Canadian Union of Public Employees

submission to the

House of Commons Standing Committee on Finance

for the

2012 Federal Budget Consultations

August 2011

Executive SummaryThe Canadian Union of Public Employees (CUPE) is Canada’s largest and most diverse union. We represent over 600,000 members who work and live in virtually every community across Canada.

We welcome this opportunity to present our recommendations for the 2012 Federal Budget and specifically on how to:

- achieve a sustained economic recovery in Canada;

- create quality sustainable jobs;

- ensure relatively low rates of taxation, and

- achieve a balanced budget,

all in the context of a fragile economic recovery.

Canada faces significant economic challenges originating from both outside and within our borders. Our short-term problems cannot be separated from our underlying longer term weaknesses, including stagnant productivity, weak income and wage growth, and an increasingly unbalanced and inequitable economy. An emphasis on tax cuts resulted in record corporate profits, but little increase in productive investment, slow wage growth and highly indebted households. The only way we can achieve sustainable growth is by rebalancing our economy in a more productive and equitable way.

Instead of cutting public spending to finance further corporate tax cuts, the federal government should:

1. Sustain and expand public services, jobs and spending, maintaining current levels of program spending as a share of the economy, with a priority on protecting current rates of increases and the value of provincial transfers for health care, education, social services and equalization payments. The federal government should also cancel the damaging federal program spending cuts mandated in the last budget.

2. Implement fair tax reform by restoring corporate tax rates, eliminating wasteful tax loopholes, increasing taxes on the financial sector, and introducing a new tax bracket for individuals making over $250,000. Together, these measures could generate over $29 billion a year, more than enough to eliminate the deficit, stop the damaging spending cuts and fund important new programs.

3. Promote investment in sustainable growth and job creation, starting with a revitalized public infrastructure funding program. The federal government also needs to replace its laissez-faire attitude to industry development with a coordinated strategic sectoral development approach to promote private investment and create quality sustainable jobs.

Background

Canada’s economy fared better than most western countries following the financial crisis thanks to stronger regulation and fortuitous circumstances. However, we face continuing economic difficulties. This is no typical recession and recovery. Current policies will condemn us to a rocky recovery, possibly a double dip recession, slow or stagnant economic growth, or at best more boom-bust cycles. This is far from the “sustained economic recovery” that the Finance Committee and most Canadians would like to see.

Canada is not only highly dependent on economic circumstances beyond our borders, but we will have to contend with growing economic problems at home as well. While equity markets plummeted worldwide, prices for housing in Canada—where the wealth of most households resides—declined little before continuing to escalate over the past two years. As interest rates rise, a housing price correction could deliver a severe blow to the Canadian economy, just as it has done in other countries. This will magnify the problems we face as a result of weakness and stagnation in United States and European economies and a high Canadian dollar. Now is not the time to cut back on public spending or we risk derailing a very fragile recovery and plunging our economy back into recession.

At the same time, it would be a mistake to see these as just short-term economic problems. Before the financial crisis hit, economic and job growth appeared strong but masked anemic productivity, stagnant family incomes and an increasingly unbalanced economy. In fact, the financial and economic crisis and the immediate problems we face are a direct consequence of these underlying long-term weaknesses.

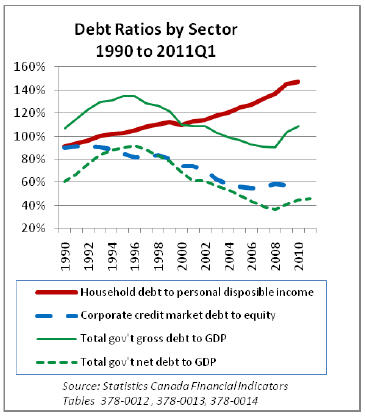

For the past decade our economic growth has been largely driven by consumer-debt led spending. Business tax cuts have allowed corporations to rack up record profits, but they’ve done little to stimulate real productive investment. Instead, much of these surpluses went into financial investments that fuelled the boom-bust cycle. Businesses are sitting on tens of billions in excess cash—and it’s not trickling down. Supply-side economic policies of tax cuts, deregulation and investor rights deals have failed to achieve sustainable economic growth.

Meanwhile family household debt ratios have risen to record levels as a result of slow wage growth, rising housing prices and cuts to public services. As funding for public services is cut, families are forced to pay more for education, health care, transit, and community programs. Our longer-term economic growth and well-being is also undermined by inadequate investments in productivity-enhancing public infrastructure, higher education and research and development.

During the decade from 2000 to 2010, households accumulated over $300 billion more in debt, while corporations piled up over $500 billion in surpluses—a complete reversal of the relationship that held since at least 1960. This is the real debt crisis facing Canadians and it’s concentrated among lower and middle income families: inequalities of income and wealth have reached levels not seen since the great depression. Government deficits increased as a result of the recession, but Canada is still in very good fiscal shape both from an international and historical perspective. Our debt ratios are still lower than a decade ago and deficits can be eliminated in a few years with sustained economic growth.

With weakness in export markets, little growth in business investment and overextended households, cuts to public sector spending could easily pull Canada back into recession and at the very least condemn us to slow economic growth – in addition to hurting Canadian families through job losses and the deterioration of public services. Maintaining stimulus is important, but we also need to direct public and private investment into less wasteful, more productive and sustainable activities.

Sustain and expand public services, jobs and spending

Quality public services are critical for sustaining shared prosperity and a high standard of living for all Canadians. Research has shown that public services provide an annual benefit equivalent to $41,000 for the average Canadian family and $17,000 for each individual. Cuts to public spending not only damage the economy, but they also diminish the living standard of all Canadians—and particularly the most vulnerable.

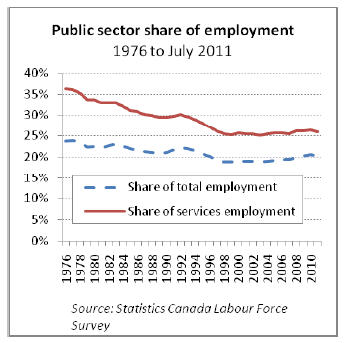

It’s a myth that public sector deficits were caused by rising rates of public spending. Federal spending as a share of the economy recently plummeted to the lowest level since at least 1961. Total government spending of all levels of government also recently declined to the lowest rate since 1975. The increase in the past two years is solely because of weakness in the private sector economy and higher social benefits as a result of the recession—and not because of unsustainable spending growth.

Public sector employment has also been at a historically low share of total employment. Its share of total employment increased slightly in recent years, but that’s more because of a decline in private sector jobs than because of increases in public sector employment: already its share is falling again.

It’s also a myth that public sector workers are paid significantly more than workers in the private sector. Women and low paid workers suffer less of a pay gap in the public sector thanks to greater pay equity in the public sector. Average salaries for men in the public sector are actually lower than those for males in similar occupations in the private sector.

Canada is in considerably better fiscal shape than the OECD average and most other western countries and yet our governments are imposing deeper spending and job cuts which will weaken the economy and increase unemployment. Instead of cuts and austerity, the focus of federal and provincial governments in upcoming budgets should be on maintaining and expanding public services that provide benefits to Canadians and create jobs. Program spending cuts mandated in the 2010 budget are just now starting to take effect; the impacts of the deeper cuts from the 2011 budget will be even more damaging.

The federal government should maintain current levels of program spending as a share of the economy, with a priority on protecting current rates of increases and the value of provincial transfers for health care, education, social services and equalization payments. The federal government should commit to long-term agreements for funding of health care and other major transfers. Funding should be tied to public delivery of these services with enforcement of these provisions. The hard cap on Equalization payments tied to GDP growth will mean some Equalization-receiving provinces could suffer an overall decline in major federal transfers. The federal government should extend major transfer protection to all provinces at least until the renewal of these agreements in 2013/14.

The federal government can find savings by eliminating the $1 billion plus P3 Canada Fund (which perversely subsidizes privatization) and the requirement for P3 screening through the Building Canada Fund. Further savings can be achieved by cancelling wasteful government procurement, such as the over $16 billion sole-source fighter jet program and ineffective tax preferences and credits. Numerous studies show it is much more effective to fund public program directly instead of providing “boutique” tax cuts and tax credits. For instance, notable Canadian economists have recently calculated that, not only does every

$1 investment in quality public child care yield over $2.50 in long term economic benefits, but Quebec’s child care program more than pays for itself in terms of increased revenue to governments[1] . Improving the Canada Pension Plan by doubling benefits through gradual increases to premiums and increasing the Guaranteed Income Supplement would ensure decent retirement incomes for all seniors at very little cost to the federal government.

Implement Fair Tax Reform

Canada’s tax system has become increasingly regressive over the past two decades with the greatest benefits goes to the wealthiest. The top 1% now pays a lower rate of overall tax than the poorest 10%[2] . Further corporate tax cuts will not only increase the deficit, but also make our tax system even more regressive. There’s little convincing evidence that corporate income tax cuts actually stimulate investment or create jobs, particularly when businesses are sitting on tens of billions in excess cash.

Fair tax reform could help achieve a balanced budget without increasing tax rates on middle and low income Canadians. As a priority, the federal government should:

- Cancel corporate tax cuts. Cancelling tax cuts planned for 2012 would save the federal government approximately $3 billion a year; returning to 2007 rates would increase revenues by approximately $12 billion a year.

- Eliminate wasteful and regressive tax preferences. For example, closing the executive stock option loophole alone would recover close to $1 billion a year for the federal government. Equitable taxation of capital gains income would recover more than $7 billion a year.

- Introduce a new tax bracket at 35% for income over $250,000, generating over $4 billion a year.

- Introduce either a Financial Transactions Tax or Financial Activities Tax (as proposed by the IMF) to compensate for lower rates of taxation on banks and the financial sector, raising approximately $5 billion a year[3] .

Just these few fair tax reform measures could generate over $29 billion a year: more than enough to eliminate the federal deficit, stop the damaging cuts and fund important new public programs.

Promote investment in sustainable growth and job creation

Moving forward, Canada needs to make significant investments in sustainable growth and job creation. Our economy suffered from stagnant rates of productivity for a decade before the financial and economic crisis struck. Business tax cuts have had little success in increasing investment. Governments now need to take a proactive approach, with increased direct public investment and coordinated sectoral development policies to promote private investment into productive activities that provide sustainable quality jobs.

As a priority, the federal government should revitalize infrastructure funding with a focus on sustainable growth. The fast-tracking of infrastructure under the stimulus program has meant that virtually all funding for major components of the Building Canada program through to 2013/14 has already been allotted. There’s almost no funding left for new projects while other forms of base funding are diminishing in real dollar terms. Meanwhile, Canadian municipalities continue to bear an enormous burden for rebuilding our deteriorating infrastructure and face even higher costs to deal with the impacts of climate change. Reductions in federal support will only increase the $120 billion plus infrastructure deficit.

The federal government needs to commit to real increases in funding as part of a long-term national infrastructure plan developed together with provinces and local communities with a focus on sustainable growth. Investments in public transit, clean water, energy efficiency, affordable housing, and community and health services will not only create jobs, but also increase productivity and provide savings for employers and households as a result of reduced costs of energy, congestion and private care. Statistics Canada has confirmed that every dollar in public infrastructure investment yields average cost savings of 17% a year for business alone, not including benefits to households. This rate of return not only far exceeds the public cost of borrowing but also most private rates of return as well.

Federal and provincial governments need to lead the way in this area, but we also need to take steps to direct private investment into more productive and sustainable activities. The federal government needs to replace its laissez- faire approach to industry with coordinated strategic development, working together with industry, labour and educational institutions to develop higher value added and sustainable jobs. Tools here include tax policy, procurement, proactive regulations, coordinated training and labour market policies, support for sectoral development councils and financing.

August 2011

:nc/cope 491

[1] Childcare Human Resources Sector Council, Literature Review of the Socioeconomic Effects and Net Benefits, p. 39. Report prepared by Robert Fairholm of the Centre for Spatial Economics, 2009. Fortin, Pierre. Economic Consequences of Quebec’s Educational Childcare Policy, 2011.

[2] Lee, Mark. Eroding Tax Fairness. Canadian Centre for Policy Alternatives, 2007.

[3] Sanger, Toby. Fair Shares: How Banks, Brokers and the Financial Industry Can Pay Fairer Taxes. Canadian Centre for Policy Alternatives, April 2011.