FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

In announcing the pre-budget consultations for 2007, the Committee asked Canadians to comment on the following question: what is the appropriate form and level of personal taxes, fees and other charges?

Within this context, and before recommending changes to taxes, fees and other charges paid by individuals, it is instructive to examine the contribution that personal tax revenues make to total federal tax revenues, current tax rates and thresholds, and select measures that are used by individual taxpayers to reduce the amount of taxes that they owe.

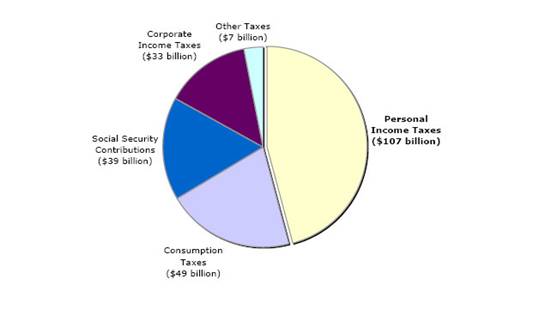

Since the end of the 1960s, federal personal income tax revenues have constituted the largest source of federal tax revenues. In 2005-2006, the federal government collected more than $105 billion in personal income taxes. As shown in Figure 3.1, this amount is more than twice the amount collected in 2005-2006 in federal consumption taxes, the second largest source of federal tax revenues.

Figure 3.1 — Federal Tax Revenues and Social Security Contributions, Canada, 2005 - 2006

Note: Social security contributions include contributions to the Canada and Quebec Pension Plans and Employment Insurance premiums. Capital taxes are included in corporate income taxes.

Source: Data obtained from Statistics Canada, CANSIM tables 385-0002 and 385-0006.

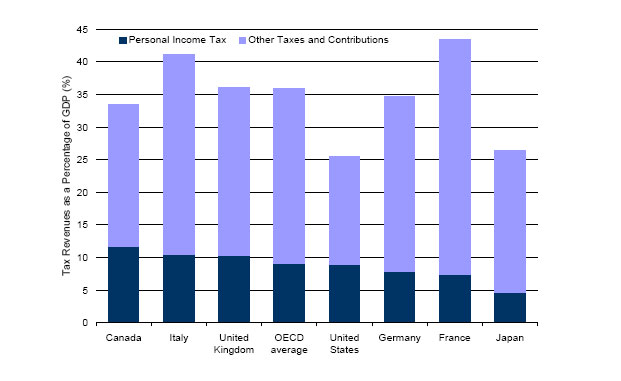

Canada’s reliance on personal income taxes is, and has traditionally been, relatively greater than that of any other Group of Seven (G7) country and of many Organisation for Economic Co-operation and Development (OECD) countries. Statistics from the OECD indicate that, in 2004, Canada’s reliance on personal income tax revenues was higher than that of all other G7 countries and the OECD average, both as a share of Gross Domestic Product (GDP) and as a share of total tax revenues, as shown in Figure 3.2.

Figure 3.2 — Tax Revenues (Including Social Security Contributions) As a Percentage of Gross Domestic Product and As a Percentage of Total Tax Revenues, All Levels of Government, Selected Countries, 2004

Source: Organisation for Economic Co-operation and Development, Revenue Statistics, 1965-2005

Personal income tax rates and brackets have changed relatively substantially over the last two decades. For example, prior to 1988, there were nine brackets; reforms in 1988 reduced the number of brackets to three. For the 2001 and subsequent taxation years, a fourth bracket was established for income exceeding $100,000; the tax rate for the first bracket fell from 17% to 16% and then to 15% for the 2005 taxation year, before rising to the announced rates of 15.25% and 15.5% for the 2006 and 2007 taxation years respectively. As well, for the 2001 and subsequent taxation years, the rate for the second bracket was lowered from 25% to 22%, and for the third was reduced from 29% to 26%; the rate for the new, fourth bracket was 29%. The October 2007 Economic Statement reduced the lowest personal income tax rate, starting for the 2007 taxation year, to 15%; the effect of this change is that, from a practical perspective, the 15.5% rate originally legislated for the 2007 taxation year will not be paid by taxpayers.

The income thresholds, as well as other amounts within the personal income tax system, have been fully indexed to inflation since 2000.

Federal marginal personal income tax rates for the 2007 taxation year are:

· 15% on the first $37,178 of taxable income;

· 22% on taxable income between $37,179 and $74,357;

· 26% on taxable income between $74,358 and $120,887; and

· 29% on taxable income over $120,887.

C. Exemptions, Credits and Deductions

Taxpayers are entitled to earn income on a tax-free basis up to a defined amount, known as the basic personal amount, which was valued at $8,839 for the 2006 taxation year. The October 2007 Economic Statement announced that the basic personal amount will increase to $9,600 for the 2007 and 2008 taxation years, and to $10,100 for the 2009 taxation year.

Taxpayers may also claim an amount for a spouse, common-law partner or eligible dependant in an amount equal to the basic personal amount, reduced on a dollar-for-dollar basis by the spouse’s, common-law partner’s or dependant’s net income.

All taxpayers aged 65 and older receive an age amount in addition to the basic personal amount. The age amount is $5,177 for the 2007 taxation year.

Finally, the personal tax system provides tax credits and deductions that recognize a variety of personal expenses incurred during the year, such as those related to employment, education, union dues, medical requirements, pension plans, the Employment Insurance program, and charitable and political donations.

A. Personal Income Tax Rates, Thresholds And Other Amounts

Witnesses shared their views with the Committee about personal tax changes in respect of rates, thresholds and the basic personal amount. They also commented on the ability of couples to split their income for the purpose of calculating taxes.

A number of the Committee’s witnesses, including the United Steelworkers, the Canadian Federation of Nurses Unions, the Hamilton Roundtable for Poverty Reduction, the Manitoba Federation of Labour, the Nova Scotia Government & General Employees Union and the Association NPD de Lotbinière–Chutes-de-la-Chaudière, suggested that the level of personal taxation should be aligned with the level of public goods and services desired by Canadians. In view of projected increases in the cost of such public services as health care, child care, post-secondary education, environmental protection and initiatives to reduce poverty, such groups as the Canadian Association of Social Workers, the Nova Scotia Federation of Labour, SpeciaLink: The National Centre for Child Care Inclusion and the Canadian Union of Public Employees urged the federal government not to reduce personal income taxes further.

Other witnesses — including the Victoria Labour Council, the Canadian Labour Congress, the National Anti-Poverty Organization and First Call: BC Child and Youth Advocacy Coalition — went further, and advocated greater progressivity through an increase, to 31.5% from 29%, in the top personal income tax rate. The Public Service Alliance of Canada and Calgary and District Labour Council requested the introduction of a new and higher tax rate on personal income in excess of $250,000, while the Canadian Labour Congress proposed that the capital gains inclusion rate be increased to 100%. Figure 3.3 shows the estimated impact on federal personal tax revenues of a one percentage point change in personal tax rates, assuming everything else remains unchanged.

Figure 3.3 — Estimated Federal Fiscal Impact of a One Percentage Point Change in Personal Income Tax Rates, 2008

Tax Rate Change |

Estimated Reduction in Federal Personal Tax

Revenues |

From 15% to 14% |

2,691 |

From 22% to 21% |

1,715 |

From 26% to 25% |

503 |

From 29% to 28% |

682 |

Source: Library of Parliament’s estimations using Statistics Canada’s Social Policy Simulation Database and Model (SPSD/M), version 15. The Library of Parliament is responsible for the use and interpretation of this model.

Some witnesses, including the Toronto Financial Services Alliance, supported personal income tax reductions. Some witnesses highlighted the importance of competitive personal income tax rates in order to attract highly skilled and internationally mobile workers. The Committee was also told that lower tax rates have positive impacts on work effort and personal investments in work-related training, among other effects, all of which are important for a productive economy.

In particular, the Canadian Printing Industries Association, the Canadian Retail Building Supply Council and the Canadian Hardware & Housewares Manufacturers Association urged the federal government to prioritize substantial and comprehensive personal income tax reductions over program spending.

Specific concerns were expressed about the ability of businesses to attract and retain highly qualified engineers, scientists, business developers and managers. The Information Technology Association of Canada asked the federal government to reduce the top marginal personal tax rate and to raise the associated income threshold. The Greater Victoria Chamber of Commerce and the Halifax Chamber of Commerce proposed that the top income tax threshold be increased to $150,000, and possibly up to $200,000 as fiscal conditions permit.

Another witness, Trevor Nakka, argued that personal tax rates should not rise with increasing income from labour. The Committee was told that a flat tax rate across income thresholds would provide an incentive for increased labour force activity, especially for the most productive employees.

Other witnesses spoke about low- and medium-income earners who experience high marginal personal tax rates as a result of clawbacks imposed on federal benefits — such as the Goods and Services Tax Credit and the Canada Child Tax Benefit — as income rises, and the resulting negative impacts on incentives to work. Such witnesses as the Canadian Chamber of Commerce and the Greater Kitchener Waterloo Chamber of Commerce advocated tax relief for low- and modest-income earners.

Réseau Solidarité Itinérance du Québec and Women Elders in Action urged the federal government to increase the basic personal amount to the level of the Statistics Canada’s measure of low income. The Canadian Conference of the Arts advocated an increase in the basic personal amount for self-employed individuals to $12,000, while the Professional Association of Canadian Theatres suggested raising the basic personal amount to $11,500. The Alliance to End Homelessness proposed the creation of a refundable income tax credit for individuals and families based on Statistics Canada’s measure of low income. Figure 3.4 shows the estimated federal fiscal cost of increasing the basic personal amount to various levels, assuming everything else remains unchanged.

Figure 3.4 — Estimated Federal Fiscal Cost of Increasing the Federal Basic Personal Amount to Various Levels, 2008

Basic Personal Amount |

Estimated Reduction in Federal Personal Tax

Revenues |

From $9,600 to $10,600 |

2,743 |

From $9,600 to $11,600 |

5,404 |

From $9,600 to $20,000 |

24,940 |

Note: The spouse or common-law partner and wholly dependant relative amounts are increased by the same amount in order to remain equivalent to the basic personal amount.

Source: Library of Parliament’s estimations using Statistics Canada’s Social Policy Simulation Database and Model (SPSD/M), version 15. The Library of Parliament is responsible for the use and interpretation of this model.

The Greater Victoria Chamber of Commerce requested that the federal government allow the deferral of income tax on capital gains when the proceeds from the sale of assets are reinvested within a six-month period; amounts not reinvested within that period should be taxed on a pro-rata basis.

Few witnesses commented on family income splitting, which would permit couples to split their taxable income on their tax returns in order to minimize tax liabilities. Those who mentioned the concept — including Randall Garrison and the Canadian Federation of Students — were opposed to it, mainly because it would favour higher-income couples, have implications for federal tax revenues and not benefit single mothers.

A number of the Committee’s witnesses spoke about federal support for children. In particular, they mentioned the Canada Child Tax Benefit (CCTB), the National Child Benefit Supplement (NCBS), the Universal Child Care Benefit (UCCB) and other tax-related measures that they believe would improve the lives of Canada’s children.

1. The Canada Child Tax Benefit, the National Child Benefit Supplement and the Universal Child Care Benefit

KAIROS: Canadian Ecumenical Justice Initiatives and the National Anti-Poverty Organization urged the federal government to increase the maximum benefit from the CCTB and the NCBS combined from $3,200 to at least $5,000 annually, while First Call: BC Child and Youth Advocacy Coalition advocated consolidation of the UCCB and the NCBS with the CCTB and a maximum annual benefit of $5,100 per child. In addition, a number of witnesses, including the Alliance to End Homelessness, commented on provincial government reductions in social assistance benefits by all or a portion of the NCBS amount. Figure 3.5 shows the estimated federal fiscal cost of increasing the annual amount of the CCTB to various levels, assuming everything else remains unchanged.

Figure 3.5 — Estimated Federal Fiscal Cost of Proposed Changes to the Canada Child Tax Benefit (CCTB), the National Child Benefit Supplement (NCBS) and the Universal Child Care Benefit (UCCB), 2008

Proposed Change |

Estimated Federal Fiscal Cost |

Increasing the Canada Child Tax Benefit maximum annual benefit per child by $1,800 |

10.5 |

Consolidating the Universal Child Care Benefit and the National Child Benefit Supplement with the Canada Child Tax Benefit, and a single maximum annual benefit of $5,100 per child |

18.2 |

Source: Library of Parliament’s estimations using Statistics Canada’s Social Policy Simulation Database and Model (SPSD/M), version 15. The Library of Parliament is responsible for the use and interpretation of this model.

The Fédération des femmes du Québec, the Conseil d'intervention pour l'accès des femmes au travail and the Fédération des associations de familles monoparentales et recomposées du Québec told the Committee that the UCCB is an inappropriate way in which to provide public support for child care. These witnesses, in addition to the Catholic Women's League of Canada and Heike Schmidt, shared their view that making the UCCB non-taxable would improve the fairness of the program.

Witnesses also made other proposals with respect to children and child care. The Catholic Women’s League of Canada proposed that a tax credit for stay-at-home parents be created, while the Fédération des femmes du Québec, the Conseil d'intervention pour l'accès des femmes au travail and the Fédération des associations de familles monoparentales et recomposées du Québec urged replacement of the income tax deduction for child care expenses with a refundable tax credit that would be gradually reduced with increases in income. UNICEF Canada said that the federal government should undertake a comprehensive analysis of the impacts of taxes on children, and should examine the distributional impact of proposed taxes, fees and levies on children. Finally, another witness — Heike Schmidt — suggested that every family in Canada should be able to deduct all expenses required to raise children.

Witnesses presented the Committee with a range of views and proposals in respect of tax measures that affect students, including tax credits, education savings plans, tuition fees and employment income.

1. Tax Credits and Savings Plans

The Canadian Federation of Students requested that education and tuition fee tax credits, the registered education savings plan (RESP) initiative and the Canada Education Savings Grant program be discontinued, with the funds that are saved instead allocated to a comprehensive national system of need-based grants.

The College Student Alliance made a similar request, and urged the federal government to consider the development and implementation of more effective tax policies or programs to motivate students and their families to contribute to their post-secondary education. For example, measures that would reduce the tax burden on parents or on persons who support students enrolled in post-secondary education were advocated.

2. Measures Related to Tuition Fees and Other Education Costs

The Canadian Association for Graduate Studies proposed that tuition fees be made fully deductible from taxable income, and the College Student Alliance suggested that the financial burden on students could be effectively lessened through such tax measures as tuition tax rebates, refundable sales tax credits or targeted tax deductions. New Brunswick’s Tuition Tax Cash Back Credit was mentioned as an example of a tax measure that could be offered by the federal government. This provincial credit allows students to recover 50% of eligible tuition fees paid after January 2005, up to a lifetime maximum of $10,000 in credits.

The Catholic Women’s League of Canada noted its support of a tax exemption for post-secondary education textbooks, while the Ontario Council of Agencies Serving Immigrants suggested that some recent tax initiatives — such as the textbook tax credit for students and the complete exemption of scholarships, fellowships and bursaries from taxation — provide only limited benefits and do little to increase access to post-secondary education for low-income immigrant students. Figure 3.6 shows the estimated federal fiscal cost of the textbook tax credit for 2006 and 2007.

Figure 3.6 — Federal Fiscal Cost of the Textbook Tax Credit, 2006 and 2007

Year |

Estimated Federal Fiscal Cost |

2006 |

80 |

2007 |

82 |

2008 |

83 |

Source: Department of Finance Canada, Tax Expenditures and Evaluations 2006

3. Students, Graduates and Paid Employment

Witnesses also commented that tax policies should be designed in a manner that would encourage students to support their post-secondary education through paid employment. This support could take the form of tax measures directed at individuals, such as reduced taxes for students who are employed or for newly graduated students who are employed, or at employers, such as incentives to offer summer or intern programs for students. The Association of Nova Scotia University Teachers advocated additional tax assistance for new graduates who enter the workforce with student debt.

The Greater Victoria Chamber of Commerce suggested that tax incentives should be created in order to encourage businesses to employ students, especially international students, with a view to addressing potential labour shortages. It recommended a new co-op tax credit for small- and medium-sized employers, in an amount equal to 15% of the wages paid to qualified co-op students in positions that have the potential to become full-time employment opportunities. Moreover, the Canadian Association for Graduate Studies recommended the development of a tax incentive for employers that create employment which requires graduate-level training.

Finally, the Canadian School Boards Association informed the Committee about a Saskatchewan program offering tax-free status for earned income for a limited period of time following graduation from a secondary or post-secondary institution; the objective of the program is to provide students with an incentive to complete their education and to return to Saskatchewan following graduation. It requested the establishment of a similar program at the federal level targeted to Aboriginal students graduating from secondary and post-secondary institutions.

The Committee heard about a number of tax-related proposals related to employed individuals, including the Working Income Tax Benefit (WITB), employee share purchase plans, attraction and retention initiatives, travel using employer-provided vehicles, measures related to those who are disabled, training, taxation in relation to Hutterite children who work on the farm, and the Northern Residents Deduction.

1. The Working Income Tax Benefit

While those witnesses who commented on the WITB generally supported this new initiative, some witnesses — such as the Social Planning Council of Winnipeg — advocated an increase in the benefit level and changes to the eligibility requirements in an effort to make the benefit available to more workers.

The Canadian Association of Food Banks and Feed Nova Scotia proposed that the benefit level be gradually increased over time to reach a maximum of $2,400 per year, or $200 per month, for single individuals without dependants. The Canadian Restaurant and Foodservices Association requested that the WITB be indexed to inflation and increased to a maximum of $1,250 per person per year, reduced by 10% of income in excess of $20,000 annually, and phased out at an income level of $30,000. The National Anti-Poverty Organization advocated WITB benefit levels comparable to those in the United States, where a similar credit provides support of up to about US$4,400 for a family with children and begins eligibility with the first dollar earned. Figure 3.7 shows the estimated federal fiscal cost of increasing the WITB to various levels, assuming everything else remains unchanged.

Figure 3.7 — Estimated Federal Fiscal Cost of Increasing the Working Income Tax Benefit to Various Levels

Working Income Tax Benefit (WITB) |

Estimated Federal Fiscal Cost |

Increasing the maximum annual WITB benefit by $350 for single individuals and by $700 for couples and single parents |

578 |

Increasing the maximum annual WITB benefit by $700 for single individuals and by $1,400 for couples and single parents |

1,247 |

Source: Library of Parliament’s estimations using Statistics Canada’s Social Policy Simulation Database and Model (SPSD/M), version 15. The Library of Parliament is responsible for the use and interpretation of this model.

2. Employee Share Purchase Plans

WestJet spoke to the Committee about personal taxation of employee share purchase plans, and noted that 85% of WestJet employees are active in the company’s employee share purchase plan. Under the WestJet plan, employees can buy company shares on the stock market and the company will match employees’ purchases, up to a maximum annual level; employees cannot sell those shares until a minimum period of time has elapsed. Although employees cannot immediately sell the shares, the employer’s matching contribution is deemed to be a taxable benefit, and employees must immediately pay tax on the employer’s contribution.

WestJet requested that, under an employee share purchase plan, employees not be required to pay tax on the employer’s matching contribution until the shares are sold and a financial benefit is received. Moreover, it suggested that the employer’s matching contribution should be treated as a capital gain for income tax purposes.

3. Attraction and Retention Initiatives

The Committee was told that the federal government should find ways to attract and to retain workers, and witnesses suggested a variety of measures aimed at attaining these goals. For example, the Greater Victoria Chamber of Commerce advocated the creation of tax incentives designed to attract and repatriate skilled individuals — foreign immigrants and Canadian emigrants — in specific industries where labour shortages are particularly acute. The Certified General Accountants Association of Canada urged the federal government to consider a targeted tax credit for employers who retain workers beyond age 65.

The Fédération des femmes du Québec, the Conseil d'intervention pour l'accès des femmes au travail and the Fédération des associations de familles monoparentales et recomposées du Québec advocated a reduction in the fees charged for foreigners who wish to move to Canada.

4. Employees and Employer-Provided Vehicles

In addition to the employer-provided transit proposal made by Accor Services that is discussed in Chapter 5, witnesses also spoke to the Committee about employer-provided vehicles. The Canadian Construction Association and the Road and Infrastructure Program of Canada requested a change to the tax treatment of employer-provided vehicles used under certain conditions. In particular, we were told that there are circumstances under which the use of an employer-provided vehicle to commute to and from work should not constitute a taxable benefit. These circumstances include situations where:

· the employer requires the employee to take the employer-provided vehicle home at night for such reasons as security and the lack of adequate parking facilities at the work site; and

· the employer prohibits the employee from using the vehicle for non-work-related purposes, other than to commute between the designated work site and the employee’s residence.

The Canadian National Institute for the Blind informed the Committee that some employers are reluctant to hire vision-impaired job seekers because of the perceived higher costs of accommodation and training. It requested the federal government to create a tax credit for employers that hire, accommodate and retain — for at least a 12-month period — an employee with vision loss.

The Committee was told that investments in employee training by businesses are declining, and witnesses spoke about a Conference Board of Canada report which concluded that, in 1996, employers invested $847 per employee in training; in 2006, they invested $699 (measured in 1996 constant dollars) per employee.

While the federal government is supporting capital expenditures in the manufacturing and processing sector through the 50% straight-line accelerated capital cost allowance rate applied to eligible assets, the Canadian Printing Industries Association observed that this measure would need to be accompanied by more training of employees in order to be really effective.

The Poverty Reduction Coalition suggested that the federal government should provide tax incentives for employer-sponsored training programs and work-related supports, while the Greater Victoria Chamber of Commerce advocated the creation of tax incentives for employers in order to encourage employee skills training through accredited post-secondary institutions. The Certified General Accountants Association of Canada proposed that the federal government reduce the Employment Insurance premium rates of employers that invest in employee training or that allow employees to take time off in order to complete their professional certification.

The Canadian Nurses Association and the Canadian Steel Producers Association urged the federal government to create a tax credit for training spending, which would be claimable against both employer and employee Employment Insurance premiums. Similarly, the Certified Management Accountants Canada supported the introduction of a refundable tax credit for training expenditures up to a limit of $10,000 per worker per year. Finally, the Road and Infrastructure Program of Canada proposed that the Apprenticeship Job Creation Tax Credit be extended to all provincially recognized construction trades, including those in the road building and heavy construction sectors.

A tax request was made with respect to a particular group of taxpayers: the Hutterites. Myers Norris Penny LLP suggested that Canadian Hutterite colonies are unfairly treated by the tax system, since section 143 of the Income Tax Act does not permit taxable income to be allocated to children under the age of 18 when they belong to a Hutterite colony, even though these children actively participate in colony farming operations. Although section 143 does not specifically mention Hutterite colonies, Myers Norris Penny LLP suggested that, to the extent of its knowledge, Hutteries colonies are the only group of taxpayers to which section 143 applies. Non-Hutterite farmers are normally allowed to allocate income to children as long as the amount is considered to be "reasonable" based on the work performed.

From this perspective, Myers Norris Penny LLP proposed that section 143 be amended in order to tax Hutterite colonies in a manner similar to other family farm operations while respecting their unique way of life. Specifically, the federal government was urged to permit colonies to allocate taxable income to:

· children aged 15 to 17 who work full time on the colony, up to a maximum of $25,000;

· children aged 11 to 14, up to a maximum amount equal to 1,500 hours of work at the minimum wage; and

· children aged 8 to 10, up to a maximum of 50% of the amount allocated to children in the 11-to-14 age group.

The Committee was told that the cost of living in the three northern territories is much higher than elsewhere in Canada, and residents spend significantly more for shelter and food than those in southern regions of Canada. The Northern Territories Federation of Labour, the Northern Regional Council of the Public Service Alliance of Canada and the Nunavut Economic Forum noted that the residency portion of the federal Northern Residents Deduction has not been increased since its inception in 1987, and urged that it be raised. In particular, the Northern Territories Federation of Labour requested that the residency portion of the deduction be increased by 50%, while the Nunavut Economic Forum advocated that it be increased to reflect the cumulative effect of inflation since 1987. Both witnesses proposed that the Northern Residents Deduction be indexed to inflation.

A number of witnesses spoke to the Committee about the Employment Insurance (EI) program, which is funded by premiums paid by employees and employers. They advocated changes that, in their view, would better assist the unemployed as well as improve accountability and fairness.

The Committee was reminded that the Employment Insurance account has a surplus that exceeds $50 billion, as indicated in Figure 3.8. The Canadian Union of Public Employees and Feed Nova Scotia suggested that the EI system should be reformed in order to increase benefits and coverage for a greater segment of the unemployed population.

Figure 3.8 — Employment Insurance Account, Accumulated Surplus, Canada, 1996 - 1997 to 2006 - 2007

Source: Receiver General of Canada, Public Accounts of Canada, Vol. 1, Ch. 4, selected years

Other witnesses supported a better premium rate-setting process that would enable further reductions in EI premium rates. In particular, the Canadian Chamber of Commerce advocated the introduction of an employer-based experience rating system, which would reduce the EI premium rate for firms that generate relatively fewer EI claims, and – along with the Certified General Accountants Association of Canada – requested an employer premium rate equal to the rate paid by employees. Figure 3.9 shows the EI premium rates paid by employers and employees since 2000. The Canadian Chamber of Commerce urged the implementation of a system for refunding over-contributions by employers.

The Ontario Municipal Social Services Association requested changes to EI eligibility criteria, and suggested that the criteria should take into account the growth of the self-employed, contract and contingent workforce. The Canadian Dance Assembly proposed that EI benefits be provided to all self-employed Canadians, including artists and cultural workers.

Figure 3.9 — Employment Insurance Premium Rates, Canada, 2000 - 2008

Year |

Employee |

Employer Premium Rate (%) |

2000 |

2.4 |

3.36 |

2001 |

2.25 |

3.15 |

2002 |

2.2 |

3.08 |

2003 |

2.1 |

2.94 |

2004 |

1.98 |

2.77 |

2005 |

1.95 |

2.73 |

2006 |

1.87 |

2.62 |

2007 |

1.8 |

2.52 |

2008 |

1.73 |

2.42 |

Source: Canada Revenue Agency, EI premium rates and maximums, available at www.cra-arc.gc.ca

Finally, the Canadian Restaurant and Foodservices Association requested that the federal government introduce a $3,000 yearly basic exemption similar to the existing exemption in respect of Canada Pension Plan contributions.

Witnesses spoke about a variety of tax-related measures that provide support for retirees and for retirement saving. In particular, comments were made with respect to the Guaranteed Income Supplement, Old Age Security benefits, registered savings plans and pension income splitting.

1. Old Age Security and Guaranteed Income Supplement Benefits

A number of witnesses highlighted the negative employment, phased retirement and retirement savings effects associated with the Guaranteed Income Supplement (GIS) clawback. In particular, the Canadian Restaurant and Foodservices Association requested that the GIS clawback be reduced in order to permit low-income seniors to earn employment income while retired. Canada's Association for the Fifty-Plus suggested that the GIS clawback should be replaced by an allowable range of income — perhaps $4,000 to $5,000 — above Statistics Canada’s low income cut-offs. Another witness, Ruth M. McVeigh, urged that all seniors entitled to GIS benefits be exempt from income taxes.

The Investment Funds Institute of Canada proposed that the federal government exclude income from registered retirement savings plans (RRSPs) and registered retirement income funds (RRIFs) from taxable income for the purpose of calculating GIS benefits. It also suggested that the actual amount of dividends received should be considered in the calculation of the reduction in GIS benefits, rather than the grossed-up amount that is used in the calculation of the dividend tax credit.

Canada's Association for the Fifty-Plus made a similar request with respect to the Old Age Security (OAS) repayment, advocating that the actual value of dividends be included in income for the purpose of calculating OAS repayments, rather than the grossed-up dividend amount. Another witness, Bell Pensioners’ Group Inc., urged the complete elimination of OAS repayments.

Several witnesses, including Citizens for Public Justice and First Call: BC Child and Youth Advocacy Coalition, suggested that the ability to make tax-free contributions to RRSPs is of greater benefit to taxpayers in higher tax brackets, since RRSP contributions are deducted from taxable income and the tax benefit associated with these contributions increases as a taxpayer’s marginal tax rate rises. Women Elders in Action proposed that the deduction for RRSP and registered pension plan contributions be converted to a tax credit at a fixed rate. Tax-prepaid savings plans (TPSPs) were also suggested as a potentially more effective means of encouraging tax-sheltered retirement savings for low-income individuals.

The Investment Funds Institute of Canada advocated an increase in the maximum annual RRSP contribution limit in order to reflect increases in income over time. It proposed that the contribution limit of 18% of earned income be raised to 25%, and that the $22,000 annual limit be increased to $32,000. Figure 3.10 shows increases in the RRSP contribution limit since 2000.

Figure 3.10 — Changes in the Registered Retirement Savings Plan Contribution Limit, 1999 - 2012

Year |

Contribution Limit |

1999 to 2002 |

$13,500 |

2003 |

$14,500 |

2004 |

$15,500 |

2005 |

$16,500 |

2006 |

$18,000 |

2007 |

$19,000 |

2008 |

$20,000 |

2009 |

$21,000 |

2010 |

$22,000 |

2011 - beyond |

Indexed to inflation |

Source: CCH Canadian Limited, Canadian Income Tax Act with Regulations, selected editions

Furthermore, the Investment Funds Institute of Canada observed that the dividend tax credit and the 50% capital gains inclusion rate are not applied to funds withdrawn from RRSPs or RRIFs; the preferential tax treatment for dividends and capital gains was advocated in respect of such investment income when withdrawn from registered plans.

The Canadian Institute of Actuaries shared its concerns about defined benefit pension plans. The Committee was told that there are disincentives for plan sponsors to adopt higher levels of funding, which reduces the ability of these plans to withstand adverse economic conditions and compromises the benefits of plan members. It supported several changes to the Income Tax Act and Regulations: permit the use of a pension security trust, separate from the pension plan fund, with contributions from the plan sponsor returned to it if the funds are not needed; establish a target solvency margin for each pension plan, based on the plan’s level of risk, and permit funding of the plan up to this level; and increase the maximum allowable surplus in a pension plan to the greater of twice the target solvency margin or 25% of the going concern liabilities.

Several witnesses — including the Investment Funds Institute of Canada and Susan Davison — commented on pension income splitting, and observed that pension income from an individual’s pension plan may be eligible for pension income splitting before the age of 65, while income from RRSPs and RRIFs is eligible for pension splitting starting at age 65 only. In their view, this situation creates an inequity.

The Investment Funds institute of Canada requested that income from a RRIF be eligible for pension income splitting once pensioners reach age 55, while Susan Davison informed the Committee that, in Saskatchewan, legislation allows registered pension plans to provide variable pension benefits to pensioners before age 65 and without having to move benefits into a RRIF. In order to provide uniformity across all forms of pension income, she requested that retirement income from all prescribed vehicles, including RRIFs, be eligible for income splitting before age 65.

4. Lifetime Capital Gains Exemption

The aim of the $750,000 lifetime capital gains exemption on the disposition of qualified small business shares and farm/fishing property is to encourage investment in these sectors and to facilitate the establishment of a more solid base for the retirement income of farmers and small business owners. The Canadian Automobile Dealers Association suggested that this exemption should be increased to $5 million, and proposed that private owners of small businesses be able to transfer their business to their adult child on a tax-free basis.

The Committee heard about various issues related to learning and was presented with a number of proposals regarding education, including in respect of the federal Goods and Services Tax (GST), electronic learning and resources, and registered education savings plans (RESPs).

With some witnesses highlighting the importance of reading for a full appreciation of culture and for the acquisition of the literacy skills needed for full participation in society, the Canadian Library Association suggested that the GST imposed on books has reduced the ability of some Canadians to purchase reading material. It, along with the Canadian Booksellers Association, advocated elimination of the GST on books and reading materials.

Moreover, the Canadian Association of Research Libraries told the Committee that university libraries receive a full rebate on the GST paid on printed books, and on subscriptions to magazines and periodicals with less than 5% of advertising. Since much scholarly research material is now delivered in electronic format, it suggested that scholarly materials in electronic format should qualify for the full rebate as well.

Another request related to the GST concerned the application of the tax to eligible purchases made by school boards, universities and colleges. A number of witnesses, including the Canadian Association of School Boards, the Association of Universities and Colleges of Canada and the Université de Montréal, urged the federal government to make such purchases GST-exempt. The Committee was reminded that municipalities already receive a full rebate on the GST they pay.

The Canadian Association of Research Libraries observed that the use of e-learning — the electronic delivery of educational, training and library resources — by Canadian institutions has increased by as much as 30% over the past five years. It advocated tax incentives to support e-learning by individuals.

3. Registered Education Savings Plans

In its presentation to the Committee, the Canadian Life and Health Insurance Association questioned the current requirement that all RESPs be legally structured as trusts. It maintained that this requirement results in financial institutions being unable to offer RESPs without the involvement of a third-party trustee, which may result in higher costs for RESP contributors, and proposed that non-trusteed contracts under RESPs be permitted, which would be consistent with such other savings vehicles as RRSPs and RRIFs. Figure 3.11 shows the estimated net federal fiscal cost associated with the deferral of income tax on RESP contributions for the 2001 to 2007 period.

Figure 3.11 — Net Federal Fiscal Cost of Deferred Income Tax on Registered Education Savings Plan Contributions, Canada, 2001 - 2007

Year |

Estimated Federal Fiscal Cost ($ millions) |

2001 |

96 |

2002 |

110 |

2003 |

130 |

2004 |

150 |

2005 |

145 |

2006 |

175 |

2007 |

215 |

Source: Department of Finance Canada, Tax Expenditures and Evaluations 2006

Witnesses spoke to the Committee about a range of tax measures related to formal and informal education, and education throughout one’s lifetime. For example, the Manitoba Museum, the Canadian Association of Science Centres and Discovery Centre supported the creation of a science and technology learning tax credit for science centre memberships and enrolments in science and technology programs, such as science camps and weekend club programs for children.

One witness, William A. J. Bertrand, requested that an education allowance fund be created and funded through employee and employer payroll contributions, as well as through federal contributions; employees could choose whether to participate. In his view, the fund would particularly benefit employees who have little or no post-secondary education, and who have been unable to upgrade their job skills and employability.

The ABC CANADA Literacy Foundation highlighted the importance of increasing the basic literacy level of Canadians as a mean of improving the labour force participation, employment and living standards of those with poor literacy skills. It requested the creation of tax incentives for small and medium-sized businesses to support workplace and essential skills development.

The Certified General Accountants Association of Canada advocated an increase in the limit for the education tax credit and urged that it be made refundable. It also proposed that the Income Tax Act be amended in order to clarify the criteria used in the designation of educational institutions for purposes of the tax credit.

The Committee received a range of tax-related recommendations regarding the health of Canadians. In particular, witnesses presented their views on disability-related issues, medical expenses, home care and caregivers, dental care, eye care, pandemic preparedness, health care, equipment and infrastructure, and healthy living.

1. The Disability Tax Credit, Canada Pension Plan Disability Benefits and Disability Insurance

A number of witnesses advocated improvements to the Disability Tax Credit (DTC) in order to provide assistance to a greater number of taxpayers. The Alliance for Equality of Blind Canadians supported an increase in the DTC amount, while others — including the Canadian Association for Community Living, the Council of Canadians with Disabilities, the Multiple Sclerosis Society of Canada, the Fédération des femmes du Québec, the Conseil d'intervention pour l'accès des femmes au travail and the Fédération des associations de familles monoparentales et recomposées du Québec — requested that the credit be made refundable, so that every eligible person could benefit fully from the credit regardless of their taxable income. Figure 3.12 shows Disability Tax Credit claims, by income group, for 2001.

Figure 3.12 — Disability Tax Credit (DTC) Claims, by Income Group, Canada, 2001

Income from taxable sources |

Number of individuals who claimed the DTC for themselves |

Percentage of claims |

Less than $10,000 |

59,300 |

17.2 |

Source: Report of the Technical Advisory Committee on Tax Measures for Persons with Disabilities, December 2004, Table 2.2

The Canadian National Institute for the Blind recommended that the DTC amount be refunded on a sliding scale, based on income and only for those in the labour force for at least 12 months. The Alliance for Equality of Blind Canadians urged the federal government to create a new, refundable tax benefit to assist disabled Canadians, particularly those who are not in the labour force.

The Committee also heard concerns about the DTC’s eligibility criteria. The Council of Canadians with Disabilities proposed that those eligible for Canada Pension Plan (CPP) disability benefits automatically be eligible for the DTC. The Multiple Sclerosis Society of Canada highlighted the challenges faced by Canadians with episodic disabilities in qualifying for disability benefits, and urged the federal government to modify the eligibility criteria for CPP disability benefits and the DTC in order to take into consideration the episodic nature of disabilities resulting from such diseases as multiple sclerosis, HIV/AIDS, lupus, muscular dystrophy and mental illness. For example, the Multiple Sclerosis Society of Canada suggested that the eligibility criteria for CPP disability benefits regarding part-time or occasional work should be made more flexible in order to allow recipients to work more without compromising their eligibility for benefits. It also advocated enhanced flexibility in respect of the requirement that contributions to the CPP be made in four of the last six years in order to qualify for benefits.

The Canadian Life and Health Insurance Association spoke to the Committee about the taxation of disability insurance benefits from cost-shared disability insurance plans. In order to improve employees’ access to disability insurance, it suggested that:

· if the employer contributes more than 50% of the costs of the disability insurance plan, the benefits received should be fully taxable; and

· if the employer contributes 50% or less of the costs of the disability insurance plan, the benefits received should be non-taxable.

2. The Medical Expense Tax Credit

Some witnesses spoke about the medical expense tax credit. The National Council of Women of Canada suggested that low-income taxpayers with high medical or disability-related expenses need more tax assistance. A number of witnesses supported reforms to the medical expense tax credit. For example, the Bell Pensioners’ Group Inc. and the Canadian Nurses Association said that taxpayers should be allowed to claim the full amount of medical expenses under the credit. Furthermore, in order to equalize the treatment of lower-income taxpayers compared to higher-income taxpayers in respect of this credit, the National Anti-Poverty Organization advocated elimination of the maximum amount to be deducted from medical expenses claimed.

Witnesses also commented on the types of medical expenses eligible to be claimed under the medical expense tax credit. Canada's Association for the Fifty-Plus requested that allowable medical expenses be expanded to include prescribed vitamins, over-the-counter medications, and monitoring and other assistive living devices. The Canadian Health Food Association urged the federal government to recognize natural health products as eligible expenses. Finally, the Canadian Nurses Association advocated the creation of a tax credit for medications prescribed to children.

The Committee was told that informal caregivers — largely family and friends — provide a substantial component of home care, and that the services provided by an estimated 2.1 million unpaid informal caregivers results in $5 billion in annual savings for the health care system. Various suggestions for reducing the burden on caregivers — who may experience loss of income through forgone employment as well as either a loss of, or a reduction in, employer-sponsored benefits, CPP credits, training opportunities and seniority — were shared with the Committee.

The Multiple Sclerosis Society of Canada suggested that current Employment Insurance provisions that allow caregivers to receive EI payments and that provide job protection for individuals who leave their jobs to care for a gravely ill or dying child, parent or spouse should be expanded. It urged coverage for the family caregivers of people who are severely disabled.

The Canadian Healthcare Association requested that the Canada Pension Plan/Quebec Pension Plan (CPP/QPP) be changed to permit continued contributions by those who leave the labour force to care for a senior. Alternatively, it proposed an expansion of the current provisions of the Canada Pension Plan, which permit parents with children to remove certain years of low or no earnings from the calculation of their pension benefits, to other types of caregivers.

The Nova Scotia Association of Social Workers told the Committee that many family caregivers must reduce their employment activity in order to provide care, resulting in a level of income that may be insufficient to enable them to benefit from the non-refundable caregiver tax credit and to compensate them for their financial hardship; it supported the creation of refundable tax credits. Similarly, the Fédération des femmes du Québec, the Conseil d'intervention pour l'accès des femmes au travail and the Fédération des associations de familles monoparentales et recomposées du Québec proposed the creation of a refundable credit for caregivers and suggested that the existing caregiver tax credit and the adult dependant tax credit should be merged into a single, more generous credit.

4. Dental Care, Eye Care and Pandemic Preparedness

Witnesses also advocated tax measures that would improve other aspects of health, and spoke to the Committee about dental care, eye care and pandemic preparedness. The Canadian Nurses Association requested that, in order to improve access to dental care and eye care for all Canadian children, a tax credit for dental check-ups and for eye exams be created. The Canadian Dental Association noted that oral disease is almost entirely preventable and, from this perspective, argued that the federal government has a role to play in encouraging prevention and care. It also indicated its support for continued tax deductibility of dental plan premiums for employers and for self-employed taxpayers, and urged the federal government to reduce the GST imposed on the operating costs of dental care facilities.

Hoffmann-La Roche Limited argued that many small and medium-sized businesses lack the financial resources as well as the skills and knowledge to maintain their operations if a pandemic were to occur. It advocated the creation of a tax credit for small and medium-sized businesses, with a maximum amount that is related to organizational size, in order to encourage such activities as the development of an organizational pandemic plan, the acquisition of a stockpile of antiviral medicines for treatment and preventative use, and the purchase of basic medical supplies.

5. Health Care, Infrastructure and Equipment

The Committee also heard suggestions related to health care, infrastructure and equipment. The Canadian Medical Association urged the federal government to consider the creation of a savings plan for private funding of long-term health care. In its view, the plan could be either tax pre-paid or tax-deferred, and could be based on elements of both the registered disability savings plan and the registered education savings plan; as well, it could include a federal program of income-related grants and bonds. The Canadian Lung Association requested that a portion of tax revenues from the tobacco industry and other industries that have similar negative health impacts on Canadians be allocated to fund health promotion and research activities.

In speaking about the Goods and Services Tax, the Association of Canadian Academic Healthcare Organizations advocated standardized application of the GST rebate among hospitals and publicly funded long-term care facilities and home community care services. Moreover, the Canadian Nurses Association suggested that a full rebate of the GST charged on purchases of information and communications technology (ICT) for corporations that invest in ICT for the health system should be given; this rebate would apply, for example, to purchases of laptop computers by the Victorian Order of Nurses that could help home care nurses provide more efficient services. As well, the Canadian Medical Association urged the introduction of a GST rebate for information technology (IT) purchases related to health care services that are both provided by a medical practitioner and reimbursed by a province/territory or provincial/territorial health plan.

Witnesses presented the Committee with a number of tax proposals designed to encourage healthy activities and eating habits. The First Unitarian Church of Victoria mentioned that individual activities that are detrimental to public health should be discouraged through fiscal incentives. The Heart and Stroke Foundation of Canada and the Canadian Medical Association suggested that the maximum amount of the Children’s Fitness Tax Credit should be doubled, and that the credit should possibly be extended to adults and other non-organised sports as well as to the purchase of sporting equipment.

Furthermore, the Heart and Stroke Foundation of Canada highlighted the demonstrated link between the design of communities and obesity levels, and urged federal investments in health-promoting infrastructure. It proposed that a specific percentage of funding within the federal gas tax transfer program be allocated to infrastructure needs that facilitate physical activity, such as parks and community recreation centres, and to the development of community infrastructure that promotes the use of active modes of transportation.

The Canadian Medical Association advocated a strategy to promote healthy lifestyles that would involve better nutrition and physical fitness. It requested that sales of high-calorie, nutrient-poor foods be taxed, with the revenues used to make healthier foods both less expensive and more accessible. Similarly, the Canadian Nurses Association urged the federal government to introduce an excise tax on junk food.

The Mood Disorders Society of Canada advocated an increase of five cents per drink in the excise duty on alcoholic beverages in order to finance federal investments in mental health, mental illness and addiction initiatives, while the Canadian Medical Association supported the removal of the GST from tobacco cessation aids. The Canadian Health Food Association suggested that an exemption from the GST for natural health products which have been approved by Health Canada should be given, while the Heart and Stroke Foundation of Canada urged the removal of the GST from products that promote physical activity and from healthy foods in restaurants and retail stores, and suggested that the federal government should ensure that the GST is applied uniformly to all unhealthy foods, including — for example — the purchase of more than six donuts.

The Committee recommends that:

1. the federal government amend the Income Tax Act in order to increase the income thresholds in respect of personal income taxation.

2. the federal government, in respect of the Lifelong Learning Plan, amend the Income Tax Act in order to enhance the ability of registered retirement savings plan holders to withdraw funds to support lifelong learning.

3. the federal government amend the Income Tax Act in order to make the Disability Tax Credit refundable.

4. the federal government develop and implement a non-refundable training tax credit for employers.

5. the federal government amend the Income Tax Act in order to enhance the Working Income Tax Benefit.

6. the federal government amend the Employment Insurance Act in order to:

a) enable the creation of an independent Employment Insurance fund; and

b) enhance the Employment Insurance program.

7. the federal government amend the Income Tax Act in order to increase, to a proportion to be determined in relation to going concern liabilities, the maximum tax-deductible surplus in respect of defined benefit pension plans before plan sponsor contributions must be suspended.

8. the federal government amend the Old Age Security Act in order to increase the income thresholds at which the amount of Guaranteed Income Supplement (GIS) benefits begins to be reduced or “clawed back.”