BRIEF FROM THE PROFESSIONAL INSTITUTE

OF THE PUBLIC SERVICE OF CANADA

Executive Summary

A swift and sustained recovery from the recent global financial crisis is heavily dependent on the retention of core professional public administration for the provision of critical government services and scientific expertise. In light of the newly-issued Strategic and Operating Review, public service job cuts are not the answer to increasing government revenues - focus should be directed to a ballooning Shadow Public Service of outsourced positions and further proposals for corporate tax cuts. To ensure long-run economic growth and avoid a possible double-dip recession, the federal government needs to remain cognizant of the need for a competitive public service compensation package and the benefits of investment in public R&D and innovation activities.

The Strategic and Operating Review and the Contracting-Out of Services

The 2012 Federal Budget needs to take into account that the global economy is still wrestling with the aftermath of the 2007-08 financial crisis. While Canada has weathered the crisis relatively well, our largest trading partner finds itself in a fitful and fragile recovery. The American job market took another step backward in this past quarter, increasing the chances of a double dip recession in the U.S. The impacts of this development for Canada will be significant, as our exporters are already labouring under the effects of an above-par dollar. As Canadian financial institutions were stringently regulated by OSFI, our banks were not given the autonomy to make the same mistakes as our American counterparts. Regardless, rising indebtedness of Canadian households and the growing signs of a housing bubble in major Canadian cities should bring additional vigilance. Altogether, these factors necessitate that the government exercise extreme caution in its plans to retrench spending in the 2012 budget. The government should not add risk to an already-fragile recovery with cuts to public spending and investment. Instead, planned corporate tax cuts should be cancelled and previous years’ cuts reversed.

Analysis shows that corporate tax cuts have neither stimulated economic activity, nor resulted in increased business investment. According to the Parliamentary Budget Officer, reducing the corporate tax rate from 18% in 2010 to 15% in 2012 will cost $11.5 billion from 2011-12 to 2013-14.[i] If the 2012 Budget were to implement a return to the 2007 corporate tax rate of 22%, an additional $13.8 billion in revenue would be collected.[ii] This is substantially more than the $2.8 billion per annum saved with the government’s Strategic Operating Review (SOR) spending cuts proposal.[iii] Instead of implementing a new SOR, which will certainly result in a net loss in the level and quality of services provided to Canadians, corporate tax rate reductions should be cancelled with the monies used to ensure the foundation of Canada’s future competitiveness: a modern and skilled public service. The government should follow British Columbia’s lead in planning to raise their 2012 corporate tax rate back to 12% from the 2011 rate of 10%.

Additional savings can be achieved through the capping and reduction in the volume of federal government contracts that are being outsourced. Over $1.2 billion was spent on outsourced contracts in 2009-10. Apart from the ethical concerns of having a “Shadow Public Service” that exists outside established legal guidelines, the proliferation of irresponsible contracting-out policies represent an egregious misuse of government funds.

The Public Service Employment Act (PSEA) exists to ensure staffing in government agencies is guided by principles of merit, integrity, transparency, regional and ethnic diversity, and bilingualism. In a 2010 study, the Public Service Commission (PSC) presented considerable evidence that government managers are misusing outsourcing provisions and circumventing the hiring practices set out in the PSEA. As a result, a separate workforce currently exists within the public service: thousands of people who are contracted out for long and continuous periods of time but who are not subject to, or protected by, the PSEA.

A false perception exists that contracting out personnel is a competitive and efficient process that results in lower costs. In reality, the initial bids are competitive, but winning a contract generally becomes a “foot in the door” where the costs and duration of the contract are increased repeatedly. A 2011 report from the Canadian Centre for Policy Alternatives (CCPA) has exposed how outsourcing policies are abused and just how expensive they have become. The CCPA report shows an average gap of 350% between the initial bid the firm makes and the final tab paid by the government. As time goes on, government agencies lose the ability to provide certain services in-house, which creates a dependency on the private contractor. The end result has become excessive outsourcing costs. In recent years, the overall price tag has swelled from $660 million in 2005-6, to over $1.2 billion in the 2009-10 fiscal year.[iv]

The government should aim to reduce outsourced contracts to 2005-06 levels and return the corporate tax rate to the 2007 level of 22%. These two steps will carry an additional $13.8 billion in revenue - these savings would be more than double the amount sought through the current SOR proposal.

Minimizing Public Service Damage: Protect Jobs and Maintain Competitive Compensation

The Strategic and Operational Review exposes the federal public service to substantial budget cuts in an attempt to generate cost savings of $4 billion by 2014-2015. Although these budget cuts may result in major administrative cost reductions over the next three years, their medium and long term effects on the federal public service and on the fragile ongoing economic recovery are subjects of great concern for Canadians.

Today, at the beginning of a government-wide cost-cutting initiative, the Institute emphasizes the need to critically re-examine the mid-1990s public service downsizing experience and learn from its major failures. The recently announced budget cuts should be implemented intelligently, with minimum damage to the valuable human capital of the federal public service.

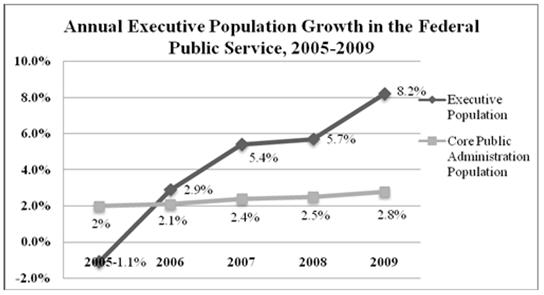

The Institute strongly recommends that the ongoing budget cuts be implemented without major workforce reductions. Over the past two decades, the federal public service has become remarkably lean and more efficient than ever before. Between 1990 and 2010, the number of public service employees increased by only 16.7%, compared to Canadian population growth of 23.1%.[v] Public service employment has already been trimmed to such a slender size that any further job cuts would result in a serious deterioration of the services delivered to Canadians. A recent study shows a gigantic 24% growth rate in executive level positions in the public service from 2005-2009.[vi] Can the Canadian public afford to continue to create executive positions at the expense of the core public service?

In today’s knowledge economy, professional and scientific positions are considered as the main source of workplace efficiency and productivity improvement. The Institute urges the federal government to take all necessary measures to avoid layoffs among its key knowledge workers whose contribution will be critical to both the ongoing economic recovery and post-recession growth. Recent layoff announcements targeting auditors at PWGSC as well as scientists at Environment Canada represent a risky drift in the wrong direction.

The protection of the federal public service in a period of fiscal restraint also requires close attention to its future ability to attract and retain the best talent after the current economic downturn. The major difficulties encountered by the federal public service in staffing professional and scientific positions after the mid-1990s downsizing experience were mainly attributed to the legislated four-year wage freeze imposed indiscriminately to all public service employees between 1993 and 1997. This freeze resulted in a significant negative pay gap with the private sector and, consequently, prevented the federal public service to effectively compete for a highly-skilled professional workforce.[vii]

The Institute invites the Treasury Board Secretariat and all federal agencies to learn from their past failures by ensuring that their employees receive a fair and competitive compensation package. The pressure to cut operational costs should not prevent all departments and agencies from offering decent salary increases in line with the inflation rate and market adjustments. Unfortunately, once again, the federal government is committing the same old mistakes. In 2008, caps on salary increases (2.5%, 2.3%, 1.5%, 1.5%, and 1.5%) were legislated and imposed indiscriminately to all public service employees between 2006 and 2011. Today, the federal government is exerting even more pressure to control compensation costs and to force public service unions to make concessions on their members’ severance pay benefit. Such government interventions would be in clear violation of a workers’ right to collective bargaining. The recent compensation restraint measures have generated once again a negative pay gap with the private sector, particularly in many scientific and professional positions.[viii]

Public Science: Investing in Our Knowledge Economy

On November 4, 2010, The Professional Institute, along with the Canadian Association of Professional Employees and the Association of Canadian Financial Officers, hosted a panel discussion entitled “Evidence vs. Ideology in Canadian Public Policy.” The discussion highlighted a disturbing shift away from knowledge-based decision making at the public policy level, despite Canada’s continued development into a knowledge-based economy. Such an economy requires fact-based policy decisions and a high capacity for innovation, research, and development in all sectors.

Science research plays a unique role within the federal government, and has broad effects on government decision-making and programs related to Canadian social and economic development. Government scientific research supports many important domains, such as public policy development and regulations and key public health, safety and security programs. However, in light of the second round of strategic review proposed budget cuts, the quality of scientific integrity and capacity that supports evidence-based policy decisions is at risk of further eroding. As well, short-term cuts to science-based programs and R&D will have long-term negative effects on Canada’s ability to compete on an international scale in key high-technology sectors and to properly monitor and address health- and security-related challenges.

Canada spends very little of its annual GDP on government R&D activities, accounting for approximately 0.2% of GDP in 2009. This is far below the G7 average, which generally allocate about 0.26% of GDP to intramural government research activities.[ix] The Canadian government has been neglecting the need for intramural science and R&D, while instead channeling funds to higher education institutions and grants for the private sector. This creates an unhealthy reliance on outside science research that does not serve the needs of the Canadian public.

A strong capacity for scientific research is needed within government to act as an independent and unbiased source of scientific information and innovation for Canadians. Further cuts to science-based government programs will also only serve to undercut the government’s ability to perform necessary regulatory functions, such as governing medical health, and ensuring food and water safety. The continued funding of federal research labs is critical to the well-being of all Canadians as these provide important regulatory functions and serve to advise policy makers. These functions would be lost if the work were to shift to educational institutions or the private sector.

Our Recommendations

1. Any federal plan to control spending must first deal with the waste of financial resources on outsourcing.

2. The Institute calls on the federal government to maintain the competitiveness of its employees’ compensation by providing sufficient funds for decent wage increases. This includes the need to protect employees’ pension and benefits and to bargain fair working conditions without arbitrarily using its legislative powers.

3. We recommend that the government prioritize the value and importance of public science and invest more strongly in its efforts for fostering in-house research and development. Such efforts are necessary for the formulation of evidence-based government policy so as to provide crucial innovations and regulations for sustained Canadian social and economic development.

[i] Parliamentary Budget Office, “Fiscal Transparency: Parliament and the Expenditure Management System Analysis of Government Responses to a Motion of the House of Commons Standing Committee on Finance,” Ottawa, Canada, February 25, 2011. Available at: http://www2.parl.gc.ca/sites/pbo-dpb/documents/Fiscal_Transparency_EN.pdf

[ii] Table A2.2, Available at: http://www.budget.gc.ca/2009/plan/bpa2-eng.html

[iv] David MacDonald. “The Shadow Public Service.” CCPA, March 2011.

[v] Statistics Canada: CANSIM - TABLE 051-0005 Estimates of Population, Canada, provinces and Territories

[vi] Statistics published in the 2009/2010 Public Service Commission annual report show that, the executive population has grown by 24% (from 3,799 to 4,716) between 2005 and 2009, compared to only a 14% increase in the core public administration workforce.

[vii] To address some of the staffing problems late 1990s and reduce the negative pay gap with the private sector, the Treasury Board Secretariat offered many of its key professional employees (such as the IT specialists, engineers, research scientists, medical doctors, nurses…) a significant bonus payment commonly called “Terminable Allowance”.

[viii] In 2007, one year before the current recession, the Treasury Board Secretariat released a report on the federal public sector compensation and comparability commonly known as the Lahey Report. One of the major findings of that report was that the compensation package offered to public service professionals is comparable to the one offered to their private sector counterparts.

[ix] Organisation for Economic Cooperation and Development, Main Science Indicators, various years.