canada: A Call to Action (a.k.a. the “Jenkins Report”) which provided several key recommendations aimed at advancing Canada’s position as an innovation leader, namely:[83]

- Create the Industrial Research and Innovation Council (IRIC), thus converging about 60 federal business innovation programs (currently managed by 17 departments) into one common point of delivery. This is known as the service “concierge” model.

- Simplification of the Scientific Research and Experimental Development (SR&ED) program and basing it on labour expenses only to encourage more SMEs to use the program, which will in turn, encourage investment.

- Make business innovation one of the core objectives of procurement. The federal government must leverage the $15 billion[84] it spends annually on procurement by integrating innovation as part of contract requirements.

- Transform the National Research Council (NRC) into several large, focused non-profit centers which would each collaborate with businesses, universities, and the provinces. Also, delegate the currently mandated public policy-driven operations (such as metrology) to appropriate departments.

- Provide innovative, high-growth firms access to venture capital through additional funding of the Business Development Bank of Canada (BDC) to help stem the tide of foreign investors transferring the benefits of Canadian innovation out of Canada.

- Establish a clear innovation champion in the executive branch who can be the federal voice in cabinet for innovation, and who can better liaise with the provinces to improve coordination of innovation-oriented programs and services.

It should be noted that many of these recommendations were addressed in Budget 2012, which included measures for a NRC concierge service to assist SMEs; new venture capital funding for BDC; and changes to the SR&ED program (addressed further in this appendix).[85]

2. COUNCIL OF CANADIAN ACADEMIES (CCA): REPORT OF THE EXPERT PANEL ON BUSINESS INNOVATION[86]

The CCA is a government-funded independent organization with a mandate to provide assessments about scientific research (including the natural, social and health sciences as well as engineering and the humanities) by expert panels.[87] In 2007, the Expert Panel on Business Innovation began a study requested by the Minister of Industry to examine why Canada was falling behind other developed nations with regard to business innovation. In June 2009, the panel presented the Government their final report entitled Innovation and Business Strategy: Why Canada Falls Short. The following is a summary of that report.

The panel defined “innovation” as “new or better ways of doing valued things,”[88] and stated it is “the key driver of labour productivity growth (increased output per hour worked) and the main source of national prosperity.”[89] As such, the panel studied innovation as an economic process rather than just research and development.

- Poor business innovation is a strong contributor to Canada’s lagging productivity growth. Canada also lags in terms of business investment in R&D, machinery and equipment, and in particular, ICT.

- Innovation as a key business strategy is driven by several factors, such as “(i) particular characteristics of the firm’s sector; (ii) the state of competition; (iii) the climate for new ventures; (iv) public policies that encourage or inhibit innovation; and (v) business ambition (i.e., entrepreneurial aggressiveness and growth orientation). The relative importance of these factors will vary from sector to sector and over the life cycle of individual firms.”[90]

- Key to understanding Canada’s position are two underlying factors:

- Canada is often “upstream” in the value chain — this is true of many resource rich economies that obtain and process raw materials for later use in value-added activities, like manufacturing. Consequently, Canada does not have sufficient presence in the part of the process where innovation can have more impact (e.g. development of new products, etc.)

- Canada’s small domestic market and large geography do not create a strong enough incentive for businesses to invest in innovation.

- Industry “clusters” are usually defined as geographic areas with a strong concentration of like-minded stakeholders. Waterloo, Ontario, for example, is a good example of a strong ICT cluster. Clusters encourage innovation given they help foster collaboration, as well as competition. Canada does not have enough clusters, and needs to do more to create a climate to encourage clusters.

- Canada must do more to create a climate that encourages both new venture financing and commercialization of innovation (particularly university research)

- While Canada has done well in supporting researchers and the creators of knowledge, more must be done to strengthen managerial capacity through better training of business managers.

3. OFFICE OF CONSUMERS AFFAIRS: MOBILE COMMERCE — NEW EXPERIENCES, EMERGING CONSUMER ISSUES[91]

The following is a summary of a report published in Consumer Trends Update, Winter 2010 by Industry Canada’s Office of Consumer Affairs. Entitled “Mobile Commerce — New Experiences, Emerging Consumer Issues,” the report defined “mobile commerce” as “business-to-consumer commercial activities conducted via a mobile device.” According to the report:

- Canadians are increasingly using cell phones and smart phones, though it is primarily through the latter that the more robust mobile commerce applications take place. After a slow start, Canada is beginning to see growth in mobile commerce. However, this new type of business activity must be governed by sound rules of consumer protection, especially in light of the fact that many Canadian minors have their own mobile devices.

- Canadians are using text messaging as a payment option for premium content features like ringtones, chatting on dating sites, horoscopes and sports updates, and voting on requested feedback for television shows. Canada is well behind global leaders in mobile banking, which are generally found to be countries in Asia. Mobile payments may offer consumers and businesses efficiencies which may lead to productivity gains.

- Mobile marketing and in particular, location-based services, or LBS, (which direct users to nearby restaurants, cinemas, retail outlets, etc.) are rapidly growing areas; for example, LBS in North America could be worth $3 billion in 2010.

4. PAYMENT SYSTEM REVIEW

On June 18, 2011, the Minister of Finance (Hon. Jim Flaherty) announced the launch of the Task Force for the Payments System Review.[92] Chaired by Dr. Patricia Meredith, the task force presented the Minister with its final report, entitled Moving Canada into the Digital Age, in December, 2011.[93]

5. CANADA REVENUE AGENCY (CRA) — SCIENTIFIC RESEARCH & EXPERIMENTAL DEVELOPMENT TAX CREDIT PROGRAM (SR&ED) *

Many members and witnesses also made reference to the SR&ED tax credit program, the Government of Canada’s main tax credit program to encourage business investment in scientific R&D. Through the CRA, this program supports Canadian businesses that conduct eligible R&D in Canada.[94] Annually, SR&ED provides $4 billion in investment tax credits to over 18,000 claimants (75% of which are SMEs).[95]

The program is intended for Canadian-controlled private corporations (CCPCs), who can earn an investment tax credit of 35% up to the first $3 million of eligible expenditures, and 20% on any excess amount. The tax credit is 20% of eligible expenditures for other types of businesses (other Canadian corporations, proprietorships, partnerships, and trusts).

Eligible and ineligible activities under the SR&ED program are:[96]

Eligible Activities:

- “experimental development to achieve technological advancement to create new materials, devices, products, or processes, or improve existing ones;

- applied research to advance scientific knowledge with a specific practical application in view;

- basic research to advance scientific knowledge without a specific practical application in view; and

- support work in engineering, design, operations research, mathematical analysis, computer programming, data collection, testing, or psychological research, but only if the work is commensurate with, and directly supports, the eligible experimental development, or applied or basic research.

Ineligible Activities:

- social science and humanities research;

- commercial production of a new or improved material, device, or product, or the commercial use of a new or improved process;

- style changes;

- market research or sales promotion;

- quality control or routine testing of materials, devices, products, or processes;

- routine data collection;

- prospecting, exploring, or drilling for or producing minerals, petroleum, or natural gas; and

- development based solely on design or routine engineering practice.”

* Budget 2012, tabled by the Minister of Finance on March 29, 2012, proposed the following changes to the SR&ED program:[97]

- The removal of capital expenditures from the base of eligible expenses incurred in 2014 and beyond.

- The reduction of the general SR&ED investment tax credit rate from 20% to 15%, effective January 1, 2014.

- An investment of $4 million in 2012–13 and $2 million in 2013–14 for CRA to implement program administration improvements.

6. INDUSTRY CANADA — SMALL BUSINESS INTERNSHIP PROGRAM (SBIP)[98]

The SBIP helps connect IT students and SMEs who wish to enhance their e-business capability. The program provides eligible SMEs 75% of a student’s wage, to a maximum of $10,000; up to 400 interns are expected to be placed through this program per year. The program will operate with a $17.5 million budget over four years (2010 to 2014).[99]

7. NATIONAL RESEARCH COUNCIL CANADA — INDUSTRIAL RESEARCH ASSISTANCE PROGRAM (IRAP)[100]

IRAP has been supporting research done by Canadian SMEs for decades through financial assistance at all stages of the innovation process. “IRAP helps small and medium-sized enterprises understand the technology issues and opportunities and provides linkages to the best expertise in Canada.” For 2010-2011, the program had planned spending of $187 million.[101] Budget 2012 proposed an additional $110 million per year for IRAP.[102]

IRAP is also the federal program responsible for the Digital Technology Adoption Pilot Program (DTAPP) which will run from October 2011 to March 31, 2014.[103] Through funding announced in Budget 2011 ($80 million over three years[104]), DTAPP has the goal of improving the level of ICT adoption for Canadian SMEs. The program specifically aims to do the following:

- “improve the rate of digital technology adoption by SMEs

- improve understanding of the link between digital technologies and productivity

- raise awareness of the benefits and importance of adopting these technologies”[105]

8. BUSINESS DEVELOPMENT BANK OF CANADA (BDC) — ICT SOLUTIONS[106]

For over 65 years, the BDC has been providing support to SMEs through “tailored financing, venture capital, and consulting services.”[107] BDC offers several services to help SMEs better understand, acquire, and use ICT, specifically:

- ICT Essentials — Provides training and personalized coaching to help SMEs better understand ICT and how it can benefit their businesses. The programs are usually conducted over four half days, plus online learning tools, for a cost of $3,900.

- ICT Diagnostic — Provides an analysis of an SME’s business processes and how current and/or proposed ICT can improve efficiencies and performance.

- Internet Consulting Services — Provides two type of value added consulting services: Web Diagnostic (to help improve how an SME uses their web site) and Internet Strategy (to help improve overall web and e-commerce).

- System Selection Support — Provides advice on how to select the most suitable ICT for an SME’s specific operating requirements and business sector.

- ICT Financing — BDC financing for use in the procurement of ICT. New clients can apply to one of two streams, depending if they require more or less than $50,000.

9. BROADBAND CANADA: CONNECTING RURAL CANADIANS[108]

As part of Canada’s Economic Action Plan, the Government of Canada allocated $225 million for Industry Canada to help improve broadband Internet availability in underserved areas of Canada. The largest component of this endeavour is Broadband Canada: Connecting Rural Canadians, which is an application-based contribution program for service providers to extend their service to underserved rural areas. Since May 2010, the program has approved 85 projects for a total funding of over $110 million; these projects aim to bring broadband internet to over 220,000 rural Canadians.[109]

10. THE NATIONAL DIGITAL STRATEGY[110]

Based on the priorities identified in the 2010 Speech from the Throne and Budget 2010, the Government of Canada began a national consultation in May 2010 to solicit input on how to return Canada to a position of global leadership in the digital economy. The findings of the consultation were presented in Improving Canada’s Digital Advantage: Strategies for Sustainable Prosperity, which outlined the following areas critical to enhancing Canada’s digital economy:[111]

- Capacity to Innovate Using Digital Technologies — How to better use digital technologies to spur innovation, which in turn will lead to improved productivity; this can be achieved through increased investment in ICT by Canadian businesses and through ensuring the online marketplace is safe.

- Building a World-Class Digital Infrastructure — How to ensure that Canada is a leader in ICT investment and deployment, which will provide the backbone of the digital economy.

- Growing the Information and Communications Technology Industry — How to ensure that Canada’s ICT industry is at the forefront of technology development and commercialization; this can be achieved through sound talent management, investment in innovation, and good public policy.

- Digital Media: Creating Canada’s Digital Content Advantage — How to ensure that Canada creates the best intellectual capital for its digital economy, by capitalizing on the investments made in the digital infrastructure.

- Building Digital Skills for Tomorrow — How to ensure that Canada does not fall behind other jurisdictions in terms of having a digitally savvy citizenry; this can be achieved by addressing the shortage of skilled workers in the ICT sector, by improving ICT skills in the workplace, and by working to reduce the level of digital illiteracy in Canada.

[1] OECD, Science, Technology and Industry Scoreboard, 2011.

[2] News Release, “Government Of Canada Launches National Consultations On A Digital Economy Strategy,” May 10, 2010, http://de-en.gc.ca/2010/05/09/news-release-may-10th-2010/.

[3] Michael Geist, Evidence, October 17, 2011, 1530, http://www.parl.gc.ca/HousePublications/Publication.aspx?DocId=5172463&Mode=1&Parl=41&Ses=1&Language=E.

[4] Statistics Canada, Table 358-0158, Canadian Internet Use Survey, Electronic commerce, electronic orders by type of payment and region.

[5] Perspectives on small business in Canada, Table A21, p.19, http://www.cfib-fcei.ca/cfib-documents/rr3231.pdf.

[6] CEFRIO, NetPME 2011: Use of ICT by Canadian SMEs - A survey of over 2,000 companies, October 2011, p.22, http://www.cefrio.qc.ca/fileadmin/documents/Publication/NetPME_2011_Use_of_ICT-angl_HW_01.pdf.

[7] Ibid, p. 22.

[8] Ibid, p.29. In the BDC survey, a high-speed connection was defined as a speed of more than 4 Megabits per second (Mbps).

[9] Ibid, p.29.

[10] Ibid, p.54.

[11] Ibid, p.56.

[12] Ibid, p.78.

[13] Ibid, p.84.

[14] Hon. Perrin Beatty, Evidence, October 19, 2011, 1535, http://www.parl.gc.ca/HousePublications/Publication.aspx?DocId=5181845&Language=E&Mode=1&Parl=41&Ses=1.