FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

It is important that we look through the short term to the longer term trends and the potential of our economy. David Dodge

Even in times of crisis and uncertainty, the recipe for a prosperous future does not change. The government must continue to lay the groundwork for a better tomorrow and this Committee continues to support initiatives that advance this goal. Just as the Finance Minister introduced clarity into the budget-making process, let us be clear about our priorities as a Committee as they relate to the long-term health of the economy. These are:

- (1) The government must invest in a national security agenda, as a response to the September 11 attacks on the United States and for our ongoing security.

- (2) The federal budget should not return to a deficit position. The fiscal credibility earned by the government is still fragile and must not be put at risk.

- (3) The government’s $23.4 billion commitment to improving health care and early childhood development must be guaranteed. This investment is vital to ensuring the viability of Canada’s health care system, a key element of the country’s social infrastructure.

- (4) The government should forge ahead with its $100 billion tax-cut plan, as announced in the 2000 Budget and fall 2000 Economic Statement and Budget Update. These reductions are necessary both to improve our international competitiveness, especially with the United States, and to help spur economic activity. The extent and timing of this commitment should not be compromised.

- (5) The government should increase support for research and development, and the Canadian Institutes for Health Research.

The budget is critically important to boost the confidence of Canadian consumers and SMEs. Small business owners have sent a clear and strong message to the federal government — “Stay the course”, continue with the five-year tax plan and do not go into deficit spending.

Canadian Federation of Independent Business

Spending measures in the next budget should respond to public priorities, such as health and education, identified by Canadians.

Canadian Chemical Producers’ Association

In its travels across the country, the Committee found that, generally speaking, Canadians strongly supported these five priorities. While everyone had suggestions on how to make Canada a better place, these five priorities represented a common baseline from which other proposals emanated. Security issues are dealt with extensively in the next chapter.

Each of these five measures, in their own way, contribute to improving productivity, one of this committee’s longstanding goals: security spending sets the stage by protecting that which we have built in the past and wish to build in the future; balanced budgets combined with fiscal and monetary credibility help keep interest rates low and investment high; health care — and R&D — gives Canadian firms a competitive edge that encourages companies to invest in Canada; and, similarly, tax reform reduces economic distortions, improves economic efficiency, helps stem the brain drain, keeps Canadian firms competitive with their foreign counterparts, and improves the overall investment climate in Canada.

We support the approach the federal government has taken in the past of debt reduction, restoration of social investment, and tax reduction.

Confederation of Alberta Faculty Associations

The Government of Canada has put in place a fundamentally sound fiscal plan. Despite the horrendous events of September 11 and their impact deepening an already weakened economic environment, it is essential for the federal government to show leadership resolve in keeping on track.

Everett E. Colby, Certified General Accountants Association of Canada

The following chart presents the results of a recent survey of small and medium- sized businesses in Canada, conducted by the Canadian Federation of Independent Business in the aftermath of the September 11 events. The small business sector accounts for one-half of GDP and one-half of employment, and the bulk of job growth in the last decade. The survey results are broadly consistent with the Committee’s priorities. The chart shows strong opposition to deficit financing and any reversal of the government’s tax reduction plan. It also demonstrates an equally strong commitment to increased security spending.

Short-Term Policy Recommendations (September 28 to October 22)

![Graphic, Short-Term Policy Recommendations (September 28 to October 22), shows that roughly 76% of respondents to a survey of the Canadian Federation of Independent Business said that the government should not stop cutting taxes; 77% said that the government should not go into deficit; 67% said it should not give subsidies to business; 86% said that it should not spend on EI [Employment Insurance] benefits; 77% said it should spend on security; and a plurality of 42% recommended no major changes.](/Content/Committee/371/FINA/Reports/RP1032025/FINARP10/07-chap2-e_files/image001.jpg)

Source: Canadian Federation of Independent Business

As such, it is essential that the federal government not jeopardize the hard-fought fiscal health of the nation by side-lining the deficit-elimination, debt-reduction and prudent spending initiatives that have not only brought Canada to its current state of economic prosperity, but have laid the foundation for future growth.

Canadian Association of Petroleum Producers

Mr. Chairman, in light of these circumstances, CCGA Canada strongly urges the federal government to proceed with caution to keep on track with the priorities set out in Budget 2000, the October economic statement and the May 2001 update. To do otherwise, could jeopardize the tax cuts promised to Canadians and eliminate the deficit that Canadians worked so hard to achieve.

Everett E. Colby, Certified General Accountants Association of Canada

Looking beyond the immediate time frame, the priorities of the small business community also have a strong anti-spending sentiment. Over one-half of respondents see debt reduction as the priority use of future projected surpluses, while one-third believe that tax cuts should be the priority. Only 15% believe that new spending should come first.

Keep the Budget Balanced

In response to the current economic slowdown, there have been calls for the government to embark on deficit spending, both to meet our security needs and to provide a boost to the economy. The Committee believes that this is not the route to go. Even in the early to mid-1990s, when the economy was not performing well, the benefits of sound fiscal policy were increasingly evident as the country’s debt grew at unsustainable rates. It was essential that credibility be established.

Credibility has been re-established, but a return to deficits could throw that all away, seriously undermining the hard-earned trust of Canadians. Indeed, Canadians have not forgotten three straight decades of budgetary deficits, in good times and in bad. As David Paterson, Executive Director of the Canadian Advanced Technology Alliance (CATA), told the Committee: “We believe that the challenges that face us can be met without a major boost in government spending, without damaging Canada’s fiscal integrity. Increased spending on security is essential, but we believe it can be offset by reduced spending on less important programs. New initiatives can be postponed until a budget surplus has been restored to a more adequate level.”

There are some who believe that with four consecutive budgetary surpluses under its belt it is time for the government to allocate funding to new programs or to expand existing ones. However, based on our fiscal analysis, we are convinced that additional spending commitments would be imprudent and would jeopardize the government’s ability to deliver on its current debt and tax reduction commitments.

Canadian Institute of Chartered Accountants

Canadians made a huge sacrifice in the 90’s to pay off government deficits. We do not support initiatives that would take the fisc back into deficit.

Retail Council of Canada

Witnesses who appeared before the Committee recognized that a renewal of our security commitments requires additional resources. However, they also told the Committee they valued a sound fiscal approach to the government’s finances. They did not support a return to deficit financing. Maintaining sound finances is essential for maintaining consumer and business confidence. As over 20 years experience with out-of-control deficits proved to Canadians, it is only too easy for chronic deficit spending to result in high interest-rate payments (which absorb money that could have been spent elsewhere) and severe cutbacks when the bill finally comes due.

Years of cutbacks have finally begun to pay dividends. Fiscal 2000-01 marked the fourth consecutive year of budgetary surpluses. As a result, the government has been able to reduce the debt by $35.8 billion since its peak in 1996-97. This represents an ongoing saving of $2.5 billion each year in lower interest payments to service the debt.

The federal government must always remember that these surpluses were earned through the hard work of Canadians who paid higher taxes and endured cuts to services.

St. John’s Board of Trade

Interest on the debt is a drain on government resources, and a major obstacle to the kind of tax reforms, which could enhance the economy’s efficiency.

David Laidler

Witnesses told the Committee — and we share their opinion — that additional spending on national security should not push the government back into a deficit position. In an economic slowdown, spending on Employment Insurance and other social welfare benefits — which act as social and economic stabilizers during economic slowdowns — will automatically rise, leading to a short-term cyclical deficit. The government should respond to such threats by taking appropriate spending cuts elsewhere to ensure that deficits do not occur.

Bill Strain (Chair, Taxation, Conference for Advanced Life Underwriting, Canadian Association of Insurance and Financial Advisors) echoed many witnesses in voicing his support for the government’s commitment to prudent government financing. “It’s been a long tough fight to get the deficit under control, to reverse the trend line of increasing debt loads, increasing debt-to-GDP ratios. We’ve finally seen the turning point and the beginning of some success in that area. I would comment that I don’t believe that fight is over by any stretch. Yes, we’ve had a huge impact from September 11, we have to address that. Finance Minister Paul Martin, in his budgets over the last number of years, has built in contingency funds. If there was ever a need for a contingency fund, this is it, no question about that. I think those issues have to be addressed.”

There can be no doubt that the war against terrorism will require additional spending. Such new costs, however, should not be simply loaded on top of a business-as-usual approach to all government activities.

Business Council on National Issues

This achievement (moving the country away from deficit financing at the federal level) is much too important to abandon now and all the members of the Canadian chamber urge the government to avoid a return to deficit financing.

Nancy Hughes Anthony, Canadian Chamber of Commerce

Protect the Investment in Health Care

Canada’s health care system is an essential part of the country’s social fabric: its universal nature is one of the expressions of what it means to be a Canadian. It also is a key determinant of Canada’s competitiveness in the world.

In the global marketplace, access to a publicly funded health care system translates to increased global competitiveness for Canadian business and is a major incentive for international corporations to locate in this country. Peter McKinnon, Chief Executive Officer, Colchester East Hants Health Authority, on behalf of the Nova Scotia Association of Health Organizations

Strategic investments in health and health care improve our ability to succeed in the highly competitive world marketplace.

Canadian Medical Association

A viable system would take into account population growth, an aging population, new technologies and economic growth. Funds would be targeted to home care, long term care, community care and pharmacare.

Alberta Association of Registered Nurses

Throughout the pre-budgetary consultation process, the Committee heard that protecting and improving the health care system remains a priority for Canadians. The Committee shares the view that the government’s commitment to the health care system must be protected. Specifically, recognizing the importance to Canadians of a well-functioning health care system, we call on the government to follow through on its commitment to invest $23.4 billion through 2005 to support the federal-provincial agreement on health care services reached on 11 September 2000. Earlier, we discussed how addressing the national security impact of September 11 has affected Canadians’ priorities. Even — especially — after 11 September 2001, the need for a strong universal health care system is of vital importance to all Canadians.

Federal Support for Health Care Renewal

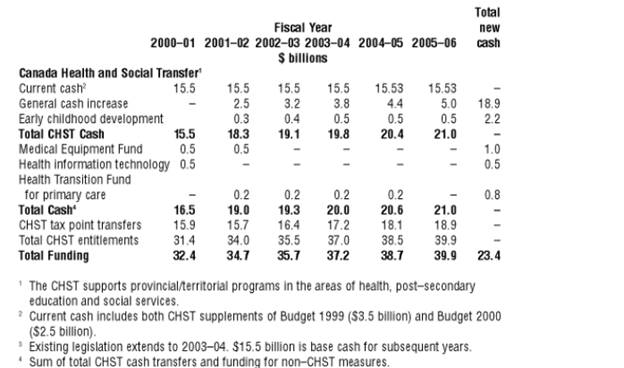

On 11 September 2000, Canada’s First Ministers agreed on a shared approach and action plan for renewing health care services and reporting to Canadians on progress made. As part of its commitment, the federal government announced $23.4 billion of new federal investments over five years to support the health agreement, together with an agreement on early childhood development. This investment consists of two major components:

- $21.1 billion over five years to the Canada Health and Social Transfer (CHST). This includes $2.2 billion for early childhood development. As a result, the cash component of the CHST will rise from $15.5 billion in 2000-01 to $21 billion by 2005-06.

- $2.3 billion to purchase up-to-date medical equipment, improve information systems supporting health services and accelerate changes in the way primary health care is provided to Canadians.

Federal Support for Health Care System

Federal Support for Health Care System

Source: Department of Finance, fall 2000 Economic Statement and Budget Update.

Throughout the pre-budgetary consultation process, the Committee heard many proposals to address the challenges faced by the health care system. Some of these included recommendations that the federal government adopt more responsibility in health care, an area that is constitutionally a provincial jurisdiction. Some groups proposed, for example, that the federal government tie its funding more explicitly to health care rather than deliver it through block funding or tax points, as is currently the case. This would, they argued, prevent the provinces from using funds intended for health care for other purposes such as tax reduction.

It is imperative that Ottawa make regular, predictable contributions to the funding of health care in Canada to bring stability to the system.

Ontario Hospital Association

The financial burden on provinces to keep up with escalating costs in health care is unsustainable over the long term.

Ontario Hospital Association

While we agree with the premiers that more money is needed, we agree with the Health Minister and the Intergovernmental Affairs Minister that at times, certain provinces have used health care dollars for purposes other than health care and that is wrong. This can be fixed by providing the money asked for by the provinces, but with strings attached. … In sum, I am saying that the federal government must fully fund Medicare and you must require accountability from the provinces.Kathleen Connors, President, Canadian Federation of Nurses Union

Although health care is a provincial responsibility, the OHA supports the critical role of the federal government in maintaining national standards under the Canada Health Act and in promoting a domestic health industry that is competitive with the rest of the world. Ontario Hospital Association

The Committee notes that there are currently two important studies into the future of the health care system underway. The Senate Study on the State of the Health Care System in Canada (Senator Michael Kirby, chair) and the Commission on the Future of Health Care in Canada (Romanow Commission) have been charged with laying out a blueprint for what federal and provincial governments can do to re-invigorate the health care sector. The Senate Committee report is expected next winter, while the Romanow Commission’s report is expected by the end of 2002.

Fixing the health care problems will require more than just money.

CanWest Global Communications Corp.

The Committee looks forward to the Kirby and Romanow reports and their recommendations on how to improve Canada’s health care system.

Sharing Best Practices

I don’t think we ever argue that the solution (to health care problems) is simply more and more money. What I think I would argue is that we cannot solve the money problem by constantly squeezing the system further and making more and more demands on front-line staff, particularly the physicians and nurses. The evidence that’s available to us is that the era of constant cost-cutting as a way of responding to these financial pressures is over and the era of social choice in dealing with them needs to start in a very fundamental way. David McKinnon, President, Ontario Hospital Association

The Committee also heard a number of proposals that would cost very little but would nevertheless help improve delivery and efficiency in the health care system. One such proposal was the suggestion that the government create a “best practices” fund to reward creative and innovative health care practices. This would not only create an incentive to develop efficient and effective medical techniques and practices but could also help disseminate knowledge about these practices if the reward were sufficiently publicized. For example, the Committee heard how the Sault Ste. Marie and District Group Health Association has been a pioneer in the field of health information sharing but has not received the widespread recognition it deserves, at least in part because Sault Ste. Marie is, according to David Murray, President and Chief Executive Officer of the District Group Health Association, “a bit off the map in Ontario, and perhaps nationally. We don’t get much press. But there are others who do find our way of delivering health care quite unique.”

One of the unique aspects of the way in which we deliver health care is our electronic medical record [EMR]. It’s the most comprehensive installation of electronic medical record in all of Canada, dealing with 50,000 primary care patients. It’s the cornerstone of every intervention that we have. Each time somebody visits their physician’s office, or sees one of our allied professionals, or gets lab results, it’s all done through the electronic medical record. The other benefit of the EMR is it allows us to do research into chronic disease management. The electronic medical record has also allowed us to save space, reduce costs and the running of paper, running charts around, etc. Those are savings we’ve been able to put directly into patient care. Mr. Chairman, we believe that EMR is a key tool and we’ve used it to improve health outcomes for our patients. It’s another example of why our health care facility can show leadership in this area and we think it’s something that needs to be adopted across the country … . David Murray, President and Chief Executive Officer, Sault Ste. Marie and District Group Health Association; Group Health Centre

There is a clear and measurable benefit to Canada’s economy and its citizens when taxes are cut.

Canadian Restaurant and Food Services Association

A number of other groups suggested proposals similar in substance to the best practices fund. For example, the Canadian Nurses Association recommended that the government create an award to recognize employers who promote nursing excellence. This kind of program could easily be folded into a best practices reward fund.

The Committee also heard a proposal to implement a Canada-wide system of hospital report cards similar to the one adopted by the Ontario Hospital Association in 1998. These report cards measure clinical performance, financial performance, consumer satisfaction and the process of change within the hospital and can play an important role in helping hospital administrators benchmark their performance against other hospitals. In turn, this helps them identify weaknesses and strengths in their hospital and elsewhere throughout the health care system.

It [the report card system] has, in academic circles, been very much welcomed as a groundbreaking effort and we are having extraordinarily great difficulty in getting that system adopted in the other provinces of Canada. Now for us that’s important because the more comparatives we have the better. We have a unique situation here in that we have done all the pioneering work necessary to report fully and completely on the hospital system which is basically adaptable to the other provinces and none have done that. David McKinnon

The Committee notes that the government has already taken several important steps to encourage the dissemination of best practices and increased efficiency through the use of technology in the delivery of health care services. In last fall’s Economic Statement and Budget Update, the government committed to investing $500 million in an independent corporation whose mandate is to develop and spread the use of common, country-wide information standards and compatible communications technologies. The ultimate goal of this program is to create electronic patient records that will be accessible regardless of the patient’s location.

In the 1999 Health Budget, government provided some $328 million over four years to improve the quality and availability of health information and to further develop health information systems across the country. This funding is helping provide information for the use of patients, health care providers and governments. The information gathered is used to report to Canadians on how the health care system is serving them, fostering greater accountability to the public. The funding also serves in investing in modern information technology such as telehealth.

Another component of the government’s strategy to improve the efficiency of the health care system was the creation of the Canadian Health Network, an arm’s-length agency funded by Health Canada whose mandate is to “empower the public, strengthen and integrate health care services, and create the information resources for accountability and continuous feedback on factors affecting the health of Canadians.” The federal government also allocated $550 million over a three-year period for health-related research and innovation with the goal of improving diagnosis and treatment of diseases, promoting best practices in health care delivery and enhancing the health and well-being of Canadians.

These kinds of investments are essential to maintaining and enhancing our competitive advantage in the field of health care. Along with many witnesses, we believe that this can be achieved by continuing to develop and implement new information technologies, collecting new health-related data on health and health care and assessing the effectiveness of diagnosis methods, treatments and ways of delivering health care.

The Committee supports the government’s ongoing efforts to use new technologies to improve the accountability, efficiency and effectiveness of medical treatments and to disseminate best practices throughout the country. The Committee encourages the government to expand on these existing efforts by creating a fund to reward and help disseminate best practices. The Committee also recommends that the government work with the provinces to develop hospital report cards to better identify areas where savings can be had and where new expenditures are most needed.

Tax Policy

This Committee has long advocated the lowering of tax rates and making the tax system “smarter” and more competitive with its major competitors, especially the United States. In its 1999 PBC document, the Committee recommended that basic personal amount should be increased, marginal tax rates should be reduced, the 5% surtax should be eliminated, the corporate tax system should be made more neutral and internationally competitive, and capital gains should be taxed at a lower rate than was then the case. All these recommendations were adopted in one form or another in the 2000 Budget and the fall Economic Statement and Budget Update.

Past Actions

From 1993 through to fiscal 1996-97, the bulk of the government’s tax measures consisted of the closing of tax loopholes, small tax increases and “base-broadening” measures designed to bring in more revenue and eliminate the deficit. Since then, however, the thrust of government tax policy has shifted to one of either holding the line on tax rates or of tax cuts, with the bulk of the latter coming in the 2000 Budget and the 2000 Economic Statement and Budget Update. Indeed, the income tax structure was little changed for most of the 1990s. From 1988 through to the beginning of 2000, there were three marginal tax rates of 17%, 26% and 29%.[26] Moreover, tax thresholds (the levels) were little changed throughout,[27] adding an element of regressivity to an otherwise progressive tax system: individuals whose income rose in line with inflation below 3% often found themselves in a higher tax bracket even though their real income (after inflation but before taxes) had not changed.[28]

We commend the government for delivering on its commitment to reduce personal taxes and for achieving its third consecutive fiscal surplus in 2000.

Canadian Bankers Association

Tax cuts will help Canada to keep pace with other industrialized nations of the G-7, which are implementing similar corporate tax reductions.

Insurance Bureau of Canada

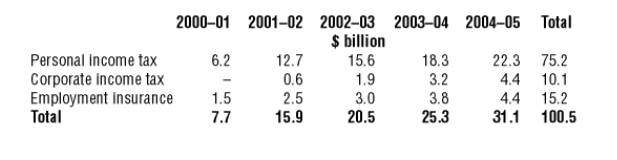

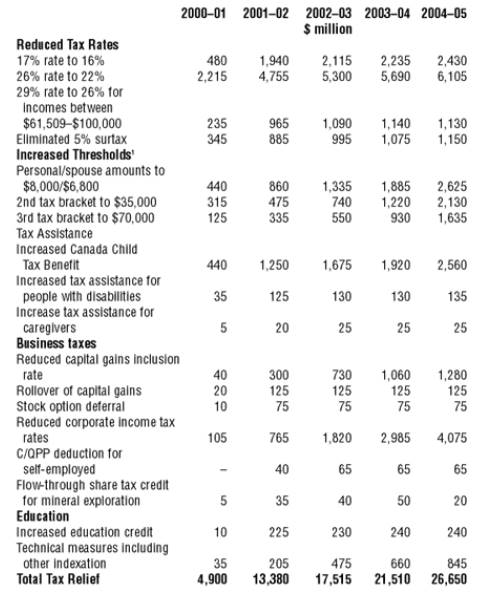

The government, in its 2000 Budget and October 2000 Economic Statement and Budget Update, responded with over $100 billion in tax cuts, significantly lowering personal and corporate tax rates. In response to another Committee recommendation, the government raised to 30% the permissible foreign content of investment in registered pension plans (RPPs) and registered retirement savings plans (RRSPs). The government also reduced the capital gains inclusion rate in two stages to 50% from 75%.

The 2000 Budget and fall 2000 Budget Statement and Economic Update therefore represented some of the most radical changes to the income tax system since at least 1988. On the personal income side, it restored full indexation for most tax thresholds as well as the basic exemption, eliminated the 5% deficit-reduction surtax, and cut the lowest tax rate to 16% and the middle rate to 22%. The rate for income between $60,000 and $100,000 was cut to 26%, with income above $100,000 now facing a 29% rate.

The Canadian chamber has applauded the government for its five-year tax reduction proposals introduced in the Economic Statement and Budget update of October 2000. Given current economic conditions, it is imperative to continue the implementation of this plan. The January 2001 start of the tax reductions could not have been better timed and the next phases of the plan are equally important.

Canadian Chamber of Commerce

As one of the few sectors of the economy that is generating economic growth, the oil and gas industry needs to be included in the announced schedule of rate reductions, the same as the rest of corporate Canada. This is of utmost importance to ensure that Canada does not lose out in maintaining and attracting significant amounts of globally mobile, job-creating investment capital.

David Daly, Canadian Association of Petroleum Producers

On the corporate side, the fall 2000 Budget Statement and Economic Update accelerated the Budget 2000 plan to cut the general corporate tax rate to 21%.

Tax Cuts Announced in the 2000 Budget and fall 2000 Economic Statement and Budget Update

Personal Tax Cuts

- Restored full indexation of the tax system;

- Increased basic exemption to at least $8,000;

- Reduced the 17% rate to16%;

- Reduced the 26% middle tax rate to 24% in Budget 2000, and to 22% in the Economic Statement;

- Reduced 29% top tax rate to 26% on incomes between about $70,000 and $100,000.

- Eliminated the deficit-reduction surtax;

- Increased the amount at which the middle tax rate applies, beyond indexation, to at least $35,000;

- Enriched the Canada Child Tax Benefit (CCTB) to a maximum of more than $2,500 for a first child by 2004;

- Raised to 30% for 2001 the permissible foreign content of investment in registered pension plans (RPPs) and registered retirement savings plans (RRSPs);

- Increased the disability tax credit amount will be raised to $6,000 from $4,293;

- Raised the credit amounts for caregivers of dependent relatives who are elderly, infirm or disabled to $3,500 from $2,386;

- Increased the tax exemption for income from scholarships, fellowships and bursaries to $3,000 from $500; and

- Doubled the education amount subject to a tax credit for full-time students to $400 from $200, and for part-time students to $120 from $60.

Corporate Tax Cuts

- Committed to reducing the general corporate tax rate to 21% from 28%, through a one-point reduction in 2001 followed by a two-point cut in each of the following three years;

- Reduce the corporate tax rate to 21% from 28% on small business income between $200,000 and $300,000;

- Reduced the capital gains inclusion rate from three-quarters to one-half;

- Allowed the postponement of the taxation of gains on shares acquired under qualifying stock options to when shares are sold, rather than when the options are exercised;

- For tax-free rollovers, expanded the size of eligible investments to $2 million from $500,000 and their availability to business worth $50 million (from $10 million); and

- Allowed self-employed individuals to deduct the portion of Canada Pension Plan and Quebec Pension Plan contributions that represents the employer’s share. Cumulative Tax Relief

Cumulative Tax Relief

Cumulative Tax Relief

Note: Numbers may not add due to rounding

Source: Department of Finance, fall 2000 Economic Statement and Budget Update

Total Tax Relief Provided by the Statement and 2000 Budget Tax Plan

Total Tax Relief Provided by the Statement and 2000 Budget Tax Plan

Note: Estimates may differ from those in the 2000 Budget because of changes in the underlying economic projections. Where applicable, estimates include indexation.

Source: Department of Finance, fall 2000 Economic Statement and Budget Update.

Maintaining the announced schedule of corporate income tax rate reductions is essential for shoring up business confidence and capital investment.

Canadian Association of Petroleum Producers

We urge the government to ‘stay the course’ with respect to announced tax reductions.

Vancouver Board of Trade

Going forward, the government must not use short-term tax relief to try to stimulate the economy. Much like calls for spending increases to address the current slowdown, the government must resist any measure that threatens its hard-earned fiscal integrity. More than ever, we must be true to the words of the 1998 pre-budgetary report, where this committee remarked that “we must ensure … that tax relief is sustainable, so that we do not embark on a roller-coaster ride of tax cuts followed by tax increases whenever the budgetary position is threatened by financial turmoil and economic slowdown.” In the Committee’s view, tax reduction and reform should have long-term economic efficiency in mind, not short-run stimulation.

The Committee recommends that the government proceed with its $100 billion tax-cut plan.

It is the view of CGA Canada that the current circumstances and events require the federal government to show leadership and resolve, commitment to its sound fiscal strategy, carrying through promised income tax reductions and lower interest rates will serve to rebuild Canadians confidence. Everett E. Colby, Chairman, Taxation Policy, Canadian Certified General Accountants Association of Canada

These tax cuts were not merely a way of rewarding citizens for their forbearance during some difficult cost-cutting years, they also served the broader, long-term productivity agenda. First, the tax cuts announced in the 2000 Economic Statement and Budget Update brought Canada’s personal and business income tax rates more in line with the United States, which as our major trading partner, source of capital and destination for capital, is the relevant comparator. While subsequent reductions in U.S. personal tax rates reduced the margin by which Canada’s tax cut plan closed that gap, Canadian tax rates are now far more competitive with the U.S. as a result of the measures taken in last year’s two budget documents.[29]

The January 2001 start of the tax reductions could not have been better timed and the next phases of the plan are equally important.

Nancy Hughes Anthony, Canadian Chamber of Commerce

We recognize that major additional tax cuts are unlikely at this point since money is needed to beef up security. However, it is useful to rank the tax reductions that are the most beneficial to the job creators.

Canadian Federation of Independent Business

Future Challenges

Continuing on the path and accelerating the pace of both personal and corporate tax rate reductions will enable Canada to remain fiscally competitive with its trading partners.

Canadian Association of Petroleum Producers

While spending pressures on the government will most likely increase, the Committee believes it would be counterproductive to delay or revoke any part of the government’s 2001 tax cuts. According to Dr. Dale Orr, Chief Economist with DRI/WEFA Inc., the tax-cut package remains affordable. More important, these personal and corporate income tax reductions are essential for making Canada an internationally competitive economic environment. As the government noted in the 2000 Budget, the tax-reduction plan “will improve living standards for Canadians. It means more money in the pockets of Canadians, stronger economic growth and enhanced job creation.”

It would also be imprudent, however, to close the door on future tax cuts. While the 2000 tax cuts improved our competitiveness vis-à-vis the United States, and while comprehensive tax cuts may not be viable at the moment, there still remains work to be done. In their submissions to the Committee, the Canadian Steel Producers Association, the Insurance Bureau of Canada, Chambre de Commerce du Québec all remarked on the importance of continued attention to the competitiveness of our tax system. The challenge to make the tax system smarter and more competitive is ongoing.

The essential message is the government has committed itself to ensuring a competitive tax system for Canada. We absolutely support and applaud that, but it’s not a static thing. Canadian Steel Producers Association

We feel that there are still strong grounds for further reductions in corporate taxes, especially on the capital tax, which is a notorious disincentive for investment. It’s a very negative factor when people are looking at investing in Canada. David Paterson

Budget 2000 and the October 2000 Economic Statement and Budget update brought several welcome changes to Canada’s tax regime but, without doubt, more needs to be done to reduce our overall tax burden and excessive public debt if we are to be sufficiently competitive.

Canadian Chamber of Commerce

In the United States, the basic investment vehicle for venture capital investment is the Limited Partnership. The CVCA proposes that the (Income Tax) Act be amended to allow the Limited Partnership vehicle to perform the same role in Canada.

Canadian Venture Capital Association

The Committee recommends that the government continue to pursue an agenda of tax reform. It should be prepared not just to cut taxes but also to reform the tax base.

The Continued Need for Productivity Improvement

The Committee has long championed the importance of productivity improvements to Canada’s well-being. Productivity increases are not an end in and of themselves: few rejoice in knowing that a company can produce more widgets in an hour with the same number of workers than it could before it bought the latest piece of production equipment. Rather, productivity increases allow firms to lower costs and prices, and thereby achieve a competitive advantage over rivals. These lower costs, in turn, allow individuals to acquire more goods for the same amount of money. Productivity increases are the result of the competitive drive, the need to obtain an “edge” over a competitor. Once obtained, this incites competitors to in turn seek out even greater productivity gains, once again leading to lower prices and ultimately greater real wealth since any given level of wages will now purchase more goods and services.

To get a sense of how powerful an effect productivity can have on everyday life, consider these simple statistics: at the beginning of the 20th century, it took nearly 15 farmers to produce the food consumed by 100 Americans.[30] If one had projected in 1910 that by 1990, only one farmer would be available to produce food for each 100 consumers, one might have projected famine and mass starvation. In fact, farm workers did fall rapidly from 15% of the population to about 1% today, with no adverse effects on food consumption. Indeed, the major problem facing farmers is that they can produce far more than they can sell, at least at profitable prices. These tremendous

Technically, productivity is a measure of the amount of resources it takes (labour, capital, knowledge) to produce a given level of output. It tells us, in other words, how efficiently society is using its resources. The most widely cited productivity statistic measures labour productivity, that is the ratio of the economy’s total output, as measured by real GDP, to the number of hours worked over some given period.

The U.S. has for many years pursued a policy of not taxing foreign investors on capital gains generated in the U.S. so long as the foreign investors did not incorporate in the U.S. This is commonly known as the “10 Commandment Rule.”

Canadian Venture Capital Association

In previous budgets and economic updates, measures have been introduced to enhance economic performance through stimulating innovation and improved productivity. More needs to be done.

Vancouver Board of Trade

Recently, researchers have been preoccupied with trying to explain why Canadian labour productivity growth has badly trailed that of the United States in the 1990s, especially the latter half. Over four years, Canadian labour productivity grew by 4.2% while American labour productivity grew by 11.5%. Over the two decade period 1978 to 1999, annual American labour productivity growth was 70% higher than Canadian. While productivity measurements suffer from a variety of statistical revisions and mis-measurement problems, the labour productivity comparisons tell a consistent story.[31]

Multifactor productivity trends are quite different. In fact, Canada’s multifactor productivity growth[32] before the U.S. GDP revisions is actually slightly better than in the United States during the last 40 years. As Statistics Canada notes, “what is remarkable about the historical performance of productivity growth in the Canadian economy is its similarity to that of the United States … . Over almost 40 years since the 1960s, Canada has continued to move in step with the United States.”[33] Nevertheless, it is labour productivity that is more closely linked to standard of living changes, which is the ultimate concern of the Committee.

The nuances of the statistical debate should not, however, unduly influence policy-makers or this committee. It is worth quoting the Committee’s previous work at length on this point: “we should not pursue this (productivity) agenda because of any real, or apparent, gap between our productivity and that of other countries, particularly the United States. While international comparisons are useful in providing us with benchmarks against which we can measure our own performance, these comparisons should not dictate our own policies. The goal is not to become like Americans or Germans or Japanese. The goal is to achieve our potential and to deliver the highest standard of living possible, now and in the future. And whether or not our productivity performance is slightly better or worse than we thought it was, it is clear that we can do better.”

Closing this (Canada-U.S. productivity) gap is one of the most important economic challenges that Canadians will confront in coming years.

Everett E. Colby, Certified General Accountants Association of Canada

Economist Rick Harris, Simon Fraser University, has “done some empirical work, which shows that every time the exchange rate falls, you do get some productivity bump-up in the short run — our utilization goes up, because we can export more easily to the U.S. But over the long term, we tend to get a decline in productivity relative to the U.S.

Dr. Thomas Courchene, Department of Law, Queen’s University

The challenge then is to come up with creative and innovative policy suggestions that can help us achieve our long-term productivity goals. The Committee reiterates its long-standing recommendations that the government should commit to a productivity covenant. Just as Program Review is an ongoing examination of federal spending, this covenant should subject all existing government initiatives (spending, taxation and regulation) to an assessment which evaluates their expected effects on productivity and hence the standard of living of Canadians. Every new budgetary initiative should be judged according to this productivity benchmark.

One important benefit of such a requirement is the fact that it provides a common benchmark against which to compare a variety of beneficial policy proposals. While it would be difficult to provide a quantitative assessment of many proposals, one should be able to provide a qualitative judgement as to whether proposals advance or hinder productivity growth.

[26] Prior to 1988, there were ten marginal tax rates, ranging from 6% on the first $1,320 to 34% on taxable income exceeding $63,347.

[27] The tax thresholds in 1988 were $27,500 and $55,000 versus $29,590 and $59,180 at the beginning of 2000. That represents a 7.6% increase during a 12 year period compared with a 30% increase in the consumer price index over the same period.

[28] While tax thresholds (brackets) were indexed to inflation above 3%, this meant little in practical terms because the Bank of Canada showed a strong determination to keep inflation below this threshold. It was successful for most of the decade.

[29] As this document was being prepared, the U.S. government was debating an economic stimulus package (related to the September 11 attacks) that would partly be composed of further tax cuts.

[30] While similar data for Canada were not readily available, broad trends in overall productivity between Canada and the U.S. suggest that the same holds true for Canada.

[31] These measures pertain to business sector labour productivity.

[32] Multifactor productivity measures the productivity of both labour and capital. It is subject to its own statistical nuances in that it is difficult to measure the size of the capital stock.

[33] Statistics Canada, Productivity Growth in Canada, 15-204-XIE, 1999, p. 59.