HUMA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

THE CUMULATIVE BALANCE IN THE

EMPLOYMENT INSURANCE ACCOUNT AND

SAFEGUARDING CONTRIBUTIONS

Section 71 of the Employment Insurance Act establishes, in the Accounts of Canada, an account called the Employment Insurance Account (EI Account). While the Act indicates that all EI revenues and expenditures are to be transacted through the Consolidated Revenue Fund (CRF), sections 73 to 78 specifically state that these amounts are to be respectively credited and charged to the EI Account. Therefore, the EI Account is essentially a consolidated accounting entity that tracks EI-related financial transactions.5 And since all EI financial transactions are consolidated in the Accounts of Canada, a year-end surplus (deficit) in the EI Account directly increases (decreases) the government’s budgetary balance by an equivalent amount. In other words, when EI revenues exceed expenditures, the federal government’s fiscal position improves by a corresponding amount. The converse is true when EI expenditures exceed revenues. The year-end balance in the EI Account is also tracked over time and this is represented by the cumulative balance, a notional amount that, according to many, is borrowed from the EI Account in the case of a surplus or owed to the CRF in the case of a deficit. This view is further supported by section 76 of the Act, which authorizes the Minister of Finance to pay interest on the cumulative balance in the EI Account in accordance with such terms and conditions and at such rates as are established by the Minister.6

It is important to note that section 77 of the Employment Insurance Act limits the government in terms of what can be charged to the EI Account and, in this regard, expenditures outside the purview of EI may not be used to reduce the cumulative balance in the EI Account. In other words, this cumulative balance cannot be wiped out by paying money out of the CRF to finance health care, defence or any other non-EI related use. There is absolutely no question that most of those who appeared before us believe that today’s cumulative surplus in the EI Account should be earmarked for EI.

… in my view, Parliament did not intend for the EI account to accumulate a surplus beyond what could reasonably be spent on the EI program. Thus, I have concluded that the government has not observed the intent of the Employment Insurance Act. (Sheila Fraser, Auditor General of Canada)7

The extra premium revenue collected since 1994 has not been paid out, not into a reserve account and not into the unemployment insurance account. They went directly into the government coffers. What makes this all the more painful is that these surpluses were built by massive cuts in protection to Canada’s unemployed, who regard the surplus as money borrowed from EI that must be repaid. (Hassan Yussef, Canadian Labour Congress)8

I just wanted to say we would object vehemently to erasing that notional account, because it takes the obligation away from the government when we do run into an economic downturn and they are going to have to look for ways to pay increased benefits, that they don’t come back to us and raise the rate. If we lose that account, that’s exactly what’s going to happen. (Joyce Reynolds, Canadian Restaurant and Foodservices Association)9

With respect to the accumulated surplus, for a number of years now, many groups and organizations, including our own, have loudly denounced the use of employment insurance surpluses for purposes other than those of the system. We believe a broad debate on this question is necessary. Even though those billions of dollars have already been spent, this way of doing things was highly debatable. We therefore think it is imperative, to say the least, that consideration be given to the possibility of reallocating those amounts to the employment insurance account, from which they should never have been withdrawn. (Pierre Séguin, Centrale des syndicats du Québec)10

I want to remind the committee of the zeal of the federal government’s counsel in the CSN-FTQ’s case against the federal government. They demonstrated that there was no separate unemployment insurance fund … and the judge agreed with them … It’s not true that the federal government can eliminate this surplus at a single stroke, by means of an act, and say that it no longer exists and we have to start from scratch with a separate fund. We won’t accept that. We’re going to go to the Supreme Court if necessary. (Mr. Roger Valois, Confédération des syndicats nationaux)11

As regards the use of the accumulated surplus, there is no doubt in our view that the money must be returned to the people who contributed. The only thing is that, in the event of a public debate in which the question would be whether this money should be strictly handed over to unemployed workers, at the cost of reducing the government's fiscal flexibility for all programs and spending, our priority would clearly be to hand it over to workers on the one hand. (Mario Labbé, Centrale des syndicats du Québec)12

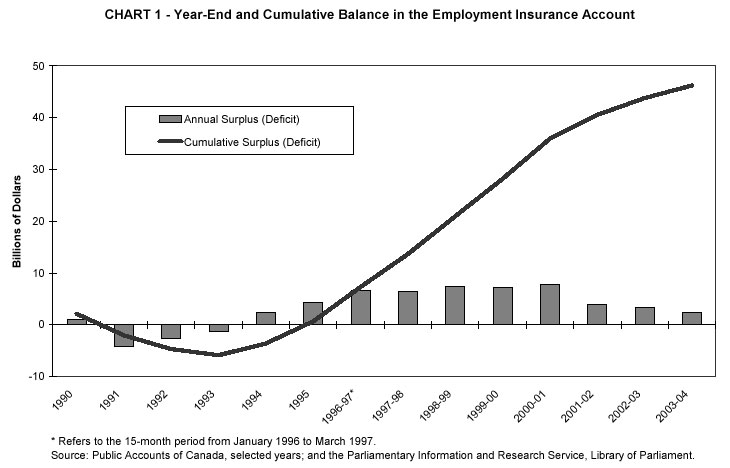

As shown in Chart 1, the cumulative surplus in the EI Account has grown rapidly since 1994 and, according to these data, reached $46 billion as of 31 March 2004. Prior to the implementation of the Employment Insurance Act in 1996, the cumulative balance in the EI Account was always moving toward a break-even level, a function of the premium rate-setting process at that time. This rate-setting process was repealed under the Employment Insurance Act, a subject that is further discussed in the next section of our report.

Not surprisingly, the origin of this unprecedented cumulative balance in the EI Account was a point of discussion throughout our hearings. Many regard the cumulative balance in the EI Account as a product of numerous changes restricting access to EI since the beginning of the 1990s. There is no doubt that the EI reform in 1996 resulted in a smaller program. In fact, one of the reform’s objectives was to reduce EI expenditures by 10%. However, it should be noted that since EI’s inception, subsequent reforms have expanded the program as evidenced by, for example, the reduction in the qualifying period for special benefits, the treatment of small weeks, the extension of parental benefits, the elimination of the intensity rule, a relaxation of the benefit repayment provision, the introduction of compassionate care benefits and, most recently, the introduction of a two-year pilot project extending benefit entitlement by five weeks in high unemployment areas of the country. Changes to EI since 1996 have generally contributed to a slightly more generous and accessible program; but despite increased spending on these measures, the cumulative balance in the EI Account has continued to grow.13

… in terms of changes to the benefits and their impacts, which is more the question you were raising, there’s no question that EI reform going back about 10 years had a number of changes that had the consequence of restricting eligibility requirements. Insofar as more recent years go … each and every change has had the impact of extending eligibility or benefits to deal with particular issues on which we felt that improvements to the program were warranted. So those are a matter of record and they are policy decisions, policy choices, and they do entail costs in addition to what there would have been had there been no change. (Andrew Treusch, Department of Human Resources and Skills Development)14

Departmental officials cited unanticipated strength in the Canadian economy, and its impact on employment growth, as the primary reason for the burgeoning cumulative balance in the EI Account. Although we acknowledge that Canada’s labour market performance may have exceeded private sector forecasters’ expectations, we also recognize that projected EI revenues have consistently and substantially exceeded projected EI expenditures during this period. In other words, like the Auditor General and many of our witnesses, we find it difficult to accept that EI premium rates were being set exclusively within the parameters of the Act.

The vast majority of those who appeared before the Subcommittee maintained that the cumulative balance in the EI Account belonged to the EI program and that the government should begin to use the CRF to reduce the cumulative balance in this Account. A few witnesses seemed to be willing to let bygones be bygones, simply in recognition of the fact that other policy objectives would have to compete with the repatriation of EI funds. Committee members do not support a “let bygones be bygones” view and, like the vast majority of our witnesses, we believe that there is a moral obligation on the part of the government to restore integrity to the Employment Insurance Act. This necessarily requires that the cumulative surplus in the EI Account be returned to the EI program.

I’d like to add one thing that I’m very concerned about. In my view, the cash surplus in the employment insurance fund absolutely must not disappear, absolutely not. It’s money that has been paid by workers … So the money in the fund must absolutely go back to unemployed workers. (France Bibeau, Confédération des syndicats nationaux)15

There is no doubt that for many years the government has been charging employers and employees far more than is necessary to pay the costs of EI benefits … Whether or not you agree with the way that money was spent it has been spent and we can no more undo the excessive EI premiums charged in the past than we can retroactively reverse the lower tax rates that Canadians enjoyed or reverse the transfers that have already been made to provinces for health care over the same period. (David Stewart‑Patterson, Canadian Council of Chief Executives)16

Among the overwhelming majority of witnesses who maintained that the cumulative balance in the EI Account should be returned to the EI program, there was a substantial difference of opinion as to how this should be done. Organizations representing employees generally expressed the view that most, if not all, of the cumulative balance in the EI Account should be used to enhance benefits and coverage under the EI program. Organizations representing employers generally favoured a continued reduction in the premium rate as well as changes to other financing-related measures. Committee members also find themselves with differing views regarding how the repatriated surplus should be used.

In our opinion, the first step in resolving this matter is to immediately halt the growth in the cumulative balance in the EI Account. We recognize that there are large fiscal implications associated with the repatriation of the EI surplus. We also recognize that premium payers, as well as taxpayers in general, have benefited from spending related to year-end surpluses in the EI Account via spending on other priorities such as health care, increased assistance for higher education, tax relief and debt reduction, to name just a few. However, it is impossible to determine who benefited and by how much.

We believe that the reallocation of CRF funds to the EI program must occur over a sufficiently long period of time so as to recognize the existence of other spending priorities as well as changes in Canada’s fiscal outlook. Finally, and perhaps most important, repatriated surplus EI revenues and EI premiums collected in the future must be managed and used in such a way so that revenues earmarked for EI are spent on EI.

… we really think the time has come again for the segregation of the fund from consolidated general revenues … (Michael Atkinson, Canadian Construction Association)17

Many witnesses who appeared before the Subcommittee were critical of EI’s current governance structure. In their view, and one which is supported by all Committee members, a notional account that is obviously ineffective in guiding the government’s use of funds collected for the purposes of EI is in need of fundamental reform. Most witnesses suggested that the EI Account should be replaced by some kind of trust account or segregated fund, although its operation vis-à-vis public sector accounting principles was often unclear. One suggestion was the creation of an insurance fund like that operated by Ontario’s Workplace Safety and Insurance Board, an entity that is referred to in the notes of the Consolidated Financial Statements of Ontario as a trust fund under administration. We do not think, however, that an entity like this would be satisfactory, because we believe, as indicated earlier, that EI should continue to be controlled by the federal government. In her appearance before the Subcommittee, the Auditor General of Canada clearly expressed the view that if the federal government continued to have control over EI, then EI should be included in the Accounts of Canada. We want to ensure that this is the case as well.

Of course all premiums are currently deposited to the consolidated revenue account, and all payments come from that same account. So there are two factors: revenue and expenditure accounting and the use of cash on hand. Cash on hand is in a bank account and can be used for all kinds of purposes. I assume it’s possible, if Parliament so decides, to establish another, separate account … In accounting terms, it would probably still be in the government’s summary financial statements. (Sheila Fraser, Auditor General of Canada)18

Recommendation 2

The Committee recommends that, in conjunction with the legislation referred to in Recommendation 1, statutory authority be given to establish a new reserve, called the Employment Insurance Fund Account. The Employment Insurance Fund Account, perhaps modelled after the Exchange Fund Account,19 would exist outside of the Consolidated Revenue Fund and act as a depository for all employment insurance premiums and other transfers from the Consolidated Revenue Fund as required by law. Funds transferred from the Employment Insurance Fund Account to the Consolidated Revenue Fund would by law be used exclusively to cover employment insurance costs.

Recommendation 3

The Committee recommends that, beginning in 2005-2006, the federal government transfer amounts from the Consolidated Revenue Fund to the proposed Employment Insurance Fund Account. This transfer must occur over a period of time, taking into consideration the year-to-year fiscal position and expected outlook of the federal government. The minimum amount to be transferred to the Fund each year must be no less than one half of the amount remaining in the Contingency Reserve at year’s end.20 These transfers would continue until the cumulative balance that existed in the Employment Insurance Account as of 31 March 2004 has been fully transferred to the Employment Insurance Fund Account. When that cumulative balance in the Employment Insurance Account reaches zero, all references to this Account in the Employment Insurance Act should be repealed.

| 5 | Prior to 1986, transactions in the Employment Insurance Account (then called the Unemployment Insurance Account) were only partially integrated into the Accounts of Canada. Since then, the Employment Insurance Account has been fully integrated into the Accounts of Canada. |

| 6 | Currently, the rate paid on the cumulative balance in the EI Account is set at 90% of the monthly average of the three-month Treasury bill rate. Interest is calculated monthly, based on the 30-day average of the cumulative balance in the EI Account. Like the cumulative balance in the EI Account, these interest payments are also notional. Although they constitute part of the cumulative balance in the EI Account, they are not recorded as a public debt charge in the Accounts of Canada. Between 1996-1997 and 2003-2004, the government has made a cumulative notional interest payment totalling some $7.1 billion. |

| 7 | SEIF, Meeting No. 1 (11:20), Thursday, 4 November 2004. |

| 8 | SEIF, Meeting No. 2 (19:35), Monday, 15 November 2004. |

| 9 | SEIF, Meeting No. 3 (16:00), Wednesday, 17 November 2004. |

| 10 | SEIF, Meeting No. 2 (19:25), Monday, 15 November 2004. |

| 11 | Ibid. (20:35). |

| 12 | Ibid. (19:55). |

| 13 | The Bloc Québécois does not consider the EI program as generous and accessible and consequently does not support this statement. |

| 14 | SEIF, Meeting No. 1 (11:45), Thursday, 4 November 2004. |

| 15 | SEIF, Meeting No. 2 (20:30), Monday, 15 November 2004. |

| 16 | SEIF, Meeting No. 3 (15:35), Wednesday, 17 November 2004. |

| 17 | Ibid. (15:25) |

| 18 | SEIF, Meeting No. 1 (11:50), Thursday, 4 November 2004. |

| 19 | The operation of the Exchange Fund Account is governed by the provisions of Part II of the Currency Act. This Account, administered by the Bank of Canada, represents financial claims and obligations of the Government of Canada as a result of foreign exchange operations. Investment income from foreign exchange transactions and net gains and losses are recorded in foreign exchange revenues on the Statement of Operations and Accumulated Deficit. |

| 20 | The Bloc Québécois recommends that at least $1.5 billion a year be refunded to the Employment Insurance Fund. It also recommends, if needed to cover one full year of contribution, a guaranteed payment of $15 billion. If this guaranteed payment is not used, it should be refunded at the rate of $1.5 billion after the payment of the initial $31 billion. |