FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

|

CHAPTER 4: STRONG COMMUNITIES Strong communities are essential for both people and businesses: it is where they live and work, and strong communities enable people to have a higher quality of life, businesses to be more prosperous and a nation to be stronger. Some witnesses spoke about various issues related to communities, including infrastructure, the environment, housing, arts and culture, charities and volunteerism, rural and remote communities, and domestic safety and security. The witnesses requested …4.1 InfrastructureIt is generally believed that adequate infrastructure that is in good repair is needed in order for people, businesses and communities to thrive and the economy to prosper. Some of the Committee’s witnesses shared their thoughts about a number of aspects of the nation’s infrastructure, particularly in relation to a federal infrastructure strategy, federal infrastructure procurement policies, federal funding for municipal infrastructure, and infrastructure in specific sectors, such as transportation, communications, electricity and energy systems, and information technology for mapping. A. Federal Infrastructure Strategy

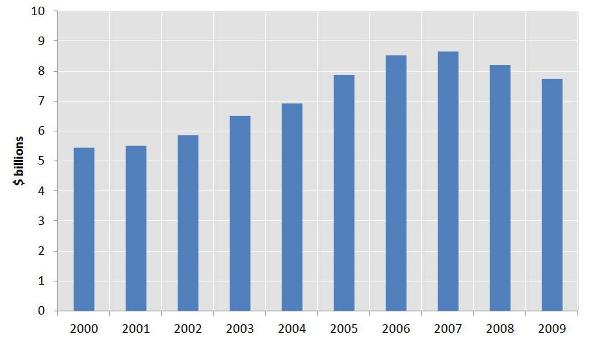

According to some witnesses, the federal government should continue to take a leadership role in the development of a national, long-term infrastructure strategy to replace the expiring Building Canada Plan and to work with the provinces, territories and municipalities to reduce the large public infrastructure deficit in Canada. They proposed a variety of measures that they believe would increase the effectiveness of a national strategy: ongoing asset management practices to assess the condition of existing infrastructure, ensuring that existing and new infrastructure can adapt to climate change, more accurate costing of infrastructure projects, realistic timetables for the completion of new projects, infrastructure investments that are publicly funded or cost-shared with the private sector, public-private partnership (P3) funding models and the imposition of tolls on new infrastructure. One witness advocated the establishment of clearly defined financial and operational roles for each level of government, consultations with the infrastructure sector and municipalities, timely completion of projects through a reduced regulatory burden, annual evaluation of progress in reducing the infrastructure deficit and elimination of the public infrastructure deficit within 20 years. B. Federal Infrastructure ProcurementOne witness informed the Committee that improved planning of individual federal infrastructure projects could occur through the use of a life-cycle analysis approach to the federal procurement process that would consider up-front and long-term maintenance costs and environmental impacts as well as societal benefits over the lifespan of the infrastructure project. Some witnesses suggested the adoption of guidelines to ensure that federal infrastructure projects are environmentally sustainable, including through a focus on enhanced energy efficiency, reduced greenhouse gas emissions and air pollution, clean water and effective waste management. One witness advocated the use of portland-limestone cement as a construction material for new federal buildings. A number of witnesses shared their view that P3 models to fund infrastructure expansion and renewal reduce the government’s costs and share the risk associated with large infrastructure projects among government and businesses. Some of the Committee’s witnesses focussed on the federal tendering process, and suggested that all applicants should be treated equally. C. Federal Funding of Municipal InfrastructureA number of the Committee’s witnesses commented on sources of federal taxes that they believe should support municipalities. Regarding the Gas Tax Fund, some witnesses suggested that the $2 billion annual cap should be indexed to inflation in order to keep pace with population and economic growth as well as to help replace aging infrastructure. Other witnesses expressed concern about raising taxes to finance indexation during this fragile economic time. One witness advocated an expanded list of eligible projects, believing that municipal administration complexes, recreation facilities, parks and sports fields should be eligible. A request was also made by one witness in relation to federal excise tax, with that witness proposing that a portion of the revenue collected in excise taxes be transferred to municipalities to fund public transit. D. Sector-Specific SupportWith Canadian commuters having some of the longest commute times in the world and in an attempt to provide more public transit options, some witnesses advocated a fund for long-term mass transit infrastructure, which they believe could be modelled on the P3 Canada Fund. One witness argued for the creation of a national public transport fund that would facilitate integration of urban development with transit systems, while another witness called for an expansion of inter-urban transit systems and to reduce the municipal costs of providing public transit. In relation to the building of roads, one witness spoke to the Committee about the requirements imposed by the Navigable Waters Protection Act, and suggested a review of the act and its definition of “navigable water.” A number of witnesses suggested that there are significant infrastructure needs across the country and that the government should work with provinces, territories and industry to identify, and explore investments in, strategic transportation infrastructure projects in order to facilitate economic development and wealth creation.

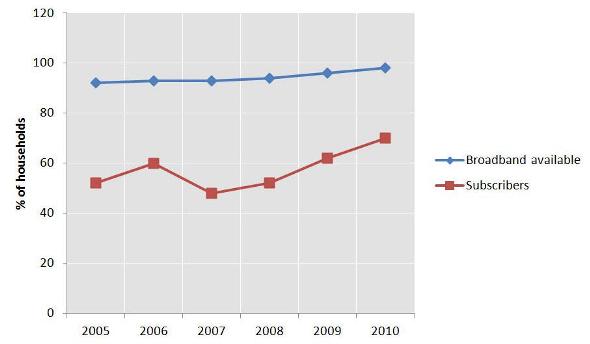

Some witnesses advocated measures designed to increase high-speed Internet and wireless communications access as well as broadband Internet speeds. For example, they suggested the creation of a national digital policy framework and a specific program to help the communications sector expand broadband networks to regions where, at present, the provision of service would not be economically feasible. In the view of one witness, direct incentives and communications initiatives could close the gap between Canada and the United States in investments in communications technology. In relation to rural and remote areas, one witness told the Committee that federal funding should be provided to network providers in Canada’s North, such as the Yukon, in order to link broadband networks there with networks in Canada’s provinces, enhance the reliability of the northern networks, and increase broadband access for individuals and businesses outside urban areas. Some witnesses spoke about government-mandated minimum levels regarding broadband access and speeds for rural and remote areas, which could be achieved through revenue obtained from future wireless spectrum auctions. In speaking about spectrum auctions, they proposed that the government should have unrestricted auctions, with successful bidders required to meet conditions regarding rural deployment. In speaking about energy-related infrastructure, one witness called for a reduction in the regulatory burden for electrical generation and transmission operators in order to address the complexity resulting from supervision of Canada’s electricity transmission network by multiple jurisdictions and associated delays in project approval. The Committee was also informed by one witness that the electricity transmission network or grid is either unreliable or non-existent in the Yukon and in northern British Columbia, and a suggestion was made by that witness for federal investments in a clean and reliable energy strategy for the Yukon, in combined heat and power systems, and in new transmission lines in northern British Columbia. The Committee was also told by one witness about the need for lower energy costs in northern and remote communities, and that witness suggested federal government support of private-sector energy initiatives. One witness highlighted the importance of water monitoring and quality for communities throughout Canada, and requested funds for a variety of purposes: to support long-term forecasting of future water availability and safety, to upgrade water and wastewater systems throughout Canada, and to help municipalities meet the new wastewater requirements under the Canada-wide Strategy for the Management of Municipal Wastewater. Another witness urged upgrades to drinking water systems in First Nations communities, while yet another witness called for improvements to the collection and management of water data. Arguing that the digitization of map information can help with emergency management, increase business productivity and create new markets, some witnesses urged the creation of a national geomatics action plan using existing funds from GeoConnections Canada and continued support for both the Geo-mapping for Energy and Minerals program and the Targeted Geoscience Initiative. In their view, the action plan would upgrade information technology infrastructure, acquire additional maps to ensure mapping of the entire nation, establish national guidelines and standards to integrate existing information, and provide a forum to share geomatic information with businesses. 4.2 EnvironmentThe environment is present in the daily lives of all individuals and businesses, and a sustainable environment is important for the long-term prosperity of Canadians. A number of witnesses identified environmental measures in relation to conservation, ecosystem rehabilitation and species recovery, conventional fuels, renewable energy and greenhouse gas emissions. A. Conservation, Ecosystem Rehabilitation and Species RecoveryThe Committee was informed by one witness about a variety of ideas designed to preserve ecologically sensitive Aboriginal lands in northern Canada. For example, suggestions were made by one witness for the federal government to broaden the terms of reference for the Comprehensive Community Planning program and increase funding for regional land-use planning by Aboriginal Canadians so that they are able to work with the provinces and territories on land-use planning in relation to traditional lands. In an effort to conserve Canada’s boreal forests, one witness said that the federal government should support the Canadian Boreal Forest Agreement (CBFA) through investments in the CBFA Secretariat and related Aboriginal and First Nations institutions. One witness spoke to the Committee about the need to improve the health of the Great Lakes St. Lawrence Seaway through increased funding for the implementation of the Great Lakes Water Quality Agreement, environmental monitoring, and the development of an invasive species and climate change impact strategy. Some witnesses mentioned that other aquatic environments require rehabilitation, and supported increased funding for the Lake Winnipeg Basin Stewardship Fund and for implementation of the Northwest Territories Water Stewardship Strategy. As well, some witnesses presented their views on measures to prevent wildlife species from becoming extinct and to help in the recovery of species currently at risk. One witness supported an extension of funding for the federal species at risk strategy for another five years so that action plans could be implemented and Canada could meet the requirements of the Convention on Biological Diversity. Another witness made suggestions about the improvement of salmon stocks and their habitats in Canada, with specific requests for continued federal financial support for the Salmonid Enhancement Program and salmon conservation facilities, and for investments to restore the Strait of Georgia ecosystem in British Columbia. B. Conventional FuelsA number of witnesses expressed opinions on the federal support that should be given to the conventional fuel extraction industry. One witness advocated amending the current Canadian exploration expense guidelines to allow companies to deduct costs associated with government requirements, while other witnesses requested that the Canadian exploration expense and the Canadian development expense be aligned with normal depreciation rates in order to reduce the tax incentives available to the conventional fuel extraction sector. Some witnesses expressed their views on the implementation of a carbon tax. A number of witnesses supported the implementation of such a tax, while other witnesses did not. C. Renewable EnergyOne witness spoke to the Committee about the need for increased awareness and education regarding energy efficiency and environmental impacts of consumer behaviour, and proposed the creation of a fund to assist small and medium-sized not-for-profit organizations in creating environmental awareness programs. Another witness urged the development of federal education programs modelled on the Energy Star program to promote environmentally responsible consumer behaviour. To increase investments in renewable energy technologies, some witnesses urged continuation of the ecoEnergy for Renewable Power program, the implementation of a national green homes strategy and the creation of green bonds with government-guaranteed returns that would be marketed by Canadian financial institutions. Solar energy was also identified by a number of the Committee’s witnesses as requiring federal support. One witness requested the establishment of a national solar industry association that would facilitate investments and education in solar energy, develop and administer Canadian solar energy technology standards and codes, and promote P3 models to increase investment. Another witness suggested the creation of an investment tax credit for solar energy technologies. D. Greenhouse Gas EmissionsOne witness spoke to the Committee about the regulation of greenhouse gas emissions, and suggested an alignment of Canada’s regulations with those of the United States in order to prevent trade disruptions as well as federal consultations with the provinces and industry stakeholders, with a view to creating a national greenhouse gas management system consistent with international approaches. Regarding clean energy and renewable resources, one witness encouraged the creation of a refundable investment tax credit that would support clean energy technology, while some witnesses called for federal identification of effective policy measures to increase the use of renewable resources in the manufacture of goods. The transportation sector, notably vehicles, was a concern of some witnesses. Each witness made a suggestion designed to increase the use of cleaner fuels: maintain the excise tax exemption for natural gas fuel purchased for vehicular use, develop fiscal measures to encourage sustainable transportation, examine incentives to increase the adoption of natural gas, develop a strategy to promote a variety of clean fuels, create tax credits in relation to the use of alternative fuels, provide a tax credit in relation to the purchase of propane-powered vehicles and the construction of propane refuelling infrastructure, and create a tax credit for the commercialization of bio-fuels. One witness mentioned that the use of vehicles powered by electricity and natural gas should be promoted, and suggested the implementation of an electric and natural gas vehicle incentive program for purchasers as well as a requirement that a portion of the federal fleet of vehicles operate using electricity. To increase the adoption of electric vehicles, that witness urged the harmonization of codes and standards within North America, and federal funding of a portion of the installation costs associated with electric automobile charging stations. In order to ensure fairness for vehicle manufacturers that have increased the fuel efficiency of their vehicles, another witness called for elimination of the Green Levy. To help developing countries meet climate change and emission objectives, and to address climate impacts on vulnerable populations, one witness advocated federal financial support for international aid initiatives. 4.3 HousingA number of witnesses shared their thoughts about the availability of affordable and accessible housing, house prices in Canada, and some issues related to home renovations. A. Availability of Affordable Housing and Housing that is Accessible to Persons with DisabilitiesSome witnesses encouraged the federal government to establish a national housing strategy to address a variety of socio-economic problems, with certain witnesses suggesting that the strategy focus specifically on the vulnerable as well as the needs of women and Aboriginal Canadians. A number of witnesses stressed the need for additional rental properties across Canada, which would both stimulate economic activity and assist low-income individuals in meeting their housing needs. To encourage the construction of rental properties, they proposed that those who purchase buildings intended for rental housing should be exempt from paying the GST/HST, and that capital gains taxation on rental property sold by an individual taxpayer should be deferred in situations where the proceeds from the sale are used to purchase another rental property, perhaps with a requirement that the property be of higher value. One witness proposed that the government should increase funding for the Homelessness Partnership Strategy and create a national housing fund that would support investments in new affordable housing, while another witness urged the Canada Mortgage and Housing Corporation to prioritize developments that provide affordable housing to Canadians and provide insurance products that support housing affordability. One witness supported enhancements to the Home Buyers’ Plan and proposed a modification to the First Time Home Buyers Tax Credit that would provide incentives to increase housing accessibility for individuals who are eligible for the Credit for Physical and Mental Impairment. B. House PricesA number of witnesses informed the Committee that the average house price in Canada has nearly doubled in the past two decades, and expressed their concern that – in certain parts of the country – purchasing a home is becoming unattainable for the average Canadian family. In an effort to ensure that certain government programs take increases in house prices into account, one witness suggested that the GST/HST New Housing Rebate thresholds should be adjusted in accordance with changes in a measure of average house prices, and another witness stated that the amount that can be withdrawn under the Home Buyers Plan should be indexed to changes in the Consumer Price Index (CPI). One witness suggested that the First Time Home Buyers Tax Credit should be restricted to newly constructed homes with an appraised value below the average real estate prices in the locality and to home purchasers with incomes below the local median household income. Another witness proposed that the federal government should create a single house price threshold below which the GST/HST would be applied to the purchase price at a lower rate, with the difference in taxes paid at the lower rate and taxes paid at the unreduced GST/HST rates serving as a tax rebate, and above which the unreduced GST/HST rate would be applied to the purchase price but the rebate would equal the amount of the rebate at the threshold. C. Home RenovationsIn order to mitigate the impact of the introduction of the GST on home renovations and decrease the use of contractors not registered with the CRA for GST purposes, one witness argued for a GST rebate on home renovations, while another witness supported a requirement that all small businesses register for a business number with the CRA. Yet another witness proposed that the government should explore funding for renovations to social housing. 4.4 Arts and CultureArts and culture are important contributors to a society, enhancing individuals’ quality of life, making communities with such amenities attractive to people and businesses alike, and adding to a country’s gross domestic product. Some witnesses provided their suggestions about a variety of subjects related to arts and culture, including existing funds, credits and institutions, proposed funds and credits, and domestic and international marketing of arts, culture and tourism. A. Existing Funds, Credits and InstitutionsA number of the Committee’s witnesses proposed measures in relation to existing credits that assist arts and culture. For example, they spoke about the need for changes to the Canadian Film or Video Production Tax Credit, and proposed changes that were supported by one witness each: an increase in the credit’s rate and the inclusion of labour costs associated with the production of digital content and costs associated with post-production activities; modification of the rules to provide theatrical productions with a larger credit; and extending eligibility to Web series and a broader range of costs. Some witnesses called for the ability to include relevant non-labour costs and for the measure to apply to all audiovisual content, whether destined for cinema, television, online or mobile devices. The Committee also heard requests for support of existing funds and programs. For example, some witnesses urged an increase in, and indexation of, the Canada Media Fund’s budget, while one witness proposed expanding the mandate of the fund to include support for research and development in the audiovisual industry. Regarding other audiovisual funds and organizations, some witnesses proposed an increase in funding for the Canada Council for the Arts, the Canadian Broadcasting Corporation, the National Film Board and Telefilm Canada. A number of proposals were supported by one witness in each case, including: an increase in the budget of the Canada Feature Film Fund, an increase in funding for the Telefilm Theatrical Documentary Fund, permanent funding for the Telefilm Theatrical Documentary Fund, separate funding for the Theatrical Documentary Program, and funding for Young Canada Works at Building Careers in Heritage internship and the Young Canada Works in Heritage Organizations program. Regarding Canadian Heritage, some witnesses suggested that funding should be continued, while one witness encouraged support for Canadian Heritage programs that would ensure access to arts and culture for all Canadians and another witness supported federal investments to develop and maintain cultural infrastructure. Noting that the Museums Assistance Program is delivered through a variety of programs administered by Canadian Heritage and that additional funds to museums are allocated from other federal departments, programs and agencies, one witness argued that these funding sources should be consolidated in order to improve efficiency. A number of the Committee’s witnesses commented on French arts and culture, and made suggestions designed to support Canada’s linguistic diversity. For example, one witness urged the federal government to maintain its support for the Canadian Broadcasting Corporation/Radio-Canada, with part of its funding invested in the development of the arts and culture of the Canadian francophonie; this measure would facilitate a federal commitment to the long-term vitality of the arts and culture of the Canadian francophonie while promoting access to arts and culture for all Canadians through Canadian Heritage’s official languages support programs. Some witnesses spoke about renewal of the Roadmap for Canada’s Linguistic Duality, with the addition of an arts and culture component to the roadmap and improved bilingual services. A number of the Committee’s witnesses advocated reduced funding for particular arts and culture activities and groups. One witness mentioned Telefilm Canada, the Canada Council for the Arts and the National Film Board. B. Proposed Funds and CreditsA number of the Committee’s witnesses spoke about a variety of forms of media, including digital and interactive media as well as sound recording. Proposals that were supported by one witness in each case included: the need for incentives to encourage private investment in the audiovisual industry, the need for incentives for private investment in television and digital media production, the need for high-quality, professional arts training to support creativity and artistic innovation, and the need for programs and resources within the Canada Council for the Arts and Canadian Heritage to enable artists and cultural workers to meet the challenges of the digital economy. In addition, some witnesses proposed a permanent funding program for major festivals and events in small and large communities throughout Canada managed by Industry Canada. Proposals supported by one witness in each case were also made, including in respect of: a matching donation program to support Canadian museums as well as the establishment of a creative spaces children and youth infrastructure fund, a children and youth arts engagement fund, a youth arts training fund, a digital cultural fund and a creative industries investment fund. In order to fund the future operational and programming activities of Canada’s Sports Hall of Fame, one of the Committee’s witnesses identified the need to support a partnership between Canada’s Sports Hall of Fame and the federal government through Sport Canada. Other witnesses encouraged federal development of Canadian sport institutes. Other suggestions that were supported by one witness in each case included proposals in relation to funding for skills acquisition and training through apprenticeships, access by book publishers to federal programs that support the production and distribution of digital content, reading programs for new Canadians, Aboriginal communities and others, and incentives for advertisers to support Canadian websites that feature Canadian context. C. Domestic and International Marketing of Arts, Culture and TourismA number of the Committee’s witnesses urged the federal government to integrate arts and culture more fully into foreign policy initiatives, and proposed funding and programs for domestic and international touring by Canadian artists, for the development of foreign markets for Canadian arts and culture creators, institutions and industries, perhaps through international promotion assistance programs, and for cross-country and foreign exchange opportunities. They also supported re-evaluation of the funding model for the Canadian Tourism Commission and a competitive and stable funding base for it. One witness highlighted international co-production, with a proposal for the creation of a co-production fund with countries with which Canada has negotiated official treaties as well as the need for funding for a new export development program to encourage growth in the Canadian media production sector. With a view to supporting tourism, some witnesses expressed the need for enhanced funding for agencies and organizations that affect tourism, such as the Atlantic Canada Opportunities Agency, Western Economic Diversification Canada, Parks Canada and the Canadian Tourism Human Resource Council. The Committee also heard proposals that were supported by one witness in each case, including: the importance of facilitating cross-border tourism, which could require changes in customs regulations; the need to position recreational boating as the focus of national tourism strategies; and the need for federal involvement in a cost-shared plan to promote, study and expand networks of trails as well as infrastructure investments in trails that have national and regional significance, with Canada’s trails promoted locally and internationally. 4.5 Charities and the Volunteer SectorCharitable organizations and volunteers contribute to the well-being of people and the strength of communities by providing philanthropic, educational, religious and other services. A number of witnesses shared their views about tax incentives for charitable giving, financial, educational and other federal supports for charities and volunteers, measures that would improve the efficiency of the administrative requirements to which charities are subject, and foreign charitable giving in the form of foreign aid. A. Tax Incentives

Some witnesses spoke to the Committee about measures that they feel would benefit charitable and not-for-profit organizations, through either increased donations or a reduced administrative burden. One measure advocated by them was a “stretch” tax credit, which would apply to amounts that exceed a donor’s previous highest level of giving and would provide an additional 10% credit for donations exceeding the previous highest level, up to an annual donation limit of $10,000; two variations were suggested: with the first variation, the proposed measure would apply only to amounts exceeding the threshold of $200, while no such constraint would exist with the second variation. A number of witnesses supported the elimination of capital gains taxes on gifts of private company shares and real estate, subject to certain requirements: the charity would not issue a tax receipt to the donor until receiving the cash proceeds from the sale of the asset; and, if the purchaser of the asset is not at arm’s length from the donor, the charity would need to obtain two independent, professional appraisals to confirm that the charity is receiving fair market value for the sale of the asset. Some witnesses argued that the federal government should review Income Tax Act provisions that prohibit limited partnerships as investments for private foundations. Other proposals supported by one witness each included: defining charitable remainder trusts as gifting vehicles for purposes of the Income Tax Act, increasing the value of the charitable tax credit beyond certain donation thresholds and/or creating additional thresholds, developing measures to encourage overseas volunteer activities, and ensuring the ability to hear appeals of charitable status registration or revocation in the Tax Court at the initial stage. B. Financial, Educational and Other Supports for CharitiesA number of the Committee’s witnesses requested new and/or enhanced financial support for charities and other not-for-profit organizations. Some witnesses argued that charitable and not-for-profit organizations would benefit from collaboration with, and information from, other sectors of the economy, and urged the government to explore ways to foster collaboration among the private, not-for-profit, government and academic sectors. Suggestions that were supported by one witness each were made in relation to access to federal business development and capacity-building services and designation of November 15 as National Philanthropy Day on a permanent basis in order to recognize the contributions made by charitable organizations and volunteers. C. Administrative RequirementsA number of witnesses informed the Committee that the government should reduce the regulatory and information obligations experienced by charitable and not-for-profit organizations. With a view to enabling them to demonstrate their social impact more clearly, one witness urged the restructuring of reporting requirements in relation to charities; specific mention was made of the International Aid Transparency Initiative. D. Foreign Aid

Recognizing that Canada lives in a global community, some of the Committee’s witnesses urged the federal government to increase funding for foreign aid. For example, they supported an increase in the federal aid budget and implementation of a timetable for reaching the United Nations aid target of 0.7% of gross national product within a specified period of time. A number of witnesses requested that Canada increase its contributions to certain initiatives, and educational initiatives, environmental initiatives, initiatives related to maternal and reproductive health, the fight against AIDS, tuberculosis and malaria, and microfinance projects were supported by one witness in each case. Another witness told the Committee that federal foreign aid spending should be reduced. To provide financing for poverty reduction and climate change adaptation in developing countries, some witnesses called for the implementation of a financial transaction tax on financial institutions, while other witnesses were opposed to the implementation of such a tax. 4.6 Rural and Remote CommunitiesCanada’s rural and remote communities differ, in fundamental ways, from their urban communities. They have different concerns and different requirements that must be met if they are going to become and remain strong. A number of witnesses commented on First Nations communities, the agricultural, forestry and fishery industries that are often located in rural and remote communities, and community enterprises. A. First Nations CommunitiesSome of the Committee’s witnesses expressed concern about the socio-economic status of some First Nations and Aboriginal communities, and suggested that the federal government should take a variety of actions. The following proposals were supported by one witness in each case: provide financial support for an initiative, perhaps entitled the “Framework Agreement,” that would provide First Nations with the option to take control of their lands and resources, and would cause the land administration sections of the Indian Act to cease to apply; negotiate and resolve outstanding land claims; examine possible new investments that would improve the living standards of Aboriginal people; estimate the costs of meeting the policy requirements of the First Nations Child and Family Services Program; and take steps to redress the issues identified by the Auditor General of Canada regarding Directive 20-1, a national funding formula for First Nations child and family services agencies, and the 1965 Indian Welfare Agreement. B. Agriculture, Forestry and Fishery IndustriesSome witnesses highlighted their concern about the growing need of the world’s population for food and the increasing costs of producing it. For example, one witness argued that some actions taken by governments, such as subsidies and mandates for the inclusion of grain-based ethanol in gasoline and tariffs that affect the importation of ethanol from countries other than the United States and Mexico, have increased the cost of grain-based ethanol products, thereby indirectly increasing feed costs for the beef industry. As such, reversal of these policies was urged. Other proposals, each of which was supported by one witness, included: the removal of inspection fees for federally registered meat processing establishments, streamlining of the Canadian agricultural regulatory environment, and the introduction of a food safety tax credit that would be based on eligible expenses for upgrading food processing capabilities. A number of witnesses supported amendments to the Income Tax Act to defer taxation on businesses that qualify as a family farm corporation as well as changes that would either increase, or index to inflation, the small business lifetime capital gains exemption so that the transfer of farms between generations does not cause undue financial stress. Some witnesses made requests for program improvements in relation to the agricultural, forestry and fishery industries. Regarding the agricultural industry, proposals that were supported by one witness each included: rebuilding and increasing structural capacity for public research at Agriculture and Agri-Food Canada for the development and commercialization of agricultural research, reinstating the Abattoir Competitiveness and the Slaughter Improvement Programs, implementing a wine quality enhancement program, and providing funds for the Canadian Beef and Cattle Market Development Fund. A number of witnesses supported changes to the Growing Forward programs, particularly to continue the current Business Risk Management (BRM) and non-BRM programs in Growing Forward 2 and to develop and expand BRM programs. Some witnesses provided comments in relation to the forestry industry. For example, suggestions that were supported by one witness in each case included: better incorporation of wood into the National Building Code, and funding for the basic programs under the Forest Industry Long Term Competitiveness Strategy. Regarding the fishery industry, proposals were supported by one witness in each case regarding funding that would extend the Atlantic Integrated Commercial Fisheries Initiative, the development of a federal aquaculture act, the creation of an ocean and food systems institute at a Canadian university, and implementation — with the participation of Canada’s First Nations — of the Canadian Boreal Forest Agreement. C. Community EnterprisesSome of the Committee’s witnesses spoke about the importance of community enterprises and cooperative businesses in the Canadian economy, especially in the economies of rural and remote communities. Suggestions that were supported by one witness in each case were made in relation to: the establishment of a fund that could be used to invest in social investment capital, and the creation of a fund that could be used to provide long-term loans at preferred rates to co-operatives. 4.7 Domestic Safety and SecurityPeople and businesses want the communities in which they live, work and operate to be safe and secure, in part because safety and security enhances quality of life and provides an environment that supports higher levels of economic growth. Some witnesses shared their opinions about such domestic safety and security issues as crime prevention, criminal prosecution, victims of crime and prison condition issues, emergency services, and national defence and security. A. Crime Prevention, Criminal Prosecution, Victims of Crime and Prison Condition IssuesIn speaking about crime prevention, one witness focussed on youth, and suggested that criminals’ sentences should be longer. Other witnesses suggested that funds should be redirected from the criminal justice system to after-school recreation programs, and that multi-year funding should be allocated to organizations that work with Aboriginal, Inuit and Métis youth, youth in gangs, young girls and youth living in poverty. Some witnesses informed the Committee about the manufacture, importation and sale of contraband cigarettes, and proposed measures to reduce these activities: enforce contraband laws and order the closure of illegal cigarette factories; create a Canada-Ontario-Quebec task force on illegal cigarettes to coordinate an effective response against contraband trade in tobacco; undertake a public education campaign; increase penalties for the manufacture, importation and sale of contraband tobacco; broaden the seizure powers of law enforcement authorities; create an anti-contraband Royal Canadian Mounted Police task force; and enhance security at the shared Canada-U.S. border through joint law enforcement procedures designed to reduce the importation of contraband tobacco. Regarding law enforcement authorities, one witness urged the federal government to increase funding in order to train law enforcement units in the investigation and prosecution of human traffickers, while other witnesses advocated the provision of long-term funding for community policing, and enhanced support for cooperative efforts among national, provincial and municipal law enforcement authorities. One witness informed the Committee that, with recent funding regulations and budget reductions at Status of Women Canada, the department’s budget for 2010 amounts to $1.78 per woman and girl in Canada. Some witnesses advocated increased spending for services that assist women experiencing violence and for organizations that are working on public policy solutions to violence. A number of proposals were supported by one witness in each case: grants, to be administered by Status of Women Canada, or multi-year funding to help address gaps in the provision of emergency shelter to women fleeing violent situations; the initiation of a national inquiry to examine violence against Aboriginal women and girls, and to focus on missing and murdered Aboriginal women and girls across Canada; the launch of federal, provincial and territorial and municipal discussions to ensure policy coordination, with input from relevant stakeholders, and funding to continue the “Sisters in Spirit” initiative. To help victims of crime, one witness proposed an amendment to the Criminal Code to make victim fine surcharges mandatory during sentencing. Regarding the treatment of women in the prison system, one witness suggested an amendment to the Corrections and Conditional Release Act, and supported funding for an independent national women’s governance committee to monitor the imprisonment conditions of women. B. Emergency Services

Some witnesses provided the Committee with suggestions regarding emergency personnel and infrastructure. For example, one witness urged the creation of a national public safety officer compensation benefit for the families of fire fighters and other emergency responders killed in the line of duty, renewed funding for the hazardous materials training for first responders in order to prepare emergency personnel for chemical and biological attacks in Canada, and a review of the federal disaster assistance program. Other witnesses called for the establishment of long-term funding for the Canadian Coast Guard. C. National Defence and SecurityMilitary expenditures were a concern for a number of witnesses, and they provided suggestions about the level of spending on national defence that they believed to be appropriate. One witness proposed an increase in defence spending through the implementation of a long-term plan for equipment maintenance and the purchase of new equipment. Another witness advocated an increase in the amount of the yearly surplus that the Department of National Defence is allowed to carry forward to the next fiscal year, and a guarantee that the department’s capital spending will not fall below 25% of its total budget. Other witnesses supported a reduction in military expenditures. One witness argued that such spending should be returned to the levels that existed prior to September 11, 2001, while another witness suggested that management at the Department of National Defence should consult with employees in order to review and reduce expenditures on contractors. Some witnesses advocated greater use of alternative service delivery, argued that lower-cost, private-sector delivery of aircraft services should occur and suggested that alternative payment methods should be explored. One witness called for increased parliamentary oversight of spending by the Department of National Defence on equipment in order to ensure effective management of military spending. Regarding the level of research in relation to national defence and security, one witness suggested that the Industrial and Regional Benefits Program should provide more research and development support for Canadian businesses. One witness told the Committee that a new Canadian space program should be created. In this witness’ view, the program would focus on developing new technologies for export to the rest of the world as well as changes to the space technology procurement process to allow participants more flexibility in choosing the technology to be used in fulfilling requests. In an effort to maintain the number of reservists through improved employment opportunities during their transition to civilian life, some witnesses suggested the development and implementation of a compensation program and tax incentives for employers that hire reservists or veterans as well as training for reservists to increase their employment opportunities following their military service The Committee feels that strong communities support strong businesses and strong people, and contribute to a nation’s prosperity and resiliency. Communities are where people live and businesses operate, and it is important that they be characterized by adequate and functional infrastructure, investment in the development and use of renewable and clean energy, a housing market that is viable, charitable giving that supports domestic and international priorities, and the absence of illegal and/or undesirable behaviours, such as those relating to contraband tobacco. In believing that policy actions are needed in each of these areas in order to ensure a resilient and prosperous future for our communities, with benefits for businesses and people, we make a number of related recommendations. Consequently, the Committee recommends that: The federal government, as committed to in Budget 2011, continue to work with provinces, territories, the Federation of Canadian Municipalities and other stakeholders to develop a long-term plan for public infrastructure that extends beyond the expiry of the Building Canada plan, including ensuring support for rural communities. The federal government continue to advance public-private partnerships (P3s) to produce value for taxpayers in the delivery of public infrastructure. The federal government work with municipalities, especially in rural Canada, to continuously review the Navigable Waters Protection Act. The federal government, in partnership with the provincial and territorial governments, continue to support economically viable clean energy projects that will assist regions and provinces in the replacement of fossil fuel with renewable fuel sources, such as the Lower Churchill hydroelectric project. The federal government support the development and maintenance of standards and codes for Canadian solar energy technology. The federal government continue to explore cost-effective ways to support greater energy cost savings, especially with regard to northern and remote communities and transportation choices for Canadians. The federal government encourage the development of the natural gas vehicle industry by partnering with Canada’s transportation industry and exploring ways to support sustainable transportation. The federal government continue to invest in green technologies, business, household energy conservation and renewable energy development. The federal government continue to use tax incentives to promote the development and use of renewable energy. The federal government continue to monitor Canada’s housing market and ensure its long-term stability. The federal government continually commit to making its international assistance more accountable and transparent to improve the effectiveness of such investments, including continued and growing involvement in the International Aid Transparency Initiative. The federal government continue to explore ways to encourage greater charitable giving by Canadians, including supporting initiatives such as the House of Commons Standing Committee on Finance’s study on tax incentives for charitable donations. The federal government examine the concept of a First Nations Property Ownership Act as proposed by the First Nations Tax Commission. The federal government work with the provinces and territories to support Canada’s agriculture industry with the continued development of the Growing Forward 2 agricultural policy framework, ensuring it is frequently reviewed to ensure it helps the competitiveness and success of the industry in the most effective manner. The federal government continue to acknowledge contraband tobacco and help reduce the problem of its trafficking, as it has become a black-market industry that makes it easier for children to start smoking, and results in losses in revenue and higher health care costs. |