FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

During the Committee’s pre-budget consultations for 2007, Canadians were also asked to comment on the following question: what is the appropriate form and level of corporate taxes, fees and other charges?

A review of the contribution that corporate tax revenues make to total federal tax revenues, tax rates, and selected exemptions, credits and deductions provides some context for the subsequent discussion of suggested changes to taxes, fees and other charges paid by corporations and to measures used by them to reduce the amount of taxes owed.

The federal government began taxing corporations on their income in 1917 and taxes are also imposed on the capital of corporations, although not at the federal level since 2006; provincial capital taxes continue to exist. Beginning in 1985, the federal government started to impose a levy of 1.25% on the taxable capital of financial institutions exceeding $1 billion employed in Canada. Financial institutions can, however, reduce their federal capital tax payable by the amount of federal income tax payable and, consequently, can pay capital taxes only to the extent that they do not have sufficient corporate income tax liability for the previous three years and the next seven years.

In 2006-2007, the federal government collected almost $38 billion in federal corporate taxes, as shown in Figure 4.1. Federal corporate tax revenues rose by almost 19% from 2005-2006 to 2006-2007, and by more than 33% from 2000-2001 to 2006-2007, despite reductions in the federal general corporate tax rate from 28% to 21% during that period. Nevertheless, federal revenues from corporate taxes continue to be lower than those from personal income taxes and consumption taxes in terms of their contribution to total federal tax revenues.

Figure 4.1 — Federal Corporate Tax Revenues, Canada, 1988 - 1989 to 2006 - 2007

Source: Data obtained from Statistics Canada, Cansim Table 385-0002

The federal general corporate income tax rate reached a high of 47% in the 1950s before beginning to decline, reaching 36% in 1980, 28% in 1990 and 21% in 2007; according to legislated reductions, the rate will be 15% in 2012. The corporate surtax of 1.12% has been eliminated beginning in 2008.

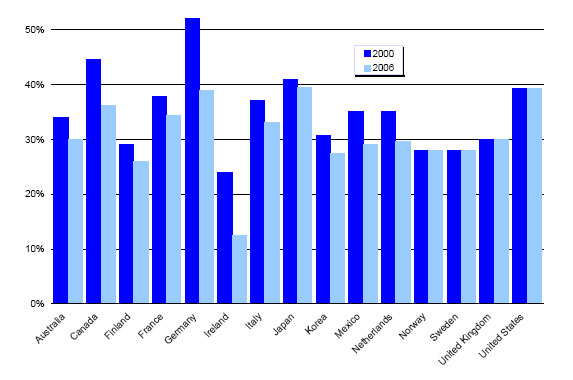

The gradual decline in the statutory general corporate income tax rate has been a feature of many other developed countries as well. As shown in Figure 4.2, 11 out of 15 selected Organisation for Economic Co-operation and Development countries lowered their statutory corporate tax rate between 2000 and 2006.

Figure 4.2 — Statutory Corporate Income Tax Rates, Selected Countries, 2000 and 2006

Source: Organisation for Economic Co-operation and Development, OECD Tax Database

Furthermore, eligible small Canadian-controlled private corporations (CCPCs) — those that have taxable capital employed in Canada of not more than $15 million — have a lower small business tax rate on their first $400,000 of income; this rate was 12% in 2007. Since 2003, the income threshold at which small businesses are taxed at the lower rate has gradually increased from $200,000 to $400,000; in that year, the eligibility criteria for receiving this lower rate were broadened. The October 2007 Economic Statement announced that the small business tax rate will be reduced to 11% in 2008 rather than in 2009, as previously scheduled.

C. Exemptions, Credits and Deductions

All firms may deduct, from accrued revenues, the expenses they incur in producing goods and services, provided there is a reasonable expectation of profit. These expenses might include current expenditures on wages, raw materials, fees, rents and energy, for example; they might also include the purchase of capital goods, such as buildings and machinery. Current expenditures are deductible in the year in which they are incurred, while the cost of capital goods can be deducted over a number of years in accordance with prescribed rates of amortization.

The corporate tax system also includes more than 50 tax exemptions, credits and deductions designed to achieve such public policy objectives as higher levels of business investment, contributions to charitable organizations and the growth of small businesses.

For example, the Scientific Research and Experimental Development (SR&ED) tax credit is intended to encourage firms to undertake research and development activities in Canada, while the Canadian Film or Video Production Tax Credit is designed to support the Canadian film and video production sector.

The Committee heard a variety of views and proposals in respect of corporate taxation. In particular, witnesses commented on the general corporate income tax rate and the small business tax rate, and presented proposals that would involve imposing taxes based on the nature of corporate activities.

1. The General Corporate Tax Rate

A number of witnesses advocated corporate tax rate reductions. The Committee was told that, although Canada’s corporate tax rates are increasingly competitive with those in the United States, the federal government should ensure that our corporate tax regime is competitive with other countries as well. Such witnesses as the Insurance Bureau of Canada and the Toronto Financial Services Alliance indicated the importance of a highly competitive corporate tax system in order to attract investment and increase productivity. Others — including the Air Transport Association of Canada and the Recreation Vehicle Dealers Association of Canada — argued that, in addition to their productivity-enhancing effects, lower corporate tax rates would increase the ability of Canadian businesses to invest and to create jobs.

Several witnesses, including the Canadian Retail Building Supply Council, the Canadian Hardware & Housewares Manufacturers Association and the Greater Kitchener Waterloo Chamber of Commerce, urged the federal government to accelerate the implementation of announced corporate tax reductions. Other witnesses, such as the Business Tax Reform Coalition, the Canadian Manufacturers & Exporters and the Canadian Restaurant and Foodservices Association, urged the federal government to reduce the corporate income tax rate to 15% over a number of years. It should be noted that some written testimony from witnesses was received by the Committee prior to the October 2007 Economic Statement, which announced reductions in the federal corporate income tax rate to reach 15% in 2012.

The Canadian Institute of Chartered Accountants requested that the federal corporate income tax rate be reduced to the level of the small business tax rate, which would increase the international competitiveness of the Canadian tax system as well as reduce compliance and administration costs by simplifying the corporate tax regime.

The Social Planning Council of Winnipeg told the Committee that Canada’s corporate income tax rate is competitive with that of other Group of Seven (G7) countries. A number of witnesses, including the Réseau solidarité itinérance du Québec, Randall Garrison, the Wellesley Institute and the Canadian Healthcare Association, suggested that additional corporate tax reductions are not needed.

The Tax Executives Institute, Inc. advocated the establishment of a system that would enable the transfer of losses among the different entities of a corporate group. It told the Committee that the adoption of such a system would complement existing administrative practices.

Several witnesses highlighted the important role that small businesses play in the economy. As noted above, some of the Committee’s written testimony was received prior to the October 2007 Economic Statement, which announced a reduction in the small business tax rate to 11% in 2008; a number of witnesses supported such a change. Furthermore, the Canadian Restaurant and Foodservices Association requested that the rate be reduced to 10% over the next three to five years, while the Canadian Health Food Association and Gordon E. MacKinnon advocated further reductions in the small business tax rate. As well, the Canadian Construction Association proposed an increase in the $400,000 threshold, while the Canadian Automobile Dealers Association proposed that the threshold be increased to $1 million. The Canadian Automobile Dealers Association maintained that the eligibility criteria for the small business tax rate are unfair to capital-intensive industries, and told us that an automobile dealer begins to lose access to the small business tax rate once taxable capital exceeds $10 million and is eliminated at the $15 million threshold.

The Canadian Automobile Dealers Association informed the Committee that, unlike other retailers, automobile dealers finance their inventory through lien notes, which have to be included in taxable capital; taxable capital must also include the assets or investments of other corporations with whom the dealer is associated. It urged redefinition of taxable capital in order to exclude lien notes, and advocated greater flexibility in the definition of associated corporations.

3. Variable Corporate Tax Rates

A number of witnesses advocated corporate tax rates that would vary across businesses. The Capital Unitarian Universalist Congregation suggested that corporations with negative environmental or social impacts should be taxed at a higher rate, while the Catholic Women’s League of Canada proposed that Canadian multinational mining companies receive beneficial tax measures only to the extent that they adhere to international and Canadian standards of mining practices while doing business in developing countries. The British Columbia Environmental Network supported a federal corporate income tax rate reduction that could be funded by imposing levies on corporations based on their environmental footprint and by increasing provincial charges for natural resource extraction.

The Tax Executives Institute told the Committee that, since 2003, the United States has negotiated a zero withholding tax rate under its tax treaties with the United Kingdom, Mexico, the Netherlands, Japan and Sweden for inter-corporate dividends from affiliates that are more than 80% owned by the parent company (the threshold is 50% for Japan). Furthermore, it highlighted proposed U.S. protocols with Germany, Denmark and Finland, as well as a proposed treaty with Belgium, that are awaiting ratification and that include a similar provision. The Tax Executives Institute urged the federal government to negotiate, with the U.S., a similar protocol that would eliminate withholding taxes on inter-corporate dividends.

B. Scientific Research and Experimental Development Tax Credit

Witnesses spoke to the Committee about the importance of research and development and, in particular, about changes that they believe should be made to the Scientific Research and Experimental Development (SR&ED) program. On October 5, 2007, the federal government launched consultations on how to improve the effectiveness of the SR&ED program for businesses wishing to engage in research and development. The consultations ended on November 30, 2007.

A number of witnesses told the Committee that the SR&ED tax credit is an important public policy measure for encouraging innovation in Canada. The SR&ED Tax Credit Coalition informed us that a 2006 study concluded that every $1 billion in additional SR&ED tax credits led to the creation of 10,000 new jobs, generated $200 million in additional tax revenues, and resulted in at least $675 million in new economic activity and other spin-off advantages.

Several witnesses — including the Information Technology Association of Canada — observed that, since the SR&ED program was introduced in the early 1980s, many countries have created or improved their research and development (R&D) incentive programs; the result has been intense competition among nations in attracting investments in research and innovation. We were reminded that Canada now ranks 14th among OECD countries for business expenditures on R&D, despite having what many consider to be one of the most generous R&D incentive programs in the world in terms of rates and allowable expenditures. Figure 4.3 indicates eligible expenditures under the SR&ED tax credit over the 2002 to 2004 period.

Figure 4.3 — Eligible Expenditures under the Scientific Research and Experimental Development Tax Credit, Canada, 2002 - 2004

Year |

All Corporations |

Small Canadian-Controlled Private Corporations |

($ millions) |

||

2002 |

14,144 |

3,116 |

2003 |

13,645 |

3,348 |

2004 |

14,148 |

3,728 |

Source: Department of Finance Canada, Tax Incentives for Scientific Research and Experimental Development, Consultation Paper, October 2007

Witnesses observed that there are aspects of the tax credit that undermine its effectiveness, such as limited refundability and the reality that the value of credits claimed in Canada by a Canadian affiliate of a multinational company increases the tax payable of the parent company located in a foreign jurisdiction. The Canadian Manufacturers & Exporters requested that SR&ED credits claimed be excluded from the federal revenue base.

Several witnesses, including the Association of Canadian Academic Healthcare Organizations, said that the administration of the SR&ED tax credit should be improved, particularly with respect to the eligibility of costs, transparency, regulations and the application process. The Red River College of Applied Arts, Science and Technology urged the federal government to make private-sector contributions to research infrastructure programs offered by the Canada Foundation for Innovation clearly eligible for the SR&ED tax credit.

A number of the Committee’s witnesses suggested that some businesses that make large investments in R&D cannot take full advantage of the tax credit because they lack sufficient taxable income. Such witnesses as the SR&ED Tax Credit Coalition, the Information Technology Association of Canada, the Aerospace Industries Association of Canada and the Canadian Meat Council requested that the SR&ED tax credit be made fully refundable for all investors. The Forest Products Association of Canada pointed out that the non-refundability of the tax credit provides no immediate benefits to companies during sustained market downturns. As well, we were told that the majority of SR&ED tax credits are earned in the manufacturing sector, as shown in Figure 4.4 for 2004.

Figure 4.4 — Distribution of Scientific Research and Experimental Development Tax Credits, by Industrial Sector, Canada, 2004

Industrial Sector |

Percentage of Total Credits Earned (%) |

Agriculture, forestry, fishing and hunting |

2.1 |

Manufacturing |

47.6 |

Information and cultural industries |

11.6 |

Wholesale and retail trade |

5.4 |

Mining, oil and gas |

3.2 |

Construction |

0.7 |

Financial Intermediaries |

1.3 |

Others |

28.1 |

Total |

100 |

Source: Department of Finance Canada, Tax Incentives for Scientific Research and Experimental Development, Consultation Paper, October 2007

The Committee heard various proposals designed to address concerns about the inability to take full advantage of SR&ED tax credits. For example, Canadian Pensioners Concerned Inc. — Ontario Division advocated the establishment of a market for trading unused SR&ED tax credits, while the Certified Management Accountants Canada supported the ability to offset unused SR&ED tax credits against Employment Insurance premiums. The Information Technology Association of Canada proposed that, in any given year, companies should be able to choose a refundable wage credit, based on a similar credit offered in Quebec, rather than accumulating unused SR&ED tax credits.

3. Eligible Amounts and Adjustments for Inflation

The Canadian Association for Graduate Studies suggested that the definition of eligible SR&ED expenditures should be broadened to include research in the social sciences and humanities, while Canada’s Research-Based Pharmaceutical Companies advocated adoption of the definition of social sciences used by the Organisation for Economic Co-operation and Development.

A number of witnesses, including BIOTECanada, proposed that the taxable capital threshold be increased to $50 million and the annual expenditure limit be raised to $10 million in an effort to reflect inflation and the increased costs of research. BIOTECanada also requested that the CCPC restriction be removed, while maintaining other eligibility requirements with respect to taxable income and taxable capital thresholds.

Several witnesses discussed the extent to which expenditures related to the commercialization of new technology and discoveries in Canada are eligible for the SR&ED tax credit. The Canadian Manufacturers & Exporters as well as the Partnership Group for Science and Engineering urged the federal government to expand the SR&ED tax credit to include such pre-commercialization activities as patenting, prototyping, product testing and other activities in the first stage of commercialization of new technologies. Canadian Light Source Inc., which is involved in commercialization, suggested that the SR&ED tax credit should be expanded to include private investments in science facilities and should encourage industry participation in national research facilities.

4. International and Academic Collaboration

Some witnesses commented that, in their view, the SR&ED tax credit does not adequately recognize international collaborative R&D. Since they believe that companies which engage in international R&D collaboration or partnerships are denied benefits under the SR&ED program, witnesses supported consideration of international research when determining eligibility for the credit.

Moreover, the Canadian Manufacturers & Exporters advocated a threshold requiring that 80-90% of research activities be conducted within Canada; such a requirement would accommodate R&D projects where some aspects of the research must be conducted in another jurisdiction. The Red River College of Applied Arts, Science and Technology told the Committee that Canadian colleges increasingly conduct applied research and commercialization activities through international partnerships. It requested that these activities be eligible for the SR&ED tax credit.

Witnesses also identified the need for more collaborative research between the private and academic sectors. The Partnership Group for Science and Engineering advocated a review of the incentives for such collaboration, while the Red River College of Applied Arts, Science and Technology urged the federal government to provide an additional incentive to companies that work in partnership with colleges and that are eligible for the SR&ED tax credit. Research Canada: An Alliance for Health Discovery requested an increase in the SR&ED tax credit rate for small business expenditures incurred in the course of collaborative R&D with organizations in the academic and government research sectors.

C. Capital Cost Allowance Rates and Other Measures Related to Capital Investments

A number of witnesses spoke to the Committee about the importance of investments in such capital as buildings, machinery and equipment acquired for manufacturing, industrial, professional or other business activities, the costs of which cannot be deducted as a current expense when calculating net income for taxation purposes, but are instead depreciated over time in accordance with the schedule of capital cost allowance (CCA) rates. Since 1987, the policy of the federal government has been to set and revise CCA rates in order to reflect the economic life of assets as closely as possible.

Figure 4.5 — Recent Changes to Capital Cost

Allowance Rates, Canada,

2000 - 2007

Budget 2000

|

Budget 2001

|

Budget 2003

|

Budget 2004

|

Budget 2005

|

Budget 2006

|

Budget 2007

|

* This change was initially announced in The Economic and Fiscal Update of November 2005

Source: Compiled by the Library of Parliament based on federal budget documents

The 2007 federal budget announced a 50% accelerated CCA rate on a straight-line basis for the manufacturing and processing sector; investments in eligible machinery and equipment made during the March 19, 2007 to December 31, 2008 period are eligible for this rate. Figure 4.5 shows changes to CCA rates since 2000.

1. The Policy Approach in Setting Capital Cost Allowance Rates

Witnesses commented on the policy approach that is used to establish CCA rates. The Canadian Electricity Association observed that the economic or functional life of assets may depend on a variety of factors, such as changes in demand, technology, the physical environment and management requirements. The Canadian Chamber of Commerce and the Canadian Institute of Chartered Accountants, among others, urged the federal government to review CCA rates in order to ensure that they appropriately reflect the economic life of assets.

2. The 50% Accelerated Capital Cost Allowance Rate

Some witnesses shared their view that the timeframe associated with the 50% accelerated CCA rate for manufacturing and processing investments is too limited to be effective. The Business Tax Reform Coalition reminded the Committee that large-scale projects may take up to five years from planning and obtaining regulatory approvals to purchasing and installing new machinery and equipment. Such witnesses as the Canadian Steel Producers Association and the Canadian Chemical Producers’ Association proposed that the 50% accelerated CCA rate be extended by an additional five years; the Canadian Manufacturers & Exporters urged that it be extended by at least five years. The Cement Association of Canada suggested that the accelerated CCA for manufacturing and processing investments should be available to the manufacturing and processing sector for the entire lifespan of the federal Regulatory Framework for Air Emissions.

In addition, the Forest Product Association of Canada shared its view that the accelerated CCA for manufacturing and processing investments should be extended to include capital investments in information and communication technologies. The Canadian Printing Industries Association urged the federal government to consider allowing small manufacturers to deduct, in the year in which assets are acquired, a fixed amount of at least $45,000. The Canadian Finance & Leasing Association proposed that the accelerated CCA for manufacturing and processing investments be continued if the measure is shown to accelerate or increase investment in machinery or equipment.

3. Capital Cost Allowance Rates to Encourage Environmentally Desirable Investments

In addition to the proposals related to the environment that are identified in Chapter 5, witnesses also suggested that CCA rates should be used as a tool to encourage environmentally desirable investments. One witness, Gordon MacKinnon, suggested that accelerated CCA rates for investments in environmental upgrading should be provided, while the BC Sustainable Energy Association advocated a CCA structure that would discourage investments in assets causing greenhouse gas emissions and that would encourage alternative investments.

The Road and Infrastructure Program of Canada told the Committee that companies in the road building and heavy construction industry commonly use the same diesel-powered equipment or vehicle for 15 to 20 years. It urged the federal government to provide an accelerated CCA rate for new, diesel-powered engines that meet stringent emissions standards.

Friends of the Earth Canada and The Canadian Water and Wastewater Association requested an increase in the accelerated depreciation of capital investments in water and wastewater infrastructure and in technologies supportive of the water soft path approach to water management.

Moreover, the Canadian Gas Association supported an accelerated CCA rate for energy-efficient commercial buildings — including multi-unit residential buildings — that meet advanced energy efficiency and environmental design criteria, such as Leadership in Energy and Environmental Design (LEED) Green Building Rating System and/or Energy Star certification.

As well, the Canadian Electricity Association proposed that “Smart Meters,” which allow customers to reduce their electricity use during peak hours of consumption when prices are typically higher, as well as their related Advanced Metering Infrastructure (AMI) equipment, have a CCA rate of 45%; a CCA rate increase to 12% for new electricity transmission and distribution assets was also supported. For natural gas distribution pipelines, it requested an increase in the CCA rate to 8%. The Canadian Electricity Association also urged the federal government to re-enact Class 24 (air) and Class 27 (water) in the federal CCA regulations.

Finally, the Railway Association of Canada informed the Committee that Canadian railways, unlike trucks and most other modes of transportation, pay the full cost of their infrastructure, and urged the federal government to increase the CCA rate for rail rolling stock to at least 30%. In its view, this rate should be available to railway companies, rail leasing companies and private car owners, and would enable Canadian railways to purchase more fuel-efficient locomotives sooner, resulting in lower rail emissions.

4. Capital Cost Allowance Rates to Encourage Other Investments

Witnesses also commented on changes to CCA rates for other investments. For example, the Retail Council of Canada highlighted the importance of investments in radio frequency identification (RFID) technology for retailers in order to improve inventory management, and proposed an increase to 60% in the CCA rate for computer equipment under Class 45, including a direct reference to RFID technology, and consideration of depreciation for these investments over two years.

As well, the Retail Council of Canada noted the benefits for retailers of information technology (IT) investments, and urged the federal government to permit retailers to deduct the cost of investments in computers, peripheral equipment and software in the year in which these costs are incurred.

In addition to the proposals noted in Chapter 5 in respect of rental housing, comments were also made about this type of housing and CCA rates. The Canadian Federation of Apartment Associations advocated an increase in the CCA rate to 5% for concrete structures and to 6% for wood-frame structures of rental housing projects, and observed that the CCA rate for wood-frame construction, which is currently 4% and was 5% until 1988, was 10% before the late 1970s.

The Slave River Hydro Development told the Committee that large hydroelectric projects do not benefit from tax incentives that are available to smaller projects, and proposed that hydroelectric projects greater than 50 megawatts — such as the Slave River Hydro Development — be eligible for the same tax incentives as smaller projects, as well as for other non-renewable and renewable clean energy forms. Particular mention was made of the wind power production incentive and the Canadian renewable and conservation expense as well as a CCA rate of 30% per year for efficient biomass and renewable hydroelectricity generation projects, and of 50% per year for highly efficient biomass and renewable hydroelectricity generation projects.

The Association of Equipment Manufacturers requested that the federal government modernize the CCA schedule as it pertains to agricultural equipment, since farmers are now upgrading their equipment on a more frequent basis in order to take advantage of new technologies that allow for reductions in fuel costs.

Bell Canada told the Committee that a refundable investment tax credit is a relatively more effective mechanism to stimulate business investment than are improvements to CCA rates, especially for small and medium-sized businesses. The federal government was urged to introduce a refundable tax credit for new ICT investments as well as for related training and business process changes.

Enbridge asked the federal government to explore allowing qualified clean energy projects, such as stationary fuel cells, and energy recovery technologies, such as expansion turbines, to obtain an investment tax credit based on installed capacity. In its view, such a credit would increase the early adoption and deployment of such technology, particular if the credit is refundable.

Patrick Lafferty told the Committee that health researchers have difficulty raising venture capital to finance the development of new discoveries for the global life science market. He proposed that the federal government provide the same flow-through shares and limited partnership tax incentives that have been provided for oil and gas exploration and development to risky investments in health innovation.

D. Provincial Capital Taxes and Sales Taxes

Unlike corporate income taxes, which are paid when a corporation has taxable income, capital taxes must be paid regardless of whether a corporation is profitable. Moreover, the tax is applied directly on capital investment, as opposed to investment returns. As noted earlier, the federal capital tax on large corporations was eliminated beginning in 2006; as shown in Figure 4.6, however, provincial capital taxes continue to exist in some jurisdictions.

Figure 4.6 — Capital Tax Rates and Planned Elimination, by Jurisdiction, Canada

Jurisdiction |

General Capital Tax Rate, 2008 |

Planned Elimination |

Federal |

Nil |

|

Newfoundland and Labrador |

Nil |

|

Prince Edward Island |

Nil |

|

Nova Scotia |

0.212% - 0.425% |

Gradual elimination, to be completed in July 2012 |

New Brunswick |

0.1% |

Elimination effective January 2009 |

Quebec |

0.36% |

Gradual elimination, to be completed in January 2011 |

Ontario |

0.225% |

Elimination effective July 2010 |

Manitoba |

0.3% - 2.5% |

Gradual elimination, to be completed in January 2011 subject to balanced budget requirements |

Saskatchewan |

0.075% |

Elimination effective July 2008 |

Alberta |

Nil |

|

British Columbia |

Nil |

Source: CCH Online, Canadian Tax Reporter Commentary, January 2008

As shown in Figure 4.7, five provinces — British Columbia, Saskatchewan, Manitoba, Ontario and Prince Edward Island — have provincial retail sales taxes, with rates ranging from 5% to 10%. Quebec administers its own provincial value-added tax and collects the Goods and Services Tax (GST) on behalf of the federal government. Three Atlantic provinces — Newfoundland and Labrador, New Brunswick and Nova Scotia — have adopted a Harmonized Sales Tax (HST), which replaces the federal GST and the provincial retail sales tax. Finally, Alberta has no provincial sales tax.

Figure 4.7 — Provincial Sales Tax and Harmonized Sales Tax Systems and Rates, by Jurisdiction, Canada, 2007

Province |

Description of provincial sales tax system |

Provincial Sales Tax Rate |

British Columbia |

Administers its own provincial sales tax |

7% |

Alberta |

Has no provincial sales tax |

n.a. |

Saskatchewan |

Administers its own provincial sales tax |

5% |

Manitoba |

Administers its own provincial sales tax |

7% |

Ontario |

Administers its own provincial sales tax |

8% |

Quebec |

Administers its own provincial value-added tax and collects the Goods and Services Tax (GST) on behalf of the federal government |

7.5% |

New Brunswick |

Harmonized Sales Tax |

8% |

Nova Scotia |

Harmonized Sales Tax |

8% |

Prince Edward Island |

Administers its own provincial sales tax |

10% |

Newfoundland and Labrador |

Harmonized Sales Tax |

8% |

Source: Library of Parliament

A number of witnesses spoke to the Committee about provincial capital taxes, and urged the federal government to continue its work with provincial governments with a view to eliminating such taxes. The Greater Kitchener Waterloo Chamber of Commerce indicated that the elimination of provincial capital taxes is critical for the manufacturing sector, and would reduce the overall tax burden on new business investment by 1.3 percentage points. The Canadian Institute of Chartered Accountants proposed that the federal government provide incentives to provincial governments to accelerate the elimination of capital taxes by 2009.

Witnesses also commented on provincial retail sales taxes, and similarly advocated that the federal government continue its work in encouraging the five remaining provinces that have a retail sales tax (RST) system — British Columbia, Saskatchewan, Manitoba, Ontario and Prince Edward Island — to move to a value-added tax system with the same base as the federal Goods and Services Tax.

The Canadian Manufacturers & Exporters and the Canadian Institute of Chartered Accountants reminded the Committee about the observation in the 2007 federal budget that if all provinces were to move to a value-added tax system harmonized with the Goods and Services Tax, Canada’s overall marginal effective tax rate on capital would decline by 6.2 percentage points. Bell Canada suggested that the federal government should fund independent research on the benefits of sales tax harmonization, including the impact on new capital investment in the provinces. The Canadian Institute of Chartered Accountants requested that the federal government pursue retail sales tax harmonization with the remaining provinces by offering financial incentives to provincial governments as a means of ensuring timely harmonization.

Finally, the Canadian Restaurant and Foodservices Association suggested that further harmonization of the Goods and Services Tax with provincial sales taxes should not occur until several differences in the provincial tax treatment of restaurant meals are addressed.

In October 2006, the federal government announced a new tax on distributions from publicly traded income trusts or publicly traded partnerships, other than those that only hold passive real estate investments. Furthermore, in December 2006, it indicated that conversions of an income trust — and other specified investment flow-through entities — to a corporation would be permitted to occur without any tax consequences for investors.

Witnesses, including the Coalition of Canadian Energy Trusts, the Canadian Energy Infrastructure Group and the Canadian Association of Petroleum Producers, indicated their lack of support for the federal government’s 2006 decision in respect of income trusts.

The Coalition of Canadian Energy Trusts requested an exemption for the energy sector from the application of the new tax on distributions from income trusts as well as an extension to the period of transition for the application of the new tax on income trusts from four to ten years for all entities currently operating as income trusts. The Canadian Association of Income Funds informed the Committee that the income trust sector needs more clarity with respect to the transition rules for conversions from an income trust to a corporation, and urged the federal government to require the Department of Finance and the Canada Revenue Agency to provide additional guidance. It also suggested that a legal framework is needed in order to facilitate the income trust conversion to corporate status on a tax-deferred basis.

A number of the Committee’s commented on federal taxes, fees and charges that have specific impacts on their sector. These sectors include air transportation, rail transportation, horse racing, grocery distribution, agriculture, vehicle sales, transmission pipelines, labour-sponsored venture capital corporations, arts and culture, and counterfeit and pirated goods.

The Vancouver Airport Authority, on behalf of the Arrivals Duty Free Coalition, and the Association of Canadian Airport Duty Free Operators told the Committee that duty-free sales at Canadian airports declined by 23% between 2002 and 2005. They supported the implementation of arrivals duty-free purchases in Canada, with no change in the maximum allowable amount of such purchases.

The Air Transport Association of Canada advocated immediate elimination of the Air Travellers Security Charge, and shared its belief that airport security should be publicly funded in the same way that it is for roads, rail and sea travel in Canada. Figure 4.8 shows revenues generated by the charge, as well as expenditures by the Canadian Air Transport Security Authority, for the 2003-2004 to 2004-2005 period.

Figure 4.8 — Air Travellers Security Charge Revenues and Expenditures by the Canadian Air Transport Security Authority, 2003 - 2004 to 2004 - 2005 ($ thousands)

2003-2004 |

2004-2005 |

|

Air Travellers Security Charge (ATSC) |

411,749 |

378,912 |

Goods and Services Tax / Harmonized Sales Tax related to the ATSC |

7,701 |

7,071 |

Penalties and Interest |

2,298 |

1,911 |

Total Revenues |

421,748 |

387,894 |

Operating Expenses |

246,577 |

281,147 |

Amortization |

11,117 |

30,360 |

Contributions |

2,408 |

(1,439) |

Total Expenses |

260,102 |

310,068 |

Source: Auditor General of Canada, Audit of Revenues for the Air Travellers Security Charge and of Expenses for the Enhanced Air Travel Security System for the Fiscal Year 2004-2005, August 17, 2007

The Air Transport Association of Canada also commented on airport rents, and proposed the gradual elimination of these rents, with reductions for each airport commensurate with its passenger volume. The International Air Transport Association advocated an immediate reduction of at least 52% in the airport rent charged to Toronto Pearson International Airport, with a view to eliminating the rent in the longer term. The Halifax Chamber of Commerce supported the elimination of airport rents.

Finally, the Air Transport Association of Canada spoke to the Committee about the aviation fuel excise tax. With federal revenues collected from this tax more than doubling in the last five years, largely due to increases in the price of fuel, it advocated the elimination of the aviation fuel excise tax.

The Railway Association of Canada told the Committee that the federal government applies an excise tax of four cents per litre on locomotive diesel fuel, and that this tax was introduced as a federal deficit reduction measure in the mid-1980s. Since the United States abolished its federal excise tax on locomotive fuel on January 1, 2007, and because Canadian railways are in direct competition with U.S. railways for North American freight traffic, it proposed that the federal excise tax on locomotive diesel fuel be eliminated.

The Horse Racing Alliance of Canada told the Committee that section 31 of the Income Tax Act is severely limiting the financial success, and thereby threatening the survival, of the horse racing industry in Canada. Although losses incurred while operating a business are generally fully deductible against other sources of income if it can be shown that there is a reasonable expectation that the business will generate a profit, section 31 restricts the ability of part-time farmers — that is, taxpayers for whom the income derived from their farming business, including the maintaining of horses for racing, does not constitute their main source of income — to deduct all of their losses against other income. It urged the federal government to repeal section 31.

The Canadian Council of Grocery Distributors observed that, since 1991 when the GST was introduced, consumers have changed their eating behaviours. While basic groceries, such as raw fruits and vegetables, are zero-rated products for purposes of the GST, if grocers cut and combine two or more fruits into a single package, the product becomes taxable — even if it is essentially composed of zero-rated groceries — unless the fruit mix is canned or vacuum-sealed. It urged the federal government, immediately and regularly, to review and update the products included in the definition of basic groceries in order to ensure that the definition reflects current eating habits and supports the public health objectives of greater consumption of fresh fruits and vegetables.

As well, the Canadian Council of Grocery Distributors argued that the current system of GST rulings by the Canada Revenue Agency needs to be improved. It told the Committee about a pilot project – ECCnet – that used a grocery industry database in order to enhance the efficiency and consistency of the GST ruling process for the grocery industry. It supported the full adoption of this project as well as measures that would ensure that GST rulings under this project would not be subject to future reassessments.

The Canadian Federation of Agriculture advocated the creation of a federal cooperative investment plan, based on a similar plan introduced in Quebec in 1985, which it believes would result in significant investments in the cooperative sector of rural communities. Its proposal would provide a 125% tax deduction to cooperative members and employees who invest in their cooperative’s preferred shares.

The Canadian Health Food Association indicated that domestic demand for organic food is rising, and proposed that the federal government provide tax incentives or grants to farmers in order to support the transition from conventional to organic agriculture.

The Recreation Vehicle Dealers Association of Canada and the Canadian Automobile Dealers Association informed the Committee that vehicle dealers are required to charge the GST on all vehicles sold, while sales of such used vehicles by private individuals are exempt from the GST. In an effort to remedy what it perceives to be an inequity, it suggested a number of proposals, including elimination of the GST on the sale of all vehicles whether they are sold by an individual or a business, a requirement that the GST be applied on the sale of all used vehicles or restoration of the system of notional input tax credits to dealers.

The Canadian Energy Pipeline Association informed the Committee that when a pipeline comes to the end of its useful life, it is abandoned, although environmental reclamation minimizes the overall impact on the environment; the costs associated with that abandonment are called terminal negative salvage (TNS) costs.

The federal government was urged to permit Canadian transmission pipeline companies that are governed by an independent regulator to claim a deduction equal to the TNS component of the pipeline transportation tolls against revenues received, provided that the TNS component of the pipeline transportation tolls is contributed to a qualifying prescribed trust. According to the proposal, the trust would not be subject to tax on its investment income until disbursed to the owner of the designated pipeline asset, who would then include these disbursements in income for purposes of taxation.

8. Labour-Sponsored Venture Capital Corporations

The Committee was told that Canada’s value of venture capital assets, on a per-capita basis, is about 40% of that in the United States, and that Labour-Sponsored Venture Capital Corporations (LSVCCs) account for approximately 50% of the venture capital in Canada. With a relatively sharp decline since 2001 in the supply of venture capital, GrowthWorks Capital Ltd. and GrowthWorks Atlantic Ltd. suggested that the maximum amount an investor may claim for the federal LSVCC investment tax credit should be increased to $1,500, which corresponds to an investment of $10,000.

Witnesses commented on a range of tax-related issues in respect of the arts and culture sector. For example, the Independent Media Arts Alliance told the Committee that artists often finance their creative work with earnings from non-artistic work. It urged the federal government to invest in artistic production by lowering the taxes to which artists are subject.

Such witnesses as the Writers Guild of Canada, the Professional Association of Canadian Theatres and the Canadian Conference of the Arts urged the federal government to implement a system of income averaging as a means of providing, in their view, fair and equitable tax treatment for self-employed creative professionals whose incomes tend to fluctuate from year to year. The Professional Association of Canadian Theatres proposed that the federal government, with the involvement of the Canada Revenue Agency, develop a policy whereby all professional artists would be presumed to be independent contractors for the purposes of income taxation, unless an explicit employee/employer contract of service exists.

Some witnesses, including the Canadian Conference of the Arts and the Professional Association of Canadian Theatres, advocated a tax exemption for copyright revenues of at least $30,000 annually, while the Canadian Conference of the Arts and the Canadian Dance Assembly supported a complete tax exemption for grants awarded to individual artists and creators.

The Association of Canadian Publishers spoke to the Committee about the challenges faced by Canadian publishers, and urged the federal government to provide a tax credit to authors for advances they earn from Canadian-owned publishers. It also suggested that the government develop financial and/or regulatory incentives for public institutions to buy Canadian books.

The Association des producteurs de films et de télévision du Québec advocated reform of the Canadian Film or Video Production Tax Credit, and urged the federal government to improve the value of the credit, especially for French-language productions. Moreover, with the number of co-productions with foreign firms declining because other countries have started to offer more generous tax credits for co-productions, it supported improved tax measures for such productions.

Finally, in order to help arts organizations finance their activities, the Professional Association of Canadian Theatres asked the federal government to create a tax incentive that would reimburse all or part of the cost of a subscription to a theatre, symphony or opera company. It also urged the extension of existing programs, such as the Children’s Fitness Tax Credit, to assist parents who register their children in cultural activities.

10. Counterfeit and Pirated Goods

The Committee was told that administrative monetary penalties, which are similar to court-levied fines but are imposed through an administrative process and do not result in a criminal record, have been introduced by the federal government in recent years in order to encourage compliance with laws and regulations. In noting that counterfeiting and piracy of goods results in economic losses to Canada and may have negative impacts on the health and safety of Canadians, the Purchasing Management Association of Canada urged the federal government to introduce administrative monetary penalties for the importation and exportation of counterfeit and pirated goods, with the penalties set sufficiently high to serve as an effective deterrent.

The Committee recommends that:

9. the federal government amend the Income Tax Act in order to extend, for a five-year period, the accelerated capital cost allowance for manufacturing and processing machinery and equipment.

10. the federal government amend the Income Tax Act in order to increase the capital cost allowance rate applied to rail rolling stock. The rate should be comparable to that in the United States and should reflect the useful life of the rolling stock.

11. the federal government, in respect of the Scientific Research and Experimental Development tax credit, amend the Income Tax Act in order to:

· increase the annual expenditure limit;

· increase the taxable capital threshold;

· remove the Canadian-controlled private corporation restriction; and

· make the credit partially refundable for all claimants.

12. the federal government develop and implement a non-refundable tax credit to encourage small and medium-sized businesses to undertake activities related to pandemic preparedness.

13. the federal government develop a concrete policy to assist the manufacturing and forestry sectors. This policy should include implementation of the fiscal recommendations contained in the February 2007 report of the House of Commons Standing Committee on Industry, Science and Technology.

14. the federal government clarify the income trust guidelines issued by the Department of Finance on 15 December 2006.

15. the federal government amend the Excise Tax Act in order to permit arrivals duty-free purchases at Canadian airports.