BRIEF FROM THE CANADIAN FEDERATION

OF INDEPENDENT BUSINESS

Ensuring Stability in Uncertain Times

Small and Medium-sized Enterprises (SMEs) are recovering from the last recession and confidence among CFIB members is relatively strong. Still, the impacts of the sovereign debt uncertainties in Europe and the US could spill over to the Canadian economy. Canada’s capacity to face these uncertainties will be strengthened if governments tackle the deficit and implement SME policies that encourage employment. Not increasing payroll taxes, addressing the inequity between public and private sector pensions, and reducing red tape are three key areas government must tackle to ensure stability in these uncertain times, and help to position Canada for a prosperous future.

Corinne Pohlmann, VP National Affairs

Esma Guenin, Policy Analyst

Introduction

The world economy experienced a serious recession during the 2008-2009 financial crisis that originated in the United States and quickly spread to the rest of the world.[1] Along with most advanced economies, Canada experienced a drop in GDP, a noticeable increase in unemployment, and a steep decline in business activity and consumer confidence. To increase demand and create jobs, Canada – as many other countries – created a countercyclical stimulus package. Although it was a good foundational tool for economic recovery, the Canadian government must now face serious spending and deficit issues. While Canada has emerged fairly well from the recession, economic uncertainty still shadows the world and Canadian growth is moderate. The structural debt issues of the U.S, and the sovereign debt crisis that faces more than one European country, are only some of the elements that will delay the global economic recovery and most likely have an impact on Canadian growth. Difficult decisions that will allow Canada to be fiscally sound going forward must be made today so that we do not end up facing many of the same problems afflicting the USA and many European countries.

Equally important to cutting spending is to support Canadian SMEs with policies that encourage employment and foster growth. SMEs are an integral part of the Canadian economy. As 98 per cent of all businesses in Canada have fewer than 50 employees, the importance of SMEs cannot be overstated. Almost 60 per cent of working Canadians are employed by SMEs and they represent almost half of Canada’s economy. SMEs are the backbone of the Canadian economy. As a result, it is essential that government helps create and support an environment that fosters entrepreneurship and encourages smaller businesses to grow, thereby diversifying the economy and creating new jobs and opportunities for Canadians. In fact, major macroeconomic indicators for the past year and a half show that Canadian SMEs are emerging from the recession, restoring the jobs and the business activity lost during the economic turmoil.

Small business owners have many tales to tell about their businesses’ performance during the economic downturn. Some cut costs to the bare minimum. Others explored and thrived in new markets. CFIB will use part of this submission to give a portrait of SMEs behaviour during the recession (for more details see CFIB’s upcoming report Survival of the Smallest to be published in September 2011). Since SMEs are such an important component of Canada’s economy and society, it is imperative that government and policy makers take into consideration these recommendations, as they can have a tremendous impact on SMEs. By working together, we will prevent Canada from falling behind and pave the road to a financially sustainable future in which Canadian entrepreneurs can thrive.

SMEs and the Recession

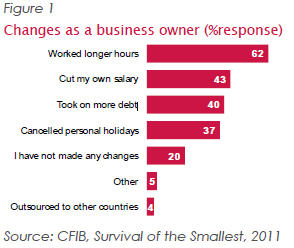

To overcome the economic downturn, 62 per cent of business owners worked longer hours. Cutting their own salary, taking more debt, and cancelling personal holidays were also tough choices made to help ride out the difficult times. Only one-fifth of small business owners responded that they did not make any changes (see Figure 1).

Figure 1

Changes as a business owner (%response)

Source: CFIB, Survival of the Smallest, 2011

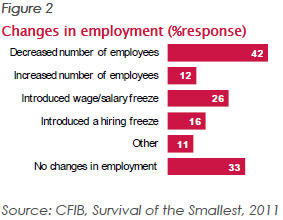

In addition, about 42 per cent of SME owners decreased their number of employees during the recession while almost 1 in 3 business owners maintained their employee count (see Figure 2). Freezing wages and salaries was also a popular strategy among business owners (26 per cent). On a positive note, 12 per cent of SME owners were able to increase their number of employees during the economic downturn.

To put these numbers in perspective, a May 2010 CFIB report showed that large and medium-sized enterprises lost 5.6 and 5.9 per cent of payroll employment respectively, whereas small enterprises (i.e. those with less than 50 employees) lost only 2.0 per cent of payroll.[2]

Figure 2

Changes in employment (%response)

Source: CFIB, Survival of the Smallest, 2011

SMEs’ responses to the recession in terms of employment also revealed significant variation across provinces. British Columbia, Alberta and Ontario reported a higher percentage of decreases in the number of employees than the national average (48, 49, and 45 per cent, respectively). All other provinces reported lower percentages of reduction in the number of employees than the national average. Among major industries, manufacturing decreased its number of employees more than any other industry.

SMEs’ actions and desired policies to combat recession

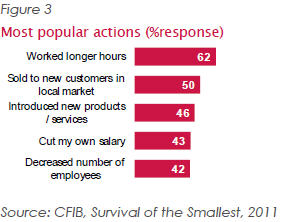

Business owners implemented many changes in various areas of their business to survive the recession. Of the 22 actions provided in the survey, the most frequently reported by business owners were: working longer hours (62 per cent), seeking new customers (50 per cent) and introducing new products/services (46 per cent) (see figure 3 on next page).

Figure 3

Most popular actions (%response)

Source: CFIB, Survival of the Smallest, 2011

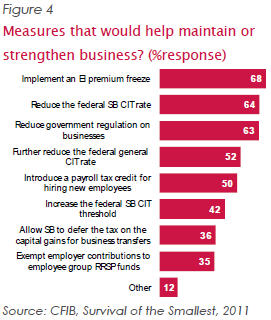

In addition to inquiring about business owners’ experiences during the recent recession, SMEs were asked which measures would help maintain or strengthen their business performance going forward. Overall, respondents identified an Employment Insurance (EI) premium freeze, a reduction in the federal small business corporate income tax rate, and a reduction of government regulation as the top three measures to help SMEs maintain or strengthen their business (see Figure 4).[3]

Figure 4

Measures that would help maintain or strengthen business? (%response)

Source: CFIB, Survival of the Smallest, 2011

Recommendations

Support hiring and training

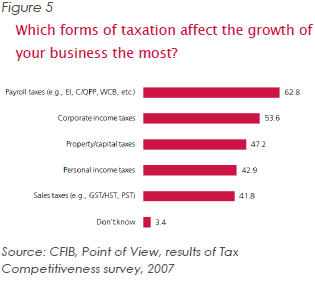

It is widely recognized that payroll taxes (e.g EI, WCB, CPP, etc.) are the most harmful kind of tax due to their profit-insensitive nature, which directly affects job creation. While some tax rates have declined, many payroll taxes and premiums have increased in the past five years, with several threatening to undergo further rate hikes[4]. SMEs are strongly opposed to these increases, which put their ability to retain employees in jeopardy, effectively limiting their ability to be Canada’s job creators.

An administratively simple measure that recognizes the higher cost of training and partially offsets payroll taxes for SMEs is the Hiring Credit for Small Business. This credit gives employers a “holiday” for a period of time on their EI contributions for any increase in payroll (usually linked to a new employee hire or an increase in salary). It is a popular measure among all SMEs but is particularly important among growing firms as it helps them strengthen business performance[5]. We applaud this measure, but would like to see the Hiring Credit for Small Business extended and eventually become an ongoing fiscal incentive to hire and train SME workers.

Figure 5

Which forms of taxation affect the growth of your business the most?

Source: CFIB, Point of View, results of Tax Competitiveness survey, 2007

The EI Work-Share program was also beneficial to many SMEs during the recession. The program allowed businesses to keep their employees while at the same time reducing costs for themselves and for the federal government, who payed less in EI benefits. The Work-Share program is a great success among SMEs and should serve as a model for other EI programs. For instance, internal government audits have reported that some EI pilot projects are ineffective, yet they have been extended multiple times. In a period of scarce resources, only programs that are proven to integrate the unemployed into the labour market should be pursued.

CFIB recommends that government consider diverting some of the money from the $2 billion in EI funds already dedicated to hiring and training annually, as well as some of the $600 million being used for pilot projects, to the Hiring Credit as it is likely to be more effective in helping to get people back to work than some of the current EI training programs and pilot projects.

Tackling retirement income

Canada Pension Plan (CPP)

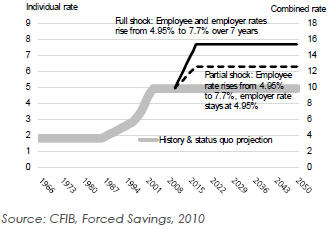

There is political pressure to increase CPP based on the argument that it is the only way to improve retirement for the majority of Canadians. However, increasing retirement income is not as simple as doubling CPP benefits as advocated by some. On the contrary, doubling CPP benefits would cost 1.2 million person years of employment and, in the long run, a CPP increase will force wages down by 2.5 per cent while increased benefits for retirees won’t be fully effective for 40 years. In fact, every 1 per cent increase in CPP premiums beyond the current 9.9 per cent rate would cost 220,000 person-years of employment [6] (see Figure 6).

Figure 6

Employer and Employee CPP Premium Assumptions, % of pensionable earnings

Source: CFIB, Forced Savings, 2010

Put purely and simply, a mandatory CPP increase equates to a hike in payroll taxes that will hinder economic growth (see Figure 5). It is no surprise then that 71 per cent of our members are opposed to a mandatory CPP premium increase[7].

Public Sector Pensions

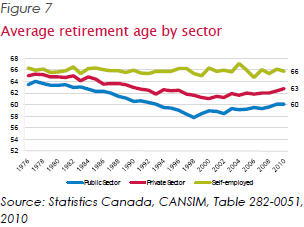

In addition, many of our members would like to see the gap between public and private sector pensions narrowed. Generous public sector pensions are guaranteed at the expense of taxpayers, many of whom must delay their own retirement because they cannot afford to retire. Most public sector employees retire around age 60 while 47 per cent of small business owners believe they will only be able to retire after 65 (see Figure 7).

Figure 7

Average retirement age by sector

Source: Statistics Canada, CANSIM, Table 282-0051, 2010

There is an urgent need for an overhaul of Canada’s pension system to reduce the unfair and unsustainable gap between public and private sector pensions. Currently, federal government employees contribute 34 per cent of total pension contributions while the federal government (ie. taxpayers) kick in the remaining 66 per cent. In addition, the federal pension plan is already underfunded by $208 billion[8]. To bring fairness and sustainability, CFIB is not calling for changes to past benefits that have been earned but asking government to take action on fixing unsustainable public sector pensions going forward. This would involve a national examination of: all federal, provincial and municipal public sector pension liabilities using a common methodology; increasing pension contributions of public sector employees; and ending early retirement provisions. These changes would also bring significant cost savings to government as it has been reported that eliminating early retirement would save the government $2.2 billion per year and requiring a 50/50 split on pension contributions would save government $890 million per year.

Reduce Red Tape

One of the best, low-cost stimulus measures the government can undertake in a period of economic instability is cutting red tape. According to CFIB’s 2010 report, Prosperity Restricted By Red Tape, regulations and paper burden cost the Canadian economy $30.5 billion dollars a year. If the federal government were to undertake a government-wide initiative to permanently reduce and track regulations and paperwork, as has been done in British Columbia, this would free up $5 to $10 billion per year going forward, a significant productivity enhancement for businesses, without any real cost to the government.[9] In fact, cutting unnecessary regulations and forms could also help in governments’ efforts to reduce administrative and labour costs. The savings that could be achieved through common-sense regulatory reform combined with the productivity enhancements to the Canadian economy, make red tape reduction a perfect response to help stimulate the economy during Canada’s current economic recovery.

Though there have been some recent encouraging promises from governments across Canada, including the introduction of the Red Tape Reduction Commission, only British Columbia promised to legislate a permanent solution. A 2009 CFIB survey revealed that 26 per cent of our members would not have gone into business had they known of all the red tape associated with running their operations.[10] What is needed is political leadership and legislation that requires government to measure and publicly report the impact of regulations and the quality of government customet service, as well as place constraints on regulators. These actions are key if government is serious about achieving red tape relief for small businesses.

Conclusion

Economic downturns and recessions are tumultuous times for everyone. There are many heated debates as to the best course of action. CFIB and its members have consistently called for economic prudence, sound fiscal policy and balanced budgets. Moreover, Canada needs to support the job creators by implementing policies and measures that avoid unnecessary regulatory burden, and encourage growth and job creation. Following is a summary of our key recommendations:

· Do not increase payroll taxes: Offset the planned EI hike by extending the Hiring Credit for Small Business to 2012 so that small businesses can receive an EI holiday on increased payroll. Also, do not increase CPP premiums but focus instead on creating a voluntary Pooled Registered Pension Plan (PRPP) that is accessible and cost-effective for small firms.

· Tackle the deficit and review public sector pensions: Most SMEs are concerned with the level of federal government spending and would like the government to eliminate the deficit by 2014. One way to do so would be to commit to bringing federal public sector wages and benefits more in line with the private sector. Government should also take action on fixing unsustainable public sector pensions going forward by examining all federal, provincial and municipal public sector pension liabilities with a common methodology; increasing contributions of public sector employees; and ending early retirement provisions. Taking action on these items could potentially save the government more than $3 billion per year.

· Reduce Red Tape: Through the work of the Red Tape Reduction Commission, now is a great opportunity to make permanent and lasting change to Canada’s regulatory framework that is comprehensive and not piece-meal. As such, CFIB recommends making regulatory reduction permanent via binding legislation. This legislation should require government to conduct ongoing measurements and public reporting of regulatory activity and of the quality of government customer service. It should also place constraints on regulators, so that for every one new regulation that is introduced, one (or two if you want to reduce the burden) must be eliminated. Finally, there should be ongoing political leadership to ensure it is properly implemented.

[1] World Bank, 2010, “The Great Recession and the Developing Countries”

[2] CFIB, A Peek at the Trough, 2010, p. 1

[3] In the chart, “SB’’ is short for “small business”, “CIT” is “Corporate Income Taxes”, and “RRSP” is “Registered Retirement Savings Plan”

[4] For instance, EI premiums went up in 2011 and are expected to increase by 10 cents for employees and 14 cents for employers for the next three years. In addition, minimum wage and workers’ compensation premiums are climbing in most provinces.

[5] CFIB, Survival of the Smallest, 2011

[6] CFIB, Forced Savings, 2010

[7] CFIB, Securing the Future, 2010

[8] Robson, William B.P. Cutting Through Pension Complexity: Easy Steps Forward for the 2010 Federal Budget. C.D. Howe Institute, February 2010.

[9] CFIB, Prosperity Restricted By Red Tape, 2010

[10] Idem.