BRIEF FROM ING DIRECT

Executive Summary

ING DIRECT is pleased to provide input to the House of Commons Standing Committee on Finance for its pre-budget deliberations this year. In this submission, we offer our views on how to achieve a sustained economic recovery in Canada. Just as the government is intent on tackling the country’s deficit and accumulated debt in achieving this, so must Canadians be made aware of the need to make the right financial decisions now to address both their immediate and longer term needs.

We have long held concerns regarding the level of consumer debt in Canada and believe it is imperative that individual Canadians understand the implications of taking on debt and what this means for their short and long-term financial security, particularly if their debt has been growing faster than their income. Put simply, the over accumulation of debt directly impacts Canadians’ ability to save and prosper, today and in the future. And when a society is overleveraged, it is not only short and long term savings potential that suffers, but also the freedom and sense of wellbeing that comes with financial preparedness. Improving financial literacy starts with an understanding of the need to balance today’s spending with the need to plan for the future.

With this in mind, we make the following recommendations, which centre on educating Canadians on how much to save for the road ahead, getting young Canadians on the right track by starting now to save for their retirement, and proceeding with the introduction of Pooled Registered Pension Plans.

· Educate individual Canadians on the savings needed for retirement through the creation of an annual personalized “check-up” letter;

· Encourage RRSP participation by younger Canadians through the creation of a Canada Retirement Savings Grant (CRSG) for individuals aged 18 to 24; and

· Proceed with the introduction of Pooled Registered Pension Plans.

Introduction

ING DIRECT is the country’s eighth largest retail bank with $36.7 billion in assets at the end of 2010. Founded in 1997, the Bank currently has roughly 1.8 million clients and offers savings and chequing accounts, GICs, TFSAs, mortgages, and low cost mutual funds.

Unlike other banks, we don’t have an expensive branch network. Instead, we operate an efficient direct bank that delivers a high level of customer service, and passes savings on to customers in the form of higher interest on their deposits, lower interest on their mortgages, and low fees on their investments. The Bank is also committed to educating its clients, and Canadians at large, so they can feel empowered to take control of their financial lives.

At the outset, we acknowledge the federal government’s focus on getting its fiscal house in order, and applaud the commitment to balancing the budget by 2014/2015, thus beginning the process of reducing the debt thereafter. Reducing the deficit and the debt is crucial to freeing up tax dollars and investing in other priorities. Public debt charges consumed nearly $30 billion in federal revenues in 2009/2010, and are projected to rise to nearly $40 billion by the time the government achieves a balanced budget in 2014/2015.[1] Given the magnitude of these figures, it is clear that the government’s fiscal room to manoeuvre is limited by deficit financing.

Strong financial management is important for our government, and just as vital for each of us as individuals. A recent report by the Certified General Accountants Association of Canada[2] examines household indebtedness in Canada, and its findings show that Canadians must act now to get their own finances in order. While some of the report’s findings are encouraging - for example, that growth in household debt has moderated somewhat in the last year - others give rise for concern. Consider the following:

· Increasing debt has not been accompanied by an increase in income or wealth;

· Consumption rather than asset accumulation remains the primary cause of debt run up: 57 per cent of indebted respondents cite daily living expenses as the main cause for increasing debt;

· The debt-to-income ratio reached a new record high of 146.9 per cent in the first quarter of 2011;

· The level of concern over increasing household debt is declining; and

· 27 per cent of non-retired Canadians are not saving regularly, not even for retirement.

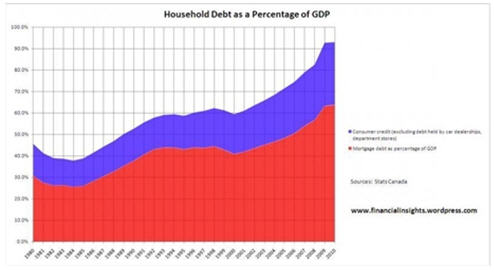

A report issued by Statistics Canada in June, 2010[3] echoes these concerns, finding that about half of those making financial preparations for retirement do not know how much they need to save in order to maintain their standard of living in retirement. Against this backdrop, personal savings rates have been in decline over the last 20 years, and as of the first quarter of 2011, stood at just 4.2 per cent. And as the chart below indicates, household debt stands at more than 90 per cent of GDP. A lack of savings and high personal debt levels pose a distinct threat to our economic recovery. With personal finances over-leveraged, too many Canadians risk being unable to afford an increase in interest rates or even a slight downturn in the economy.

ING DIRECT has long held concerns regarding the level of consumer debt as compared to savings. It is important that Canadians understand the implications when personal debt is growing faster than income, and how this impacts everyday financial decisions as well long term financial wellbeing. Of particular concern is the degree to which Canadians are relying on their home equity. In the last decade, money borrowed by Canadians against the value of their homes, using Home Equity Lines of Credit or HELOCs, has grown 170 per cent, or twice the rate of growth in mortgages. HELOCs are an important financial tool, but they must be used responsibly. Many HELOCs can be accessed via bank debit cards, and easy access to this money facilitates its use for everyday purchases. Canadians need to be aware that using their home equity as an ATM extends the time it takes to pay off a mortgage, forces individuals to take on significantly larger interest payments over time and potentially threatens their ability to manage personal and family finances down the road, particularly when interest rates rise.

We acknowledge the federal government’s efforts to address consumer indebtedness, through measures such as adjusting the rules for government-backed insured mortgages to help prevent Canadian households from becoming overextended. We also note the move made earlier this year to withdraw government insurance backing on lines of credit secured by homes, such as HELOCs. Similarly, requiring consumers’ express consent before providing a new optional product or service and mandating that they receive information on fees and costs before granting consent is a welcome initiative, as is banning the distribution of unsolicited credit card cheques.

While these moves are prudent, we collectively need to do more to help change the way Canadians think about borrowing money and their financial independence. We believe that banks and bankers have a responsibility to speak out about this issue. We need to help Canadians understand the risk they’re taking by carrying such high levels of debt and what they can do to save their money and put their families on a much more solid financial footing to deal with their needs today and in the future.

Key to achieving this is acting on the work of the government’s Task Force on Financial Literacy, whose report lays the groundwork for a national strategy on financial literacy for consideration by the federal government. ING DIRECT supports the task force’s recommendations - and in particular, the following:

· Having financial services providers place a strong emphasis on delivering education information to Canadians so that they can make responsible financial decisions;

· Requiring all financial services providers to simplify their informational materials and disclosure documents; and

· Requiring financial institutions to publicly report their financial literacy initiatives.

We also support the government’s intention to appoint a Financial Literacy Leader to promote national efforts, and the commitment to providing $3 million per year to advance financial literacy initiatives. Central to this work is the need to better educate Canadians about debt: how to manage it, and how much they can reasonably afford, the importance of paying it off as quickly as possible, and the implications for their financial wellbeing of being over-leveraged. Understanding the risks may make more Canadians less inclined to accumulate excessive levels of debt.

We also acknowledge and commend federal and provincial governments for their commitment to introduce the new Pooled Registered Pension Plan (“PRPP”). The PRPP presents an important opportunity for the millions of Canadians who do not now belong to an employer-sponsored retirement plan to save in a simple and cost effective way for their retirement.

Our Recommendations

The Committee has asked for recommendations on how to achieve a sustained economic recovery in Canada. Just as the government is intent on tackling the country’s deficit and accumulated debt as a key component in achieving this, so must Canadians adjust their mindset in making the right financial decisions to address their needs now, and over the longer term.

We cannot ignore the parallels between the high levels of government debt here and abroad and personal debt levels in Canada. Individuals can't ask for an act of Congress or bill in the House of Commons to provide them with more money to pay their bills. When interest rates remain at historic lows for long stretches it is all too easy to grow comfortable with high levels of debt. Once rates begin to rise, the opportune time for fixing the problem will have come and gone.

With this in mind, we make the following recommendations, which centre on educating Canadians on how much to save for the road ahead, getting young Canadians on the right track by starting now to save for their retirement, and proceeding with the introduction of Pooled Registered Pension Plans.

1. Educate individual Canadians on savings needed for retirement

A January 2010 study[4] found that six in 10 Canadians have at least some degree of concern that they are not saving adequately for retirement. As indicated above, savings rates are at historical lows, and too many Canadians are unaware of how much they need to save for their retirement.

We believe that Canadians would become better informed of their situation through the creation of an annual personalized “check-up” letter indicating the current status of their retirement savings from all sources. The letter would be sent to all Canadian tax filers and would show a projection of the retirement income they would have, based on their current CPP/QPP and OAS entitlements and any holdings in registered employer pensions, RRSP and TFSA accounts (and, in the future, PRPPs). Much of this information is already collected by the Canada Revenue Agency (CRA), and could be produced on an individual level. The CRA could ask for the remainder of the necessary information from private plans. (Supplying this information would be voluntary and up to the individual.) While some Canadians may plan to utilize savings outside registered accounts to fund their retirement, the letter will provide a good overall representation of each individual’s current retirement savings.

The content of the letter would be similar to the Statement of Contributions letter created by the Canada Pension Plan (CPP), which contains a history of earnings and contributions to the CPP, as well as an estimate for any CPP benefits that the individual may be eligible to receive. Our recommendation envisages a similar format but would provide a more holistic illustration of the income an individual can expect in retirement from government programs and their current level of retirement savings - through both employer-sponsored and personal retirement plans. The letter will be for illustrative purposes and use baseline assumptions or ranges for inputs such as retirement age, life expectancy, inflation, and rate of return on investments. It would offer an estimation of retirement income the individual would enjoy based on government programs and savings accrued to date. The information we recommend providing would be similar to the input requirements for the Canadian Retirement income calculator on the Services Canada website.

A retirement savings letter would easily allow Canadians to see how they are progressing towards their retirement savings goals, and help them understand the importance of financial decisions they make today. As it currently requires some degree of effort and knowledge for an individual to perform these calculations, they are apt to ignore them completely and trust they will be taken care of. Issuing an annual statement of retirement savings would remove this barrier and make it easier for everyone to understand whether they are on the right path, and if they are not, what it would take to get on it. The letter could also help boost financial literacy by providing Canadians with tips on reducing their debts, limiting reliance on credit and other sources of debt and increasing their savings. At the very least, this letter would prompt Canadians to spend more time thinking about their retirement situation.

2. Introduce a Canada Retirement Savings Grant for Young Canadians

Young Canadians typically earn lower wages and pay less in taxes than older Canadians, making the tax deferral benefit of an RRSP less of a motivation for them to begin saving for retirement. Only about 20 per cent of tax filers under the age of 25 have taxable income. To encourage RRSP (and/or PRPP) participation by this group, the government should create and market the Canada Retirement Savings Grant (CRSG) for individuals aged 18 to 24. The CRSG would function for the RRSP/PRPP in the same way the Canada Education Savings Grant does for the Registered Education Savings Plan, and would be targeted at young Canadians just starting out. Based on CRA and Statscan data, only 6.2 per cent (240,000) of Canadians in this age group contributed to an RRSP in 2008. We contend the federal government should aim to increase this amount to 25 per cent (815,000) through offering a tax free grant that would operate as follows:

· Eligible for Canadians aged 18 to 24

· Matching 50 per cent of RRSP/PRPP contribution, up to a maximum of $1,250 for a $2,500 contribution

· Like the RESP, the contributor loses the grant if the funds are withdrawn prior to retirement

· Banks and other Financial Institutions to have automatic link with government agency based on SIN-CSG; should be seamless and should not require a form to be filled out on behalf of the contributor

· Estimated annual cost: $838M, or less than 0.2 per cent of the federal budget

A person contributing $2,500 per year for each of these seven years would contribute a total of $17,500 and receive a total government grant of $8,750, for a total principal contribution of $26,250. Starting early allows more time for these funds to compound in value; enabling these funds to grow for 40 years rather than 30 produces an additional $300,000 in assets. This program could entice an additional 575,000 young Canadians to begin planning for their retirement as they complete their education and start their working lives. Improved take-up during an individual’s formative years sets them on the right path, early on, making them more likely to become a regular retirement savings contributor later in life, and less likely to accumulate excessive levels of debt. It would also help improve financially literacy by stressing early on the importance of deferring a portion of consumption in order to ensure a comfortable retirement.

3. Proceed with the Introduction of Pooled Registered Pension Plans

There has already been a great deal of industry and public dialogue regarding PRPPs and ING DIRECT has provided feedback during these consultations. Rather than adding additional commentary on the matter, we would simply refer to the submissions of the Canadian Bankers Association, reiterate our support for the initiative and encourage the government to proceed expeditiously with the introduction of PRPPs.

Conclusion

We appreciate the opportunity to provide input to the Committee’s pre-budget deliberations. Too many Canadians are unaware of the implications of carrying excessive levels of debt, and despite research which shows that most are concerned about saving adequately for retirement, savings levels continue to drop. Drawing on the example being set by the federal government in reducing the deficit and committing to balancing the budget, Canadians must be encouraged to act now to get their finances in order. The government can provide assistance by improving the financial literacy of Canadians - especially with respect to balancing today’s spending against addressing longer term financial needs - and by providing additional incentives aimed at encouraging more Canadians to save for their retirement.

[1] Federal Budget: A Low-Tax Plan for Jobs and Growth, June 6, 2011

[2] A Driving Force No More: Have Canadian Consumers Reached Their Limits? Certified General Accountants Association of Canada, June 2011.

[3] Retirement-Related Highlights from the 2009 Canadian Financial Capability Survey, Schellenberg, Grant and Ostrovsky, Yuri, Statistics Canada, June 2010

[4] Standard Life - BNN Retail Investors’ Survey, Winter 2009-2010, January 25, 2010